PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939715

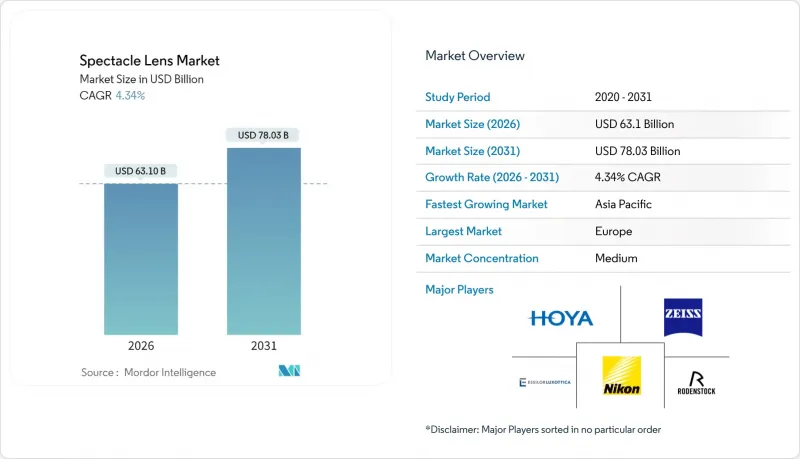

Spectacle Lens - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The spectacle lens market is expected to grow from USD 60.47 billion in 2025 to USD 63.1 billion in 2026 and is forecast to reach USD 78.03 billion by 2031 at 4.34% CAGR over 2026-2031.

This expansion is fueled by demographic aging that raises presbyopia prevalence, urban lifestyles that intensify digital-screen exposure, and a sustained upsurge in myopia cases across East and South-East Asia. Competitive differentiation centers on premium progressive technologies, AI-guided free-form surfacing, and multi-function coatings that merge clarity with ocular protection. Material innovation-especially in high-index plastics-and supply-chain investments by leading monomer suppliers are mitigating raw-material volatility while creating sustainability advantages. Consolidation among vertically integrated players, omnichannel retail strategies, and enterprise procurement programs further reinforce the spectacle lens market's growth momentum.

Global Spectacle Lens Market Trends and Insights

Aging Population & Presbyopia Prevalence

Global demographic shifts are materially increasing demand for presbyopia correction. China recorded 296.97 million citizens aged 60 and above in 2023, catalyzing uptake of premium progressive and trifocal designs. EuroEyes International's 21% annual growth in trifocal surgeries from 2020-2024 underscores the commercial pull toward multifocal solutions. The FDA's July 2025 approval of VIZZ eye drops introduces pharmaceutical competition but also heightens consumer awareness of presbyopia treatments. As non-surgical and surgical alternatives coexist, lens makers are leveraging lifestyle-oriented marketing that emphasizes seamless near-intermediate-distance vision. These trends collectively sustain long-term demand for complex lens geometries and reinforce the spectacle lens market's resilience to refractive surgery uptake.

Rising Digital-Screen Exposure Among Gen-Z & Millennials

Average daily screen time now exceeds nine hours for urban Gen-Z cohorts, intensifying blue-light exposure and digital eye strain. The pandemic-driven shift to hybrid work further cemented near-work habits, accelerating myopic progression. ZEISS BlueGuard blocks 40% of hazardous blue wavelengths while halving digital reflections compared with legacy coatings. Zenni Optical's Blokz+ Tints extend filtration to 92%, illustrating escalating functional expectations. Enterprises incorporate blue-light filters into wellness budgets, opening a high-volume B2B avenue with favorable margins. Collectively, heightened screen exposure is broadening the spectacle lens market beyond traditional refraction correction into preventive ocular health solutions.

Shift Toward Contact Lenses & Refractive Surgery

The U.S. contact-lens segment is projected to top USD 6 billion in 2025, reflecting consumer appetite for aesthetics and convenience. Orthokeratology is expanding at double-digit rates, offering overnight corneal reshaping appealing to active youth segments. Surgical alternatives such as AI-guided LASIK and SILK deliver permanent correction with shrinking recovery times. While these modalities capture share from low-to-mid prescription wearers, premium spectacle lenses maintain relevance among presbyopes, pediatric myopia cases, and users with contraindications for surgery. The restraint thus skews toward market segmentation rather than wholesale substitution, moderating-but not derailing-spectacle lens market growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing Prevalence of Myopia in Asia-Pacific

- Disposable-Income-Led Premiumization in Urban China & India

- High Price Sensitivity in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Progressive designs are the spectacle lens market's primary value driver. Their 4.72% CAGR through 2031 exceeds all other categories, underpinned by global presbyopia growth and continuous design refinement. Nikon's SeeMax Ultimate exemplifies personalization by factoring prescription, posture, and habitual reading distance into a unique free-form surface. Seiko's Brilliance integrates TwinEye 360° modulation to enhance binocular balance. Single-vision lenses, though mature, retain the largest unit volume owing to widespread myopia correction needs. Myopia-control spectacles, incorporating defocus segments or peripheral power rings, represent a fast-emerging specialty, particularly across Chinese primary-school populations. The spectacle lens industry embeds AI analytics into progressive fitting protocols, bolstering practitioner confidence and patient satisfaction.

Unit economics differ markedly across the lens spectrum. Progressive and myopia-control lenses carry gross margins 2-4 times higher than basic single-vision products, incentivizing retailers to upsell. As technologies such as wavefront optimization migrate downward into mid-tier pricing, adoption spreads to cost-sensitive markets, propelling overall spectacle lens market penetration.

CR-39 retains 63.02% volume leadership given its optical clarity and low cost. Polycarbonate remains indispensable in pediatric and safety eyewear, meeting impact-resistance mandates. High-index plastics >= 1.60 offer thin, lightweight profiles that improve aesthetics for high prescriptions. Mitsubishi Gas Chemical's IURESIN 1.74 monomer capacity expansion directly responds to robust demand for ultra-high refractive index options. Bio-based Episleaf introduces a sustainability narrative resonating with environmentally conscious consumers.

Material choice is increasingly aligned with fashion-driven rimless frames and larger lens diameters, where edge thickness compromises appearance. While high-index resin costs are 2-3 times higher than CR-39, willingness-to-pay rises in tandem with disposable incomes and premium retail positioning. Supply-chain resilience initiatives-multi-sourcing critical monomers, investing in regional polymerization plants-help cushion price swings and secure availability, stabilizing margins in the spectacle lens market.

The Spectacle Lens Market Report is Segmented by Lens Type (Single Vision, Bifocal, and More), Material (CR-39 Resin, Polycarbonate, and More), Coating Type (Anti-Reflective, Scratch-Resistant, and More), Usage (Prescription Glasses, OTC Reading Glasses), Distribution Channel (Offline Optical Retail, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with 47.61% spectacle lens market share in 2025, benefits from mature insurance systems, strong progressive uptake, and early adoption of AI-driven surfacing tools. Corporate wellness subsidies amplify blue-light-lens volumes, while continuous aging of the baby-boom demographic safeguards baseline demand. The United States exhibits robust premiumization, with high-index purchases outpacing low-gain single-vision units. Canada's public health integration sustains routine eye-examinations, whereas Mexico's rising middle class unlocks mid-tier growth potential. Expansion remains steady at a 5.04% regional CAGR, propelled more by product mix enhancements than unit growth.

Asia-Pacific is the fastest-growing hub, mirroring demographic tidal forces-both rising myopia among youngsters and burgeoning presbyopia among seniors. China's urban retirees pursue trifocal replacements and digital-ready progressives, while India's megacities embrace high-index aesthetics. Japan leads in AI-fabrication expertise, selling export licenses to neighboring lens labs. Southeast Asian markets, still under-penetrated, absorb affordable CR-39 progressives bundled with photochromic coatings. Regional supply-chain localization, including new monomer plants by Mitsui Chemicals, secures availability of advanced materials, buttressing the spectacle lens market's 5.05% CAGR.

Europe remains a sophisticated but slower-growing region in absolute volume terms. Stringent CE and ISO standards underpin consumer trust and foster innovation such as electro-active lens prototypes developed through Zeiss-Mitsui IP agreements. Aging populations in Germany, Italy, and Spain bolster progressive uptake. Environmental regulations spur adoption of bio-derived polymers and solvent-free coatings. Economic uncertainties post-Brexit and variable reimbursement ceilings challenge pricing strategies, yet the market's affinity for quality and sustainability keeps premium lenses in demand.

- EssilorLuxottica

- HOYA

- Carl Zeiss

- Nikon

- Rodenstock

- Shamir Optical Industry Ltd.

- Seiko Optical Products Co., Ltd.

- Vision-Ease Lens

- Mitsui Chemicals Inc.

- Chemiglas Corp.

- Inspecs Group plc

- Jiangsu Hongchen Optical

- Shanghai Conant Optical

- Wanxin Optical

- Chemilens Corp.

- Tokai Optical

- HOYA MiYOSMART

- Younger Optics

- Warby Parker Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population & presbyopia prevalence

- 4.2.2 Rising digital-screen exposure among Gen-Z & Millennials

- 4.2.3 Growing prevalence of myopia in Asia-Pacific

- 4.2.4 Disposable-income-led premiumisation in urban China & India

- 4.2.5 AI-enabled personalised free-form lens surfacing (under-the-radar)

- 4.2.6 Enterprise procurement of blue-light-filter lenses for staff wellness (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Shift toward contact lenses & refractive surgery

- 4.3.2 High price sensitivity in emerging economies

- 4.3.3 Counterfeit & low-quality lenses eroding brand trust (under-the-radar)

- 4.3.4 Volatile prices for high-index monomers disrupting supply (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Lens Type

- 5.1.1 Single Vision

- 5.1.2 Bifocal

- 5.1.3 Trifocal

- 5.1.4 Progressive

- 5.1.5 Myopia-Control

- 5.2 By Material

- 5.2.1 CR-39 (Resin)

- 5.2.2 Polycarbonate

- 5.2.3 High-Index Plastic (>=1.60)

- 5.2.4 Glass

- 5.3 By Coating Type

- 5.3.1 Anti-Reflective

- 5.3.2 Scratch-Resistant

- 5.3.3 UV-Blocking

- 5.3.4 Blue-Light-Filtering

- 5.3.5 Anti-Fog / Hydrophobic

- 5.4 By Usage

- 5.4.1 Prescription Glasses

- 5.4.2 OTC Reading Glasses

- 5.5 By Distribution Channel

- 5.5.1 Offline Optical Retail

- 5.5.2 Company-Owned Stores

- 5.5.3 E-commerce Platforms

- 5.5.4 Eye-Care Clinics & Hospitals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 EssilorLuxottica

- 6.3.2 Hoya Corporation

- 6.3.3 Carl Zeiss AG

- 6.3.4 Nikon Corporation

- 6.3.5 Rodenstock GmbH

- 6.3.6 Shamir Optical Industry Ltd.

- 6.3.7 Seiko Optical Products Co., Ltd.

- 6.3.8 Vision-Ease Lens

- 6.3.9 Mitsui Chemicals Inc.

- 6.3.10 Chemiglas Corp.

- 6.3.11 Inspecs Group plc

- 6.3.12 Jiangsu Hongchen Optical

- 6.3.13 Shanghai Conant Optical

- 6.3.14 Wanxin Optical

- 6.3.15 Chemilens Corp.

- 6.3.16 Tokai Optical Co., Ltd.

- 6.3.17 HOYA MiYOSMART

- 6.3.18 Younger Optics

- 6.3.19 Warby Parker Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment