PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940737

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940737

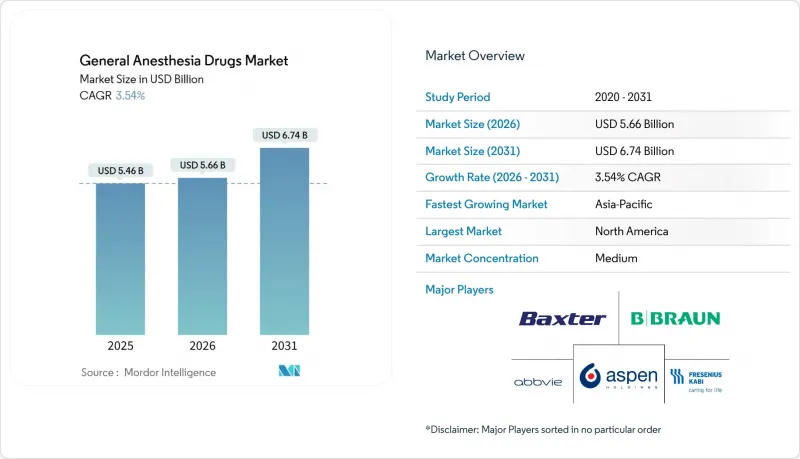

General Anesthesia Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The General Anesthesia Drugs Market is expected to grow from USD 5.47 billion in 2025 to USD 5.66 billion in 2026 and is forecast to reach USD 6.74 billion by 2031 at 3.54% CAGR over 2026-2031.

This steady expansion is underpinned by rising global surgical volumes, widening uptake of artificial-intelligence-enabled closed-loop delivery systems, and the progressive rollout of ambulatory surgical centers that favor rapid-recovery agents. Hospital administrators are increasingly shifting toward total intravenous anesthesia (TIVA) protocols to meet environmental targets and improve patient throughput, while sustained shortages in key volatile agents continue to disrupt purchasing strategies. Competitive dynamics are also changing as novel molecules such as ciprofol and remimazolam win regulatory approval and erode incumbent drug revenues. Together, these forces are re-shaping formulation portfolios, commercial alliances, and regional demand patterns across the general anesthesia drugs market.

Global General Anesthesia Drugs Market Trends and Insights

Approvals of Novel Anesthetic Agents & Formulations

Accelerated clearance of ciprofol and remimazolam has widened the therapeutic toolkit for anesthesiologists, lowering injection-site pain incidence from 77.1% to 18.0% and offering superior cardiovascular stability in elderly patients. The United States Food and Drug Administration's 2025 nod for JOURNAVX (suzetrigine) underscores a wider pivot toward non-opioid peri-operative analgesia that complements general anesthesia protocols. Amneal's 2024 launch of single-dose propofol vials aimed at easing recurrent shortages is projected to generate USD 314 million in annual revenue. Collectively, these approvals expand the number of viable intravenous options, intensify competition, and raise the innovation bar throughout the general anesthesia drugs market.

Rising Adoption of Ambulatory Surgical Centers

United States ASC expenditure reached USD 6.1 billion for 3.3 million Medicare fee-for-service beneficiaries in 2022, and the segment's revenue base is poised to advance from USD 37 billion in 2021 to USD 59 billion by 2028. The CMS-backed NOPAIN Act will grant distinct reimbursement for non-opioid analgesics such as EXPAREL from January 2025, sharpening the economic case for fast-recovery anesthesia protocols in outpatient settings. Growing ASC footprints are therefore heightening demand for rapid-onset drugs like ciprofol, driving measurable incremental volumes across the general anesthesia drugs market.

Volatile-Agent Shortages from Environmental Regulations

The National Health Service's phase-out of desflurane and the European Commission's pending restrictions have reduced global inhalational agent emissions by 27% over the last decade. Concurrent equipment recalls, including Getinge's sevoflurane vaporizers owing to hydrogen-fluoride release risk, exacerbate pressure on supply chains. Hospitals are therefore stockpiling or transitioning to TIVA, muting growth in volatile revenues across the general anesthesia drugs market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of TIVA Protocols in Emerging Markets

- AI-Enabled Closed-Loop Delivery Systems

- Stringent Regulatory Scrutiny & Approval Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sevoflurane retained 36.78% of general anesthesia drugs market share in 2025, but propofol is projected to post a 4.65% CAGR through 2031, reflecting a decisive shift toward TIVA protocols. The general anesthesia drugs market size for propofol-based formulations is set to expand further as ciprofol demonstrates non-inferiority while slashing injection-site pain rates. Desflurane's trajectory remains negative because of impending European environmental bans, whereas dexmedetomidine and remifentanil maintain specialized, procedure-specific niches. Regulatory withdrawals affecting dexmedetomidine in 2024 temporarily tightened supply but did not materially alter long-term demand. Midazolam's stricter scheduling in China is pushing providers toward remimazolam, which offers rapid recovery without the same regulatory burden. Ketamine and etomidate continue to occupy stable, smaller segments, with etomidate indispensable for hemodynamically unstable cases despite periodic shortages.

Underlying drivers include tighter environmental rules, heightened interest in immunomodulatory advantages linked to intravenous agents, and the operational efficiency of AI-driven infusion pumps. Collectively, these trends cement the intravenous pivot and reinforce propofol's leadership role within the evolving general anesthesia drugs market.

Inhalational techniques held 58.41% of the general anesthesia drugs market in 2025, yet intravenous delivery displayed a 5.88% CAGR that signals accelerating preference for precision-controlled infusions. The general anesthesia drugs market size for intravenous products is benefitting from closed-loop systems that automatically titrate dosing in response to EEG-derived depth metrics, a feature that volatile agents cannot replicate. Emission-reduction mandates and inconsistent supply of halogenated gases are compelling hospitals to treat TIVA as a compliance strategy rather than a clinical luxury.

Volatile capture technology delivers only 25-73% real-world efficiency, limiting its viability as a full-scale mitigation approach and indirectly supporting the intravenous surge. Emerging clinical literature additionally links intravenous anesthesia to lower postoperative nausea, faster cognitive recovery, and reduced inflammatory markers. These medical and regulatory tailwinds position intravenous administration to continue outgrowing inhalational routes across the general anesthesia drugs market.

The General Anesthesia Drugs Market Report is Segmented by Drug Type (Propofol, Sevoflurane, Desflurane, Dexmedetomidine, Remifentanil, and More), Route of Administration (Inhalation, Intravenous), Application (General Surgery, Cancer Surgery, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 37.84% of general anesthesia drugs market revenue in 2025, reflecting advanced surgical infrastructure, early adoption of AI-driven delivery systems, and supportive reimbursement policies. Federal scrutiny of consolidation illustrated by the FTC's case against U.S. Anesthesia Partners-may temper future roll-up strategies but is unlikely to derail volume growth. Workforce shortages, with 78% of U.S. facilities reporting staffing gaps in 2022, are prompting accelerated investment in automated solutions that can safely extend clinician bandwidth.

Asia-Pacific is the fastest-growing geography at 5.19% CAGR through 2031, fueled by rising surgical volumes, government incentives to upgrade operating theatres, and national policies aimed at lowering volatile-agent emissions. China's Category I scheduling of midazolam is already steering clinicians toward remimazolam, while India's phased GMP compliance program seeks to raise manufacturing quality without choking supply. Europe faces both opportunity and constraint as sustainability agendas phase out desflurane; the United Kingdom's National Health Service completed full withdrawal in 2024 and the wider European Union weighs region-wide bans by 2026. German and Scandinavian hospitals lead trials of volatile capture systems but admit that sub-100% efficiencies will leave TIVA as the primary compliance pathway. European suppliers such as Fresenius are responding with expanded injectable lines, evidenced by Q1 2025 revenue growth of 7% despite stringent regulatory landscapes.

- Abbvie

- Baxter

- Fresenius

- Pfizer

- Hikma Pharmaceuticals

- Paion AG

- Aspen Pharmacare Holdings Ltd.

- Piramal Critical Care

- Endo International plc (Par)

- AVET Pharmaceuticals Inc.

- B. Braun

- Dr. Reddy's Laboratories Ltd.

- Glenmark Pharmaceuticals

- Sandoz (Novartis Generics)

- Jiangsu Hengrui Medicine Co.

- Maruishi Pharmaceutical Co.

- Sagent Pharmaceuticals

- Jiangsu Nhwa Pharmaceutical Co.

- Safeline Pharmaceuticals

- Mylan N.V. (Viatris)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Approvals & Launches of Novel Anesthetic Agents/Formulations

- 4.2.2 Rising Adoption of Ambulatory Surgical Centers

- 4.2.3 Growth of Total Intravenous Anesthesia (TIVA) Protocols in Emerging Markets

- 4.2.4 AI-Enabled Closed-Loop Anesthesia Delivery Systems Boosting Drug Consumption Per Case

- 4.2.5 Increasing Volume of Surgical Procedures

- 4.2.6 Expanding Use of Low-Flow Anesthesia Driving Demand for Advanced Inhalational Drugs

- 4.3 Market Restraints

- 4.3.1 Volatile-Agent Shortages from Environmental Regulations

- 4.3.2 Stringent Regulatory Scrutiny & Approval Delays

- 4.3.3 Adverse Effects & Post-operative Complications

- 4.3.4 Rise of Regional & Non-Opioid Sedation Techniques

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Drug Type

- 5.1.1 Propofol

- 5.1.2 Sevoflurane

- 5.1.3 Desflurane

- 5.1.4 Dexmedetomidine

- 5.1.5 Remifentanil

- 5.1.6 Midazolam

- 5.1.7 Etomidate

- 5.1.8 Ketamine

- 5.1.9 Other Drugs

- 5.2 By Route of Administration

- 5.2.1 Inhalation

- 5.2.2 Intravenous

- 5.3 By Application

- 5.3.1 General Surgery

- 5.3.2 Cancer Surgery

- 5.3.3 Heart Surgery

- 5.3.4 Orthopedic Replacements

- 5.3.5 Neurological Surgery

- 5.3.6 Other Application

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc.

- 6.3.2 Baxter International Inc.

- 6.3.3 Fresenius SE & Co. KGaA

- 6.3.4 Pfizer Inc.

- 6.3.5 Hikma Pharmaceuticals plc

- 6.3.6 Paion AG

- 6.3.7 Aspen Pharmacare Holdings Ltd.

- 6.3.8 Piramal Critical Care

- 6.3.9 Endo International plc (Par)

- 6.3.10 AVET Pharmaceuticals Inc.

- 6.3.11 B. Braun Melsungen AG

- 6.3.12 Dr. Reddy's Laboratories Ltd.

- 6.3.13 Glenmark Pharmaceuticals

- 6.3.14 Sandoz (Novartis Generics)

- 6.3.15 Jiangsu Hengrui Medicine Co.

- 6.3.16 Maruishi Pharmaceutical Co.

- 6.3.17 Sagent Pharmaceuticals

- 6.3.18 Jiangsu Nhwa Pharmaceutical Co.

- 6.3.19 Safeline Pharmaceuticals

- 6.3.20 Mylan N.V. (Viatris)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment