PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939703

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939703

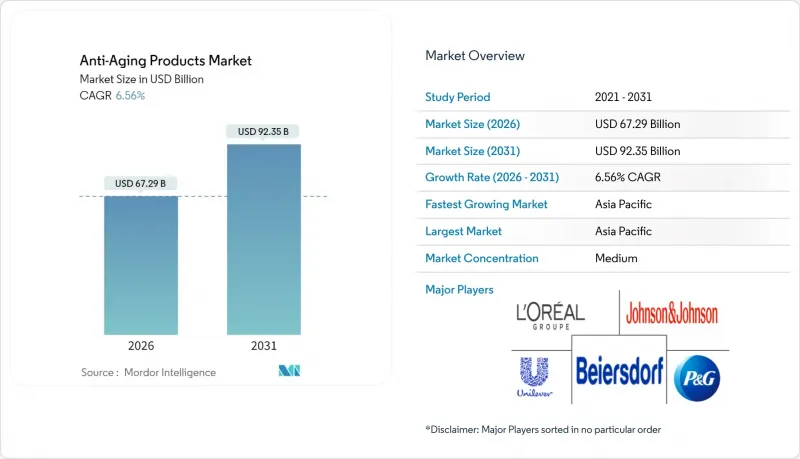

Anti-Aging Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The anti-aging products market is expected to grow from USD 63.15 billion in 2025 to USD 67.29 billion in 2026 and is forecast to reach USD 92.35 billion by 2031 at 6.56% CAGR over 2026-2031.

This growth trajectory reflects the convergence of demographic shifts, technological breakthroughs, and evolving consumer behaviors that are fundamentally reshaping how beauty brands approach skin aging solutions. The market's expansion is anchored by scientific innovations in peptide formulations and biotechnology-derived ingredients, with Shiseido's recent discovery of the CCN2 "definitive beauty gene" demonstrating how molecular-level research is translating into commercially viable anti-aging strategies. Regional growth is led by Asia-Pacific, where sophisticated consumers and supportive policy frameworks accelerate ingredient experimentation. Meanwhile, online channels capitalize on algorithmic personalization to simplify complex anti-aging science for time-constrained shoppers, driving new customer acquisition at lower marginal costs. Competitive intensity remains moderate; multinationals leverage scale and regulatory depth, yet biotechnology start-ups capture high-margin niches with proprietary actives that answer precise skin-aging pathways.

Global Anti-Aging Products Market Trends and Insights

Growing Awareness About Skin Health

Consumer understanding of skin biology has evolved beyond surface-level concerns to encompass cellular mechanisms, with research demonstrating that majority of women aged 55+ want brands to address aging openly rather than through euphemistic messaging. This shift drives demand for formulations targeting specific pathways like inflammaging, where chronic low-grade inflammation accelerates visible aging signs. Biotechnology companies are responding with ingredients like naringenin, which L'Oreal-backed Deinde utilizes to combat inflammatory processes that begin affecting skin repair mechanisms after age 25. The awareness trend extends to understanding environmental factors, with consumers increasingly recognizing the "exposome" concept that encompasses all external influences on skin aging. This knowledge base enables more targeted product selection and creates opportunities for brands that can effectively communicate complex scientific concepts through accessible channels.

Scientific and Technological Advancements

Breakthrough discoveries in cellular senescence research are revolutionizing anti-aging approaches, with senotherapeutic peptides demonstrating superior efficacy compared to traditional retinol treatments in clinical studies. Artificial intelligence integration is accelerating ingredient discovery and formulation optimization, as demonstrated by Shiseido's VOYAGER platform that analyzes over 500,000 data points to enhance product development efficiency. Advanced delivery systems, including nanoliposomes that co-deliver multiple bioactive peptides, are achieving enhanced penetration and sustained release profiles that significantly improve clinical outcomes. Biotechnology-derived ingredients are gaining regulatory acceptance, with Estee Lauder's Belgium BioTech Hub producing bio-based raw materials that meet both efficacy and sustainability requirements. These technological advances are creating competitive moats for companies that can successfully translate laboratory innovations into consumer-accessible products.

Prevalence of Counterfeit and Unsafe Products

Counterfeit skincare products pose significant consumer safety risks and market integrity challenges, as demonstrated by recent FDA enforcement actions against aestheticians importing counterfeit Botox from China that resulted in severe botulism cases . Research from Iraq reveals that counterfeit cosmetic products cause adverse effects including acne, erythema, and long-term skin atrophy, particularly affecting young female consumers seeking skin lightening benefits. The proliferation of unsafe products undermines consumer confidence in legitimate anti-aging formulations and creates regulatory compliance burdens for authentic manufacturers. Cosmetovigilance systems are being implemented globally to monitor adverse events and enhance consumer protection, though enforcement capabilities vary significantly across different markets. The counterfeit challenge is exacerbated by e-commerce platforms where product authenticity verification remains technically complex and economically challenging for both platforms and consumers.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media and Beauty Influencers

- Transparency and Clean Beauty Movement

- Complexity in Ingredient Compliance and Testing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Facial creams and lotions command 48.21% market share in 2025, reflecting consumer familiarity with traditional formulation formats and their suitability for comprehensive skincare routines that address multiple aging concerns simultaneously. However, serums and concentrates represent the fastest-growing segment with 7.52% CAGR through 2031, driven by consumer preference for targeted active delivery and higher ingredient concentrations that enable visible results in shorter timeframes. Under-eye creams maintain steady demand as consumers increasingly recognize the delicate eye area's unique aging patterns and specialized treatment requirements. The "others" category, encompassing facial oils and sheet masks, benefits from Korean beauty influence and consumer experimentation with diverse application methods.

Advanced peptide formulations are revolutionizing serum efficacy, with clinical evidence demonstrating that multi-peptide combinations can synergistically activate skin cell regenerative capacity beyond individual ingredient performance. Estee Lauder's recent launch of the GF 15% Solution anti-aging serum exemplifies how brands are leveraging concentrated active formulations to differentiate premium offerings in competitive markets. The segment's growth trajectory reflects technological advances in ingredient stability and delivery systems that enable higher active concentrations without compromising skin tolerance or product shelf life.

Mass-market products maintain 70.82% market share in 2025, demonstrating consumer price sensitivity and the effectiveness of accessible formulations in delivering basic anti-aging benefits through established retail channels. The premium segment's 7.22% CAGR through 2031 reflects growing consumer willingness to invest in scientifically backed formulations that offer superior efficacy or unique ingredient profiles. This growth pattern indicates market polarization where consumers either seek value-oriented solutions or invest significantly in premium products, with limited middle-market expansion opportunities.

The demand for premium anti-aging products is rising steadily as consumers increasingly prioritize skincare and overall wellness. Affluent and health-conscious buyers are willing to invest in high-quality formulations that promise visible results and use advanced ingredients. Growing awareness of preventive skincare, coupled with the influence of social media and beauty trends, further fuels this demand. Additionally, the desire for personalized and luxury skincare experiences is driving the expansion of the premium anti-aging segment globally. Premium segment success increasingly depends on proprietary ingredient technologies, clinical validation, and sophisticated consumer education that demonstrates measurable benefits over mass-market alternatives.

The Anti-Aging Products Market is Segmented by Product Type (Facial Creams and Lotions, Serums and Concentrates, Under Eye Creams, Others), Price Range (Mass and Luxury), End-User (Men and Women), Category (Conventional and Organic), Distribution Channel (Supermarkets/Hypermarkets, Health and Beauty Stores, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates with 41.10% market share in 2025 and leads growth at 7.08% CAGR through 2031, driven by sophisticated consumer preferences, regulatory frameworks that encourage ingredient innovation, and robust domestic manufacturing capabilities. China's cosmetics export value increased 8.7% year-on-year while imports declined, indicating local brand strength and consumer preference shifts toward domestic alternatives. India's luxury beauty market is projected to grow, with skincare expected as the fastest-growing category. Japanese and South Korean markets drive technological innovation through advanced research capabilities and consumer willingness to adopt novel ingredients and application methods. The region's regulatory harmonization efforts, particularly China's implementation of comprehensive safety assessment requirements, are establishing new global standards for product development and market entry strategies.

North America represents a mature market characterized by high consumer awareness, stringent regulatory oversight, and premium product adoption rates that support innovation investments. The region's aging demographic creates sustained demand for anti-aging solutions, with baby boomers controlling USD 2.6 trillion in buying power and demonstrating strong preference for products that support healthy aging . The U.S. population over 65 increased 38.6% from 2010 to 2020, creating a substantial consumer base for specialized anti-aging formulations. Regulatory complexity is increasing with state-level initiatives like Washington's Toxic-Free Cosmetics Act and California's PFAS restrictions, requiring enhanced compliance capabilities that favor established multinational corporations over smaller market entrants. Europe maintains strong market presence through sophisticated regulatory frameworks, consumer preference for scientifically validated products, and leadership in clean beauty movement adoption. The EU's ban on 1,300 skincare ingredients and upcoming restrictions on retinol derivatives are reshaping product formulation strategies and creating opportunities for alternative active ingredients. Extended Producer Responsibility laws are expanding across European markets, requiring brands to manage packaging waste and incorporate sustainability considerations into product development processes. South America and Middle East and Africa represent emerging opportunities with growing middle-class populations and increasing beauty product accessibility, though market development requires localized strategies that address distinct consumer preferences and regulatory environments.

- L'Oreal S.A.

- Estee Lauder Inc.

- Procter & Gamble

- Shiseido Co. Ltd.

- Beiersdorf

- Unilever

- Johnson & Johnson

- Amorepacific Corp.

- Kao Corp.

- Natura & Co.

- Clarins Group

- Coty Inc.

- Oriflame Holding AG

- Naos (Bioderma)

- Caudalie SAS

- Galderma SA

- Allergan Aesthetics (AbbVie)

- No7 Beauty Company

- Innisfree Corp.

- The Ordinary (Deciem)

- LVMH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Awareness About Skin Health

- 4.2.2 Scientific and Technological Advancements

- 4.2.3 Influence of Social Media and Beauty Influencers

- 4.2.4 Transparency and Clean Beauty Movement

- 4.2.5 Aging Demographic Seeking Active Aging

- 4.2.6 Expansion of Modern Retail and E-commerce

- 4.3 Market Restraints

- 4.3.1 Prevalence of Counterfeit and Unsafe Products

- 4.3.2 Complexity in Ingredient Compliance and Testing

- 4.3.3 Ethical Concerns about Anti-Aging Claims

- 4.3.4 Social and Psychological Barriers

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Creams and Lotions

- 5.1.2 Serum and Concentrates

- 5.1.3 Under Eye Cream

- 5.1.4 Others

- 5.2 By Price Range

- 5.2.1 Mass

- 5.2.2 Luxury

- 5.3 By End-User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Category

- 5.4.1 Conventional

- 5.4.2 Organic

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Health and Beauty Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Estee Lauder Inc.

- 6.4.3 Procter & Gamble

- 6.4.4 Shiseido Co. Ltd.

- 6.4.5 Beiersdorf

- 6.4.6 Unilever

- 6.4.7 Johnson & Johnson

- 6.4.8 Amorepacific Corp.

- 6.4.9 Kao Corp.

- 6.4.10 Natura & Co.

- 6.4.11 Clarins Group

- 6.4.12 Coty Inc.

- 6.4.13 Oriflame Holding AG

- 6.4.14 Naos (Bioderma)

- 6.4.15 Caudalie SAS

- 6.4.16 Galderma SA

- 6.4.17 Allergan Aesthetics (AbbVie)

- 6.4.18 No7 Beauty Company

- 6.4.19 Innisfree Corp.

- 6.4.20 The Ordinary (Deciem)

- 6.4.21 LVMH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK