PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940730

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940730

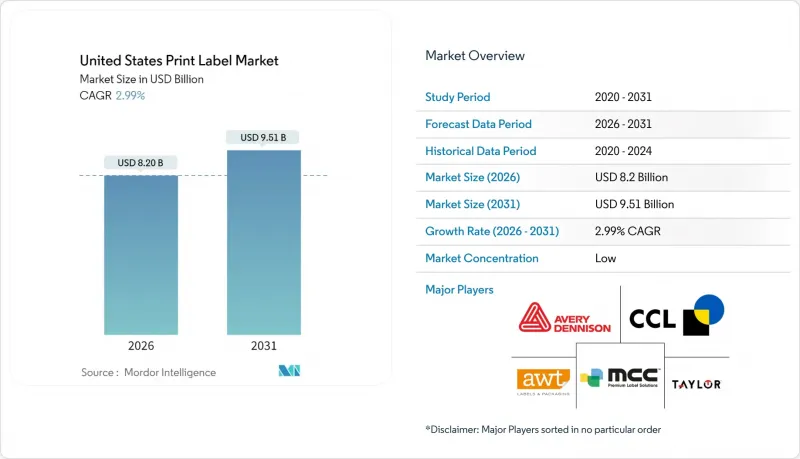

United States Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States print label market is expected to grow from USD 7.96 billion in 2025 to USD 8.2 billion in 2026 and is forecast to reach USD 9.51 billion by 2031 at 2.99% CAGR over 2026-2031.

Robust demand from food, healthcare, and e-commerce applications anchors growth, while digital printing and sustainability mandates reshape technology choices, materials, and business models. Flexography retains a sizeable installed base, yet digital workflows gain ground as variable-data, short-run economics, and serialization rules favor agile presses. Linerless, recyclable, and bio-based constructions accelerate through Extended Producer Responsibility (EPR) legislation in states such as California. Automation spending offsets skilled-labor shortages, and raw-material cost volatility triggers inventory and sourcing shifts across the value chain. Consolidation continues as scale helps leading converters secure supply, fund R&D, and deploy hybrid press platforms that address emerging smart-label needs across fulfillment corridors.

United States Print Label Market Trends and Insights

Digital Print Technology Penetration

Demand for variable data pushes converters toward digital presses that slash makeready times and support ERP-direct PDF workflows. Toshiba's BX410T series, launched in January 2025, integrates a dual-core processor and Linux operating system, enabling driver-free operation and cloud fleet management that mitigates skilled-labor gaps. Pharmaceutical brands leverage these systems for unit-level serialization, while cosmetics lines exploit on-demand color flexibility to run seasonal variants. Remote firmware updates and predictive maintenance improve uptime, tipping capex decisions toward digital platforms. As early adopters demonstrate ROI through reduced waste and quicker campaign cycles, the United States print label market increasingly favors converters with hybrid or fully digital capacity.

Healthcare and Cosmetics Label Uptake

In January 2024, the FDA finalized Patient Medication Information rules that enforce single-page formats and standardized typography, creating recurrent relabeling cycles for generic drugs. Cosmetics brands simultaneously escalate tamper-evident and premium finishes to stand out on retail shelves. Brady Corporation responded by expanding water-dissolvable laboratory labels and RFID-enabled traceability solutions, underpinned by a 5.1% R&D-sales ratio in 2024. Healthcare and beauty accounts thus reward converters skilled in compliant substrates, micro-font legibility, and specialty adhesives, lifting average margins compared with commodity food labels across the United States print label market.

Volatile Paper and Resin Input Costs

Pulp price swings and petrochemical disruptions squeeze converter margins, especially on long-term contracts signed before spike events. Vertically integrated players hedge exposure by forward-buying or leveraging in-house film extrusion, whereas small independents often ration inventory or renegotiate terms mid-cycle. Paper-liner recycling constraints add hauling fees when mills are distant, as documented in Associated Labels & Packaging's 2024 West Coast pilot study. Cost uncertainty encourages substrate light-weighting and linerless trials, but material substitutions can compromise performance, pressing QA teams to validate every change under tight timelines.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce and Logistics Label Volumes

- Smart/IoT Labels for Supply-Chain Traceability

- Skilled Narrow-Web Labor Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexography commanded 37.02% of the United States print label market share in 2025, supported by fast line speeds and cost-effective polymer plates for long food and beverage runs. Gravure, though smaller, is on track for a 3.76% CAGR through 2031 as luxury wine, cosmetic, and specialty-chemical brands demand photographic quality and metallic finishes. The United States print label market for digital electrophotography and UV inkjet remains modest currently, yet installs grew double-digit in 2024 because pharmaceutical and craft-beverage buyers need serialization or SKU-specific artwork on every lot. Converters offering hybrid presses switch seamlessly between analog and digital stations, cutting waste and turnaround times.

Brand owners embracing e-commerce launch micro-campaigns that rarely fill a flexo cylinder. Digital thus captures incremental revenue without cannibalizing base flexo volumes, preserving plate investments while unlocking dynamic QR code and personalization features. Screen printing retains niche roles for heavy varnish layers and tactile effects, whereas offset lithography serves precise color-match jobs in premium spirits. Letterpress now survives mainly in artisanal studios catering to high-margin gift and stationery products. Process diversity gives converters bargaining power on capex buys and supports full-line service pitches to multinational clients across the United States print label market.

Pressure-sensitive rolls occupied 52.05% of the United States print label market in 2025 due to universal applicability and automated applicator compatibility. However, linerless reels are forecast to log a 4.26% CAGR, spurred by EPR-driven waste targets and measurable throughput gains, sometimes fitting 40% more labels per pallet. Wet-glue remains cost-effective for mainstream beer bottlers using legacy lines, but craft brewers adopt shrink sleeves and PS because they accommodate unique bottle shapes and small batches. Multi-part sets flourish in chain-of-custody scenarios, particularly medical diagnostics and aerospace part tracking.

In-mold options appeal to durable goods and industrial pails that require scuff resistance for product life spans exceeding five years. Shrink and stretch sleeves provide billboard graphics and tamper indication for beverage, nutraceutical, and household cleaners, where shelf appeal directly drives sell-through. As retailers enforce recyclability standards, converters pair floatable sleeve films with washable inks that separate during PET reclamation. Material engineers, therefore, sit alongside press operators in R&D teams to ensure adhesion, opacity, and sustainability targets converge within the United States print label market.

The United States Print Label Market Report is Segmented by Print Process (Offset Lithography, Gravure, Flexography, Screen, and More), Label Format (Wet-Glue Labels, Pressure-Sensitive Labels, Linerless Labels, and More), End-User Industry (Food, Beverage, Healthcare, Cosmetics, Household, and More), Material Type (Paper, Plastic Films, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Avery Dennison Corporation

- Multi-Color Corporation

- Fort Dearborn Company LLC

- AWT Labels & Packaging

- Brady Corporation

- RR Donnelley & Sons Company

- Taylor Corporation

- Weber Packaging Solutions

- Grand Rapids Label

- DRG Technologies Inc.

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- Label Masters LLC

- 3M Company

- Resource Label Group LLC

- Fortis Solutions Group LLC

- Brook & Whittle Holdings Corp.

- Inland Label & Marketing Services LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Print Technology Penetration

- 4.2.2 Healthcare and Cosmetics Label Uptake

- 4.2.3 E-Commerce and Logistics Label Volumes

- 4.2.4 EPR-Driven Shift to Linerless/Recyclable Labels

- 4.2.5 Smart/IoT Labels for Supply-Chain Traceability

- 4.2.6 Near-Shoring Driving Short-Run VDP Demand

- 4.3 Market Restraints

- 4.3.1 Durability Limits in Harsh Conditions

- 4.3.2 Volatile Paper and Resin Input Costs

- 4.3.3 Skilled Narrow-Web Labor Shortages

- 4.3.4 Recycling-Stream Fragmentation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Print Process

- 5.1.1 Offset Lithography

- 5.1.2 Gravure

- 5.1.3 Flexography

- 5.1.4 Screen

- 5.1.5 Letterpress

- 5.1.6 Electrophotography

- 5.1.7 Inkjet

- 5.2 By Label Format

- 5.2.1 Wet-Glue Labels

- 5.2.2 Pressure-Sensitive Labels

- 5.2.3 Linerless Labels

- 5.2.4 Multi-part Tracking Labels

- 5.2.5 In-Mold Labels

- 5.2.6 Shrink and Stretch Sleeves

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare

- 5.3.4 Cosmetics

- 5.3.5 Household

- 5.3.6 Industrial (Automotive, Chemicals, Durables)

- 5.3.7 Logistics

- 5.3.8 Other End-User Industries

- 5.4 By Material Type

- 5.4.1 Paper

- 5.4.2 Plastic Films (PP, PET, PE)

- 5.4.3 Specialty and Sustainable Facestocks

- 5.4.4 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Avery Dennison Corporation

- 6.4.2 Multi-Color Corporation

- 6.4.3 Fort Dearborn Company LLC

- 6.4.4 AWT Labels & Packaging

- 6.4.5 Brady Corporation

- 6.4.6 RR Donnelley & Sons Company

- 6.4.7 Taylor Corporation

- 6.4.8 Weber Packaging Solutions

- 6.4.9 Grand Rapids Label

- 6.4.10 DRG Technologies Inc.

- 6.4.11 CCL Industries Inc.

- 6.4.12 Constantia Flexibles Group GmbH

- 6.4.13 Label Masters LLC

- 6.4.14 3M Company

- 6.4.15 Resource Label Group LLC

- 6.4.16 Fortis Solutions Group LLC

- 6.4.17 Brook & Whittle Holdings Corp.

- 6.4.18 Inland Label & Marketing Services LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment