PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939136

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939136

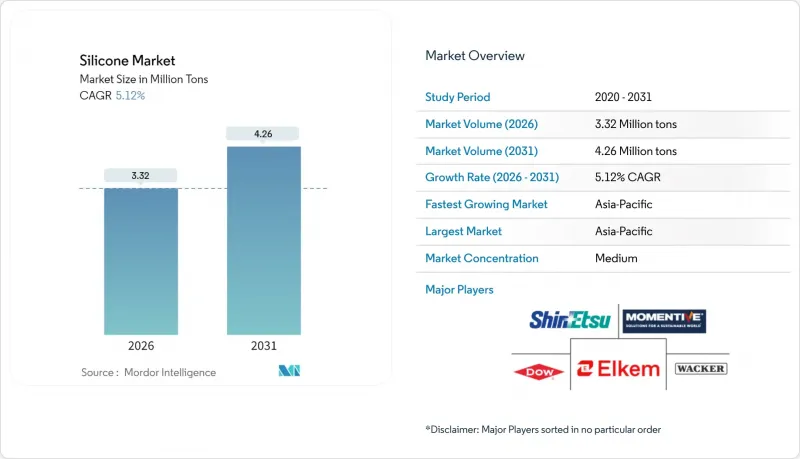

Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Silicone market size in 2026 is estimated at 3.32 million tons, growing from 2025 value of 3.16 million tons with 2031 projections showing 4.26 million tons, growing at 5.12% CAGR over 2026-2031.

This measured expansion reflects the material's entrenched role across mature end-uses while signaling rapid uptake in next-generation applications that demand higher performance and reliability, especially in electric mobility, renewable power, advanced electronics, and medical technology. Robust infrastructure spending in Asia-Pacific, the shift to battery-electric vehicles, and regulatory pushes for more durable, low-maintenance materials continue to underpin baseline growth. At the same time, specialty grades designed for thermal management, biocompatibility, and environmental compliance are unlocking price premiums that help producers protect margins from silicon-metal volatility. Competitive barriers remain rooted in integrated supply chains, proprietary formulations, and the qualification cycles required in safety-critical applications, all of which support a steady value-creation path for incumbents in the silicone industry.

Global Silicone Market Trends and Insights

Rising Applications in Automotive and E-mobility

Electric-vehicle (EV) adoption is multiplying the use of silicone by widening the performance gap versus traditional elastomers. Battery-pack sealing, thermal gap-pads, and high-voltage cable insulation collectively add close to 15 kg of silicone per Tesla Model Y, roughly triple that of an internal-combustion sedan. European OEMs now favor liquid-silicone rubber (LSR) for under-hood parts that must withstand new glycol-free coolants at 150 °C. Chinese EV makers have begun dual-sourcing high-consistency rubber and addition-cure LSR to buffer silicon-metal price swings, encouraging integrated suppliers to lock in long-term contracts. As stringent zero-emission targets phase in, every major automaker is redesigning gasketing, potting, and interface materials, creating an enduring pull for advanced grades across the silicone industry.

Increasing Usage in Healthcare and Medical Devices

Medical-grade silicones must clear USP Class VI and ISO 10993 testing, a protocol that can extend new-product roadmaps by up to 24 months, thereby shielding incumbent suppliers from short-cycle pricing pressure. Wearable glucose monitors, cardiac leads, and neuromodulation implants all hinge on LSR's hypoallergenic profile and stable modulus at body temperature. Hospitals value the polymer's sterilization compatibility with gamma, steam, and e-beam methods, which supports lean re-use strategies in minimally invasive tools. Digitization of care-particularly remote monitoring-has sparked OEM demand for translucent, optically clear silicone films that integrate optical sensors without compromising flex-life. Collectively, these factors cement healthcare as a margin-accretive pillar of the silicone industry.

Volatile Silicon-metal Prices and Supply Bottlenecks

Spot silicon-metal swung between USD 1,800-3,200/ton in 2024 on energy-price gyrations and trade measures, squeezing margin profiles across integrated and merchant producers alike. China supplies nearly 68% of global output, so provincial power rationing immediately reverberates through downstream silicone volumes and pricing. While long-term offtake contracts provide partial insulation, most renew annually, leaving buyers exposed to structural energy-cost inflation. Pilot recycling of semiconductor kerf scrap yields less than 5% of chemical-grade demand, offering only modest relief. Until diversified, low-carbon smelting gains scale, raw-material turbulence will shadow short-term forecasts for the silicone industry.

Other drivers and restraints analyzed in the detailed report include:

- Demand from Power Transmission and Distribution Grids

- 5G Base-station Thermal Interface Materials

- Stringent Siloxane Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Elastomers controlled 49.35% of the silicone market share in 2025 and are forecast to grow at a 5.33% CAGR through 2031. Within this group, liquid-silicone rubber for EV connectors and medical catheters captures the lion's share of incremental tonnage, while high-consistency rubber secures repeat orders in industrial gasketing. LSR's platinum-cure chemistry shortens cycle times, allowing multi-cavity molds that scale efficiently for high-volume parts. Meanwhile, room-temperature-vulcanizing (RTV) grades strength-en sealant franchises in construction rehabilitation, feeding consistent demand regardless of macro-cycles. Collectively, these attributes make elastomers the pivotal innovation hub in the silicone industry.

Fluids rank second in volume, anchored by their role as process aids, lubricants, and personal-care emollients. Although impending siloxane limits challenge commodity cyclics, linear-chain fluids with lower volatility are gaining traction and help offset losses. Resins continue to deliver niche growth as protective encapsulants in power electronics and solar panels, where their thermal stability outperforms epoxy analogs. Specialty formats-gels, foams, and powders-round out the portfolio, supplying advanced textiles, 3-D printing resins, and additive-manufacturing binders. Even as boundaries blur, the cumulative developments sustain a balanced contribution to the silicone market size.

The Silicone Report is Segmented by Form (Fluids, Elastomers, Resins, and Others), Application (Transportation, Construction Materials, Electronics, Healthcare, Industrial Processes, Personal Care and Consumer Products, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific wielded 65.10% of the global silicone market share in 2025, propelled by integrated supply chains and prolific downstream manufacturing. China features fully backward-integrated players that couple local silicon-metal furnaces to elastomer finishing plants, enabling cost competitiveness and rapid scale-up.

North America remains a technology vanguard, where aerospace, advanced automotive, and biomedical device makers impose stringent material specifications. The CHIPS Act catalyzes domestic semiconductor production, triggering new orders for ultra-low-ionic contamination silicone encapsulants. Wind-turbine repowering in the Midwest and solar-farm expansions in the Southwest anchor demand for high-durability sealants, while the U.S. Food and Drug Administration's predictable pathway for LSR components bolsters healthcare volumes. These trends, paired with active research into bio-based siloxane precursors, position the region as an innovation driver in the silicone industry.

Europe secures its role through specialty applications and regulatory leadership. Producers invest in closed-loop depolymerization units that convert spent elastomer scrap into cyclic monomers, aligning with the bloc's circular-economy vision. Automotive electrification mandates energize demand for high-temperature, low-bleed thermal pads, while offshore-wind build-outs in the North Sea necessitate robust resins for nacelle encapsulation. Although REACH obligations elevate compliance costs, they also create barriers that temper direct price competition, sustaining value density across the European silicone industry.

- BRB International (PETRONAS)

- CHT Germany GmbH

- DIC Corporation

- Dongyue Group

- Dow

- DyStar Singapore Pte Ltd

- Elkem ASA

- Evonik Industries AG

- Hoshine Silicon Industry Co., Ltd

- KANEKA Corporation

- KCC SILICONE CORPORATION

- Momentive

- Shin-Etsu Chemical Co. Ltd

- Siltech Corporation

- Wacker Chemie AG

- Wynca Tinyo Silicone Co., Ltd.

- Zhejiang Hengyecheng Organic Silicone Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising applications in automotive and e-mobility

- 4.2.2 Increasing usage in healthcare and medical devices

- 4.2.3 Demand from power transmission and distribution grids

- 4.2.4 5G base-station thermal interface materials

- 4.2.5 LSR adoption in wearable medical sensors

- 4.3 Market Restraints

- 4.3.1 Volatile silicon-metal prices and supply bottlenecks

- 4.3.2 Stringent siloxane emission regulations

- 4.3.3 Competition from fluoropolymers and thermoplastics

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Fluids

- 5.1.2 Elastomers

- 5.1.3 Resins

- 5.1.4 Others

- 5.2 By Application

- 5.2.1 Transportation

- 5.2.2 Construction Materials

- 5.2.3 Electronics

- 5.2.4 Healthcare

- 5.2.5 Industrial Processes

- 5.2.6 Personal Care and Consumer Products

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 Nordics

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 BRB International (PETRONAS)

- 6.4.2 CHT Germany GmbH

- 6.4.3 DIC Corporation

- 6.4.4 Dongyue Group

- 6.4.5 Dow

- 6.4.6 DyStar Singapore Pte Ltd

- 6.4.7 Elkem ASA

- 6.4.8 Evonik Industries AG

- 6.4.9 Hoshine Silicon Industry Co., Ltd

- 6.4.10 KANEKA Corporation

- 6.4.11 KCC SILICONE CORPORATION

- 6.4.12 Momentive

- 6.4.13 Shin-Etsu Chemical Co. Ltd

- 6.4.14 Siltech Corporation

- 6.4.15 Wacker Chemie AG

- 6.4.16 Wynca Tinyo Silicone Co., Ltd.

- 6.4.17 Zhejiang Hengyecheng Organic Silicone Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet Need Assessment