PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940669

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940669

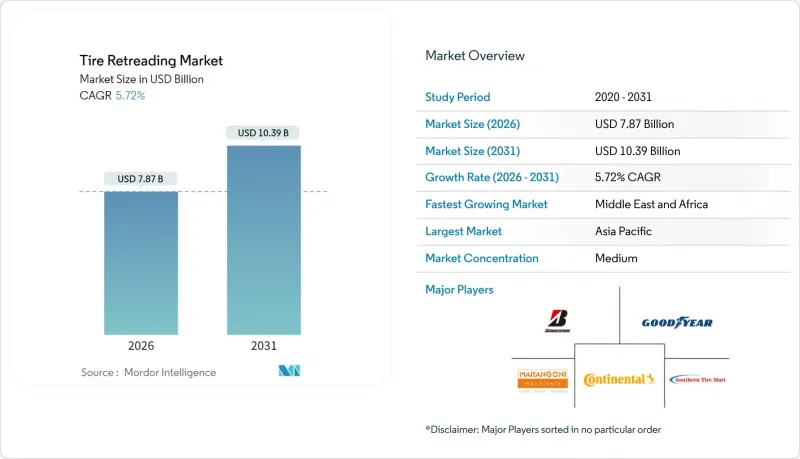

Tire Retreading - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Tire Retreading Market was valued at USD 7.44 billion in 2025 and estimated to grow from USD 7.87 billion in 2026 to reach USD 10.39 billion by 2031, at a CAGR of 5.72% during the forecast period (2026-2031).

Driven by rising raw-material prices, ongoing carbon-reduction targets, and the imperative to maximize truck uptime, the momentum in the retreading industry continues. Retreaded casings offer significant cost savings and achieve notable reductions in carbon emissions and energy consumption, underscoring their dual economic and environmental advantages. The Asia-Pacific region commands the largest share of the market, thanks to China's expansive heavy-duty fleet and India's rapidly expanding logistics networks. In contrast, the Middle East & Africa emerge as the region with the most robust growth, driven by heightened off-road tire usage spurred by booming mining and infrastructure projects. Furthermore, advancements like RFID tracking, automated inspection lines, and predictive maintenance analytics are evolving from a mere cost-saving measure to a pivotal, data-centric service integral to comprehensive fleet contracts.

Global Tire Retreading Market Trends and Insights

Cost-savings Over New Tires

Commercial operators now embed retreading in annual budget planning because a single retread delivers two-fifths purchase-price relief versus a comparable new tire. That differential widens as synthetic rubber and petroleum costs trend upward, reinforcing retreading's payback in high-utilization fleets such as long-haul trucking and express-parcel delivery. China's heavy-duty sector, which logged almost 300,000 truck sales in the first half of 2025, epitomizes this cost calculus, while airlines stretch aviation-tire service life across multiple cycles to preserve thin operating margins .

Stricter Circular-Economy & CO2 Regulations

EU Circular Economy Action Plan rules oblige transport operators to prioritize reuse over disposal, turning tire retreading into a compliance tool rather than a discretionary measure. Euro 7 emission thresholds reinforce the mandate by penalizing premature tire replacement, and similar stimuli surface in North America and key Asia-Pacific economies. Environmental math is straightforward: every retread slashes carbon output by 30% and energy inputs by 70%, metrics that help carriers meet Scope 3 reporting targets .

Volatile Casing & Rubber Prices

Sudden swings in natural-rubber benchmarks and petroleum-linked synthetic rubber costs erode profit margins and complicate pricing grids for retread shops. Smaller independents often lack forward-buying capacity, exposing them to spot-market shocks that compress gross margin or force price hikes that narrow retread's cost edge against new imports. When raw material prices pull back, new-tire discounts can temporarily curb retread demand until equilibrium reasserts.

Other drivers and restraints analyzed in the detailed report include:

- Fleet-Mileage Growth From E-Commerce Logistics

- Government Tax-Credit Schemes For Domestic Retreads

- Influx Of Ultra-Low-Cost Import Tires

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium and heavy-duty trucks generated 45.02% of 2025 revenue, confirming that high-mileage cycles make retreading indispensable for line-haul and regional-haul carriers. This segment will continue anchoring the tire retreading market through 2031 as freight demand remains resilient. Off-the-road and mining tires are charted for a 5.96% CAGR, riding on mineral extraction activity in Africa and South America, where specialized casings cost multiples of on-road equivalents. With its 4-10 approved retread cycles, the aviation niche reveals how rigorous safety oversight can coexist with aggressive cost management, forecasting a robust CAGR that outpaces most ground-based segments.

Passenger car retreading remains marginal in Europe and North America amid safety perceptions but maintains footholds in Latin America and Asia, where regulatory barriers are lower. Light commercial vans, pivotal in e-commerce logistics, now adopt shorter retread cycles adjusted to urban stop frequency. Emerging double-articulated rigs in Japan require retread designs capable of handling higher axle loads, a technical capability that only the most advanced independent retreaders currently offer.

The pre-cure process held 60.95% of global revenue in 2025 and remains the go-to for high-volume truck casings. Its competitive advantage stems from lower per-unit cost and faster throughput. Mold-cure is gaining a 5.88% CAGR owing to improved precision heating and automated presses that shorten cycle times while allowing bespoke tread patterns. Automation, from AI-based surface inspection to collaborative robotic handlers, props up both methods by standardizing quality and trimming labor input. However, capitalization requirements could accelerate industry consolidation as smaller shops struggle to fund upgrades.

The tire retreading market size attributed to mold-cure lines is projected to increase as fleet demand for custom patterns grows. Yet, pre-cure's simplicity and lower energy load keep it the preferred method for cost-sensitive fleets. OEM-integrated retread plants hedge their bets by running hybrid facilities that switch methods based on order mix and casing availability.

The Tire Retreading Market Report is Segmented by Vehicle Type (Passenger Car, Light Commercial Vehicle, and More), Production Method (Pre-Cure and Mold-Cure), Tire Type (Radial, Bias, and Solid/Foam-filled), Sales Channel (Independent Retreaders and More), End-User Industry (Transport & Logistics Fleets and More), Application (On-Road, Off-Road), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 38.51% revenue in 2025, due to China's gigantic truck fleet and India's infrastructure push that multiplies highway ton-kilometers. Government policies emphasizing circular-economy compliance, such as China's Large-scale Equipment Renewal Action Plan, channel fleets toward retreading while they phase into new-energy vehicles. Japan's emphasis on total-life cost modeling translates into sophisticated demand for retread services that plug directly into predictive maintenance dashboards.

Middle East & Africa, the fastest-advancing region at 6.06% CAGR, gains from energy and mineral projects that lift off-road tire usage in deserts and open-pit mines. Saudi Arabia's ban on retread imports, combined with incentives for domestic production, shields local plants from foreign price shocks. South Africa and Botswana mining corridors underpin steady demand, although logistical constraints require mobile inspection units and on-site buffing rigs to curtail equipment downtime.

North America remains a mature yet tech-progressive territory where RFID programs and government incentives foster plant modernization. Canada hosts multiple dedicated retread facilities focused mainly on truck casings, and proposed U.S. credits would boost domestic volumes if passed into law. Europe blends regulatory tailwinds, Euro 7 and waste-framework directives, with competitive headwinds from low-priced imports, prompting retreaters to invest in automated stereography and robotics to achieve cost and quality leadership.

- Bridgestone Corporation

- Michelin

- Goodyear

- Marangoni

- Continental AG

- Vipal Rubber

- Kal Tire

- Best-One Tire Group

- Southern Tire Mart

- Yokohama Rubber

- Hankook Tire

- Pirelli

- Sumitomo Rubber

- MRF

- Oliver Rubber

- TreadWright

- Qingdao Doublestar

- Rethread (Pty) Ltd

- Parrish Tire

- Redburn Tire

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-Savings Over New Tires

- 4.2.2 Stricter Circular-Economy & Co2 Regulations

- 4.2.3 Fleet-Mileage Growth From E-Commerce Logistics

- 4.2.4 Government Tax-Credit Schemes for Domestic Retreads

- 4.2.5 RFID-Enabled Lifecycle Tracking & Warranty Analytics

- 4.2.6 Green Procurement Policies by Freight Majors

- 4.3 Market Restraints

- 4.3.1 Volatile Casing & Rubber Prices

- 4.3.2 Influx of Ultra-Low-Cost Import Tires

- 4.3.3 Passenger-Car Safety Perception Gaps

- 4.3.4 Limited EV-Ready Retread Designs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Light Commercial Vehicle

- 5.1.3 Medium & Heavy-Duty Truck

- 5.1.4 Bus & Coach

- 5.1.5 Off-the-Road & Mining

- 5.1.6 Agriculture & Specialty

- 5.2 By Production Method

- 5.2.1 Pre-cure

- 5.2.2 Mold-cure

- 5.3 By Tire Type

- 5.3.1 Radial

- 5.3.2 Bias

- 5.3.3 Solid / Foam-filled

- 5.4 By Sales Channel

- 5.4.1 Independent Retreaders

- 5.4.2 OEM / Captive Fleet Facilities

- 5.5 By End-user Industry

- 5.5.1 Transport & Logistics Fleets

- 5.5.2 Construction & Mining

- 5.5.3 Agriculture

- 5.5.4 Aviation

- 5.5.5 Military & Defense

- 5.5.6 Waste Management & Others

- 5.6 By Application

- 5.6.1 On-road

- 5.6.2 Off-road

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Russia

- 5.7.3.6 Spain

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Turkey

- 5.7.5.4 Egypt

- 5.7.5.5 South Africa

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Bridgestone Corporation

- 6.4.2 Michelin

- 6.4.3 Goodyear

- 6.4.4 Marangoni

- 6.4.5 Continental AG

- 6.4.6 Vipal Rubber

- 6.4.7 Kal Tire

- 6.4.8 Best-One Tire Group

- 6.4.9 Southern Tire Mart

- 6.4.10 Yokohama Rubber

- 6.4.11 Hankook Tire

- 6.4.12 Pirelli

- 6.4.13 Sumitomo Rubber

- 6.4.14 MRF

- 6.4.15 Oliver Rubber

- 6.4.16 TreadWright

- 6.4.17 Qingdao Doublestar

- 6.4.18 Rethread (Pty) Ltd

- 6.4.19 Parrish Tire

- 6.4.20 Redburn Tire

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment