PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940609

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940609

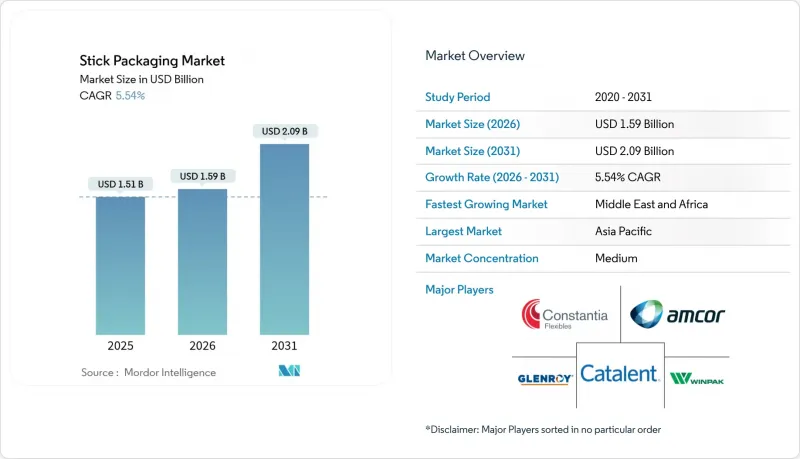

Stick Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The stick packaging market was valued at USD 1.51 billion in 2025 and estimated to grow from USD 1.59 billion in 2026 to reach USD 2.09 billion by 2031, at a CAGR of 5.54% during the forecast period (2026-2031).

Growing demand for convenient single-serve formats, mounting regulatory pressure to curb plastic waste, and continuous improvements in flexible-film barrier performance underpin this outlook. Producers are investing in digital presses to serve personalized short-run orders, while brand owners lean on portion-control benefits to align with wellness trends. Resin price volatility and aluminum tariffs are increasing the relative attractiveness of lightweight laminates. At the same time, the need to meet e-commerce fulfilment efficiency targets is pushing suppliers to favor narrow, compact packs that optimize volumetric shipping costs. Consolidation among top converters is boosting purchasing leverage and accelerating the scale-up of recyclable mono-material structures.

Global Stick Packaging Market Trends and Insights

Convenience & On-the-Go Consumption Boom

City-centric lifestyles and rising female workforce participation have made portability a prime purchase criterion, steering consumers toward single-dose packs. Brand owners report higher household penetration when powder beverages, instant coffee, or electrolyte mixes are sold in slim sachets that fit pockets and gym bags. Quick-service chains are extending this logic to condiments, replacing bulky pouches with narrow sticks that reduce pack material by as much as 35%. In parallel, e-commerce grocery platforms value the rectangular footprint of stick packs because it minimizes void space and shipping fees. The self-reinforcing cycle between lifestyle convenience and channel efficiency places the stick packaging market in a favorable long-run demand position.

Demand for Material & Weight Reduction

Input-cost inflation is sharpening the focus on downgauged laminates. Corrugated board prices rose USD 70 per ton in early 2025, and aluminum foil attracts 25% import tariffs in the United States, widening the cost delta between rigid and flexible substrates. Stick formats typically consume 30-40% less film area per gram of product than pillow pouches, allowing brand owners to limit exposure to resin price swings. Suppliers are capitalizing by introducing thinner sealant layers and higher-yield PE-based barriers that do not compromise machinability. Together, these shifts are reinforcing the stick packaging market's competitiveness in inflationary environments.

Single-Use-Plastic Regulation Tightening

Bans on certain single-use articles and taxes on packaging containing less than 30% recycled resin are raising compliance costs for multi-layer laminates. Financial penalties in the United Kingdom can reach GBP 200 per ton for non-conforming packs, prompting retailers to pressure suppliers for verified PCR content. Although stick formats use less material, their narrow gauge complicates PCR incorporation because small film defects can impair line speeds. Converters must therefore accelerate the qualification of mass-balance certified resins to safeguard volume growth.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Mandates for Flexible Packs

- Pharma Micro-Dosing & Pediatric Formats

- Limited Recyclability of Multi-Layer Films

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The plastics family accounted for 63.42% of 2025 revenue, underpinned by cost-effective PE and PET structures that offer well-established processing windows. Demand for downgauged coextrusions and EVOH-based oxygen barriers helped the segment preserve share despite regulatory scrutiny. However, bioplastics are projecting a 10.24% CAGR, the fastest across the material spectrum. Producers such as Fraunhofer Institute have demonstrated PLA blends with 80% bio-based content that replicate LDPE flexibility, clearing a significant performance hurdle. Paper-foil hybrids remain niche but are gaining traction in condiment channels that tolerate shorter shelf life.

In value terms, traditional substrates will continue to dominate the stick packaging market size until at least 2028, yet the incremental gains will concentrate in bio-based films as traceable feedstock certification unlocks ESG procurement budgets. Early movers among multinational beverage brands are negotiating multi-year offtake contracts for bio-PE to secure volumes ahead of regulatory deadlines. Meanwhile, metal foils face cost inflation from tariff regimes, limiting their use to high-barrier pharmaceutical sticks that demand >99% light protection. The net result is a gradual rebalancing rather than a sudden disruption.

Powder applications retained 57.35% of the stick packaging market in 2025, reflecting entrenched usage in instant coffee, dietary supplements, and sports nutrition mixes. Their free-flowing nature enables high-speed filling and reliable seal integrity, supporting attractive unit economics. That said, liquids are on track for a brisk 8.92% CAGR, supported by continuous-motion vertical form-fill-seal (VFFS) platforms equipped with improved viscosity control. Futamura's demonstration of compostable film for aqueous sachets illustrates how performance gaps are narrowing, making liquid sticks a more common sight in personal-care travel kits.

Functional beverage brands value the precise 10 ml to 15 ml dose that liquid sticks deliver, enabling consumers to mix collagen shots or electrolyte boosters on demand. From a logistics standpoint, packs ship as flat carts rather than bulky PET bottles, slashing freight costs and carbon intensity. As machinery OEMs refine nozzle design to prevent drips, the stick packaging market size for liquids is expected to reach USD 673 million by 2031, outpacing powders in relative expansion though not absolute scale. Granular and semi-solid fillings will grow more moderately, held back by higher shearing requirements and fewer automated equipment options.

The Stick Packaging Market Report is Segmented by Material (Plastics, Paper, Metal Foils, Bioplastics), Product Form (Powders, Granules, Liquids, Semi-Solids), End-User Industry (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Industrial & Household), Packaging-Machinery Lane Count (1-3 Lanes, 4-10 Lanes, 11-20 Lanes, Greater Than 20 Lanes), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded a 35.44% revenue share in 2025, anchored by China's and India's expanding middle-class appetites for portion-controlled beverages and nutraceuticals. Urban consumers gravitate toward sachet multipacks that fit small kitchens and integrate seamlessly with app-based grocery delivery. Local brand owners benefit from vertically integrated film extrusion clusters, which shorten lead times and lower minimum order quantities. Meanwhile, government initiatives that encourage bio-based polymer adoption are beginning to influence material selection, fostering early experimentation with sugarcane-sourced PE.

North America ranks as the second-largest regional contributor, supported by premium positioning and greater penetration of pharmaceutical and nutraceutical applications. The United States also hosts a deep roster of machinery OEMs and contract packers, reinforcing a virtuous ecosystem that accelerates time-to-market for new SKUs. However, elevated freight costs and resin volatility create headwinds, pushing some capacity expansion plans toward nearshore sites in Mexico.

Europe remains the rule-setter on sustainability. The forthcoming Packaging and Packaging Waste Regulation is compelling converters to redesign laminate structures for recyclability, making the region a technology test bed for mono-material PE/EVOH blends. Middle East & Africa, while still small in absolute dollars, is on pace for a 6.66% CAGR. Rising disposable incomes and rapid food-service expansion support single-serve coffee, juice, and spice applications, while regional governments court FDI into flexible-pack manufacturing to diversify away from hydrocarbons.

- Amcor plc

- Constantia Flexibles Group GmbH

- Glenroy, Inc.

- Aranow Packaging Machinery S.L.

- Fres-Co System USA, Inc.

- Catalent, Inc.

- Winpak Ltd.

- Sonoco Products Company

- ePac Holdings, LLC

- GFR Pharma Ltd.

- Sonic Packaging Industries, Inc.

- Viking Masek Global Packaging Technologies s.r.o.

- Nichrome India Ltd.

- Unither Pharmaceuticals SAS

- Marchesini Group S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience and on-the-go consumption boom

- 4.2.2 Demand for material and weight reduction

- 4.2.3 Sustainability mandates for flexible packs

- 4.2.4 Pharma micro-dosing and pediatric formats

- 4.2.5 Digital printing for mass-customised sachets

- 4.2.6 E-commerce sample sachet proliferation

- 4.3 Market Restraints

- 4.3.1 Single-use-plastic regulation tightening

- 4.3.2 Limited recyclability of multi-layer films

- 4.3.3 Barrier-grade mono-material film shortage

- 4.3.4 High-viscosity fill accuracy limits >15 lanes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Key Performance Indicators (KPIs)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Paper

- 5.1.3 Metal Foils

- 5.1.4 Bioplastics

- 5.2 By Product Form

- 5.2.1 Powders

- 5.2.2 Granules

- 5.2.3 Liquids

- 5.2.4 Semi-solids

- 5.3 By End-user Industry

- 5.3.1 Food and Beverages

- 5.3.1.1 Instant Beverages

- 5.3.1.2 Nutraceutical Powders

- 5.3.1.3 Sugar and Sweeteners

- 5.3.2 Pharmaceuticals

- 5.3.2.1 OTC

- 5.3.2.2 Rx

- 5.3.3 Cosmetics and Personal Care

- 5.3.4 Industrial and Household

- 5.3.1 Food and Beverages

- 5.4 By Packaging-Machinery Lane Count

- 5.4.1 1-3 Lanes

- 5.4.2 4-10 Lanes

- 5.4.3 11-20 Lanes

- 5.4.4 Greater than 20 Lanes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Amcor plc

- 6.4.2 Constantia Flexibles Group GmbH

- 6.4.3 Glenroy, Inc.

- 6.4.4 Aranow Packaging Machinery S.L.

- 6.4.5 Fres-Co System USA, Inc.

- 6.4.6 Catalent, Inc.

- 6.4.7 Winpak Ltd.

- 6.4.8 Sonoco Products Company

- 6.4.9 ePac Holdings, LLC

- 6.4.10 GFR Pharma Ltd.

- 6.4.11 Sonic Packaging Industries, Inc.

- 6.4.12 Viking Masek Global Packaging Technologies s.r.o.

- 6.4.13 Nichrome India Ltd.

- 6.4.14 Unither Pharmaceuticals SAS

- 6.4.15 Marchesini Group S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment