PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939097

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939097

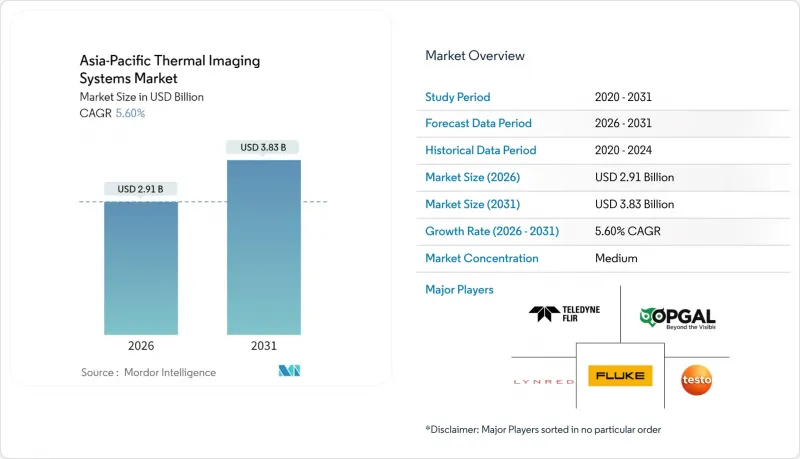

Asia-Pacific Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific thermal imaging systems market is expected to grow from USD 2.76 billion in 2025 to USD 2.91 billion in 2026 and is forecast to reach USD 3.83 billion by 2031 at 5.60% CAGR over 2026-2031.

Adoption accelerates as defense ministries fund border-surveillance upgrades, industrial firms deploy predictive-maintenance programs, and consumer devices integrate compact thermal cores. Declining uncooled micro-bolometer prices, averaging 15-20% annual reductions, open mid-tier opportunities in building inspection and smartphone accessories. Government livestock bio-security mandates and rising factory automation in China, Japan, and South Korea broaden the addressable base beyond traditional security buyers. Export-licensing friction for cooled MWIR cameras and wafer-grade VOx supply fragility remain primary cost and schedule risks. Developers are therefore prioritizing multispectral SWIR solutions, chalcogenide optics, and edge-AI analytics to safeguard future growth paths in the Asia-Pacific thermal imaging systems market.

Asia-Pacific Thermal Imaging Systems Market Trends and Insights

Declining Cost of Uncooled Micro-Bolometer Sensors

Rapid scale-up at Chinese fabs brought 15-20% annual price declines in VOx micro-bolometers, pulling portable thermal devices below USD 500 retail. Builders and home inspectors can now justify thermal add-ons for smartphones, expanding user counts in middle-income markets. Industrial electricians adopt handheld viewers to spot hot spots in switchgear before costly failures, benefiting from lower total cost of ownership. Volume gains widen though margins compress, pushing vendors toward value-added cloud software and analytics subscriptions. The democratization of sensing thus underpins a durable upswing in the Asia-Pacific thermal imaging systems market.

Rising Defense and Border-Security Spending in APAC

Territorial tensions in the South China Sea and along the Himalayas keep defense budgets rising, with USD 475 million earmarked by the U.S. for APAC maritime domain awareness since 2016. Thermal imagers equip coastal radars, vehicle-mounted ISR pods, and counter-UAS batteries capable of tracking small drones day and night. Australia procures thermal-equipped P-8 Poseidon aircraft, while Singapore layers heat-sensing cameras onto harbor surveillance grids. Procurement cycles emphasize open architectures to insert AI classification tools that accelerate operator response. Long-lead acquisition pipelines thus assure multi-year deliveries that buoy the Asia-Pacific thermal imaging systems market.

High Upfront Cost and Export-Licence Constraints for Cooled Cameras

ITAR and EAR regulations mandate U.S. sign-off for MWIR systems, adding months of paperwork and constraining Chinese and Russian buyers. Cryogenic coolers also lift lifetime costs, limiting marketability outside defense and research. Consequently, agencies often settle for uncooled alternatives despite reduced range, trimming the ceiling of the Asia-Pacific thermal imaging systems market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Predictive-Maintenance Adoption

- Smartphone, Drone and ADAS Integration of Thermal Cores

- Semiconductor-Grade VOx / InSb Wafer Supply Fragility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermography generated USD 1.02 billion in 2025, the single largest slice of the Asia-Pacific thermal imaging systems market size, anchored by factory inspection and building diagnostics in Japan, South Korea, and coastal China. Counter-UAS programs, though smaller today, are projected to log a 5.93% CAGR to 2031, expanding the Asia-Pacific thermal imaging systems market share for defense analytics as drones proliferate across contested borders.

Thermography retains leadership because predictive-maintenance ROI is immediate, and building codes increasingly specify infrared audits. Firefighting agencies employ rugged imagers that penetrate smoke and pinpoint hot spots, reducing response times during industrial blazes. Maritime and coastal surveillance packages layer thermal onto radars for 24/7 situational awareness, helping navies deter illegal fishing and smuggling. NEC's forest-fire detection grids illustrate thermal's value in disaster preparedness across typhoon-prone Japan. Medical and search-and-rescue teams adopt drone-mounted systems to locate survivors in low-visibility conditions, further broadening use cases and supporting growth within the Asia-Pacific thermal imaging systems market.

Thermal cameras continued to capture 54.10% of revenue in 2025, yet module shipments are on track for the strongest 6.22% CAGR through 2031, highlighting an OEM pivot that elevates module share of the Asia-Pacific thermal imaging systems market size. Smartphone attach-kits and automotive night-vision packages prefer modules that slot into existing boards without adding optical assemblies, boosting design flexibility.

Complete cameras still anchor industrial and public-safety projects where rugged housings, analytics, and networking come pre-integrated. Nonetheless, Teledyne FLIR's Hadron X aligns with drone frames weighing under 250 g, showing how miniaturization attracts volume customers. Module vendors bundle SDKs and AI acceleration to reduce time-to-market for integrators unfamiliar with thermography. Rising module penetration, therefore, diversifies revenue streams and cements OEM ties inside the Asia-Pacific thermal imaging systems market.

The Asia-Pacific Thermal Imaging Systems Market Report is Segmented by Application (Thermography, Maritime and Coastal Surveillance, and More), Product (Thermal Cameras, Thermal Scopes/Sights, and More), Technology (Uncooled LWIR, and More), End-User Vertical (Aerospace and Defence, Law-Enforcement and Public Safety, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Teledyne FLIR LLC

- Wuhan Guide Infrared Co., Ltd.

- Lynred

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Fluke Corporation

- Opgal Optronic Industries Ltd.

- Testo SE and Co. KGaA

- Trijicon, Inc.

- Dongguan Xintai Instrument Co., Ltd.

- Thermoteknix Systems Ltd.

- Raytron Technology Co., Ltd.

- Zhejiang Dali Technology Co., Ltd.

- Meridian Innovation Ltd.

- Nippon Avionics Co., Ltd.

- NEC Avio Infrared Technologies Co., Ltd.

- Shenzhen SAT Infrared Technology Co., Ltd.

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- BAE Systems plc

- Axis Communications AB

- Seek Thermal, Inc.

- InfraTec GmbH

- Infrared Cameras Inc.

- Tien-Yuan Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining cost of uncooled micro-bolometer sensors

- 4.2.2 Rising defence and border-security spending in Asia-Pacific

- 4.2.3 Industrial predictive-maintenance adoption

- 4.2.4 Smartphone, drone and ADAS integration of thermal cores

- 4.2.5 Livestock bio-security mandates using AI-thermal analytics

- 4.2.6 Chalcogenide optics easing germanium supply risk

- 4.3 Market Restraints

- 4.3.1 High upfront cost and export-licence constraints for cooled cameras

- 4.3.2 Scarcity of certified thermography service providers

- 4.3.3 Semiconductor-grade VOx / InSb wafer supply fragility

- 4.3.4 Smart-city privacy rules limiting thermal surveillance

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Thermography

- 5.1.2 Maritime and Coastal Surveillance

- 5.1.3 Border Surveillance

- 5.1.4 Counter-UAS / Drones

- 5.1.5 Critical Infrastructure Security

- 5.1.6 Others (Fire-fighting, Smartphones, Medical, PVS)

- 5.2 By Product

- 5.2.1 Thermal Cameras

- 5.2.2 Thermal Scopes / Sights

- 5.2.3 Thermal Modules / Cores

- 5.3 By Technology

- 5.3.1 Uncooled LWIR (VOx / a-Si)

- 5.3.2 Cooled MWIR and LWIR (InSb, MCT)

- 5.3.3 SWIR and Multispectral

- 5.4 By End-User Vertical

- 5.4.1 Aerospace and Defence

- 5.4.2 Law-Enforcement and Public Safety

- 5.4.3 Healthcare and Veterinary

- 5.4.4 Automotive and Mobility

- 5.4.5 Oil and Gas and Process Industries

- 5.4.6 Manufacturing and Utilities

- 5.4.7 Other End-User Verticals

- 5.5 By Country

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 Southeast Asia

- 5.5.5 South Korea

- 5.5.6 Australia and New Zealand

- 5.5.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Teledyne FLIR LLC

- 6.4.2 Wuhan Guide Infrared Co., Ltd.

- 6.4.3 Lynred

- 6.4.4 Hangzhou Hikvision Digital Technology Co., Ltd.

- 6.4.5 Fluke Corporation

- 6.4.6 Opgal Optronic Industries Ltd.

- 6.4.7 Testo SE and Co. KGaA

- 6.4.8 Trijicon, Inc.

- 6.4.9 Dongguan Xintai Instrument Co., Ltd.

- 6.4.10 Thermoteknix Systems Ltd.

- 6.4.11 Raytron Technology Co., Ltd.

- 6.4.12 Zhejiang Dali Technology Co., Ltd.

- 6.4.13 Meridian Innovation Ltd.

- 6.4.14 Nippon Avionics Co., Ltd.

- 6.4.15 NEC Avio Infrared Technologies Co., Ltd.

- 6.4.16 Shenzhen SAT Infrared Technology Co., Ltd.

- 6.4.17 Leonardo S.p.A.

- 6.4.18 L3Harris Technologies, Inc.

- 6.4.19 BAE Systems plc

- 6.4.20 Axis Communications AB

- 6.4.21 Seek Thermal, Inc.

- 6.4.22 InfraTec GmbH

- 6.4.23 Infrared Cameras Inc.

- 6.4.24 Tien-Yuan Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment