PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939661

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939661

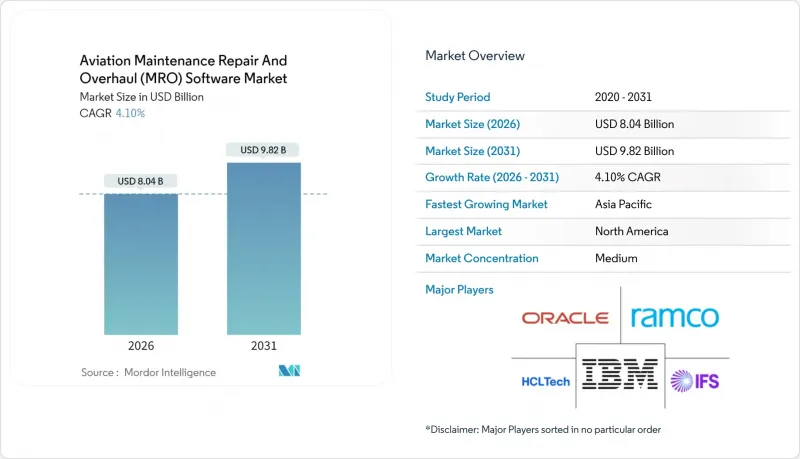

Aviation Maintenance Repair And Overhaul (MRO) Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The aviation MRO software market is expected to grow from USD 7.72 billion in 2025 to USD 8.04 billion in 2026 and is forecast to reach USD 9.82 billion by 2031 at 4.10% CAGR over 2026-2031.

Near-term growth comes from airlines shifting to cloud-hosted platforms, mounting pressure to automate labor-intensive tasks, and the need to integrate predictive analytics with maintenance, inventory, and compliance workflows. A post-pandemic jump in heavy-maintenance events, ongoing fleet modernization in emerging regions, and the rapid spread of paperless record-keeping mandates reinforce demand. Competitive intensity has increased as cloud-native entrants challenge incumbents with faster product cycles. At the same time, established vendors respond through acquisitions that bundle planning, health-monitoring, and supply-chain modules into unified ecosystems. Vendors able to deliver real-time data visibility, AI-driven component health forecasts, and seamless regulatory reporting enjoy a clear advantage as operators race to cut unscheduled downtime and stretch technician resources.

Global Aviation Maintenance Repair And Overhaul (MRO) Software Market Trends and Insights

Surge in SaaS adoption among LCCs

Low-cost airlines increasingly favor subscription-based MRO suites in the aviation MRO software market that remove heavy upfront license fees and support rapid fleet expansion. Cloud delivery lowers IT maintenance overhead and permits instant feature updates, allowing carriers to sustain thin operating margins without compromising reliability. As SaaS penetration rises, suppliers and third-party repair shops integrate their portals and APIs to accommodate cloud-centric workflows, reinforcing the migration cycle. Regional regulators now accept secure remote data storage, eliminating the legal barrier that once slowed cloud rollouts in Asia-Pacific and Europe. Vendors that can certify data-sovereignty controls and prove encryption at rest gain priority in LCC tenders.

Expansion of predictive-maintenance analytics platforms

Real-time analysis of flight, engine, and environmental data feeds algorithms that forecast component failures weeks in advance, letting operators schedule work scopes during planned ground time in the aviation MRO software market. Airlines report material cuts in delay minutes and longer on-wing life as data models mature. Providers embed AI modules that continuously retrain on fresh sensor feeds, giving customers adaptive insight without separate data-science investments. As OEMs release deeper subsystem telemetry, software firms layer those feeds onto historical maintenance records to refine degradation curves and optimize part-replacement schedules. The ability to tie cost savings to verifiable event avoidance is becoming the top buying criterion for tier-one carriers.

Persistent shortage of certified MRO-IT talent

Digital rollouts in the aviation MRO software market require technicians versed in aviation regulation, SQL-based data structures, and API orchestration. Retirements outpace new certifications, lifting wage pressure and elongating implementation timelines. Vendors package more no-code configuration tools to mitigate and offer managed-service tiers that backfill scarce skills.

Other drivers and restraints analyzed in the detailed report include:

- Integration of digital-twin engines for real-time health monitoring

- Post-COVID fleet-age spike raising heavy-maintenance demand

- Fragmented, legacy data silos impede AI scalability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premises installations held 72.85% of the aviation MRO software market share in 2025, reflecting years of investment in locally hosted solutions that satisfy strict data-sovereignty rules. Yet the aviation MRO software market is witnessing an unmistakable pivot as cloud deployments post a 5.98% CAGR, underpinned by subscription pricing that aligns cash outflows with usage and the promise of faster access to AI modules. Airlines migrating to managed clouds report 25-30% lower five-year total cost of ownership and downtime reductions during version upgrades. Security once posed a deterrent, but SOC 2 Type II and ISO 27001 certifications now cover most leading suites, easing regulator sign-off. As legacy hardware refresh cycles come due, budget-constrained operators increasingly swap server renewals for multi-tenant SaaS contracts that deliver quarterly feature drops.

Providers differentiate by offering single-tenant variants for jurisdictions mandating physical data residence and by exposing REST APIs that integrate seamlessly with flight operations, finance, and crew rostering systems. This architectural openness helps airlines weave maintenance insights into broader operational control towers, amplifying cloud adoption benefits. As proof points multiply, even large flag carriers that once championed internal data centers have scoped phased migrations of at least non-real-time modules, signaling a tipping point for the aviation MRO software market.

MRO service companies accounted for 58.02% of 2025 revenue because multi-airline workload diversity necessitates comprehensive, customer-agnostic toolsets. However, the aviation MRO software market size attributable to airlines is expanding swiftly at a 4.62% CAGR as carriers verticalize heavy checks to regain control over slot availability and reliability outcomes. Internal hangar expansions at full-service airlines in Asia and Europe rely on integrated planning engines to harmonize engineering, materials, and finance workflows. Airlines also demand platforms that blend airworthiness-directive tracking with predictive health dashboards to support mission-specific asset deployment.

Third-party shops respond by adopting customer portal functions that give airlines real-time milestone visibility. Still, airlines continue investing in in-house licenses to safeguard intellectual property around component-life analytics. OEMs remain steady buyers, yet their share slips marginally as warranty-management functions become another module inside broader suites rather than standalone systems. Across user groups, the race is on to hire digitally fluent engineers who can exploit data-science features without external consultants, reinforcing the services' upswing in the aviation MRO software market.

The Aviation MRO Software Market Report is Segmented by Deployment (Cloud-Based, and On-Premises), End User (Airlines, Mros, and OEMs), Function (Maintenance Management, Operations and Line Control, Inventory and Supply Chain, and Predictive Analytics and Health Monitoring), Solution (Software and Services), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 45.25% revenue share during 2025 due to a large installed fleet, strict FAA documentation rules, and deep maintenance-technician pools. Mature carriers embed health-monitoring dashboards into legacy enterprise resource-planning stacks, spawning lucrative upgrade cycles for vendors equipped with drop-in connectors.

In contrast, Asia-Pacific is racing ahead at 4.70% CAGR as order backlogs for narrow-body jets convert into deliveries requiring scalable maintenance IT. Flagship examples include Air India choosing a cloud-only AMOS deployment across more than 470 aircraft, and Korean Air contracting an AI-enabled engine-MRO suite for its new Incheon complex.

Europe posts steady demand driven by EASA's encouragement of digital records and the region's active low-cost sector, which leans on SaaS to limit capital exposure. Middle-East mega-carriers, operating hub-and-spoke models, deploy integrated supply chains and heavy-check modules to maintain fleet utilization. South American operators modernize more cautiously amid macroeconomic volatility but prioritize cloud records to satisfy lessor redelivery terms. In the future, vendors that localize language packs, adjust for jurisdiction-specific airworthiness rules, and stand up regional data centers will capture the next wave of the aviation MRO software market share.

- Swiss AviationSoftware Ltd. (Swiss-AS)

- Ramco Systems Ltd.

- IFS Aktiebolag

- IBM Corporation

- HCL Technologies Limited

- Oracle Corporation

- SAP SE

- Flatirons Solutions, Inc.

- VeraSafe, LLC

- IBS Software Private Limited

- Communications Software (Airline Systems) Limited

- AerData B.V.

- Trax USA Corp. (AAR CORP.)

- Ultramain Systems, Inc.

- EmpowerMX

- Aviation InterTec Services Inc.

- BytzSoft Technologies Pvt. Ltd.

- CAMP Systems International, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in SaaS adoption among low-cost carriers

- 4.2.2 Expansion of predictive-maintenance analytics platforms

- 4.2.3 Integration of digital-twin engines for real-time health monitoring

- 4.2.4 Post-COVID fleet-age spike raising heavy-maintenance demand

- 4.2.5 Ecosystem push for paperless compliance and e-signatures

- 4.2.6 OEM warranty-data liberation accelerating third-party MRO IT uptake

- 4.3 Market Restraints

- 4.3.1 Persistent shortage of certified MRO IT talent

- 4.3.2 Fragmented, legacy data silos impede AI scalability

- 4.3.3 Cybersecurity insurance premiums escalating for cloud MRO suites

- 4.3.4 Tightening export-control rules on aircraft data schemas

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud-based

- 5.1.2 On-premises

- 5.2 By End User

- 5.2.1 Airlines

- 5.2.2 MROs

- 5.2.3 OEMs

- 5.3 By Function

- 5.3.1 Maintenance Management

- 5.3.2 Operations and Line Control

- 5.3.3 Inventory and Supply Chain

- 5.3.4 Predictive Analytics and Health Monitoring

- 5.4 By Solution

- 5.4.1 Software

- 5.4.2 Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 Israel

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Swiss AviationSoftware Ltd. (Swiss-AS)

- 6.4.2 Ramco Systems Ltd.

- 6.4.3 IFS Aktiebolag

- 6.4.4 IBM Corporation

- 6.4.5 HCL Technologies Limited

- 6.4.6 Oracle Corporation

- 6.4.7 SAP SE

- 6.4.8 Flatirons Solutions, Inc.

- 6.4.9 VeraSafe, LLC

- 6.4.10 IBS Software Private Limited

- 6.4.11 Communications Software (Airline Systems) Limited

- 6.4.12 AerData B.V.

- 6.4.13 Trax USA Corp. (AAR CORP.)

- 6.4.14 Ultramain Systems, Inc.

- 6.4.15 EmpowerMX

- 6.4.16 Aviation InterTec Services Inc.

- 6.4.17 BytzSoft Technologies Pvt. Ltd.

- 6.4.18 CAMP Systems International, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment