PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939598

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939598

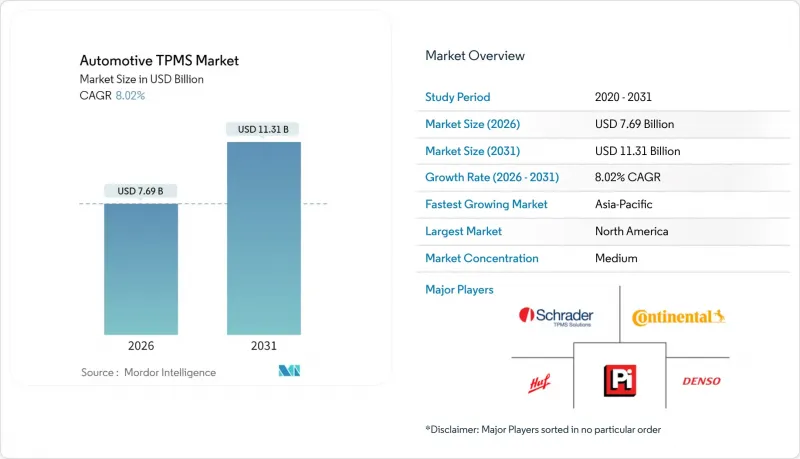

Automotive TPMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Automotive TPMS market is expected to grow from USD 7.12 billion in 2025 to USD 7.69 billion in 2026 and is forecast to reach USD 11.31 billion by 2031 at 8.02% CAGR over 2026-2031.

The expansion stems from tightly enforced safety rules, the shift toward electrified powertrains, and deeper integration of tire data into advanced driver-assistance and connected-car stacks. Real-time tire health analytics are replacing legacy pressure-only alerts, allowing automakers to align predictive maintenance with over-the-air software capabilities while protecting driving range in weight-sensitive electric models. Consolidation of sensor, gateway, and cloud platforms is also lowering system costs, accelerating adoption in two-wheelers and commercial fleets. In parallel, innovation in piezoelectric energy harvesting and secure 2.4 GHz connectivity is redefining how sensors power themselves and how data move between tires, gateways, and the cloud, positioning the Automotive TPMS market for resilient multi-segment growth.

Global Automotive TPMS Market Trends and Insights

Mandated TPMS Fitment In New-Vehicle Safety Regulations

Regulatory expansion is widening beyond passenger cars into trucks, buses, and trailers now mandated by the EU's General Safety Regulation from July 2024. Comparable rules in the United States under FMVSS 138 keep all light vehicles under 10,000 lb within scope and have demonstrated fitment costs of USD 48.44-69.89 per unit. Early adoption in South Korea and draft frameworks in India offer blueprints for emerging markets, ensuring the Automotive TPMS market sustains regulatory pull into the medium term. Commercial fleets that previously lagged adoption are rapidly upgrading, swelling replacement volumes and driving economies of scale in sensor production.

Rising Integration With ADAS & Connected-Car Telematics Platforms

Merging direct TPMS data with vehicle stability, automated braking, and cloud analytics amplifies overall safety value. Melexis launched the first Bluetooth-enabled OEM TPMS, unlocking over-the-air software support and frictionless pairing to mobile apps. For electric vehicles, optimized tire pressure elevates battery range and mitigates regenerative-braking variability, making TPMS data indispensable within the ADAS stack. Upcoming mandates for automatic emergency braking in 2025 vehicles further embed tire status as a critical input to decision algorithms.

High Sensor & Calibration Cost In Entry-Level Segments

In price-sensitive A-segment cars and commuter bikes, the extra USD 12-15 hardware cost plus dealer calibration fees deter full compliance. Although Continental's multi-protocol programmable sensor trims SKU counts for garages, independent repairers still require scan tools and training to avoid warranty misfires. Battery life constraints further discourage low-budget owners who view valve dismounting labor as prohibitive.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation Of Low-Cost Mems Sensors For Two-Wheelers

- Shift Toward Smart-Tire Health-Analytics Ecosystems

- Wireless TPMS Cybersecurity Vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Direct architectures held a 62.35% Automotive TPMS market share in 2025 and are projected to log an 8.01% CAGR through 2031, underpinned by real-time pressure and temperature delivery that meets UN R141 accuracy thresholds. Indirect solutions remain a cost hedge in fleet retrofits by piggybacking ABS wheel-speed signals but cannot furnish the high-granularity data streams required for ADAS sensor fusion. As automakers transition to centralized domain controllers, direct TPMS nodes slot neatly onto CAN-FD or Automotive Ethernet backbones, streamlining diagnostics and over-the-air firmware updates.

Parallel to hardware, software analytics platforms convert raw tire data into actionable maintenance intervals, predictive tread-wear alerts, and dynamic load balancing cues. Fleet management portals integrate TPMS dashboards, giving maintenance managers early insight into slow leaks before roadside blowouts. Such predictive value elevates the Automotive TPMS market from component supply to recurring service models, supporting premium pricing even as silicon costs decline.

MEMS capacitive elements captured 51.05% of Automotive TPMS market share in 2025 due to mature front-end fabrication and wide OEM validation. However, piezoelectric harvesters are rapidly gaining traction with an 8.11% CAGR outlook as suppliers integrate lead-zirconate-titanate strips that convert carcass deflection into usable charge. Proof-of-concept prototypes from the University of Perugia generated 768 V under 2 MPa radial load, adequate for microcontroller duty cycles without coin-cell batteries. Eliminating batteries eases end-of-life recycling, lengthens maintenance intervals, and opens TPMS deployment on hub-less two-wheelers where sensor access is tight.

Meanwhile, dual-axis accelerometers such as NXP FXTH87E enable automatic wheel localization, cutting 5 minutes from tire-rotation service times and underpinning field adoption across rental fleets. Strain-gauge and optical sensors continue filling niche performance cars where sub-0.1 psi resolution adds track-day value, but their higher BOM keeps volume modest.

The Automotive TPMS Market Report is Segmented by System Type (Direct, Indirect, and Hybrid), Sensor Technology (MEMS Capacitive, Strain-Gauge, and More), Fitting Method (Valve-Stem, Band/Rim-Mounted, and Embedded-Tire Module), Frequency Band (315 MHz and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM Factory-Fit and Aftermarket Retrofit), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, anchored by FMVSS (Federal Motor Vehicle Safety Standards) 138, remained the largest regional contributor to Automotive TPMS market revenue in 2025 with 36.12% market share, supported by light-vehicle installation rates and robust aftermarket supply chains. Ongoing emphasis on cybersecurity at the state level is steering suppliers toward encrypted BLE and UWB stacks that can satisfy upcoming ISO 21434 audits. Canadian adoption tracks U.S. standards, while Mexican OEM plants increasingly pre-install TPMS to serve export markets, reinforcing supply-chain clustering at Texas and Nuevo Leon logistics hubs. Commercial carriers pursuing Compliance, Safety, Accountability score improvements are bulk-retrofitting Class 8 tractors, lifting the regional retrofit penetration to almost two-fifths in 2025.

The General Safety Regulation in Europe mandated TPMS on all new commercial vehicles from mid-2024. German OEMs such as Daimler Truck and MAN have already embedded direct sensors on heavy-duty platforms. At the same time, British aftermarket distributors report more than half-year-on-year growth in van retrofit sales. The region's decarbonization targets encourage fleets to pair TPMS with low-rolling-resistance tires, capturing 2-3% fuel savings validated by TUV Nord field testing. Pan-European UN R141 harmonization further lowers homologation friction, allowing cross-border fleets to standardize part numbers for trailers operating from Rotterdam to Warsaw.

Asia-Pacific leads absolute shipment volume and is forecast to outpace global averages to 2031 with 8.19% CAGR as India, China, and Southeast Asian nations legislate broader two-wheeler and light-truck coverage. China's electric-vehicle surge is compelling battery-range-sensitive automakers to standardize TPMS across A-segment hatchbacks, with BYD sourcing millions of sensor annually from local tier-twos. South Korea's early 2013 mandate offers a mature aftermarket for replacement sensors, while India's Automotive Industry Standard 149 revision proposes mandatory TPMS on M and N categories from 2026. Motorcycle OEMs in Vietnam already bundle direct sensors on 150 cc models priced under USD 1,500, underscoring the rapid cost deflation achievable in high-volume ASEAN ecosystems.

- Continental AG

- Sensata Technologies / Schrader

- Pacific Industrial Co. Ltd.

- Huf Hulsbeck & Furst

- DENSO Corporation

- ZF Friedrichshafen AG (incl. TRW)

- Valeo SA

- ALLIGATOR Ventilfabrik GmbH

- Alps Alpine Co. Ltd.

- Delphi / Aptiv plc

- Continental - Vitesco JV

- PressurePro Enterprises Inc.

- Steelmate Co. Ltd.

- Orange Electronic Co. Ltd.

- Bartec USA LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated TPMS Fitment In New-Vehicle Safety Regulations

- 4.2.2 Rising Integration With ADAS & Connected-Car Telematics Platforms

- 4.2.3 Proliferation Of Low-Cost Mems Sensors For Two-Wheelers

- 4.2.4 Shift Toward Smart-Tire Health-Analytics Ecosystems

- 4.2.5 Electrification Increasing Weight-Sensitive Range Anxiety

- 4.2.6 Insurance-Telematics Incentives For Tire-Pressure Compliance

- 4.3 Market Restraints

- 4.3.1 High Sensor & Calibration Cost In Entry-Level Segments

- 4.3.2 Aftermarket Installation Complexity & Maintenance Issues

- 4.3.3 Wireless TPMS Cybersecurity Vulnerabilities

- 4.3.4 Advent Of Airless & Run-Flat Tire Technologies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By System Type

- 5.1.1 Direct

- 5.1.2 Indirect

- 5.1.3 Hybrid

- 5.2 By Sensor Technology

- 5.2.1 MEMS Capacitive

- 5.2.2 Strain-Gauge

- 5.2.3 Piezoelectric

- 5.2.4 Others (Optical, SAW, etc.)

- 5.3 By Fitting Method

- 5.3.1 Valve-Stem (Snap-In & Clamp-In)

- 5.3.2 Band / Rim-Mounted

- 5.3.3 Embedded-Tire Module

- 5.4 By Frequency Band

- 5.4.1 315 MHz

- 5.4.2 433 MHz

- 5.4.3 More than or equal to 2.4 GHz & UWB

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Commercial Vehicle

- 5.5.3 Two-Wheelers

- 5.6 By Sales Channel

- 5.6.1 OEM Factory-Fit

- 5.6.2 Aftermarket Retrofit

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Australia

- 5.7.4.6 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Turkey

- 5.7.5.4 Egypt

- 5.7.5.5 South Africa

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Sensata Technologies / Schrader

- 6.4.3 Pacific Industrial Co. Ltd.

- 6.4.4 Huf Hulsbeck & Furst

- 6.4.5 DENSO Corporation

- 6.4.6 ZF Friedrichshafen AG (incl. TRW)

- 6.4.7 Valeo SA

- 6.4.8 ALLIGATOR Ventilfabrik GmbH

- 6.4.9 Alps Alpine Co. Ltd.

- 6.4.10 Delphi / Aptiv plc

- 6.4.11 Continental - Vitesco JV

- 6.4.12 PressurePro Enterprises Inc.

- 6.4.13 Steelmate Co. Ltd.

- 6.4.14 Orange Electronic Co. Ltd.

- 6.4.15 Bartec USA LLC

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment