PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940664

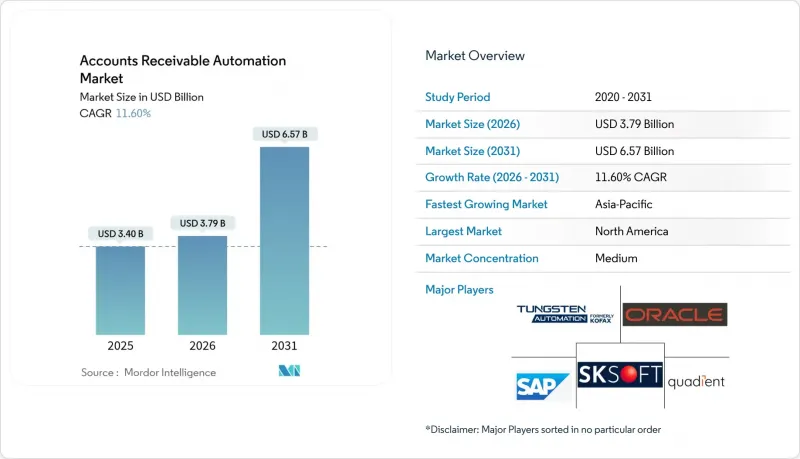

Accounts Receivable Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Accounts Receivable Automation market is expected to grow from USD 3.40 billion in 2025 to USD 3.79 billion in 2026 and is forecast to reach USD 6.57 billion by 2031 at 11.6% CAGR over 2026-2031.

Organizations continue to streamline order-to-cash processes, and heightened demand for predictive cash-flow visibility, compliance with e-invoicing mandates, and the roll-out of real-time payment rails are steering sustained expansion of the AR automation market. Rapid cloud adoption among small and medium enterprises, combined with AI-driven credit and dispute analytics that achieve payment-date forecast accuracy above 90%, is shortening reconciliation cycles and reducing Days Sales Outstanding. Competitive positioning is shifting toward AI-native designs that automate complex workflows, while ecosystem partnerships with payment networks are becoming critical levers for market entry and revenue scale. North America retains the largest regional footprint, but the AR automation market is expanding fastest in Asia-Pacific as government digital-finance programs, tax-digitization rules, and SME digitization incentives converge.

Global Accounts Receivable Automation Market Trends and Insights

Need to Improve Cash-Flow and Working-Capital Efficiency

Mid-sized companies that deploy intelligent AR suites shave seven days off average DSO and save USD 440,000 each year through labor elimination and early-payment capture. Predictive dashboards flag at-risk invoices in real time, letting finance teams prioritize outreach before delinquency occurs. Manufacturers and healthcare providers that traditionally face elongated receivables cycles now report 95% straight-through cash application, which materially strengthens liquidity buffers. CFOs increasingly link receivables performance metrics to working-capital KPIs that feed enterprise-wide financing models, elevating AR automation to a board-level priority. Macroeconomic volatility further intensifies the push for receivables digitization because quick cash conversion mitigates borrowing costs.

Rapid Adoption of Cloud-Based AR Suites by SMEs

SaaS delivery lowers entry hurdles by eliminating heavy infrastructure and long consulting schedules, enabling a go-live window of eight weeks for most SMEs. Multi-tenant architectures spread maintenance overhead and ensure continuous feature roll-outs such as embedded analytics and policy-driven credit limits. Public-sector subsidy programs in India and Brazil reimburse part of subscription costs, accelerating uptake among first-time adopters. Vendors respond with industry-specific templates that reduce configuration steps and provide native connectors to leading accounting packages. Despite the momentum, SMEs still cite data-security worries and limited IT staff as adoption inhibitors, prompting providers to bundle managed services and zero-trust security controls.

Legacy ERP Integration Complexity

Many factories still run heavily customized versions of SAP ECC or Oracle E-Business Suite that lack modern APIs. AR automation roll-outs, therefore, require custom extract-transform-load jobs, dual-Writeback scripts, and downtime windows that extend implementation timelines. Data silo fragmentation across regional ERP instances introduces reconciliation errors that compromise audit trails. Middleware connectors are evolving to translate legacy data objects into JSON payloads, yet deep process re-engineering is often unavoidable. Service partners now package fixed-price integration bundles to de-risk budgets for mid-market adopters.

Other drivers and restraints analyzed in the detailed report include:

- AI/ML-Driven Credit and Dispute Analytics

- Global E-Invoicing and Tax Digitization Mandates

- Cyber-Security and Data-Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions contributed 85.92% to 2025 revenue, underscoring their centrality to end-to-end receivables transformation within the Accounts Receivable Automation Market. The segment bundles invoice generation, credit risk scoring, and AI-powered cash application into integrated suites that replace point tools. Cash-application engines that match real-time payment references to open invoices are on pace for a 14.95% CAGR, the fastest across components, as FedNow and PIX volumes accelerate payment velocity. Platform vendors embed generative AI copilots that guide collectors toward high-risk accounts and auto-compose follow-up e-mails, further solidifying the solution's moat.

Service revenue stems from implementation, integration, and managed operations that surround the core software stack. Adoption of AI-native capabilities amplifies demand for data-science consulting, model tuning, and change-management engagements. Managed service arrangements resonate with SMEs that prefer outcome-based pricing tied to DSO reduction. Vendors combine 24/7 support desks with robotic monitoring tools that remediate interface breaks in near real time, sustaining platform uptime above 99.9%.

Cloud solutions controlled 80.65% of the Accounts Receivable Automation Market share in 2025 and are on track for a 16.34% CAGR through 2031. Multi-tenant SaaS eliminates server refresh cycles and ensures quarterly feature drops, which resonates with finance teams that lack internal IT resources. Built-in compliance toolkits address PCI-DSS, ISO 27001, and local e-invoicing formats, reducing audit overhead. Edge-optimized architectures are now surfacing, placing lightweight agents inside corporate networks that synchronize sensitive data while analytics stay in the provider cloud.

On-premise installations persist in defense, healthcare, and government entities that enforce data-sovereignty statutes. Hybrid deployments bridge these needs by hosting encrypted data vaults on-site while offloading workflow orchestration to the cloud. Vendors publish reference architectures that outline network segmentation, key management, and API traffic flows. These blueprints guide risk committees that must certify every new data pathway.

Accounts Receivable Automation Market Report Segments the Industry by Component (Solutions and Services), Deployment Model (On-Premise and Cloud), Organization Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, IT and Telecommunications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 44.40% revenue in 2025, supported by mature real-time payment rails and a deep ecosystem of fintech integrators. Large corporates extend automation pilots to subsidiaries, and the prevalence of SOC 2 compliant datacenters eases adoption. U.S. regulators encourage faster settlement infrastructures, which in turn lift the adoption of AI-driven cash application that processes 95% of transactions without human touch.

Asia-Pacific is the fastest-growing theatre with a 14.05% CAGR through 2031, propelled by India's GST e-invoice schema and China's digital-RMB pilots that normalize electronic trade documents . Government subsidies lower the total cost of ownership for cloud deployments, and mobile-first SMEs leapfrog legacy ERPs. Cross-border trade corridors within ASEAN stimulate demand for multi-currency, multilingual invoicing modules.

Europe posts steady gains as GDPR alignment drives demand for platforms with data-minimization and consent-tracking. Italy, France, and Germany extend B2B e-invoice mandates that ripple through value chains, prompting suppliers to modernize receivables quickly. Multinationals operating shared-service centers in Poland and Portugal favor cloud architectures because automation savings offset local labor arbitrage.

- SAP SE

- Oracle Corporation

- SK Global Software LLC

- Quadient SA (YayPay Inc.)

- Kofax Inc.

- Workday, Inc.

- Corcentric LLC

- HighRadius Corporation

- Qvalia AB

- MHC Software, LLC (MHC Automation)

- Bill.com Holdings, Inc.

- Comarch SA

- Esker SA

- BlackLine, Inc.

- Serrala Group GmbH

- Versapay Corporation

- Invoiced, Inc.

- Rimilia (BlackLine Cash-App) Ltd.

- Open Text Corporation (Tungsten Network)

- Synergy Resources Ltd. (Sidetrade)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need to improve cash-flow and working-capital efficiency

- 4.2.2 Rapid adoption of cloud-based AR suites by SMEs

- 4.2.3 AI/ML-driven credit and dispute analytics

- 4.2.4 Global e-Invoicing and tax digitisation mandates

- 4.2.5 Real-time-payments rails enabling auto-cash-application

- 4.2.6 ESG-linked supply-chain finance pushing receivables automation

- 4.3 Market Restraints

- 4.3.1 Legacy ERP integration complexity

- 4.3.2 Cyber-security and data-privacy concerns

- 4.3.3 Fragmented B2B identity standards

- 4.3.4 Skilled-talent shortage in finance automation

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Invoice-to-Cash Suites

- 5.1.1.2 Credit and Risk Management

- 5.1.1.3 Cash-Application Engines

- 5.1.2 Services

- 5.1.2.1 Implementation and Integration

- 5.1.2.2 Managed and Support Services

- 5.1.1 Solutions

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Information Technology and Telecommunications

- 5.4.3 Manufacturing

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Transportation and Logistics

- 5.4.6 Retail and E-commerce

- 5.4.7 Others (Energy, Education, Public Sector)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 SK Global Software LLC

- 6.4.4 Quadient SA (YayPay Inc.)

- 6.4.5 Kofax Inc.

- 6.4.6 Workday, Inc.

- 6.4.7 Corcentric LLC

- 6.4.8 HighRadius Corporation

- 6.4.9 Qvalia AB

- 6.4.10 MHC Software, LLC (MHC Automation)

- 6.4.11 Bill.com Holdings, Inc.

- 6.4.12 Comarch SA

- 6.4.13 Esker SA

- 6.4.14 BlackLine, Inc.

- 6.4.15 Serrala Group GmbH

- 6.4.16 Versapay Corporation

- 6.4.17 Invoiced, Inc.

- 6.4.18 Rimilia (BlackLine Cash-App) Ltd.

- 6.4.19 Open Text Corporation (Tungsten Network)

- 6.4.20 Synergy Resources Ltd. (Sidetrade)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment