PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939147

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939147

Automotive Coolant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

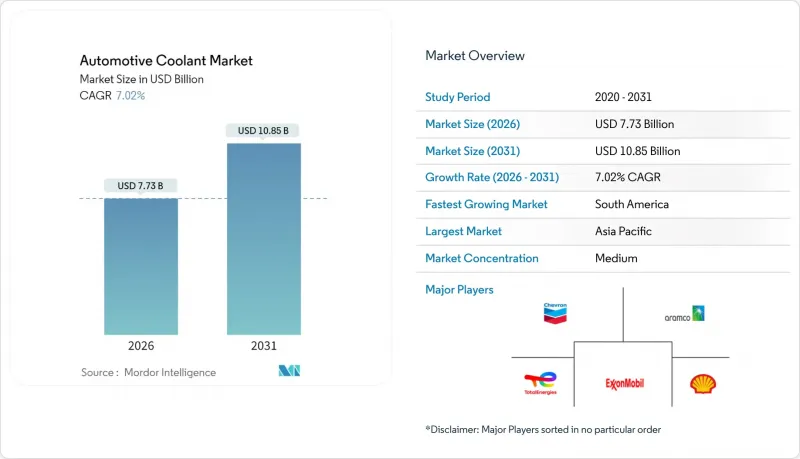

The automotive coolant market is expected to grow from USD 7.22 billion in 2025 to USD 7.73 billion in 2026 and is forecast to reach USD 10.85 billion by 2031 at 7.02% CAGR over 2026-2031.

Rising electric-vehicle production, aging internal-combustion fleets that require frequent fluid changes, and stricter thermal-management regulations all contribute to the steady expansion of the automotive coolant market. Suppliers gain from value-added chemistry that lengthens drain intervals, while fleet operators reduce downtime costs through premium formulations. Electrification reshapes product needs by pushing low-conductivity, dielectric coolants into volume production, creating a fresh revenue layer atop traditional ethylene-glycol lines.

Global Automotive Coolant Market Trends and Insights

Rising Global Vehicle Parc and Aging Fleet

Fleet aging dynamics create sustained aftermarket demand as older vehicles require more frequent coolant service intervals compared to modern extended-life formulations. The global vehicle parc expansion, particularly in emerging markets, generates replacement demand that outpaces the growth of new vehicle sales. India's automotive aftermarket is projected to reach a significant scale, driven by government policies such as PLI and PM E-DRIVE that incentivize domestic vehicle production while maintaining substantial ICE fleet operations. This trend particularly benefits aftermarket coolant suppliers as aging fleets in North America and Europe transition from conventional to long-life coolant systems during major service intervals. Heavy-duty commercial vehicles demonstrate this pattern most clearly, where fleet operators increasingly adopt extended-life coolants to reduce maintenance costs while managing larger vehicle populations.

OEM Push for Long-Life OAT/HOAT Coolants

Original equipment manufacturers are standardizing on organic acid technology and hybrid formulations to achieve service intervals exceeding 150,000 miles, fundamentally altering coolant demand patterns from volume-based to value-based consumption. General Motors' DexCool adoption established the template, with service life extending to 150,000 miles compared to conventional coolants' 30,000-mile intervals. This shift reduces total coolant volume consumption per vehicle over its lifetime while increasing per-unit coolant value and complexity. European OEMs, such as Mercedes-Benz, specify 15-year service intervals for certain applications, creating demand for premium coolant chemistries with enhanced stability and corrosion protection. The transition challenges aftermarket suppliers to stock multiple chemistry types while educating service technicians on compatibility requirements, as mixing incompatible coolant types accelerates component failures.

Raw-Material (Glycol) Price Volatility

Ethylene glycol price fluctuations directly impact coolant manufacturing costs, with supply chain disruptions creating margin pressure for coolant producers while potentially limiting market growth in price-sensitive segments. Global ethylene glycol pricing volatility affects coolant manufacturers' ability to maintain stable pricing, particularly impacting the penetration of emerging markets, where cost sensitivity remains high. The challenge intensifies as bio-based glycerin alternatives, while environmentally preferred, command premium pricing that limits adoption in cost-conscious aftermarket segments. Supply chain resilience becomes critical as manufacturers like Arteco establish local production facilities in China to mitigate risks associated with import dependency and currency fluctuations. Raw material constraints, particularly for smaller coolant manufacturers lacking vertical integration or long-term supply contracts, can accelerate industry consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Emerging-Market Vehicle Production

- Demand for Dielectric Thermal-Management Fluids in EVs

- Extended Drain Intervals Cutting Aftermarket Volume

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ethylene glycol maintains its market leadership with a 51.92% of the automotive coolant market share in 2025, driven by its proven performance characteristics and established supply chains. Meanwhile, glycerin emerges as the fastest-growing segment, with a 9.01% CAGR through 2031, reflecting environmental sustainability mandates and the adoption of bio-based chemistry. The ethylene glycol segment benefits from mature manufacturing infrastructure and cost advantages, particularly in Asia-Pacific production hubs where scale economies support competitive pricing.

The segment dynamics reflect a broader industry transformation, where traditional chemistry leadership faces disruption from sustainability-driven innovation, creating opportunities for suppliers with bio-based capabilities while challenging established ethylene glycol producers to develop renewable alternatives or risk erosion of their market share.

Passenger cars maintain a 45.52% of the automotive coolant market share in 2025, as e-commerce expansion and last-mile delivery electrification create specialized thermal management requirements. Light commercial vehicles represent the fastest-growing segment, with a 7.12% CAGR through 2031. The passenger car segment benefits from volume production and standardized coolant specifications; however, growth moderates as extended-life coolants reduce the need for replacement. Commercial vehicle applications require higher-performance coolants that can support extended service intervals and severe-duty operation. The heavy-duty segments are increasingly adopting OAT formulations to achieve a 1,000,000-mile service life. Medium- and heavy-duty commercial vehicles benefit from the purchasing power of fleets and professional maintenance practices that favor premium coolant formulations over conventional alternatives.

The segment transformation reflects broader transportation electrification trends, where commercial fleets lead EV adoption due to total cost of ownership benefits, creating demand for specialized battery thermal management coolants. EPA regulations mandating substantial PEV penetration through 2032 particularly impact medium-duty delivery vehicles, where fleet purchasers like Amazon and FedEx drive early adoption of electric powertrains requiring dedicated thermal management solutions.

The Automotive Coolant Market Report is Segmented by Product Type (Ethylene Glycol, Propylene Glycol, Glycerin, Others), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Technology (IAT, OAT, HOAT), End User (OEM, and Aftermarket), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region maintains the largest regional market share, accounting for 34.53% of the automotive coolant market in 2025. This is driven by China's stringent EV thermal management regulations and India's rapid expansion of automotive production, which is supported by government manufacturing incentives. China's GB standards mandate specific electrical conductivity limits for EV coolants, creating demand for specialized formulations that balance thermal performance with electrical safety requirements. India's automotive aftermarket growth, supported by PLI and PM E-DRIVE policies, generates sustained demand for both conventional and EV-specific coolant formulations as domestic OEMs establish thermal management supply chains. Japan and South Korea contribute to advanced EV technology development, which requires specialized dielectric coolants for battery and power electronics cooling applications.

South America emerges as the fastest-growing region, with a 6.67% CAGR through 2031, benefiting from Argentina-Brazil automotive integration policies that streamline vehicle homologation and component approval processes, while expanding commercial vehicle production to meet growing e-commerce demand. The region's growth acceleration stems from mutual recognition agreements that reduce regulatory barriers for coolant suppliers serving both major markets, creating economies of scale for regional operations.

North America and Europe represent mature markets with moderate growth rates, as the adoption of extended-life coolants reduces replacement frequency, while regulatory requirements drive specification upgrades toward premium formulations. European markets are facing particular transformation pressure from REACH regulations and PFAS restrictions, which favor bio-based coolant alternatives, creating opportunities for suppliers with sustainable chemistry capabilities. North American fleet operators increasingly adopt extended-life coolants to reduce maintenance costs, creating structural headwinds for aftermarket volume growth while benefiting OEM fill applications.

- BASF SE

- Dow Inc.

- Chevron Corporation

- ExxonMobil Corp.

- Shell plc

- TotalEnergies SE

- China Petroleum and Chemical Corp. (Sinopec)

- BP plc (Castrol)

- Saudi Aramco Group

- PETRONAS (Petroliam Nasional Berhad)

- Cummins Inc.

- Fuchs Petrolub SE

- Motul S.A.

- Old World Industries, LLC (PEAK)

- Recochem Corporation

- CCI Corporation

- Prestone Products Corporation

- Evans Cooling Systems Inc.

- AMSOIL Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Vehicle Parc And Aging Fleet

- 4.2.2 OEM Push For Long-Life OAT/HOAT Coolants

- 4.2.3 Growth Of Emerging-Market Vehicle Production

- 4.2.4 Adoption Of High-Performance ICE Designs

- 4.2.5 Demand For Dielectric Thermal-Management Fluids In EVs

- 4.2.6 Environmental Shift Toward Bio-Based Glycerin Coolants

- 4.3 Market Restraints

- 4.3.1 Raw Material (Glycol) Price Volatility

- 4.3.2 Extended Drain Intervals Cutting Aftermarket Volume

- 4.3.3 Sealed Cooling Loops in Next-Gen EV Platforms

- 4.3.4 Toxicity-Driven Ethylene-Glycol Restrictions

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Product Type

- 5.1.1 Ethylene Glycol

- 5.1.2 Propylene Glycol

- 5.1.3 Glycerin

- 5.1.4 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Bus and Coaches

- 5.3 By Technology

- 5.3.1 Inorganic Additive Technology (IAT)

- 5.3.2 Organic Additive Technology (OAT)

- 5.3.3 Hybrid Organic Acid Technology (HOAT)

- 5.4 By End User

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Dow Inc.

- 6.4.3 Chevron Corporation

- 6.4.4 ExxonMobil Corp.

- 6.4.5 Shell plc

- 6.4.6 TotalEnergies SE

- 6.4.7 China Petroleum and Chemical Corp. (Sinopec)

- 6.4.8 BP plc (Castrol)

- 6.4.9 Saudi Aramco Group

- 6.4.10 PETRONAS (Petroliam Nasional Berhad)

- 6.4.11 Cummins Inc.

- 6.4.12 Fuchs Petrolub SE

- 6.4.13 Motul S.A.

- 6.4.14 Old World Industries, LLC (PEAK)

- 6.4.15 Recochem Corporation

- 6.4.16 CCI Corporation

- 6.4.17 Prestone Products Corporation

- 6.4.18 Evans Cooling Systems Inc.

- 6.4.19 AMSOIL Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment