PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939126

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939126

Europe Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

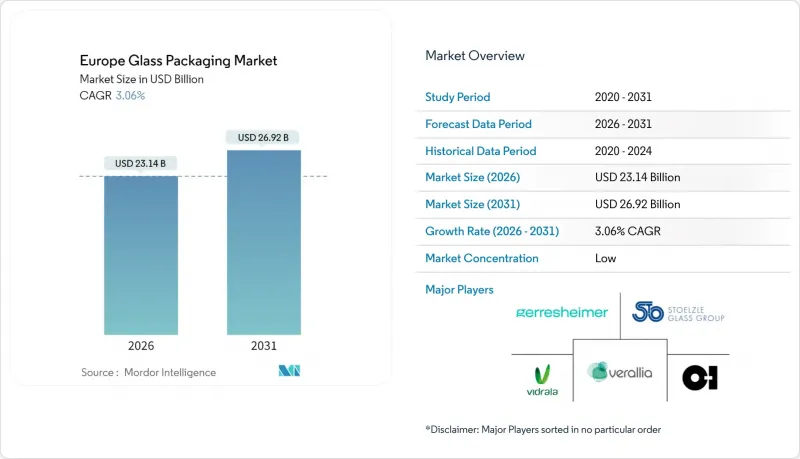

The Europe glass packaging market was valued at USD 22.45 billion in 2025 and estimated to grow from USD 23.14 billion in 2026 to reach USD 26.92 billion by 2031, at a CAGR of 3.06% during the forecast period (2026-2031).

Maturation of the market coexists with transformative regulatory pressure, notably the EU Packaging and Packaging Waste Regulation (PPWR), which mandates full recyclability by 2030 and structurally favors glass because it can be recycled infinitely without quality loss. Technology investments in hybrid and electric furnaces are lowering carbon intensity and countering the impact of volatile natural-gas prices, while premium positioning in beverages, cosmetics, and pharmaceuticals sustains pricing power despite logistics cost headwinds. Competitive strategies revolve around capacity rationalization, cullet-quality upgrades, and specialized pharmaceutical offerings to protect margins that have come under pressure since 2024.

Europe Glass Packaging Market Trends and Insights

EU Packaging and Packaging-Waste Regulation Accelerates Infinitely Recyclable Glass Adoption

The PPWR stipulates that every packaging format sold in the bloc be deemed recyclable by 2030, and its proposed fee modulation will penalize composite structures while rewarding mono-material containers such as glass. Glass already enjoys collection rates exceeding 80% across most member states, with Italy surpassing 90% in 2023, and unlike polymeric substitutes, it does not down-cycle during repeated loops. PFAS restrictions on food-contact surfaces introduce further compliance hurdles for plastic and multilayer laminates, reinforcing glass as the low-risk alternative. The regulation's 10% reuse target for beverage containers by 2030 also underpins refillable glass growth, particularly in countries extending deposit-return schemes.

Premiumisation in Beverages and Cosmetics Boosts Design-Rich Demand

Luxury brands highlight glass aesthetics and tactile weight to signal authenticity and justify premium price points, as illustrated by Bienaime's EUR 160 Monsieur eau de parfum packaged in a custom flacon from Waltersperger. Spirits bottlers, craft breweries, and boutique wineries adopt intricate embossing, unique hues, and recycled glass blends to satisfy consumer desires for premium yet sustainable experiences. Cosmetics players such as SGD Pharma now supply flint bottles containing 20% post-consumer cullet, enabling high-end brands to market lower Scope 3 profiles without sacrificing clarity. Premiumisation resists economic slowdowns because target shoppers prioritize perceived quality and sustainability over unit price.

Lightweight Aluminium and PET Gain Share Through Logistics Edge

Ardagh Metal Packaging's European unit grew 6% to USD 2.16 billion revenue in 2024, behind demand for light cans whose superior cube and weight efficiency reduces freight cost per unit, appealing to price-sensitive beverage fillers. Wine producers report that 31% have migrated part of their portfolio to bag-in-box or PET to shave transport emissions and freight bills, trends pronounced in Eastern Europe, where the distance to retail hubs is larger and fuel cost pass-through is limited.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Preference for Inert, Micro-Plastic-Free Containers Strengthens Loyalty

- Industry Shift to Hybrid and Electric Furnaces Protects Licence to Operate

- Volatile Energy Prices Squeeze Melting Margins and Production Economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European glass packaging market size tied to Bottles/Containers stood at USD 14.84 billion in 2025, equal to 66.12% of the total value. Mature beverage and food channels sustain their baseline demand, but margins compress as customers demand lightweight options. Vials, Ampoules, and Syringes together form a smaller pool but grow at 4.35% CAGR on the back of biologics, GLP-1 therapies, and a strong pipeline of parenteral drugs. The European glass packaging market share for Vials will gradually expand as capacity additions by Gerresheimer and SGD Pharma come online, supported by stringent ISO 15378 quality specifications.

Pharmaceutical buyers accept higher unit prices for dimensional accuracy, delamination resistance, and traceability, driving multi-year supply agreements that reduce revenue volatility for producers. Innovations such as SCHOTT's Velocity Vials, manufactured from Type I borosilicate tubing, increase filling-line speeds and reduce cosmetic defects, sharpening the competitive edge of specialty suppliers.

Type III soda-lime captured 57.75% of the Europe glass packaging market share in 2025 because its cost profile aligns with mass beverages and food jars. Nevertheless, Type I borosilicate is projected to expand at a 4.58% CAGR given the pharmaceutical sector's uncompromising purity standards. The Europe glass packaging market size tied to Type I borosilicate is forecast to crest USD 6.66 billion by 2031, aided by regulatory momentum around advanced biologics.

Borosilicate manufacture demands tighter furnace temperature control and higher raw-material purity. Producers invest in all-electric furnaces to secure a more stable heat curve while cutting CO2 output. ISO-based audit trails and pharmacopoeia conformity requirements serve as entry barriers that shield established vendors from price-led competition.

The Europe Glass Packaging Market Report is Segmented by Product (Bottles/Containers, Vials, Ampoules, and Syringes/Cartridges), Glass Type (Type I Borosilicate, Type II Treated Soda-Lime, Type III (Soda-Lime), and Amber), End-User Vertical (Food, Soft-Drink Beverages, Alcoholic Beverages, Pharmaceutical, and More), Capacity Range (<30 Ml, 30-100 Ml, 100-500 Ml and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Verallia S.A

- BA Glass B.V.

- O-I Glass, Inc.

- Vidrala, S.A.

- Verescence SAS

- Gerresheimer AG

- Saverglass SAS

- ALGLASS S.A.

- Quadpack Industries S.A.

- Berlin Packaging L.L.C.

- Wiegand-Glas Holding GmbH

- Ardagh Group S.A.

- Heinz-Glas GmbH & Co. KGaA

- Zignago Vetro S.p.A.

- Beatson Clark Limited

- Stoelzle Oberglas GmbH

- Vetropack Austria GmbH

- CP Glass S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Packaging and Packaging-Waste Regulation (PPWR) accelerates switch to infinitely-recyclable glass

- 4.2.2 Premiumisation in beverages and cosmetics boosts demand for design-rich glass bottles

- 4.2.3 Consumer preference for inert, micro-plastic-free containers strengthens brand loyalty

- 4.2.4 Industry shift to hybrid-/electric furnaces lowers carbon footprint, protecting licence to operate

- 4.2.5 AI-enabled optical sorting raises cullet quality and glass availability

- 4.2.6 Sustainability Push and Plastic Bans Accelerate Glass Packaging Adoption

- 4.3 Market Restraints

- 4.3.1 Lightweight aluminium and PET gaining share on logistics cost advantage

- 4.3.2 Volatile energy prices squeeze melting margins

- 4.3.3 Gen-Z perception that boxed and canned wine is "greener" than glass

- 4.3.4 Plastic and Metal Packaging Alternatives Erode Glass Share in Mass SKUs

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Trade Scenario Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Bottles / Containers

- 5.1.2 Vials

- 5.1.3 Ampoules

- 5.1.4 Syringes / Cartridges

- 5.2 By Glass Type

- 5.2.1 Type I (Borosilicate)

- 5.2.2 Type II (Treated Soda-lime)

- 5.2.3 Type III (Soda-lime)

- 5.2.4 Amber

- 5.3 By End-user

- 5.3.1 Food

- 5.3.2 Soft-drink Beverages

- 5.3.3 Alcoholic Beverages

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Pharmaceutical

- 5.4 By Capacity Range

- 5.4.1 <30 ml

- 5.4.2 30 - 100 ml

- 5.4.3 100 - 500 ml

- 5.4.4 500 - 1,000 ml

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Verallia S.A

- 6.4.2 BA Glass B.V.

- 6.4.3 O-I Glass, Inc.

- 6.4.4 Vidrala, S.A.

- 6.4.5 Verescence SAS

- 6.4.6 Gerresheimer AG

- 6.4.7 Saverglass SAS

- 6.4.8 ALGLASS S.A.

- 6.4.9 Quadpack Industries S.A.

- 6.4.10 Berlin Packaging L.L.C.

- 6.4.11 Wiegand-Glas Holding GmbH

- 6.4.12 Ardagh Group S.A.

- 6.4.13 Heinz-Glas GmbH & Co. KGaA

- 6.4.14 Zignago Vetro S.p.A.

- 6.4.15 Beatson Clark Limited

- 6.4.16 Stoelzle Oberglas GmbH

- 6.4.17 Vetropack Austria GmbH

- 6.4.18 CP Glass S.A.

7 MARKET OPPORTUNITIES ANDFUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment