PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940572

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940572

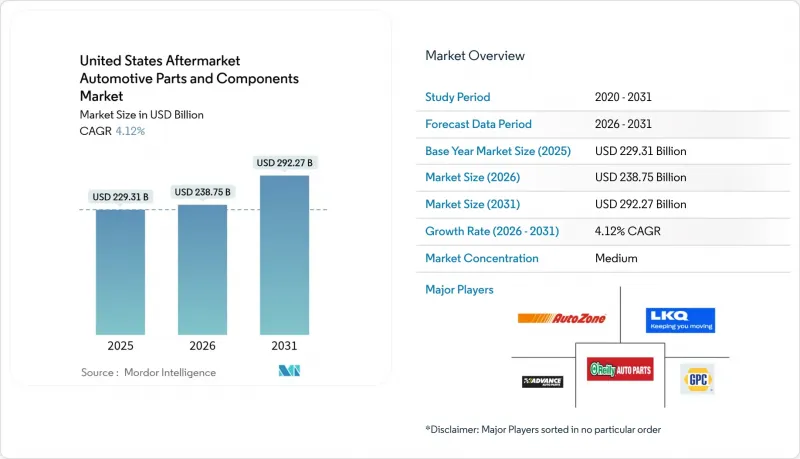

United States Aftermarket Automotive Parts And Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States aftermarket automotive parts and components market is expected to grow from USD 229.31 billion in 2025 to USD 238.75 billion in 2026 and is forecast to reach USD 292.27 billion by 2031 at 4.12% CAGR over 2026-2031.

A longer average vehicle age, strong light-truck sales, and rapid e-commerce uptake underpin this expansion. Elevated new-vehicle prices, wider right-to-repair statutes, and post-pandemic driving recovery stimulate replacement demand, while emerging electrified retrofit kits carve out premium specialty niches. Competitive intensity varies by component category, yet suppliers that pair omnichannel distribution with electronics expertise are positioning for durable growth. Regulatory initiatives, from EPA emissions rules to state EV mandates, act as simultaneous headwinds and tailwinds, reshaping the aftermarket automotive parts market through shifting compliance requirements.

United States Aftermarket Automotive Parts And Components Market Trends and Insights

Shift to Larger SUVs and Pickups Raises Wear-Part Revenues

Light trucks are poised to take the automotive market by storm, likely capturing a substantial share of new-vehicle sales by 2027. Each of these robust vehicles commands a higher aftermarket expenditure compared to traditional passenger cars, reflecting their unique demands and capabilities. The components that comprise these trucks, suspension, braking, and drivetrain parts, must endure considerably greater stress due to the hefty loads they tow and carry.

As lifestyle trends like overlanding, trailering, and outdoor adventures gain popularity, the appetite for performance-enhancing upgrades swells. Enthusiasts are seeking out lift kits, heavy-duty shocks, and oversized tires to elevate their driving experiences and tackle rugged terrains. The market for specialty equipment tailored to pickups has already surpassed an impressive USD 16 billion annually, prompting manufacturers to roll out dedicated product lines for these versatile vehicles.

Light-truck owners are often passionate about customization, leading to an average transaction value for upgrades that frequently eclipses that of standard replacements. This trend not only enhances the aesthetics and functionality of their trucks but also elevates profit margins across the aftermarket automotive parts sector, signaling a thriving market with boundless potential.

E-Commerce Penetration Accelerates Long-Tail SKU Availability

The vast majority of aftermarket transactions now traverse the dynamic landscape of digital channels, far surpassing the overall adoption of retail e-commerce across the United States. This remarkable shift allows online storefronts to showcase specialized SKUs without the burdensome costs of inventory that traditional brick-and-mortar wholesalers encounter. As a result, they can effortlessly provide nationwide access to hard-to-find parts for vintage models, catering to enthusiasts and collectors alike. Drop-shipment logistics and real-time inventory data reduce lead times for DIYers and small garages, redistributing market power toward digitally savvy suppliers. Yet counterfeit inflow remains an acute risk; federal enforcement actions underscore the importance of brand-protection programs . Firms that combine robust authentication technology with user-friendly interfaces are capturing a disproportionate share of the expanding digital aftermarket.

ADAS Lowers Collision-Part Volumes

Automatic emergency braking and lane-keeping systems are cutting crash rates, trimming demand for bumpers, fenders, and lamps. Collision frequency declines most among late-model premium vehicles, where ADAS penetration is highest, compressing volumes for cosmetic body parts. Offsetting this decline, repairs on ADAS-equipped vehicles command higher invoice values due to mandatory sensor calibration and longer labor hours. Replacement of damaged cameras or radar modules fosters growth in specialized electronics sub-segments. Collision-repair centers are upskilling and investing in advanced scan tools, benefiting parts suppliers that offer OE-grade sensors and calibration fixtures.

Other drivers and restraints analyzed in the detailed report include:

- Electrified Retrofit Kits Open High-Margin Specialty Niches

- Post-Pandemic Rebound in Vehicle Miles Traveled Lifts Service Frequency

- OEM "Service-as-Software" Subscriptions Cannibalize Hardware Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars accounted for 52.74% of the United States Aftermarket Automotive Parts and Components Market overall revenue in 2025, anchored through an expansive installed base. Nevertheless, commercial light trucks are projected to post a 7.05% CAGR, elevating their contribution to the aftermarket automotive parts market size as parcel delivery and service fleets log higher daily mileage. Combining intensive duty cycles and stringent uptime requirements lifts replacement frequency for brake assemblies, driveline joints, and cooling components. Fleet operators' procurement practices favor suppliers that guarantee rapid availability and streamlined warranty processes, nudging parts makers toward depot-level inventory and predictive fulfillment systems.

Medium and heavy trucks yield outsized monetary value, while smaller in volume, because individual components carry higher price tags and downtime penalties. EPA 2027 emissions rules motivate prebuy activity and aftermarket retrofits of selective catalytic reduction and particulate filters, temporarily boosting heavy-duty demand. Buses and coaches, newly segmented in the forecast, open ancillary potential for specialist providers of high-capacity thermal-management and suspension products. Passenger-car segments remain relevant but confront a plateauing unit base as households question the need for multiple vehicles in the era of hybrid work, whereas fleet vehicles appear locked into growth trajectories tied to logistics expansion.

Engine components retained 31.45% of the United States Aftermarket Automotive Parts and Components Market in 2025, mirroring the still-dominant ICE parc. Yet ADAS sensors are forecast for a 7.52% CAGR, signaling the pivot from mechanical to electronic value. Camera modules, radar units, and control ECUs often fail in minor collisions or succumb to environmental contaminants, creating high-margin replacement cycles. Continental's 2024 launch of 700 new engine-management SKUs illustrates suppliers' dual strategy of defending mechanical strongholds while scaling electronics portfolios.

Suspension, brake, and tire categories see ongoing lift from the trend toward heavier SUVs and pickups. Electrical and infotainment sub-segments increase as drivers seek connectivity upgrades and over-the-air functionality, blurring the line between aftermarket hardware and software services. Body and exterior parts face mixed fortunes: ADAS reduces collision frequency, yet personalization culture and regional climate damage sustain baseline demand. Tools, diagnostics, and shop consumables are expanding as independent garages gear up to service complex, software-driven vehicle systems.

The United States Aftermarket Automotive Parts and Components Market is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component Type (Engine Components, Transmission and Driveline, and More), Sales Channel (Online and Offline), Propulsion Type (ICE Vehicles, and More), and by Service Channel (DIY, DIFM Independent Garages, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Magna International Inc.

- Continental AG

- ZF Friedrichshafen AG

- DENSO Corporation

- Robert Bosch GmbH

- Lear Corporation

- Flex-N-Gate Corporation

- Panasonic Automotive Systems Co. of America

- Aisin World Corp. of America

- American Axle & Manufacturing

- Yazaki North America

- Adient PLC

- Faurecia SE

- Aptiv PLC

- LKQ Corporation

- Advance Auto Parts Inc.

- O'Reilly Automotive Inc.

- AutoZone Inc.

- Genuine Parts Co. (NAPA)

- Tenneco Inc.

- Dana Incorporated

- BorgWarner Inc.

- Goodyear Tire & Rubber Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Light-Vehicle Parc Drives Replacement Demand.

- 4.2.2 Shift To Larger SUVs and Pickups Raises Wear-Part Revenues.

- 4.2.3 E-Commerce Penetration Accelerates Long-Tail SKU Availability.

- 4.2.4 Electrified Retrofit Kits Open High-Margin Specialty Niches.

- 4.2.5 Right-To-Repair Statutes Widen Independent Aftermarket Access.

- 4.2.6 Post-Pandemic Rebound In Vehicle-Miles-Traveled Lifts Service Frequency

- 4.3 Market Restraints

- 4.3.1 EVs Contain 30-40 % Fewer Moving Parts.

- 4.3.2 ADAS Lowers Collision-Part Volumes

- 4.3.3 OE Service-As-Software Subscriptions Cannibalize Hardware Sales.

- 4.3.4 Counterfeit Inflow Via Cross-Border E-Commerce Erodes Brand Share.

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles (Class 1-3)

- 5.1.3 Medium & Heavy Trucks (Class 4-8)

- 5.1.4 Buses & Coaches (NEW)

- 5.2 By Component Type

- 5.2.1 Engine Components (filters, gaskets, pistons)

- 5.2.2 Transmission & Driveline

- 5.2.3 Electrical & Electronics (sensors, alternators, ADAS)

- 5.2.4 Suspension & Brakes

- 5.2.5 Body & Exterior (bumpers, lighting)

- 5.2.6 Tires

- 5.2.7 Interior & Accessories

- 5.2.8 Fluids & Lubricants

- 5.2.9 Others (Seat and Covers, etc.)

- 5.3 By Sales Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Propulsion Type

- 5.4.1 Internal-Combustion Engine (ICE) Vehicles

- 5.4.2 Hybrid Electric Vehicles (HEV)

- 5.4.3 Battery Electric Vehicles (BEV)

- 5.4.4 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.4.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.5 By Service Channel

- 5.5.1 DIY (Do-It-Yourself)

- 5.5.2 DIFM Independent Garages

- 5.5.3 Fleet / Commercial Service Providers

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Magna International Inc.

- 6.4.2 Continental AG

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 DENSO Corporation

- 6.4.5 Robert Bosch GmbH

- 6.4.6 Lear Corporation

- 6.4.7 Flex-N-Gate Corporation

- 6.4.8 Panasonic Automotive Systems Co. of America

- 6.4.9 Aisin World Corp. of America

- 6.4.10 American Axle & Manufacturing

- 6.4.11 Yazaki North America

- 6.4.12 Adient PLC

- 6.4.13 Faurecia SE

- 6.4.14 Aptiv PLC

- 6.4.15 LKQ Corporation

- 6.4.16 Advance Auto Parts Inc.

- 6.4.17 O'Reilly Automotive Inc.

- 6.4.18 AutoZone Inc.

- 6.4.19 Genuine Parts Co. (NAPA)

- 6.4.20 Tenneco Inc.

- 6.4.21 Dana Incorporated

- 6.4.22 BorgWarner Inc.

- 6.4.23 Goodyear Tire & Rubber Co.

7 Market Opportunities & Future Outlook