PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939596

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939596

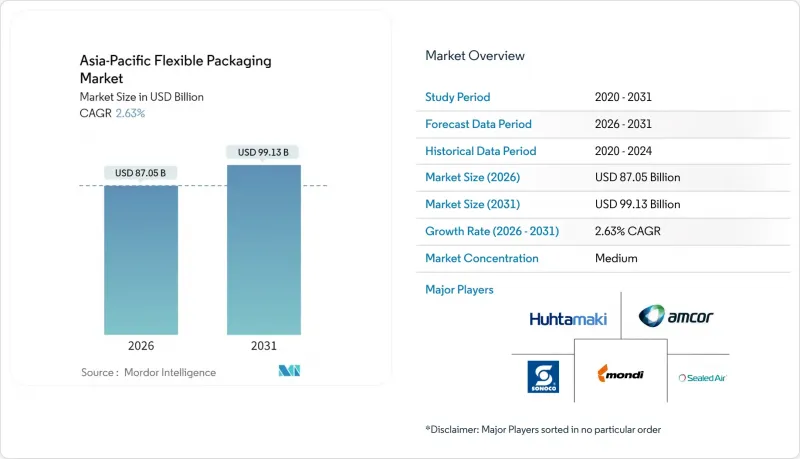

Asia-Pacific Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific flexible packaging market size in 2026 is estimated at USD 87.05 billion, growing from 2025 value of USD 84.82 billion with 2031 projections showing USD 99.13 billion, growing at 2.63% CAGR over 2026-2031.

Capital now flows toward high-barrier, recyclable designs rather than raw tonnage, as regulators tighten mandates on mono-material formats in Japan, Australia, and pilot cities in China and India. China still offers scale advantages, yet India's 4.89% CAGR signals a geographic pivot as converters seek lower labor costs and rising demand for snacks and personal care. Plastics held a 68.12% share in 2024, but bioplastics and compostables are gaining momentum, expanding at a rate of 4.33% annually as brand owners future-proof their portfolios against extended producer responsibility schemes. Bags and pouches remained the cost-efficient workhorse, accounting for 47.63% of product-type revenue. Meanwhile, sachets and stick packs gained ground, with a 3.67% growth curve that speaks to the affordability of single-serve products across tier-2 and tier-3 Asian cities. Digital printing, growing at a rate of 4.76% per year, is reshaping converter economics by enabling profitable runs of less than 10,000 linear meters and supporting limited-edition launches in Japan and South Korea.

Asia-Pacific Flexible Packaging Market Trends and Insights

Increased Demand for Convenient Packaging

Urbanization exceeding 60% in China and a rising share of single-person households in Japan are shrinking meal-prep time, prompting demand for portion-controlled, resealable pouches that minimize food waste. Southeast Asian retailers have raised shelf allocation for flexible SKUs by 22% in 2025, validating converters' investments in servo-driven pouch lines. The ability to switch SKUs within 15 minutes boosts asset utilization and supports rapid promotions. Consumers pay a convenience premium of 8-12%, cushioning margin pressure from resin fluctuations. As disposable incomes increase, flexible packaging becomes the preferred choice for snacks, beverages, and ready-to-eat meals in emerging urban clusters.

Growing E-Commerce Penetration for Packaged Goods

India's online grocery share rose from 3.2% in 2020 to 7.8% in 2024, and Vietnam's e-commerce logistics network reached 85% population coverage in 2024. Last-mile realities demand puncture-resistant, matte-finish films that can withstand multiple handling points and display well on mobile screens. Converters now engineer multi-layer structures with a puncture strength of> 4 newtons, accepting a 6-8% material premium to avoid costly returns. Variable-data codes printed digitally drive brand engagement, tying packaging to loyalty programs. The performance-plus-aesthetics combination cements flexible packs as the logical e-commerce container.

Concerns About Environmental Impact and Recycling of Plastic Packaging

Extended producer responsibility fees of 0.8-2.1% of the ex-factory price in Vietnam, Thailand, and the Philippines shave 40-60 basis points off converter margins. India's 80% collection target by 2026 remains elusive in rural districts, hindering brand-owner compliance. Surveys show 64% of consumers in Japan and South Korea avoid multilayer pouches when recyclable alternatives exist, pressuring legacy formats. Compostable films still command premiums of 25-30% and struggle in humid, high-moisture environments. Until robust recycling streams emerge, brand owners face a tension between their sustainability pledges and the realities of cost.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Mono-Material Flexible Packaging to Meet Recycling Mandates

- Surge in Cold Chain Expansion for Fresh Produce Exports in Southeast Asia

- Volatility in Raw Material Prices for Petrochemical Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics dominated 2025 with 67.35% share, and polyethylene remained the workhorse for high-speed vertical form-fill-seal lines. Within this base, bioplastics and compostables chart the fastest expansion at a 4.17% CAGR as brand owners adopt PLA and PHA blends to meet Japan and Australia's upcoming recyclability thresholds. The Asia-Pacific flexible packaging market size for bioplastics is on track to expand as global supply chains become more integrated, although freight premiums from Europe continue to impact landed cost structures. BOPP continues to excel in snacks and confectionery due to its clarity and printability, while aluminum foil maintains a niche in medical and coffee applications where sub-0.5 cc/m2/day oxygen levels are non-negotiable.

The drive to mono-material pushes polyethylene suppliers into higher-barrier formulations, replacing PET and nylon layers with metallized PE and HDPE coatings to maintain recyclability. Uflex's Flex-PET, commercialized in 2024, achieves 1.2 cc/m2/day oxygen transmission and reinforces polyethylene's claim on snack films. Paper-based laminates are gaining traction in South Korean cosmetics, trading at 18-22% cost premiums while offering a fiber-rich sustainability story. Metal's high barrier remains unmatched for pharmaceuticals yet faces scrutiny for recycling energy intensity. Net-net, the Asia-Pacific flexible packaging market faces a resin-mix recalibration favoring recyclable polyolefins over complex multilayers.

Bags and pouches held 46.95% share in 2025, powered by versatility across food, pet food, and agriculture. However, sachets and stick packs are projected to grow at a 3.55% CAGR through 2031. The Asia-Pacific flexible packaging market share for sachets is increasing as multinationals target price-sensitive consumers with single-use products such as shampoos, conditioners, and skincare creams. Unilever and Procter & Gamble expanded sachet SKUs by 14% in India in 2024 to reach households with monthly incomes of less than USD 300.

Films and wraps tie demand to manufacturing output, with stretch film facing headwinds from reusable bundling trials in Japan and South Korea. Stand-up pouches with spouts are replacing rigid bottles in liquid detergents, reducing weight by 40% and strengthening circular-economy credentials. The Asia-Pacific flexible packaging market continues to favor flexible formats that align with e-commerce logistics, as lighter parcels lower last-mile delivery costs. Niche types such as lidding films chase higher-margin bakery and produce overwraps. Collectively, product-type diversification supports converters' portfolio resilience amid fluctuating resin prices.

The Asia-Pacific Flexible Packaging Market Report is Segmented by Material (Plastics, Paper, Metal Foil, Bioplastics and Compostable Materials), Product Type (Bags and Pouches, Films and Wraps, and More), End-User Industry (Beverage, Healthcare and Pharmaceutical, Personal Care and Cosmetics, and More), Printing Technology (Flexography, Rotogravure, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Mondi plc

- Sonoco Products Company

- Rengo Co., Ltd.

- Sealed Air Corporation

- Formosa Flexible Packaging Corp.

- Wapo Corporation Ltd.

- Chuan Peng Enterprise Co., Ltd.

- TCPL Packaging Ltd.

- Ester Industries Limited

- Huhtamaki Oyj

- Uflex Ltd.

- ProAmpac Holdings Inc.

- Constantia Flexibles Group GmbH

- Winpak Ltd.

- Cosmo Films Ltd.

- Glenroy Inc.

- Toppan Printing Co., Ltd.

- Fujimori Kogyo Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Convenient Packaging

- 4.2.2 Demand for Longer Shelf Life and Innovative Packaging

- 4.2.3 Growing E-Commerce Penetration for Packaged Goods

- 4.2.4 Adoption of Mono-Material Flexible Packaging to Meet Recycling Mandates

- 4.2.5 Surge in Cold Chain Expansion for Fresh Produce Exports in Southeast Asia

- 4.2.6 Brand Owner Shift Toward Digital Printing for Short-Run Personalization

- 4.3 Market Restraints

- 4.3.1 Concerns About Environmental Impact and Recycling of Plastic Packaging

- 4.3.2 Volatility in Raw Material Prices for Petrochemical Feedstocks

- 4.3.3 Regulatory Restrictions on Multilayer Structures in Japan and Australia

- 4.3.4 Limited Food-Grade Recyclate Availability for Flexible Formats

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Other Plastics

- 5.1.2 Paper

- 5.1.3 Metal Foil

- 5.1.4 Bioplastics and Compostable Materials

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Bags and Pouches

- 5.2.2 Films and Wraps

- 5.2.3 Sachets and Stick Packs

- 5.2.4 Other Product Types

- 5.3 BY End-user Industry

- 5.3.1 Food

- 5.3.1.1 Baked Goods

- 5.3.1.2 Snacks

- 5.3.1.3 Meat, Poultry and Seafood

- 5.3.1.4 Confectionery

- 5.3.1.5 Pet Food

- 5.3.1.6 Other Food Products

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceutical

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Agriculture and Horticulture

- 5.3.6 Other End-User Industries

- 5.3.1 Food

- 5.4 By Printing Technology

- 5.4.1 Flexography

- 5.4.2 Rotogravure

- 5.4.3 Digital Printing

- 5.4.4 Other Printing Technologies

- 5.5 By Country

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Australia

- 5.5.5 South Korea

- 5.5.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 Sonoco Products Company

- 6.4.4 Rengo Co., Ltd.

- 6.4.5 Sealed Air Corporation

- 6.4.6 Formosa Flexible Packaging Corp.

- 6.4.7 Wapo Corporation Ltd.

- 6.4.8 Chuan Peng Enterprise Co., Ltd.

- 6.4.9 TCPL Packaging Ltd.

- 6.4.10 Ester Industries Limited

- 6.4.11 Huhtamaki Oyj

- 6.4.12 Uflex Ltd.

- 6.4.13 ProAmpac Holdings Inc.

- 6.4.14 Constantia Flexibles Group GmbH

- 6.4.15 Winpak Ltd.

- 6.4.16 Cosmo Films Ltd.

- 6.4.17 Glenroy Inc.

- 6.4.18 Toppan Printing Co., Ltd.

- 6.4.19 Fujimori Kogyo Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment