PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939108

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939108

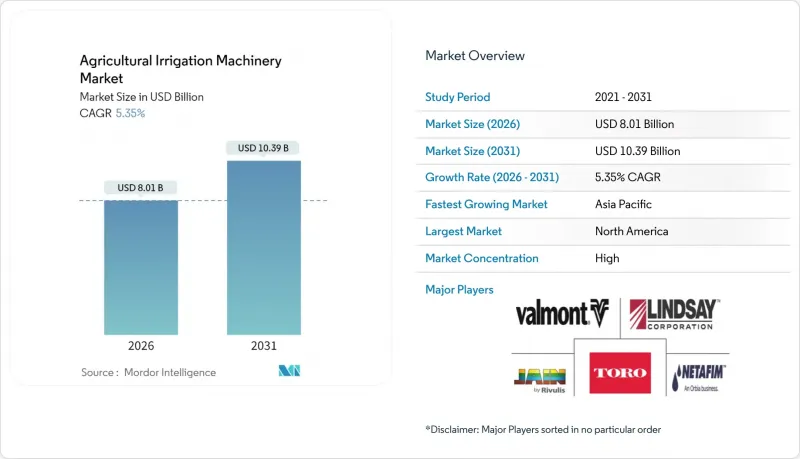

Agricultural Irrigation Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The agricultural irrigation machinery market was valued at USD 7.60 billion in 2025 and estimated to grow from USD 8.01 billion in 2026 to reach USD 10.39 billion by 2031, at a CAGR of 5.35% during the forecast period (2026-2031).

Rising water scarcity, the adoption of precision agriculture, and robust subsidy pipelines are combining to propel the agricultural irrigation machinery market, while technology-enabled service models offer fresh revenue opportunities. Competitive intensity is shaped by product innovations in sensors and automation, as well as the shift from one-off equipment sales to long-term data services. Capital availability through ESG-linked funding accelerates the deployment of micro-irrigation, yet fragmented landholdings in developing regions temper overall growth. Manufacturers that localize after-sales support and address plastic-waste concerns position themselves to capture incremental demand in the agricultural irrigation machinery market.

Global Agricultural Irrigation Machinery Market Trends and Insights

Government subsidies for micro-irrigation adoption

Expanded federal conservation funding makes upfront costs more accessible for medium-scale growers. The United States Department of Agriculture (USDA) Environmental Quality Incentives Program covered up to 75% of system outlays in fiscal 2024, allocating USD 1.9 billion to efficiency upgrades. Multi-year guarantees from the Inflation Reduction Act encourage manufacturers to boost production capacity, while outcome-based metrics align vendor offerings with policy targets. This funding certainty enables equipment manufacturers to invest in production capacity and supply chain infrastructure with confidence. The program's emphasis on measurable water savings outcomes aligns with manufacturers' precision agriculture capabilities, creating competitive advantages for technology-integrated solutions.

Rising water scarcity pushing demand for precision irrigation

Water stress indicators across major agricultural regions are accelerating the transition from flood irrigation to precision delivery systems. The United Nations' latest water development report identifies 2 billion people living in water-stressed countries, with agricultural water demand projected to increase 35% by 2050. The economic imperative extends beyond water costs to include regulatory compliance, as jurisdictions implement increasingly stringent water-use reporting requirements. Precision irrigation systems' ability to provide detailed consumption analytics positions them as essential compliance tools rather than optional efficiency upgrades.

High upfront capital cost for pivot systems

The capital intensity of center-pivot irrigation systems remains a significant barrier to adoption, despite improving economics and financing options. Complete pivot installations range from USD 1,200 to USD 2,000 per acre, depending on terrain and technology specifications, representing substantial capital commitments for mid-sized operations. The payback period extends to 7-10 years in regions with moderate water costs, posing a challenge to cash flow management for commodity producers facing price volatility. Equipment financing terms typically require down payments of 20-30%, creating liquidity constraints for operators seeking to modernize multiple fields simultaneously. Manufacturers are responding with modular installation approaches and lease-to-own programs, but adoption remains constrained by initial capital requirements.

Other drivers and restraints analyzed in the detailed report include:

- Labor shortages accelerating mechanization on mid-size farms

- Integration of IoT sensors enabling pay-as-you-grow models

- Fragmented land holdings limiting equipment ROI in developing countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drip systems retained 46.08% of the agricultural irrigation machinery market share in 2025 on superior water-use efficiency and fertigation precision. This dominance underpins a robust segment outlook as climate stresses intensify. Sprinkler equipment is the fastest-growing sub-segment, projected to post an 8.05% CAGR through 2031 as labor shortages spur mechanization across broad-acre grains. Pivot solutions unlock additional upside through sensor integration that shortens decision cycles. Valley Irrigation's AgSense 365 exemplifies the shift to unified control dashboards, lifting lifetime service value.

The segment's growth acceleration reflects improved economics as water costs rise and labor availability declines across major agricultural regions. Other irrigation types, including surface and flood systems, face declining adoption as water scarcity intensifies and regulatory frameworks increasingly favor efficiency-oriented technologies. The segmentation dynamics indicate a structural shift toward precision delivery systems capable of supporting data-driven agricultural management practices.

The Agricultural Irrigation Machinery Market Report is Segmented by Irrigation Type (Sprinkler Irrigation, Drip Irrigation, Pivot Irrigation, and Other Irrigation Types), by Application Type (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Other Applications), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 32.12% of 2025 revenue, anchored by generous cost-share programs and mature distribution networks. Budget certainty through 2031 sustains replacement and upgrade cycles, even as market saturation moderates volume growth. Canada's climate-resilient farming priorities and Mexico's export-oriented horticulture add incremental momentum to the regional agricultural irrigation machinery market.

Asia-Pacific is positioned as the fastest-growing region at an 8.06% CAGR, boosted by water-stress mandates in China and rapid micro-irrigation rollouts under India's Pradhan Mantri Krishi Sinchayee Yojana. Japan's aging farmer demographic accelerates automation spending, while Southeast Asian greenhouse clusters seek sensor-rich drip systems. This confluence drives outsized gains in the agricultural irrigation machinery market size within Asia-Pacific through 2031.

Europe delivers steady expansion under the Common Agricultural Policy's environmental pillar, which labels precision irrigation as a sustainable activity eligible for green finance. Mediterranean drought episodes hasten subsurface installations, whereas the Netherlands and Germany emphasize closed-loop greenhouse watering. In the Middle East and Africa, state-backed megafarms and climate-smart corridors dominate demand. South America's soybean heartland invests in pivots to smooth rainfall variability, reinforcing a diversified geographic revenue stream across the agricultural irrigation machinery market.

- Netafim Ltd. (Orbia Advance Corporation)

- Valmont Industries, Inc. (Valley Irrigation)

- Lindsay Corporation

- Jain Irrigation Systems Limited (Rivulis Irrigation Limited)

- The Toro Company

- Nelson Irrigation Corporation

- Rain Bird Corporation

- Mahindra & Mahindra Limited

- Hunter Industries Incorporated

- Reinke Manufacturing Company, Inc.

- Ningbo Rainfine Irrigation Co., Ltd.

- T-L Irrigation Company

- Sistemas Azud, S.A.

- Antelco Pty Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government subsidies for micro-irrigation adoption

- 4.2.2 Rising water scarcity pushing demand for precision irrigation

- 4.2.3 Labor shortages accelerating mechanization on mid-size farms

- 4.2.4 Integration of IoT sensors enabling pay-as-you-grow service models

- 4.2.5 ESG-linked finance rewarding water-efficiency investments

- 4.2.6 Surge in carbon-credit schemes for water-saving technologies

- 4.3 Market Restraints

- 4.3.1 High upfront capital cost for pivot systems

- 4.3.2 Fragmented land holdings limiting equipment ROI in developing countries

- 4.3.3 Growing concern over plastic waste from drip lines

- 4.3.4 Cyber-vulnerability of connected irrigation networks

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of Substitute Products

- 4.6.4 Threat of New Entrants

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Irrigation Type

- 5.1.1 Sprinkler Irrigation

- 5.1.1.1 Pumping Unit

- 5.1.1.2 Tubing

- 5.1.1.3 Couplers

- 5.1.1.4 Spray or Sprinkler Heads

- 5.1.1.5 Fittings and Accessories

- 5.1.1.6 Sensors

- 5.1.1.7 Controllers

- 5.1.1.8 Injectors

- 5.1.1.9 Flow Meters

- 5.1.2 Drip Irrigation

- 5.1.2.1 Valves

- 5.1.2.2 Backflow Preventers

- 5.1.2.3 Pressure Regulators

- 5.1.2.4 Filters

- 5.1.2.5 Emitters

- 5.1.2.6 Tubing

- 5.1.2.7 Other Drip Irrigation Components

- 5.1.3 Pivot Irrigation

- 5.1.4 Other Irrigation Types

- 5.1.1 Sprinkler Irrigation

- 5.2 By Application Type

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Netherlands

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Cambodia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Peru

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Turkey

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Egypt

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank or Share, Products and Services, Recent Developments)

- 6.4.1 Netafim Ltd. (Orbia Advance Corporation)

- 6.4.2 Valmont Industries, Inc. (Valley Irrigation)

- 6.4.3 Lindsay Corporation

- 6.4.4 Jain Irrigation Systems Limited (Rivulis Irrigation Limited)

- 6.4.5 The Toro Company

- 6.4.6 Nelson Irrigation Corporation

- 6.4.7 Rain Bird Corporation

- 6.4.8 Mahindra & Mahindra Limited

- 6.4.9 Hunter Industries Incorporated

- 6.4.10 Reinke Manufacturing Company, Inc.

- 6.4.11 Ningbo Rainfine Irrigation Co., Ltd.

- 6.4.12 T-L Irrigation Company

- 6.4.13 Sistemas Azud, S.A.

- 6.4.14 Antelco Pty Ltd.

7 Market Opportunities and Future Outlook