PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940740

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940740

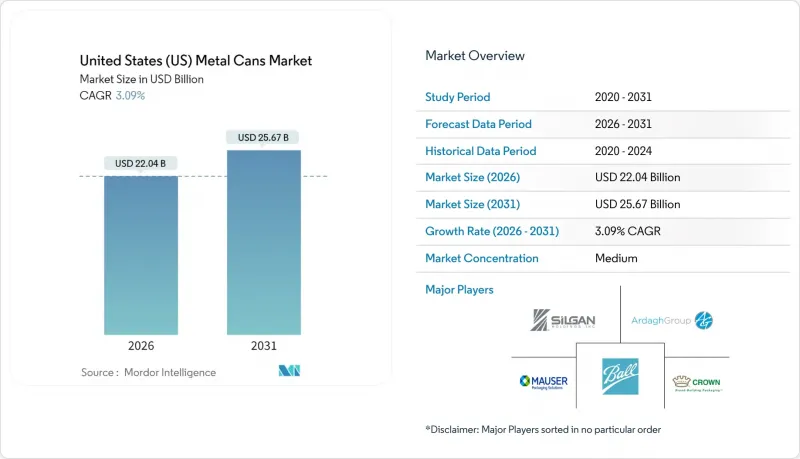

United States (US) Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States metal cans market is expected to grow from USD 21.38 billion in 2025 to USD 22.04 billion in 2026 and is forecast to reach USD 25.67 billion by 2031 at 3.09% CAGR over 2026-2031.

Growing preference for infinitely recyclable aluminum, combined with brand-owner sustainability pledges, keeps demand ahead of domestic supply and sustains near-maximum plant utilization despite a 25% tariff on empty cans imported from Mexico. Beverage, pharmaceutical, and premium personal-care brands continue to migrate to metal containers to meet durability and circular-economy goals, while lightweighting technology reduces material consumption and shipping costs. Vertical integration strategies by leading producers secure can-sheet supply and reinforce competitive barriers, yet input-price volatility and flexible packaging innovations remain persistent threats. Overall, the United States metal cans market benefits from strong end-use momentum, stable pricing power in high-value niches, and regulatory tailwinds favoring single-material packaging formats.

United States (US) Metal Cans Market Trends and Insights

High Recyclability Rates Drive Packaging Material Substitution

Metal cans contain 75% recycled content on average and can be remelted indefinitely without quality loss, giving them a clear cost and sustainability edge over PET bottles that contain 35% recycled resin on average. Municipal recycling programs earn about USD 1,200 per ton of recovered aluminum versus USD 200 for PET, incentivizing local governments to prioritize can collection infrastructure. Brand-owner mandates such as Coca-Cola's 35-40% recycled-content pledge lock in multiyear purchase volumes, guaranteeing baseline demand even during economic slowdowns. Federal procurement standards now specify recycled-content thresholds, ensuring ongoing institutional demand. As state extended producer-responsibility fees penalize complex laminates, metal cans gain additional market share in shelf-stable food and specialty beverage categories.

Craft-Beer and RTD Beverage Surge Reshapes Demand Patterns

More than 9,000 craft breweries nationwide prefer aluminum because it blocks light, maintains carbonation, and supports vibrant graphics that reinforce brand storytelling. Ready-to-drink alcoholic beverages are the fastest-growing subsegment, spurring demand for sleek 12 oz and 8.4 oz formats that command premium shelf positioning. Hard seltzer producers pay 15-20% above commodity pricing for advanced barrier coatings that avoid flavor pickup. The trend promotes regional co-packing networks to shorten product-to-shelf cycles, opening opportunities for flexible, quick-change can lines. Niche suppliers such as Independent Can Company expand West Coast capacity to meet small-batch orders, underscoring the market's responsiveness to localized beverage trends

Proliferation of Alternate Packaging Formats Intensifies Competitive Pressure

Stand-up pouches with high-barrier films weigh 60-70% less than comparable cans and enable transparent windows that showcase product freshness, appealing to millennial shoppers. Lightweight PET bottles continue to shed grams, lowering cost per unit and challenging cans on price in value-oriented beverage lines. Carton-based containers with aluminum layers undercut metal cans by 15-25% in certain soup categories, enticing cost-sensitive food processors. Rapid material-science innovation cycles and the speed of graphic changes give flexibles a marketing agility advantage. Despite these headwinds, cans maintain dominance where retort processing, carbonation retention, or long shelf life is essential.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates Accelerate Sustainable Packaging Adoption

- Lightweighting Innovations Transform Manufacturing Economics

- Raw Material Price Volatility Creates Supply-Chain Vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aluminum accounted for 70.48% of United States metal cans market share in 2025, driven by beverages that demand corrosion resistance and premium shelf appeal. Nevertheless, steel cans regain momentum in large-format foods and pet nutrition because three-piece welded bodies offer cost advantages and withstand retort temperatures.

Lightweighting has trimmed aluminum usage by 13% per can, offsetting metal-price volatility, while tinplate suppliers introduce thinner gauges with improved organosol coatings to reduce steel container weight. Geographic feedstock patterns also shape material choice: aluminum plants cluster near recycled-can streams in the South and Midwest, whereas steel can lines stay close to integrated mills. These locational advantages inform footprint decisions for both incumbent and new entrants.

Two-piece drawn-and-ironed cans captured 53.78% of United States metal cans market size in 2025 owing to high-speed lines that exceed 2,300 cans per minute and deliver superior axial strength for sparkling beverages. Monobloc aerosol bodies, however, lead structural growth at 4.68% CAGR, powered by pharmaceutical spray and dermal-foam demand.

Three-piece welded formats remain relevant in bulk foods, coffee, and industrial chemicals where easy height variation and cost efficiency outweigh seamless construction benefits. Continuous improvement in body maker precision has enabled full-panel graphics and matte finishes, expanding premiumization opportunities across craft beer and specialty energy drinks.

The United States Metal Cans Market Report is Segmented by Material Type (Aluminium, and Steel), Can Structure (Two-Piece, Three-Piece, Monobloc Aerosol), Capacity/Size (<=250 Ml, 250-500 Ml, 500-1, 000 Ml, >1, 000 Ml), Manufacturing Process (Drawn and Ironed, Drawn and Redrawn, Impact Extrusion), End-User Industry (Food, Beverage, Personal Care and Cosmetics and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Crown Holdings, Inc.

- Ball Corporation

- Silgan Holdings Inc.

- Mauser Packaging Solutions Holding Company

- Ardagh Metal Packaging S.A.

- DS Containers, LLC

- CCL Industries Inc. (CCL Container division)

- Independent Can Company

- Tecnocap S.p.A.

- CAN-PACK S.A.

- Allstate Can Corporation

- Envases Universales Group

- Trivium Packaging B.V.

- Greif, Inc.

- Toyo Seikan Group Holdings, Ltd.

- Montebello Packaging Inc.

- Crown Cork and Seal USA, Inc.

- Metal Container Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 High recyclability rates of metal packaging

- 4.1.2 Convenience and extended shelf life offered by canned foods

- 4.1.3 Craft-beer and RTD beverage boom boosting can demand

- 4.1.4 Regulatory push for sustainable, single-material packaging

- 4.1.5 Lightweighting innovations lowering per-unit can cost

- 4.1.6 Brand-owner circular-packaging pledges securing can volumes

- 4.2 Market Restraints

- 4.2.1 Proliferation of alternate packaging formats (PET, pouches)

- 4.2.2 Volatility in aluminum and steel input prices

- 4.2.3 BPA-substitute migration concerns affecting consumer trust

- 4.2.4 Domestic can-sheet capacity constraints creating supply risk

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 The Impact of Macroeconomic Factors on the Market

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Aluminium

- 5.1.2 Steel

- 5.2 By Can Structure

- 5.2.1 Two-Piece

- 5.2.2 Three-Piece

- 5.2.3 Monobloc Aerosol

- 5.3 By Capacity / Size

- 5.3.1 <=250 ml

- 5.3.2 250-500 ml

- 5.3.3 500-1,000 ml

- 5.3.4 >1,000 ml

- 5.4 By Manufacturing Process

- 5.4.1 Drawn and Ironed (DandI)

- 5.4.2 Drawn and Redrawn (DRD)

- 5.4.3 Impact Extrusion

- 5.5 By End-User Industry

- 5.5.1 Food

- 5.5.2 Beverage

- 5.5.3 Personal Care and Cosmetics

- 5.5.4 Pharmaceuticals

- 5.5.5 Paints and Industrial Chemicals

- 5.5.6 Automotive Fluids and Lubricants

- 5.5.7 Other End-User Industry

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Crown Holdings, Inc.

- 6.4.2 Ball Corporation

- 6.4.3 Silgan Holdings Inc.

- 6.4.4 Mauser Packaging Solutions Holding Company

- 6.4.5 Ardagh Metal Packaging S.A.

- 6.4.6 DS Containers, LLC

- 6.4.7 CCL Industries Inc. (CCL Container division)

- 6.4.8 Independent Can Company

- 6.4.9 Tecnocap S.p.A.

- 6.4.10 CAN-PACK S.A.

- 6.4.11 Allstate Can Corporation

- 6.4.12 Envases Universales Group

- 6.4.13 Trivium Packaging B.V.

- 6.4.14 Greif, Inc.

- 6.4.15 Toyo Seikan Group Holdings, Ltd.

- 6.4.16 Montebello Packaging Inc.

- 6.4.17 Crown Cork and Seal USA, Inc.

- 6.4.18 Metal Container Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment