PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940587

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940587

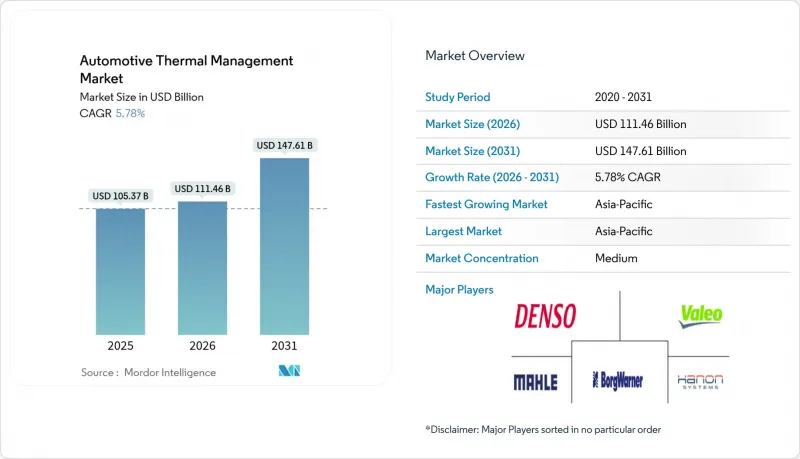

Automotive Thermal Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Automotive Thermal Management Market size in 2026 is estimated at USD 111.46 billion, growing from 2025 value of USD 105.37 billion with 2031 projections showing USD 147.61 billion, growing at 5.78% CAGR over 2026-2031.

Growth stems from rapid electrification, stricter global CO2 and CAFE rules, and rising demand for integrated battery-cooling, cabin HVAC, and power electronics thermal loops. Battery electric vehicles (BEVs) require two-fifths more thermal content per unit than internal-combustion cars, forcing suppliers to redesign architectures that hold battery temperatures in the optimal 15-35 °C band, extend pack life, and support 800 V fast-charge hardware. Competitive pressures, particularly in Asia-Pacific, accelerate innovation in immersion cooling, multi-circuit modules, and PFAS-free refrigerant heat-pumps that improve vehicle range, comfort, and regulatory compliance.

Global Automotive Thermal Management Market Trends and Insights

Mainstream EV Adoption Boosting Battery-Thermal Content

Battery packs now consume one-fifth of total thermal budgets, up from minimal in conventional cars. Hyundai Mobis introduced pulsating heat pipes in recent times that deliver ten-fold higher heat transfer than standard plates, trim thickness to 0.8 mm, and improve temperature uniformity by 20 °C, sharply lowering runaway risk. Integrated heat-pump HVAC recovers waste heat, adding minimal winter range to BEVs, and suppliers bundling battery, cabin, and inverter cooling in unified modules are booking multi-platform awards.

Under-Hood 800 V Architectures Accelerating SiC Inverter Cooling

Premium EVs now rely on 800 V silicon-carbide inverters capable of 175 °C junction temperatures. Immersion dielectric cooling keeps thermal resistance under 0.1 °C/W, enabling charge rates above 350 kW and safeguarding reliability over 150,000 cycles. Reference designs recently released by NXP and Wolfspeed embed these liquid loops, underlining the shift from air to direct liquid cooling in high-power applications.

High BOM Cost of Integrated Thermal Modules

Unified modules integrate multiple components into a single housing, but this approach significantly increases costs compared to using separate pieces. This creates challenges for vehicles operating within a limited thermal content budget. To address this, suppliers are focusing on strategies such as platform-standardization, vertical integration, and automated assembly processes to achieve cost efficiency and reach volume breakeven.

Other drivers and restraints analyzed in the detailed report include:

- Stricter CO2 / CAFE Norms Driving Multi-Circuit Cooling

- PFAS Phase-Out Forcing Switch to Natural-Refrigerant Heat-Pumps

- Reliability & Leak-Path Risks in Liquid/Immersion Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine cooling held a 35.01% of the automotive thermal management market share in 2025 as the backbone for ICE fleets. Battery systems, however, are scaling fastest at a 5.83% CAGR, reflecting OEM reallocations toward pack, module, and cell-level loops that now command almost half of BEV thermal budgets.

Stellantis' Intelligent Battery Integrated System bundles cooling plates, inverters, and chargers, boosting energy efficiency by 10% and power density by minimal. Cabin HVAC remains steady, aided by dual-source heat pumps, while waste-heat recovery and EGR modules grow in commercial sectors. Motor and inverter cooling races ahead as 800 V drivetrains proliferate, each demanding up to 200 W/cm2 heat removal.

Liquid indirect loops commanded 42.77% of the automotive thermal management market share in 2025, bolstered by mature radiators, reservoirs, and pumps. The automotive thermal management market size tied to immersion cooling is increasing at a 5.82% CAGR, reflecting physics advantages that elevate allowable power density tenfold.

Hyundai's nano-film air technology cut cabin temperatures by 12.5 °C and saved significant energy, proving air cooling's niche in lightweight systems. Phase-change materials buffer cells during peak load, and hybrid loops interlink multiple media, selecting optimal paths through AI supervision.

The Automotive Thermal Management Market Report is Segmented by Application (Engine Cooling, Cabin/HVAC, and More), Technology (Air, Liquid Indirect, and More), Component (Heat Exchangers, Compressors & Pumps, and More), Propulsion (ICE, HEV, and More), Vehicle Type (Passenger Cars, LCV, and Heavy Trucks & Buses), and Geography (North America, South America, Europe, and More). Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 39.17% of the automotive thermal management market share in 2025 and led growth at a 5.86% CAGR, powered by China's EVs built by BYD in 2024 and a considerable target for 2025 . Hanon Systems' massive compressor expansion supports North American assembly while leveraging low-cost Asian supply lines. Japanese and Korean Tier 1s push breakthroughs such as pulsating heat pipes, keeping the region technologically competitive.

North America secures the second spot, bolstered by stringent fuel efficiency standards and significant EV capital commitments from major automakers such as Ford, GM, and Tesla. The rapid adoption of advanced platforms drives increased demand for silicon carbide inverter cooling and predictive thermal control technologies. While Mexico's cost-effective manufacturing base continues to attract investments in pumps, valves, and exchangers, a shortage of skilled technicians creates challenges for managing complex EV service operations.

Europe combines strict regulatory frameworks with a strong engineering tradition. Ambitious emissions reduction targets and the phase-out of certain chemicals are accelerating the transition to environmentally friendly refrigerants. Ford recently introduced its propane-based system, showcasing innovation in thermal management. German manufacturers are prioritizing integrated modules and exhaust gas recirculation heat recovery systems, while France's aggressive push for battery electric vehicles is significantly increasing the demand for battery cooling solutions. This premium market positioning supports higher thermal management spending per vehicle, ensuring sustained profitability for suppliers.

- Denso Corporation

- Hanon Systems

- Valeo SE

- MAHLE GmbH

- Gentherm Inc.

- Robert Bosch GmbH

- Dana Inc.

- BorgWarner Inc.

- Modine Mfg. Co.

- Schaeffler AG

- ZF Friedrichshafen AG

- Kendrion N.V.

- Continental AG

- TI Fluid Systems

- Sanden Holdings

- Boyd Corporation

- VOSS Automotive

- Grayson Thermal Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream EV Adoption Boosting Battery-Thermal Content

- 4.2.2 Luxury & Comfort Features Expanding HVAC Value Per Car

- 4.2.3 Under-Hood 800 V Architectures Accelerating SIC Inverter Cooling

- 4.2.4 ICE Turbo-Downsizing Raising Engine & Oil-Cooler Demand

- 4.2.5 Stricter Co2 / Cafe Norms Driving Multi-Circuit Cooling

- 4.2.6 PFAS-Phase-Out Forcing Switch To Natural-Refrigerant Heat-Pumps

- 4.3 Market Restraints

- 4.3.1 High BOM Cost Of Integrated Thermal Modules

- 4.3.2 Reliability & Leak-Path Risks In Liquid/Immersion Systems

- 4.3.3 Scarcity Of Low-GWP Refrigerant Supply Chains

- 4.3.4 Limited Service-Technician Capabilities For Complex EV Cooling Loops

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Engine Cooling

- 5.1.2 Cabin / HVAC Thermal Management

- 5.1.3 Transmission Thermal Management

- 5.1.4 Waste-Heat Recovery / EGR

- 5.1.5 Battery Thermal Management

- 5.1.6 Motor & Power-Electronics Cooling

- 5.2 By Technology Type

- 5.2.1 Air Cooling & Heating

- 5.2.2 Liquid Indirect Cooling

- 5.2.3 Direct / Immersion Liquid Cooling

- 5.2.4 Phase-Change / PCM Systems

- 5.2.5 Hybrid & Integrated Loops

- 5.3 By Component

- 5.3.1 Heat Exchangers (Radiator, CAC, Oil Cooler)

- 5.3.2 Compressors & Pumps

- 5.3.3 Thermal Control Valves & Manifolds

- 5.3.4 High-Voltage Coolant Heaters

- 5.3.5 Sensors & Controllers

- 5.4 By Propulsion Type

- 5.4.1 ICE Vehicles

- 5.4.2 Hybrid Electric Vehicles

- 5.4.3 Plug-in Hybrid Vehicles

- 5.4.4 Battery Electric Vehicles

- 5.4.5 Fuel-Cell Electric Vehicles

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy Trucks & Buses

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Denso Corporation

- 6.4.2 Hanon Systems

- 6.4.3 Valeo SE

- 6.4.4 MAHLE GmbH

- 6.4.5 Gentherm Inc.

- 6.4.6 Robert Bosch GmbH

- 6.4.7 Dana Inc.

- 6.4.8 BorgWarner Inc.

- 6.4.9 Modine Mfg. Co.

- 6.4.10 Schaeffler AG

- 6.4.11 ZF Friedrichshafen AG

- 6.4.12 Kendrion N.V.

- 6.4.13 Continental AG

- 6.4.14 TI Fluid Systems

- 6.4.15 Sanden Holdings

- 6.4.16 Boyd Corporation

- 6.4.17 VOSS Automotive

- 6.4.18 Grayson Thermal Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment