PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939611

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939611

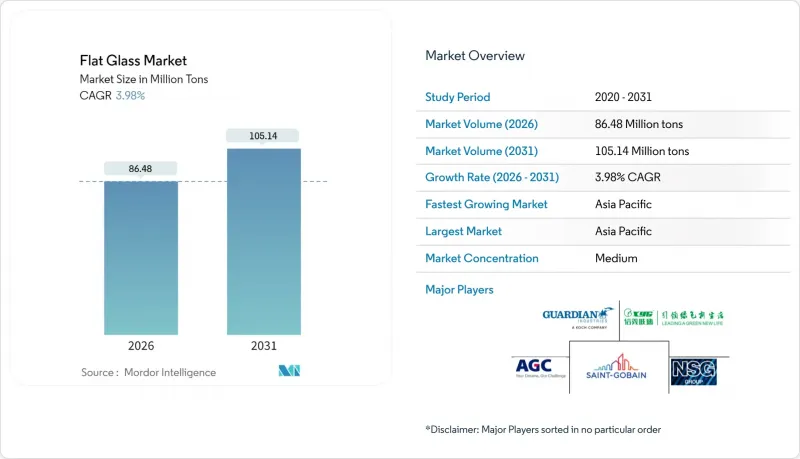

Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Flat Glass market is expected to grow from 83.17 Million tons in 2025 to 86.48 Million tons in 2026 and is forecast to reach 105.14 Million tons by 2031 at 3.98% CAGR over 2026-2031.

Demand resilience stems from stricter construction energy codes, rapid photovoltaic build-outs, and automotive lightweighting that favors advanced glazing. Manufacturers are shifting toward low-carbon melting, green hydrogen trials, and oxy-electric hybrid furnaces to secure price premiums in sustainability-conscious tenders. Solar module glass, antimicrobial coatings for healthcare facilities, and ultra-thin triple units for high-rise retrofits are expanding the revenue mix. Asia-Pacific anchors both production and consumption, while North America and Europe invest in furnace electrification to counter energy-price swings and looming carbon tariffs.

Global Flat Glass Market Trends and Insights

Growing Investments in Commercial and Residential Construction

Global construction outlays are forecast to climb, aided by lower borrowing costs and an uptick in developer sentiment. Multifamily starts accelerate in response to single-family affordability gaps, channeling sustained demand for curtain wall and window systems that integrate Low-E and triple-glazed units. Developers specify higher-performance glass to secure LEED credits, driving volume growth for sputter-coated and argon-filled insulating products. The flat glass market, therefore, benefits directly from code-driven window-to-wall ratios that favor advanced glazing solutions.

Rising Automotive Glazing Requirements for EV Safety and Lightweighting

Electric vehicle platforms intensify structural glazing needs while mandating lighter glass to offset battery mass. Fuyao committed CNY 9.1 billion (USD 1.26 billion) in 2024 for two new plants aimed at new-energy vehicle demand. Thin laminated windshields, panoramic roofs, and heads-up display-ready windscreens expand processed glass penetration. Embedded sensor packages elevate value per car, creating a lucrative growth pocket inside the broader flat glass market. Aerodynamic gains from slimmer profiles further align with range optimization, cementing glass as a critical lightweight substrate over the forecast horizon.

Availability of Polymer, Acrylic and Polycarbonate Substitutes

Automakers trial polycarbonate side windows and panoramic roofs that weigh up to 50% less than comparable glass panels. Optical clarity and UV stability have improved, yet scratch resistance and thermal tolerance still lag glass. Stringent windshield regulations keep polycarbonate use niche, confining substitution risk mostly to non-load-bearing glazing. Glass recycling advantages and tighter end-of-life circularity goals further insulate flat glass market volumes.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Capacity Additions for Solar PV Module Glass

- Energy-Efficient Building Codes Boosting Low-E and Triple Glazing Demand

- Volatile Soda-Ash and Natural-Gas Input Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processed glass generated the fastest 4.65% CAGR between 2026 and 2031, outpacing the broader flat glass market. Laminated and tempered variants supply automotive windscreens, curtain walls, and security facades where impact resistance is critical. Annealed output still dominated in 2025 with 79.62% of volume because it serves as the base substrate for downstream upgrades. The segment's cost edge keeps it central to commodity construction, yet its share is set to moderate as codes and safety norms elevate demand for value-added treatments.

Coated, reflective, and Low-E sheets advance in parallel due to mandatory thermal standards. AGC Glass Europe's 5.5 kg CO2 eq/m2 Low-Carbon Glass exemplifies product differentiation that commands premium bids. Tinted glass usage in EVs supports cabin cooling and battery efficiency. Mirror and patterned glass remain niche but attractive for interior and privacy applications. Altogether, specialization raises average selling prices, widening the processed share in the flat glass market size over the forecast horizon.

The Flat Glass Report is Segmented by Product Type (Annealed Glass, Coated Glass, Processed Glass, Mirror Glass, and Patterned Glass), End-User Industry (Building and Construction, Automotive, Solar Glass, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

The Asia-Pacific region secured 63.88% of 2025 shipments and is expanding at a 4.63% CAGR, the highest among regions. India is scaling new float lines while testing green hydrogen furnaces under a 20-year offtake pact between Asahi India Glass and INOX Air Products.

Europe focuses on decarbonization leadership. Saint-Gobain and AGC started trials of a hybrid furnace that cuts CO2 by 75% through 50% electrification and oxy-fuel combustion, supported by the EU Innovation Fund. Carbon Border Adjustment Mechanism fees, effective 2026 incentivize local sourcing, potentially boosting intra-regional sales. North American producers, led by Vitro's USD 180 million modernization and O-I's UK investment, upgrade lines to withstand gas-price volatility and ESG scrutiny.

South America, the Middle East, and Africa post rising urbanization but face infrastructure deficits and competition from Asian imports. Green-field float projects remain selective, though regional builders prefer local panes to avoid freight surcharges, supporting gradual volume growth. Altogether, geographic shifts keep Asia unchallenged in volume share while other regions chase value-added specialties within the flat glass market.

- Adamant Holding Company

- AGC Inc.

- Cardinal Glass Industries Inc.

- Central Glass Co., Ltd.

- China Glass Holdings Limited

- Euroglas

- Fuyao Group

- Guardian Industries

- Nippon Sheet Glass Co. Ltd

- Phoenicia

- Saint-Gobain

- SCHOTT

- Sisecam

- Taiwan Glass Industry Corporation

- Vitro

- Xinyi Glass Holdings Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Investments in Commercial and Residential Construction

- 4.2.2 Rising Automotive Glazing Requirements for EV Safety and Lightweighting

- 4.2.3 Rapid Capacity Additions for Solar PV Module Glass

- 4.2.4 Energy-Efficient Building Codes Boosting Low-E And Triple Glazing Demand

- 4.2.5 Uptake Of Antimicrobial Glass in Healthcare and Hospitality

- 4.3 Market Restraints

- 4.3.1 Availability of Polymer, Acrylic and Polycarbonate Substitutes

- 4.3.2 Volatile Soda-Ash and Natural-Gas Input Costs

- 4.3.3 EU Carbon Border Adjustment Mechanism Compliance Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Annealed Glass

- 5.1.1.1 Clear Glass

- 5.1.1.2 Tinted Glass

- 5.1.2 Coated Glass

- 5.1.2.1 Reflective Glass

- 5.1.2.2 Low-E Glass

- 5.1.3 Processed Glass

- 5.1.3.1 Laminated Glass

- 5.1.3.2 Tempered Glass

- 5.1.4 Mirror Glass

- 5.1.5 Patterned Glass

- 5.1.1 Annealed Glass

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adamant Holding Company

- 6.4.2 AGC Inc.

- 6.4.3 Cardinal Glass Industries Inc.

- 6.4.4 Central Glass Co., Ltd.

- 6.4.5 China Glass Holdings Limited

- 6.4.6 Euroglas

- 6.4.7 Fuyao Group

- 6.4.8 Guardian Industries

- 6.4.9 Nippon Sheet Glass Co. Ltd

- 6.4.10 Phoenicia

- 6.4.11 Saint-Gobain

- 6.4.12 SCHOTT

- 6.4.13 Sisecam

- 6.4.14 Taiwan Glass Industry Corporation

- 6.4.15 Vitro

- 6.4.16 Xinyi Glass Holdings Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment