PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940560

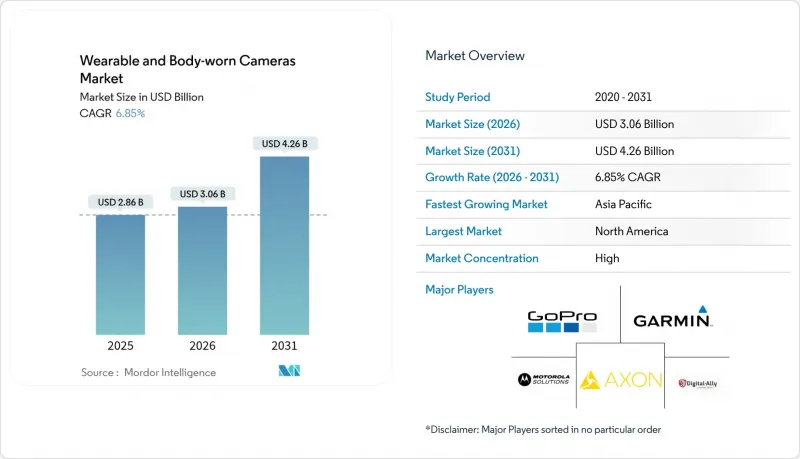

Wearable And Body-worn Cameras - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The wearable and body-worn cameras market is expected to grow from USD 2.86 billion in 2025 to USD 3.06 billion in 2026 and is forecast to reach USD 4.26 billion by 2031 at 6.85% CAGR over 2026-2031.

Growth stems from government mandates, rising transparency expectations, and technology advances that integrate high-resolution optics, AI analytics, and secure cloud ecosystems. Wider deployment across law enforcement, healthcare, industrial safety, and retail is lowering unit costs and expanding addressable demand. Data-storage architectures are also shifting to subscription-based cloud models that reduce capital outlays, while miniaturization and battery innovation enable multi-shift operation and discretion in consumer use. Competitive dynamics remain moderate; leading vendors keep share through acquisitions that fold analytics and communications into unified hardware-software stacks, yet ample white space still exists for niche disruptors focusing on specialized form factors or subscription pricing.

Global Wearable And Body-worn Cameras Market Trends and Insights

Mandated Adoption by Law-Enforcement Agencies

Regulations are the single largest catalyst for the wearable and body-worn cameras market. Illinois requires every sworn officer to use an activated camera during encounters and to retain footage for 90 days, effective January 2025. Arizona's Senate Bill 1640 obliges local agencies to deploy cameras by July 2025 and ties non-compliance to disciplinary action. Executive Order 14074 extends similar standards to all U.S. federal agencies, fostering national harmonization. Japan's National Police Agency launched a trial across 13 prefectures in 2025, earmarking JPY 10 million for 76 devices and planning nationwide coverage by 2027. Such mandates directly translate into multi-year procurement pipelines, predictable funding, and heightened vendor competition for certified evidence-management ecosystems.

Rising Demand for Accountability and Transparency

Beyond statutory triggers, public sentiment is accelerating voluntary uptake. U.S. police departments now equip roughly 79% of frontline officers with cameras, a trend mirrored by Police Scotland's GBP 13 million commitment to outfit all personnel by 2026. Private-sector implementation is growing as retailers adopt cameras to curb workplace violence, with field studies indicating up to 40% fewer complaints when devices are present. Healthcare pilots reveal that video review changes 24% of surgical consultation plans, underscoring the device's value in clinical accountability. This societal push entwines reputational risk with operational effectiveness, convincing budget holders that visibility is a strategic necessity rather than a discretionary spend.

Privacy and Data-Protection Regulations

GDPR compels agencies to conduct Data Protection Impact Assessments and to honor subject-access requests, adding administrative layers that not all municipalities can easily fund. UK guidance requires clear signage, stringent retention timelines, and automated redaction, complicating cross-border deployments. U.S. states such as Texas and Florida enacted privacy statutes in July 2024 that dictate metadata logging and consent protocols, broadening compliance costs. In healthcare, HIPAA forces encryption at rest and role-based access controls, delaying rollouts until certified solutions are available.

Other drivers and restraints analyzed in the detailed report include:

- Improvements in Battery Life and Miniaturization

- Decreasing Hardware and Cloud-Storage Costs

- High Bandwidth and Storage Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body-worn units accounted for 66.35% of 2025 revenue, cementing their role as the standard kit across policing, retail security, and hospital response teams. Their dominance stems from mounting flexibility, integrated microphones, and evidentiary admissibility protocols. The head/helmet category is pacing the wearable and body-worn cameras market at a 7.62% CAGR, buoyed by industrial safety mandates and growing sports-analytics demand. Helmet cameras excel where eye-level perspective or vibration mitigation is paramount, particularly in mining, construction, and adventure tourism. Product convergence is visible in Motorola's SVX, which fuses radio and camera functions, and in Sao Paulo Military Police's USD 18 million rollout of 12,000 units equipped with LTE streaming.

Second-generation designs integrate AI object recognition on the edge, reducing cloud calls and latency. Vendors now offer modular accessories-magnetic mounts, quick-release lanyards, and antimicrobial casings-that tailor devices to mission profiles. Standardization committees are also shaping evidence transfer protocols that favor open APIs, further widening the ecosystem of analytics partners and service providers.

Full-HD 1080p captured 52.88% of 2025 sales, balancing clarity for court admissibility with manageable storage loads. Budget-sensitive agencies still favor this tier to meet chain-of-custody thresholds under CJIS guidelines. The 4K-plus segment is registering a 7.42% CAGR as storage costs fall and as prosecutors request crisper imagery to counter motion blur and low-light issues. GoPro's HERO13 Black offers 5.3K at consumer price points, validating a technology economy that trickles into enterprise procurement.

Some departments deploy dual-resolution modes, triggering 4K only when motion or sound analytics detect probable evidentiary events, preserving bandwidth without sacrificing quality. Vendors pair high-resolution sensors with H.265 compression and cloud transcoding, shrinking file sizes by roughly 40% while retaining forensic fidelity. This balancing act is pivotal for institutions wary of ballooning storage fees.

The Wearable and Body-Worn Cameras Market Report is Segmented by Product Type (Body-Worn Cameras, Head/Helmet-mounted Cameras, and More), Resolution (HD 720p, Full HD 1080p, and More), Connectivity (Wired, Wireless Wi-Fi, and More), End User (Law-Enforcement and Public Safety, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 36.25% of 2025 revenue thanks to federal Executive Order 14074 and a patchwork of state laws that require Department of Justice-compliant cameras on every sworn officer. City councils channel public-safety budgets toward cloud storage, and Bureau of Justice Assistance grants streamline acquisition for rural counties. Integration with Computer-Aided Dispatch systems and CJIS-approved cloud environments gives domestic vendors a home-field advantage.

Asia-Pacific is the fastest-growing territory at an 8.55% CAGR. Japan's national pilot, covering 13 prefectures, underscores governmental momentum; final adoption could exceed 200,000 units by 2027 if trial KPIs are met. Australia and Singapore advance similar legislation for public-order policing and private security. Industrial exports such as mining helmets fitted with 4K optics grow regional demand outside core policing. India's smart-city programs add volume through traffic enforcement contracts that bundle cameras with analytics and e-challan issuance.

Europe records steady growth underpinned by GDPR-compliant frameworks. Police Scotland allocates GBP 13 million to deploy cameras by autumn 2026, while Germany's federal states progress at their own pace as privacy debates persist. The Middle East and Africa remain emergent, yet Gulf nations have earmarked sovereign funds for citywide surveillance that integrates on-body and fixed cameras. Latin America gains traction via Brazil's Sao Paulo Police USD 18 million procurement, signaling regional appetite for large-scale rollouts despite fiscal constraints.

- Axon Enterprise Inc.

- Motorola Solutions Inc. (WatchGuard)

- Digital Ally Inc.

- Panasonic i-PRO Sensing Solutions

- GoPro Inc.

- Garmin Ltd.

- VIEVU LLC

- Reveal Media Ltd.

- Pinnacle Response Ltd.

- Wolfcom Enterprises

- Getac Video Solutions

- Transcend Information Inc.

- Shenzhen AEE Technology

- Safe Fleet (Coban Technologies)

- Hytera Communications Corp.

- WatchGuard Video

- Zepcam B.V.

- KTandC Co. Ltd.

- Tascent Inc.

- Edesix Ltd.

- Amazon (Ring)

- Insta360

- DJI

- Ricoh Company Ltd.

- JVC Kenwood Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated adoption by law-enforcement agencies

- 4.2.2 Rising demand for accountability and transparency

- 4.2.3 Improvements in battery life and miniaturisation

- 4.2.4 Decreasing hardware and cloud-storage costs

- 4.2.5 Industrial safety and worker-training adoption

- 4.2.6 AI-driven real-time analytics integration

- 4.3 Market Restraints

- 4.3.1 Privacy and data-protection regulations

- 4.3.2 High bandwidth and storage requirements

- 4.3.3 Ergonomic/user-fatigue concerns

- 4.3.4 Cyber-security vulnerabilities

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Body-worn Cameras

- 5.1.2 Head/Helmet-mounted Cameras

- 5.1.3 Eyewear Cameras

- 5.1.4 Clip-on and Accessory Cameras

- 5.2 By Resolution

- 5.2.1 HD (720p)

- 5.2.2 Full HD (1080p)

- 5.2.3 4K and Above

- 5.3 By Connectivity

- 5.3.1 Wired

- 5.3.2 Wireless - Wi-Fi

- 5.3.3 Wireless - Cellular

- 5.3.4 Wireless - Bluetooth

- 5.4 By End User

- 5.4.1 Law-enforcement and Public Safety

- 5.4.2 Military and Defense

- 5.4.3 Sports and Adventure

- 5.4.4 Healthcare and Tele-medicine

- 5.4.5 Industrial and Commercial Workforce

- 5.4.6 Consumer / Personal

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Axon Enterprise Inc.

- 6.4.2 Motorola Solutions Inc. (WatchGuard)

- 6.4.3 Digital Ally Inc.

- 6.4.4 Panasonic i-PRO Sensing Solutions

- 6.4.5 GoPro Inc.

- 6.4.6 Garmin Ltd.

- 6.4.7 VIEVU LLC

- 6.4.8 Reveal Media Ltd.

- 6.4.9 Pinnacle Response Ltd.

- 6.4.10 Wolfcom Enterprises

- 6.4.11 Getac Video Solutions

- 6.4.12 Transcend Information Inc.

- 6.4.13 Shenzhen AEE Technology

- 6.4.14 Safe Fleet (Coban Technologies)

- 6.4.15 Hytera Communications Corp.

- 6.4.16 WatchGuard Video

- 6.4.17 Zepcam B.V.

- 6.4.18 KTandC Co. Ltd.

- 6.4.19 Tascent Inc.

- 6.4.20 Edesix Ltd.

- 6.4.21 Amazon (Ring)

- 6.4.22 Insta360

- 6.4.23 DJI

- 6.4.24 Ricoh Company Ltd.

- 6.4.25 JVC Kenwood Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment