PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940746

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940746

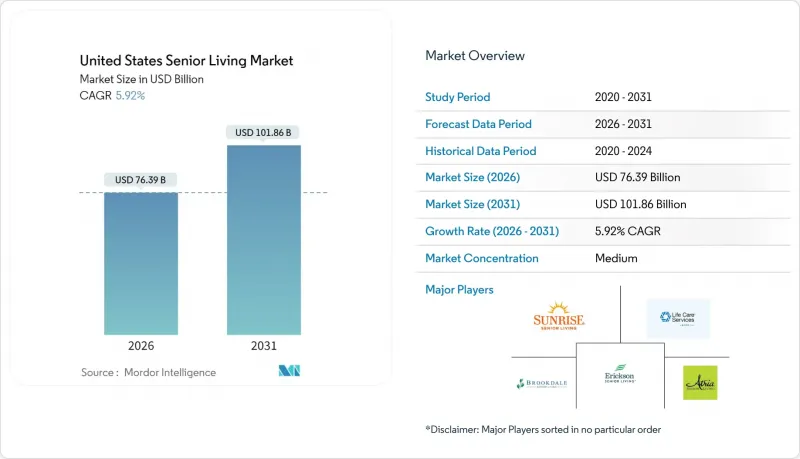

United States Senior Living - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United States senior living market size in 2026 is estimated at USD 76.39 billion, growing from 2025 value of USD 72.11 billion with 2031 projections showing USD 101.86 billion, growing at 5.92% CAGR over 2026-2031.

Continued demand from an aging population, constrained new-build supply, and sophisticated capital inflows combine to create pricing power for operators while supporting steady occupancy gains. Healthcare integration deepens competitive moats because communities that embed primary care and rehabilitation services capture higher margins, lift length of stay, and reduce hospital transfers. Rental pricing flexibility lets operators respond quickly to wage inflation and regulatory costs, helping to maintain operating margins despite labor pressures. Institutional investors, especially healthcare REITs, sustain development pipelines through joint ventures and sale-leasebacks, fueling consolidation even as interest rates remain elevated. Technology adoption, from electronic health records to predictive analytics, further enhances resident outcomes and cost efficiency.

United States Senior Living Market Trends and Insights

Aging Baby-Boomer Cohort Driving Sustained Demand Across Care Levels

Nearly all 69 million baby boomers will be 70 or older by 2033, dramatically enlarging the resident pool for the United States senior living market. Higher home ownership and net worth among this cohort underpin private-pay affordability, while broader acceptance of technology raises comfort with digitally enabled care. The 85-plus population, most likely to require skilled nursing and memory care, is set to double by 2040, guaranteeing demand for high-acuity services. States attracting retirees through favorable taxes and climate, such as Texas and Florida, will see especially strong growth. Operators that tailor amenities, payment plans, and marketing to this wealthier, tech-savvy generation are positioned to capture lifetime value. Green Street estimates show more than 40% of seniors can pay for senior housing without liquidating assets, indicating significant latent demand.

Deep Capital Markets and Active Healthcare REITs Supporting Development and Consolidation

Healthcare REITs are pouring record funds into United States senior living market assets. Ventas lifted its 2025 investment target to USD 1.5 billion after deploying USD 2 billion in 2024, signaling long-term conviction in sector fundamentals. Welltower's USD 3.2 billion acquisition of Amica Senior Lifestyles illustrates the scale REITs will transact to secure premier portfolios. Debt capital remains abundant, with Walker & Dunlop arranging USD 600 million in seniors-housing loans during 2024. Private equity heavyweights such as Fortress add further competition for assets, driving valuations and spurring operational upgrades. Strong liquidity supports new builds in undersupplied metros and offers exit paths for regional owner-operators, accelerating consolidation and professionalization across the ecosystem.

Labor Shortages and Wage Inflation Pressuring Margins and Service Levels

Severe staffing shortages plague virtually every care level, forcing communities to raise hourly wages, expand benefits, and rely heavily on agency labor. New CMS nursing-home staffing rules requiring 3.48 nursing hours per resident per day ripple into assisted and independent living through competition for licensed nurses. Only 6% of nursing homes currently meet the 24/7 RN mandate, driving cross-sector bidding wars that compress margins. Caregiver wage campaigns, such as Nevada's push from USD 16 to USD 20 per hour, spotlight inflationary pressures. The FTC's pending ban on non-compete clauses may further elevate turnover, undermining continuity of care. Operators in rural areas confront the steepest hurdles, sometimes restricting admissions to maintain mandated staff-resident ratios.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Healthcare-Integrated Models Enhancing Value Proposition and Resident Outcomes

- Home-Sale Equity and Retirement Savings Enabling Private-Pay Affordability

- State-by-State Regulatory Complexity Increasing Compliance Costs and Development Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nursing care facilities controlled 40.62% of the United States senior living market size in 2025 and will post the quickest 6.29% CAGR through 2031. Demand stems from residents with multiple chronic conditions who prefer aging in place within a continuum-of-care setting instead of hospital transfers. Assisted-living remains the mainstream entry point, yet operators retrofit wings for memory-care or sub-acute services to retain residents and capture value. Independent-living communities focus on lifestyle amenities, fitness centers, chef-led dining, and cultural programs, geared toward younger seniors who prize autonomy. The maturation of memory-care units, complete with secured layouts and dementia-trained staff, illustrates the sector's pivot to higher acuity while preserving residential ambience. Continuing-care retirement communities, though niche, gain traction among affluent seniors desiring contractual access to multiple care levels.

Nursing-care dominance compels capital investment in clinical staff training, negative-pressure rooms, and on-site therapy suites. Operators deploy electronic medication-administration records and smart lifts to boost safety and efficiency. Rising acuity also attracts insurer partnerships seeking reduced readmissions, adding payer-driven revenue to the United States senior living market. However, regulatory scrutiny on staffing ratios, infection control, and reimbursement adequacy remains intense, requiring sophisticated compliance infrastructures.

The United States Senior Living Market Report is Segmented by Property Type (Assisted Living, Independent Living, Memory Care, Nursing Care), by Business Model (Outright Sale (Freehold), Long-Lease / Rental, Hybrid (Sale + Lease)), by Age (55 To 64 Years, 65 To 74 Years, and More), and by States (Texas, California, Florida, New York, Illinois, Rest of US). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Brookdale Senior Living Inc.

- Atria Senior Living Inc.

- LCS (Life Care Services)

- Erickson Senior Living

- Sunrise Senior Living

- Five Star Senior Living

- Holiday by Atria

- Kisco Senior Living

- Sonida Senior Living

- Watermark Retirement Communities

- Silverado Senior Living

- Trilogy Health Services

- Benchmark Senior Living

- Ensign Group Inc.

- Ventas Inc.

- Welltower Inc.

- Capital Senior Living (Grace Management)

- Pegasus Senior Living

- Frontier Management

- Merrill Gardens

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging baby-boomer cohort driving sustained demand across independent, assisted, and memory care

- 4.2.2 Deep capital markets and active healthcare REITs supporting development and consolidation

- 4.2.3 Shift to healthcare-integrated models (primary care, rehab, memory care) enhancing value proposition

- 4.2.4 Home-sale equity and retirement savings enabling private-pay affordability in many metros

- 4.2.5 Technology adoption (remote monitoring, EHRs, fall detection) elevating care quality and efficiency

- 4.3 Market Restraints

- 4.3.1 Labor shortages and wage inflation pressuring margins and service levels

- 4.3.2 State-by-state regulatory complexity increasing compliance costs and timelines

- 4.3.3 Affordability gaps and uneven occupancy recovery in certain secondary markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Policy & Regulatory Framework (state guidelines, licensing, incentives)

- 4.6 Insight on Upcoming and Ongoing Projects

- 4.7 Insights on Digital & Tech Enablers (telemedicine, smart amenities)

- 4.8 Insights on Business Model & Operator Evolution

- 4.9 Insights on Investment & Financing Trends

- 4.10 Insights Sustainability & Design Innovation

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Assisted Living

- 5.1.2 Independent Living

- 5.1.3 Memory Care

- 5.1.4 Nursing Care

- 5.2 By Business Model

- 5.2.1 Outright Sale (Freehold)

- 5.2.2 Long-Lease / Rental

- 5.2.3 Hybrid (Sale + Lease)

- 5.3 By Age

- 5.3.1 55 to 64 years

- 5.3.2 65 to 74 years

- 5.3.3 75 to 85 years

- 5.3.4 Above 85 years

- 5.4 By States

- 5.4.1 Texas

- 5.4.2 California

- 5.4.3 Florida

- 5.4.4 New York

- 5.4.5 Illinois

- 5.4.6 Rest of US

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Brookdale Senior Living Inc.

- 6.3.2 Atria Senior Living Inc.

- 6.3.3 LCS (Life Care Services)

- 6.3.4 Erickson Senior Living

- 6.3.5 Sunrise Senior Living

- 6.3.6 Five Star Senior Living

- 6.3.7 Holiday by Atria

- 6.3.8 Kisco Senior Living

- 6.3.9 Sonida Senior Living

- 6.3.10 Watermark Retirement Communities

- 6.3.11 Silverado Senior Living

- 6.3.12 Trilogy Health Services

- 6.3.13 Benchmark Senior Living

- 6.3.14 Ensign Group Inc.

- 6.3.15 Ventas Inc.

- 6.3.16 Welltower Inc.

- 6.3.17 Capital Senior Living (Grace Management)

- 6.3.18 Pegasus Senior Living

- 6.3.19 Frontier Management

- 6.3.20 Merrill Gardens

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment