PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940748

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940748

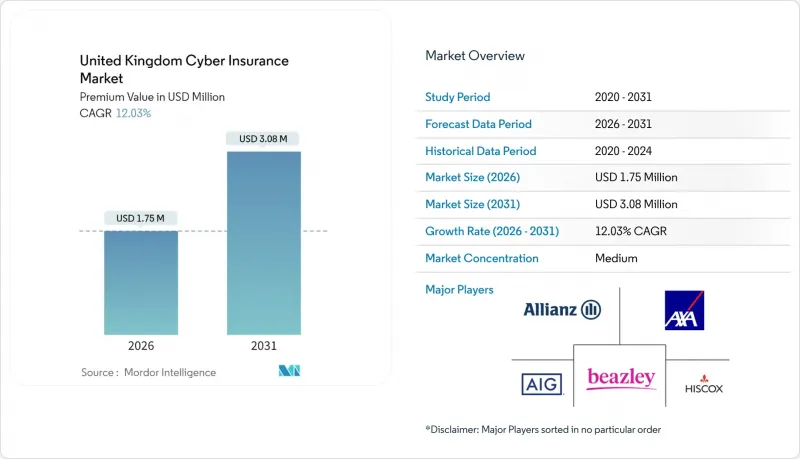

United Kingdom Cyber Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom Cyber Insurance market is expected to grow from USD 1.56 million in 2025 to USD 1.75 million in 2026 and is forecast to reach USD 3.08 million by 2031 at 12.03% CAGR over 2026-2031.

Structural demand arises from mandatory breach-notification rules, the enduring shift to hybrid work, and Lloyd's globally recognized capacity hub. Heightened ransomware activity, averaging 50% victimization of U.K. firms in 2024, accelerates the adoption of standalone cover. Continuous digitalization among small and micro businesses unlocks a fast-growing segment in the UK cyber insurance market, while premium inflation and tighter sub-limits temper penetration. Reinsurance capacity pressures and systemic-risk uncertainties signal a maturing market moving toward selective underwriting and active-risk management models.

United Kingdom Cyber Insurance Market Trends and Insights

Accelerating Ransomware Frequency & Severity

Ransomware campaigns have matured into well-financed ecosystems that target both critical infrastructure and mid-market firms. Double- and triple-extortion tactics drive up forensic, legal, and business-interruption costs, pushing average claim values past historical models. Supply-chain attacks, exemplified by MOVEit, expose even security-mature organizations through third-party software dependencies. Insurers now embed continuous-monitoring services and incident-response retainers within policies to shorten dwell time and recover data swiftly. Market capacity favors carriers that can leverage threat-intelligence telemetry to refine pricing in near-real time.

Mandatory GDPR & ICO Breach-Notification Fines

The 72-hour disclosure rule compels firms to formalize incident-response playbooks and purchase higher indemnity limits covering regulatory defense and penalty mitigation. ICO enforcement demonstrates a readiness to impose multi-million-pound fines for insufficient technical controls, especially in healthcare and finance. Insurers differentiate underwriting by mapping policy wording to accountability principles, rewarding certified controls with premium credits. As cross-border data transfers rely on standard contractual clauses, carriers add extensions for legal consultancy and escrow services. Heightened regulatory clarity transforms compliance coverage from a discretionary add-on into a core purchasing driver.

Premium Inflation & Coverage Sub-Limits

Annual premium hikes of 15-25% outpace many firms' risk budgets, compelling buyers to select lower limits or accept higher retentions. Sub-limits on business-interruption, bricking, and reputational harm leave sizable gaps only discovered during claims. SMEs, already confronting tight cash flow, risk-averse selection by exiting the market, and enlarging insurers' high-risk pools. Rising reinsurance costs flow directly into retail pricing with limited transparency. This feedback loop threatens sustainable growth unless actuarial certainty improves and alternative risk-transfer instruments emerge.

Other drivers and restraints analyzed in the detailed report include:

- Post-COVID Remote-Work Attack-Surface Expansion

- SME-Focused Digital Broker Platforms (Embedded Cyber)

- Limited Actuarial Loss History for the United Kingdom Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standalone offerings accounted for 70.10% of the United Kingdom cyber insurance market share in 2025, underscoring demand for specialized coverage unhindered by generic indemnity caps. The segment is forecast to grow at a 12.78% CAGR, reinforcing its position as the primary engine of the United Kingdom cyber insurance market. Buyers recognize that silent-cyber gaps in commercial-combined packages present unacceptable uncertainty when regulators can impose multimillion-pound fines. Active-insurance models layered atop standalone forms integrate monitoring, threat-intel, and rapid-response retainers, shortening mean-time-to-contain and lowering severity. Packaged add-ons remain relevant for micro-enterprises entering cover for the first time, but their constrained limits and incident-response capabilities curtail adoption as cyber maturity rises.

Standalone carriers leverage proprietary telemetry from policyholder networks to refine pricing and automate endorsements during the policy term. This feedback-rich environment allows mid-term limit increases or ransomware-deductible reductions once risk controls improve. Average premiums span £2,000-£15,000 for SMEs and £50,000-£500,000 for large corporates, reflecting exposure granularity over headline turnover. Technology-vertical endorsements cover source-code escrow, crypto-asset theft, and AI-model poisoning, illustrating the pace of product diversification. The packaged segment may sustain single-digit growth by aligning with embedded-broker platforms targeting long-tail micro-businesses that value simplicity over breadth.

The United Kingdom Cyber Insurance Market Report is Segmented by Product Type (Packaged, Standalone), Enterprise Size (Large Enterprises, Medium Enterprises, Small and Micro Enterprises), Industry Vertical (BFSI, IT & Telecom, Retail & E-Commerce, Healthcare & Life Sciences, Manufacturing, Government & Public Sector, Education), and Geography (United Kingdom). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AIG

- Beazley

- Hiscox

- Allianz

- AXA XL

- Zurich

- Chubb

- Tokio Marine Kiln

- CNA Hardy

- QBE

- RSA

- Sompo International

- Corvus London Markets

- Lloyd's syndicates (collective)

- Marsh McLennan

- Aon

- WTW

- Howden

- Gallagher

- CFC Underwriting

- Coalition

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating ransomware frequency & severity

- 4.2.2 Mandatory GDPR & ICO breach-notification fines

- 4.2.3 Post-COVID remote-work attack-surface expansion

- 4.2.4 SME-focused digital broker platforms (embedded cyber)

- 4.2.5 United Kingdom government Cyber Essentials scheme uptake

- 4.2.6 NHS & CNI zero-trust procurement mandates

- 4.3 Market Restraints

- 4.3.1 Premium inflation & coverage sub-limits

- 4.3.2 Limited actuarial loss history for United Kingdom market

- 4.3.3 War-exclusion & systemic-risk uncertainty

- 4.3.4 Reinsurance capacity tightening (post MOVEit)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Packaged

- 5.1.2 Standalone

- 5.2 By Enterprise Size (Value)

- 5.2.1 Large Enterprises

- 5.2.2 Medium Enterprises

- 5.2.3 Small and Micro Enterprises

- 5.3 By Industry Vertical (Value)

- 5.3.1 BFSI

- 5.3.2 IT & Telecom

- 5.3.3 Retail & E-commerce

- 5.3.4 Healthcare & Life Sciences

- 5.3.5 Manufacturing

- 5.3.6 Government & Public Sector

- 5.3.7 Education

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AIG

- 6.4.2 Beazley

- 6.4.3 Hiscox

- 6.4.4 Allianz

- 6.4.5 AXA XL

- 6.4.6 Zurich

- 6.4.7 Chubb

- 6.4.8 Tokio Marine Kiln

- 6.4.9 CNA Hardy

- 6.4.10 QBE

- 6.4.11 RSA

- 6.4.12 Sompo International

- 6.4.13 Corvus London Markets

- 6.4.14 Lloyd's syndicates (collective)

- 6.4.15 Marsh McLennan

- 6.4.16 Aon

- 6.4.17 WTW

- 6.4.18 Howden

- 6.4.19 Gallagher

- 6.4.20 CFC Underwriting

- 6.4.21 Coalition

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment