PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939672

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939672

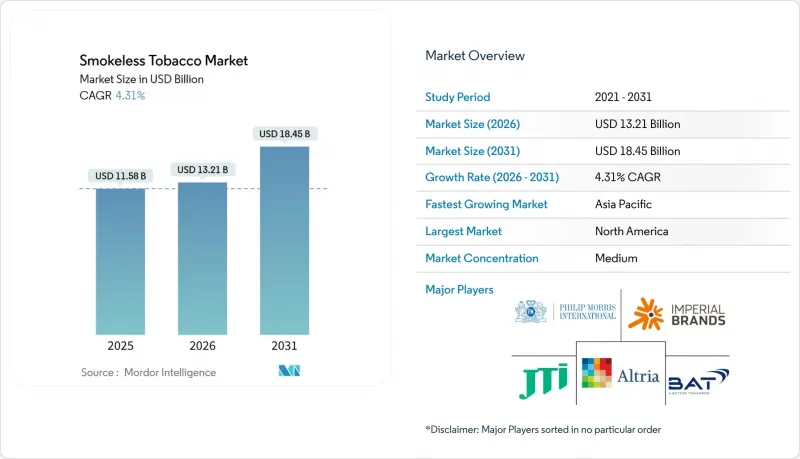

Smokeless Tobacco - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The smokeless tobacco market is expected to grow from USD 14.75 billion in 2025 to USD 15.47 billion in 2026 and is forecast to reach USD 19.63 billion by 2031 at 4.88% CAGR over 2026-2031.

This growth is driven by a shift from combustible products, increasing regulatory acceptance of harm-reduction tools, and the pivotal U.S. green light for ZYN tobacco-free pouches in January 2025. Volume growth is bolstered by North America's loyal user base, Scandinavia's cultural acceptance, and surging demand in the Asia-Pacific. The introduction of new product varieties, such as synthetic nicotine, herbal bases, and premium flavor extensions, has created diverse price tiers, thereby pushing up average selling prices. E-commerce platforms are expanding their reach, enabling discreet purchases in areas with stringent in-store display regulations. In response, major tobacco firms are making significant moves, underscoring their commitment with multi-billion-dollar acquisitions, expanded manufacturing, and cross-category innovations.

Global Smokeless Tobacco Market Trends and Insights

Public-smoking bans accelerating switch to smokeless alternatives

Public smoking restrictions across various jurisdictions are inadvertently steering existing nicotine users towards smokeless tobacco. The Netherlands is preparing to implement a total ban on nicotine pouches. This move underscores the country's regulatory unpredictability. Yet, it has also spurred stockpiling and hastened market penetration ahead of the ban. In 2024, Australia rolled out a sweeping ban on smokeless tobacco. Ironically, this led to a surge in cross-border e-commerce and the growth of an illicit market, underscoring the challenges of enforcement when demand remains strong despite a ban. In 2024, Poland imposed restrictions on synthetic nicotine pouches. This action carved out a distinction in the market between tobacco-derived and synthetic products, allowing traditional smokeless tobacco to seize the opportunity and capture the displaced demand. In 2024, Malaysia tightened its grip on Act 852, resulting in reduced retail availability. However, this push drove consumers towards online platforms and markets in neighboring countries. These regulatory moves, rather than quelling demand, are reshaping consumption patterns. This shift is bolstering the growth of compliant smokeless alternatives in regions where they're still permitted.

Product and flavour innovation in nicotine pouches

As manufacturers adapt to regulatory constraints and evolving consumer preferences, the pace of innovation in oral nicotine pouches has intensified. In 2024, British American Tobacco introduced Velo Plus, a synthetic nicotine pouch. This move allowed them to sidestep restrictions on tobacco-derived products, all while ensuring effective nicotine delivery. Meanwhile, Black Buffalo's tobacco-free pouches have carved out a niche by mimicking the experience of traditional smokeless tobacco, but without the use of tobacco leaves. This strategy resonates with health-conscious consumers who still desire familiar sensory profiles. In 2024, ZYN broadened its flavor offerings by introducing Gold tobacco variants, moving beyond the usual mint and fruit flavors. This expansion targets consumers making the switch from conventional smokeless tobacco. Altria unveiled its Swic heated tobacco capsules and On Plus enhanced nicotine pouches in February 2024. These launches underscore a strategy of multi-category innovation, aiming at diverse consumer segments within the smokeless alternatives market. Such innovations not only differentiate products but also uphold premium pricing, broadening the market reach beyond just traditional smokeless tobacco users.

Increased government regulations and bans

Regulatory tightening across multiple jurisdictions is creating market access barriers and compliance costs, constraining the industry's growth potential. In 2024, Australia implemented a comprehensive ban on smokeless tobacco, not only eliminating a significant market opportunity but also setting a precedent for other jurisdictions contemplating similar restrictions. The European Union's planned 60% tax hike on white snus products, scheduled for July 2025, poses a threat to market viability in key European markets, with potential reductions in consumption due to price elasticity effects. In New Zealand, political moves toward liberalizing nicotine pouches are met with resistance from public health advocates, leading to regulatory uncertainty that hampers market entry and investment decisions. Meanwhile, Canada's evolving regulations on nicotine replacement therapies are crafting complex approval pathways, seemingly favoring pharmaceutical companies over traditional tobacco manufacturers. Collectively, these regulatory pressures are heightening market entry barriers and diminishing profitability through increased compliance costs and limited distribution channels.

Other drivers and restraints analyzed in the detailed report include:

- Targeted marketing and appeal to younger demographics

- Emergence of synthetic-nicotine and herbal pouches in flavour-ban states

- Mounting scientific evidence of health risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, moist snuff dominates the market with a commanding 91.52% share, underscoring deep-rooted consumer preferences and well-entrenched distribution networks. Meanwhile, chewing tobacco emerges as the frontrunner, boasting a robust growth potential with a projected 6.50% CAGR through 2031. Traditional moist snuff products, bolstered by brand loyalty and cultural acceptance, find a particularly strong foothold in North America, with brands like Copenhagen and Grizzly leading the charge. In Europe, Swedish-style snus, a subset of the moist snuff category, is on the rise, buoyed by regulatory frameworks that acknowledge its harm reduction potential over combustible tobacco. Despite facing challenges from health concerns and regulatory scrutiny, US-style moist snuff retains its market dominance, thanks to premium product positioning and innovative flavors.

Chewing tobacco's rapid ascent can be attributed to product innovations and a strategic push into emerging markets, where traditional loose-leaf products still hold cultural significance. Today's chewing tobacco boasts modern formulations with enhanced flavors and innovative packaging, elevating the user experience while respecting traditional consumption habits. This segment enjoys a regulatory advantage, facing less scrutiny than newer nicotine delivery systems, allowing for smoother market expansion. In 2024, Imperial Brands made a significant move, investing USD 329 million in next-generation product development, with a notable emphasis on enhancing traditional smokeless alternatives rather than venturing into entirely new categories. Furthermore, the FDA's tobacco product standards set quality benchmarks, inadvertently favoring established manufacturers adept at compliance over their smaller regional counterparts.

The Smokeless Tobacco Market is Segmented by Product Type (Chewing Tobacco and Moist Snuff (US-Style Moist Snuff (Dip) and Swedish Style Snus)), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, and More), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The Market Forecasts are Given in Terms of Value (USD).

Geography Analysis

In 2025, North America holds a dominant 75.74% market share, driven by a long-standing smokeless tobacco culture and regulatory frameworks that emphasize harm reduction. The region continues to experience steady growth due to product innovations and a shift toward premiumization. The U.S. leads the market with traditional moist snuff and the growing popularity of oral nicotine pouches. Altria reported USD 2.776 billion in revenue from oral tobacco products in 2024, reflecting a 4.1% growth despite volume declines in traditional segments. In Canada, regulatory changes create opportunities for authorized products while curbing unauthorized ones, fostering growth through compliance-driven consolidations.

Europe presents a mixed regulatory landscape. Sweden anchors market stability with the world's highest per-capita smokeless tobacco consumption, driven by daily snus use among men and a preference for premium products. However, the EU's proposed 60% tax hike on white snus could disrupt market economics, potentially increasing cross-border trade and illicit activity. Countries like Denmark, Norway, and the Czech Republic offer selective access to smokeless alternatives, benefiting established players adept at navigating compliance. Conversely, restrictive policies across much of Europe hinder market growth, though ongoing discussions on harm reduction suggest potential future liberalization. The Asia-Pacific region is on a growth trajectory, with a projected CAGR of 6.23% through 2031. This growth is fueled by India's entrenched consumption habits and evolving regulations in developed markets like Australia and New Zealand. Despite regulatory challenges, India's vast smokeless tobacco market remains resilient, with products like gutkha and pan masala thriving due to informal distribution channels and regional variations. Traditional usage among tribal communities, particularly older demographics, ensures stable demand. Across the broader region, cultural acceptance of smokeless tobacco varies, offering selective growth opportunities for manufacturers who can navigate regulatory and competitive landscapes effectively.

Globally, markets reflect diverse regulatory approaches and cultural attitudes. In South Africa, regulations permit certain smokeless tobacco products but impose strict limits on advertising and youth access, creating a controlled environment that benefits established manufacturers. Algeria and other North African markets exhibit cultural acceptance of traditional smokeless tobacco, though tightening regulations may constrain future growth. Japan Tobacco International's authorization to begin production in Morocco in 2025 highlights expanding opportunities in North Africa, supported by regulatory frameworks favorable to tobacco manufacturing. Beyond these regions, emerging markets are influenced by cultural factors, regulatory developments, and competition from alternative nicotine products, shaping the adoption of smokeless tobacco.

- Altria Group Inc.

- British American Tobacco plc

- Philip Morris International Inc.

- Imperial Brands plc

- Swedish Match AB

- Japan Tobacco Inc.

- KT&G Corporation

- Turning Point Brands Inc.

- DS Group

- Dholakia Tobacco Pvt Ltd.

- Regie Nationale des Tabacs et des Allumettes

- Kothari Group Ltd.

- ITC Limited

- Black Buffalo Inc.

- Swisher International Inc.

- Kretek International Inc.

- Scandinavian Tobacco Group A/S

- Mac Baren Tobacco Company A/S

- Fiedler & Lundgren AB

- Snus AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Public-smoking bans accelerating switch to smokeless alternatives

- 4.2.2 Product and flavour innovation in nicotine pouches

- 4.2.3 Targeted marketing and appeal to younger demographics

- 4.2.4 Cultural and traditional use in specific regions

- 4.2.5 Emergence of synthetic-nicotine and herbal pouches in flavour-ban states

- 4.2.6 Potent nicotine delivery for addiction

- 4.3 Market Restraints

- 4.3.1 Growth of alternative, less harmful nicotine products

- 4.3.2 Aggressive anti-tobacco campaigns

- 4.3.3 Increased government regulations and bans

- 4.3.4 Mounting scientific evidence of health risks

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Chewing Tobacco

- 5.1.2 Moist Snuff

- 5.1.2.1 US-Style Moist Snuff (Dip)

- 5.1.2.2 Swedish Style Snus

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience/Grocery Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Czech Republic

- 5.3.2.2 Denmark

- 5.3.2.3 Norway

- 5.3.2.4 Sweden

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South Africa

- 5.3.4.2 Algeria

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Altria Group Inc.

- 6.4.2 British American Tobacco plc

- 6.4.3 Philip Morris International Inc.

- 6.4.4 Imperial Brands plc

- 6.4.5 Swedish Match AB

- 6.4.6 Japan Tobacco Inc.

- 6.4.7 KT&G Corporation

- 6.4.8 Turning Point Brands Inc.

- 6.4.9 DS Group

- 6.4.10 Dholakia Tobacco Pvt Ltd.

- 6.4.11 Regie Nationale des Tabacs et des Allumettes

- 6.4.12 Kothari Group Ltd.

- 6.4.13 ITC Limited

- 6.4.14 Black Buffalo Inc.

- 6.4.15 Swisher International Inc.

- 6.4.16 Kretek International Inc.

- 6.4.17 Scandinavian Tobacco Group A/S

- 6.4.18 Mac Baren Tobacco Company A/S

- 6.4.19 Fiedler & Lundgren AB

- 6.4.20 Snus AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK