PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939726

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939726

Sports Sunglasses - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

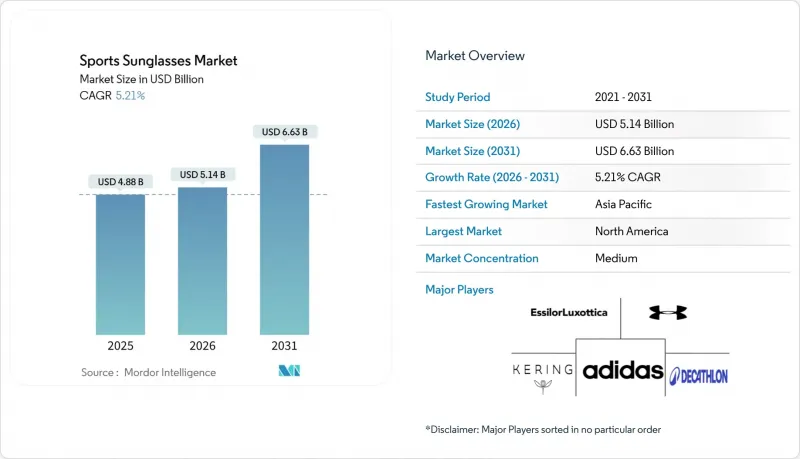

The sports sunglasses market is expected to grow from USD 4.88 billion in 2025 to USD 5.14 billion in 2026 and is forecasted to reach USD 6.63 billion by 2031 at 5.21% CAGR over 2026-2031.

Driving factors behind this growth include a surge in women's participation in sports, the melding of eyewear with fashion trends, and government investments in new sports facilities. North America leads in market volume, but the Asia-Pacific region is poised for the fastest growth, spurred by government policies and a boost in local manufacturing. While athletes remain the primary users of sports sunglasses, there's a notable uptick in demand from lifestyle consumers using them for daily activities. The premium segment of the product category is witnessing rapid growth, although the mass-market segment retains a dominant share. E-commerce is reshaping the sales landscape, positioning online platforms as vital channels for companies. The market is concentrated, with a handful of key players at the helm. For example, Essilor Luxottica is broadening its global manufacturing reach, setting up a lens production hub in Thailand and expanding its high-index lens facility in Mexico.

Global Sports Sunglasses Market Trends and Insights

Increasing participation in outdoor and sports activities

More people around the world are taking part in sports and outdoor activities, which is increasing the demand for performance gear like sports sunglasses. In 2024, around 247.1 million Americans, or about 80% of the population, participated in at least one sport, fitness, or outdoor activity . Popular activities such as hiking, running, cycling, and water sports have seen significant growth. For example, over 37 million people are cycling, 40 million are camping, and activities like paddleboarding, climbing, and mountain biking are steadily growing each year. Similarly, visits to U.S. national parks reached nearly 331.9 million in 2024, the highest ever recorded, showing a clear rise in outdoor recreation . Globally, more young people are also getting involved in sports, especially outdoor activities. With this increased participation in outdoor environments where sun exposure is high, there is a growing awareness of the need for protective and functional eyewear. Brands like Sunski launched its Spring 2025 Collection featuring ultralight models such as Foxtrot, targeting casual users who prioritize comfort and aesthetics over technical specifications.

Favorable government initiatives to boost sports culture

Governments worldwide are increasingly prioritizing safety and performance gear, such as sports sunglasses, as part of their strategies to enhance sports ecosystems. For instance, India's National Sports Policy 2024 emphasizes the use of protective equipment across all levels of sports training, from grassroots programs to elite competitions, ensuring high-performance eyewear becomes a standard part of sports gear . State-backed programs are expanding sports participation in emerging markets, creating new consumer cohorts. China's State Council set a target of 5 trillion yuan for the sports industry by 2025, with policies promoting outdoor recreation and fitness infrastructure, according to the State Council of China. India's Khelo India initiative funds grassroots sports development, increasing access to organized athletics and protective equipment, according to the Ministry of Youth Affairs and Sports, India. These interventions lower entry barriers for first-time participants, many of whom require affordable, durable eyewear. These efforts establish the consistent use and regular replacement of performance-grade sunglasses, driving sustained demand across both amateur and professional sports sectors.

Prevalence of counterfeit and low-quality products

The global market for sports sunglasses faces a significant challenge due to the rise of counterfeit and low-quality products, which undermine consumer trust and damage the reputation of premium brands. For instance, in Southeast Asia, authorities are actively combating this issue. In the Philippines, the National Bureau of Investigation seized over 1,000 fake Oakley sunglasses valued at PHP 1.6 million in May 2025. Low-quality lenses lacking UV protection pose health risks, yet price-conscious consumers often cannot distinguish fakes from genuine products. Brands are responding with authentication technologies, serialized holographic labels, blockchain-based provenance tracking, and direct-to-consumer models that bypass gray-market intermediaries. This growing prevalence of fake products not only raises safety concerns but also discourages consumers from investing in authentic, high-quality performance eyewear, ultimately hindering the growth of the market.

Other drivers and restraints analyzed in the detailed report include:

- Influence of social media platforms and celebrity endorsements

- Significant growth in women sports participation rate

- High cost of premium sports sunglasses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polarized sunglasses led the sports sunglasses market in 2025, capturing 70.04% of the market share. Their dominance is attributed to their ability to effectively reduce glare, making them highly suitable for activities like water and snow sports. This trend is expected to continue through 2031, although non-polarized lenses are anticipated to grow at a faster CAGR of 7.63%. Costa Del Mar launched new polarized models in December 2024, emphasizing water-activity performance and expedition durability, while Oakley's Watersports Collection in April 2025 targeted anglers and boaters with Prizm lens technology optimized for aquatic environments. These technological developments not only support premium pricing but also help sustain the market's position in the high-value category.

Meanwhile, non-polarized growth reflects two dynamics: budget-conscious first-time buyers entering the market through mass-market channels, and athletes in sports like cycling or running, where polarization can obscure road hazards or trail features. UVEX and 100% Speedlab offer non-polarized models with UV400 protection at accessible price points, capturing share among recreational users who value basic eye protection without advanced optics. The segment also benefits from fashion-forward consumers who prioritize aesthetics over technical performance, particularly in athleisure contexts where sunglasses function as style accessories. Compliance with ISO 12312-1 ensures that even non-polarized products meet minimum UV protection and optical quality standards, reducing the performance gap and making them viable for casual use, according to ISO.

In 2025, adults accounted for 78.13% of the sports sunglasses market revenue, driven by their consistent demand for high-performance lenses and regular replacement cycles. While adults remain the primary consumers of sports sunglasses due to their purchasing power and preference for premium products, the rising adoption among school-age athletes is creating new growth opportunities. The increasing focus on youth-oriented designs and safety features is diversifying the market, ensuring it caters to a broader age group. This shift not only reflects the evolving consumer base but also underscores the importance of addressing the unique requirements of younger users. As a result, the sports sunglasses market is poised for sustained growth across both adult and children's segments.

However, the children's segment is projected to grow at a faster CAGR of 6.21%, propelled by rising youth sports enrollment and heightened parental awareness of eye-injury risks. England reported that 47.8% of children aged 5-16 met activity guidelines, while the US records approximately 600,000 sports-related eye injuries annually among youth, with 90% preventable through proper eyewear, according to Sport England and the American Academy of Ophthalmology. ASTM F803 sets impact-resistance standards for youth sports eyewear, and compliance is increasingly mandated by schools and youth leagues, creating a regulatory tailwind for certified products. EssilorLuxottica expanded its Essilor Stellest sun lens range in May 2024, offering prescription sunglasses for children and adolescents with myopia-correcting optics and UV protection, addressing both vision correction and outdoor safety.

The Sports Sunglasses Market Report is Segmented by Product Type (Polarized Sunglasses and Non-Polarized Sunglasses), by End User (Adult and Kids/Children), by Consumer Group (Amateur and Professional Athletes and More), by Category (Mass and More), by Distribution Channel (Offline and Online), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 33.04% of global revenue in 2025. The region benefits from high disposable incomes, widespread adoption of premium eyewear, and robust retail infrastructure spanning specialty outdoor stores, optical chains, and direct-to-consumer channels. Oakley's Foothill Ranch R&D facility and 372 global stores reflect the brand's North American roots and continued investment in product innovation. Additionally, strict FDA and ANSI regulations create high entry barriers for low-quality products, enabling premium brands to maintain strong profit margins. EssilorLuxottica reported record sales in its North American segment in FY 2024, reflecting favorable market conditions.

Asia-Pacific is the fastest-growing region at 6.55% CAGR through 2031, driven by China's 400 million outdoor enthusiasts and government policies targeting a 5 trillion yuan sports industry by 2025, according to the China Outdoor Industry Association. India's Khelo India program expands grassroots sports access, creating new consumer cohorts in tier-2 and tier-3 cities where organized athletics were previously limited, according to the Ministry of Youth Affairs and Sports, India. Japan's aging population sustains demand for outdoor recreation, with hiking and cycling popular among retirees seeking active lifestyles. The region's growth is tempered by price sensitivity; mass-market products dominate, and counterfeit proliferation erodes brand equity.

Europe, South America, and Middle East and Africa collectively account for the remaining market share, each exhibiting distinct dynamics. Europe continues to show steady growth, supported by the EN ISO 12312-1 solar protection standard, which influences global product requirements. South America's growth is constrained by economic volatility and currency fluctuations, yet outdoor recreation is gaining traction in Brazil, Argentina, and Chile, supported by natural landscapes conducive to hiking and trail running. Middle East and Africa represents a nascent opportunity, with Saudi Arabia and UAE investing in sports infrastructure as part of economic diversification strategies.

- Adidas AG

- Decathlon SA

- Under Armour Inc.

- EssilorLuxottica SA

- Kering SA

- Polaroid Eyewear

- Columbia Sportswear Co.

- Costa Del Mar

- Sunski

- Tifosi Optics Inc.

- 100% Speedlab LLC

- ROKA Sports Inc.

- Bolle Brands Group

- Gatorz Eyewear Inc.

- POC Sweden AB

- Julbo SA

- Serengeti Eyewear

- Panda Optics Ltd.

- Forever Sunglasses

- UVEX Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Significant growth in the women's sports participation rate

- 4.2.2 Aggressive marketing by reputed brands

- 4.2.3 Influence of social media platforms and celebrity endorsements

- 4.2.4 Favourable government initiatives to boost sports culture

- 4.2.5 Increasing participation in outdoor and sports activities

- 4.2.6 Fashion and lifestyle integration

- 4.3 Market Restraints

- 4.3.1 Prevalence of counterfeit and low-quality products

- 4.3.2 Lack of standardized regulations restricts growth

- 4.3.3 High cost of premium sports sunglasses

- 4.3.4 Seasonality and weather dependence

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Polarized Sunglasses

- 5.1.2 Non-polarized Sunglasses

- 5.2 By End User

- 5.2.1 Adult

- 5.2.2 Kids/Children

- 5.3 By Consumer Group

- 5.3.1 Amateur and Professional Athletes

- 5.3.2 Outdoor Lifestyle/Athleisure Consumers

- 5.4 By Category

- 5.4.1 Mass Products

- 5.4.2 Premium Products

- 5.5 By Distribution Channel

- 5.5.1 Online Stores

- 5.5.2 Offline Stores

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 Japan

- 5.6.3.3 Australia

- 5.6.3.4 China

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adidas AG

- 6.4.2 Decathlon SA

- 6.4.3 Under Armour Inc.

- 6.4.4 EssilorLuxottica SA

- 6.4.5 Kering SA

- 6.4.6 Polaroid Eyewear

- 6.4.7 Columbia Sportswear Co.

- 6.4.8 Costa Del Mar

- 6.4.9 Sunski

- 6.4.10 Tifosi Optics Inc.

- 6.4.11 100% Speedlab LLC

- 6.4.12 ROKA Sports Inc.

- 6.4.13 Bolle Brands Group

- 6.4.14 Gatorz Eyewear Inc.

- 6.4.15 POC Sweden AB

- 6.4.16 Julbo SA

- 6.4.17 Serengeti Eyewear

- 6.4.18 Panda Optics Ltd.

- 6.4.19 Forever Sunglasses

- 6.4.20 UVEX Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK