PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939694

Vietnam Aluminum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

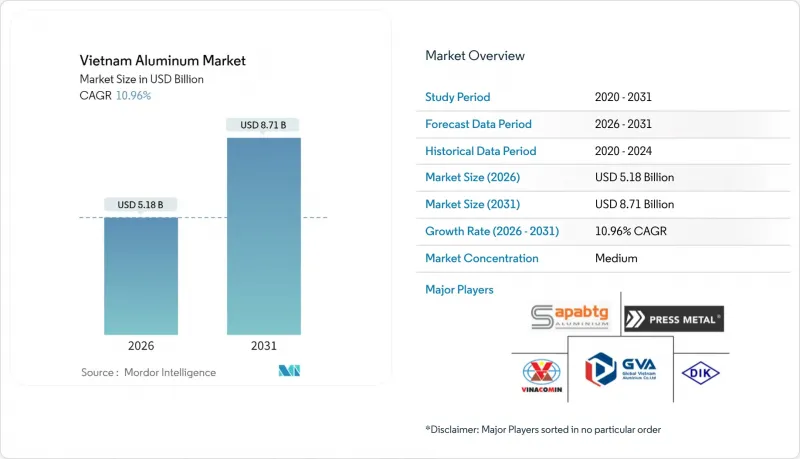

The Vietnam Aluminum Market is expected to grow from USD 4.67 billion in 2025 to USD 5.18 billion in 2026 and is forecast to reach USD 8.71 billion by 2031 at 10.96% CAGR over 2026-2031.

This uptrend positions the Vietnam aluminum market among the fastest-growing value chains in Asia as abundant bauxite reserves, new alumina capacity, and demand from mobility and construction converge. Rising EV production, green-building mandates, and packaging circularity targets foster structural demand, while upstream security from 5.8 billion tonnes of bauxite supports long-term supply. Government Decision 866 authorizing eight processing facilities plus 19 exploration projects through 2030 further underpins growth, although capacity utilization still averages 70%, highlighting operational headroom.

Vietnam Aluminum Market Trends and Insights

Auto-sector Lightweighting Push

Automotive aluminum demand is reinforced by 858 IATF 16949-certified suppliers that integrate Vietnam into regional vehicle platforms. EV production uses nearly 30% more aluminum per unit than conventional models for battery enclosures and thermal systems, and Vietnam targets 50% electric urban vehicles by 2030. Local content policies fuel component outsourcing, while commercial fleets adopt aluminum parts to maximize payload and comply with emission norms. The World Bank estimates the EV transition could generate 6.5 million manufacturing jobs by 2050, a scenario that sustains metal demand across casting, extrusion, and flat-rolled supply chains. As OEMs expand capacity, the Vietnam aluminum market benefits from rising billet and ingot off-take, incentivizing new secondary smelters.

Booming Public and Green-Building Construction

Public spending of USD 30 billion in 2024 on transport and power facilities injected near-term demand for curtain walls, roofing, and structural extrusions. Green-certified buildings rose to 430 in Q1 2024, with EDGE and LEED accounting for 75.69% of certifications, favoring aluminum for its recyclability and thermal efficiency. Power Development Plan VIII earmarks USD 135 billion through 2030, driving aluminum demand for high-voltage structures and solar frames. Ho Chi Minh City's USD 11.5 billion highway program and USD 1.2 billion of transport upgrades boost extruded profile consumption.

High Electricity Tariffs and Carbon-Pricing Exposure

Aluminum smelting requires constant low-cost power, yet Vietnam's average industrial tariff rose in 2024, compressing margins and limiting capacity use to 30-40% in some plants. The EU's Carbon Border Adjustment Mechanism affects USD 307.66 million of aluminum exports and could trim shipments by 4%, translating into USD 12 million revenue loss per year. Power Development Plan VIII calls for market-based pricing, pressuring electrolysis projects unless they secure renewables. Exporters must cut carbon intensity or pay CBAM fees that erode the Vietnam aluminum market's cost advantage.

Other drivers and restraints analyzed in the detailed report include:

- Rebound in Packaging Demand (Food-Drink and Pharmaceuticals)

- Expansion of Domestic Bauxite and Alumina Projects

- Import Dependence for Primary Metal and Billets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Extrusions commanded 39.42% of the Vietnam aluminum market in 2025 on the back of sustained demand for window frames, curtain walls, and vehicle profiles. Rising infrastructure outlays valued at USD 95.8 billion through 2027 keep extrusion mills running at high throughput, while strict LEED and EDGE criteria reward anodized and thermally broken systems. Compliance with U.S. antidumping orders incentivizes process upgrades among cooperative exporters, reinforcing quality leadership. Castings are projected to grow at a 13.62% CAGR to 2031 as automakers localize lightweight components for EV platforms.

Certification under IATF 16949 remains a prerequisite for OEM supply and underpins Vietnam's ranking as ASEAN's second-largest certified base. Producers like Mien Hua Precision generate 60% of sales domestically and export the remainder to Japan, the U.S., and Australia, reflecting the country's expanding mid-stream competitiveness.

The Vietnam Aluminum Market Report is Segmented by Processing Type (Castings, Extrusions, Forgings, Flat Rolled Products, and Pigments and Powders) and End-User Industry (Automotive, Aerospace and Defense, Building and Construction, Electrical and Electronics, Packaging, Industrial, and Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcoa Corporation

- Daiki Aluminium Industry Co. Ltd

- Emirates Global Aluminium PJSC

- GARMCO

- Global Vietnam Aluminum Co., Ltd (GVA)

- Kobe Steel Ltd

- Norsk Hydro ASA

- Press Metal

- RusAL

- Sapa Ben Thanh Aluminium Profiles Co., Ltd. (Sapa BTG)

- Vietnam Coal and Mineral Industries Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Auto-sector lightweighting push

- 4.2.2 Booming public and green-building construction

- 4.2.3 Rebound in packaging demand (food-drink and pharmaceuticals)

- 4.2.4 Expansion of domestic bauxite and alumina projects

- 4.2.5 Rapid EV/battery-housing localisation

- 4.3 Market Restraints

- 4.3.1 High electricity tariffs and carbon-pricing exposure

- 4.3.2 Cheap steel/plastics and composite substitutes

- 4.3.3 Import dependence for primary metal and billets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Processing Type

- 5.1.1 Castings

- 5.1.2 Extrusions

- 5.1.3 Forgings

- 5.1.4 Flat Rolled Products

- 5.1.5 Pigments and Powders

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Industrial

- 5.2.7 Other End-user Industries

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alcoa Corporation

- 6.4.2 Daiki Aluminium Industry Co. Ltd

- 6.4.3 Emirates Global Aluminium PJSC

- 6.4.4 GARMCO

- 6.4.5 Global Vietnam Aluminum Co., Ltd (GVA)

- 6.4.6 Kobe Steel Ltd

- 6.4.7 Norsk Hydro ASA

- 6.4.8 Press Metal

- 6.4.9 RusAL

- 6.4.10 Sapa Ben Thanh Aluminium Profiles Co., Ltd. (Sapa BTG)

- 6.4.11 Vietnam Coal and Mineral Industries Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Aluminium Recycling and Circular-Economy Plays

- 7.3 High-end EV and Battery-pack Components