PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940754

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940754

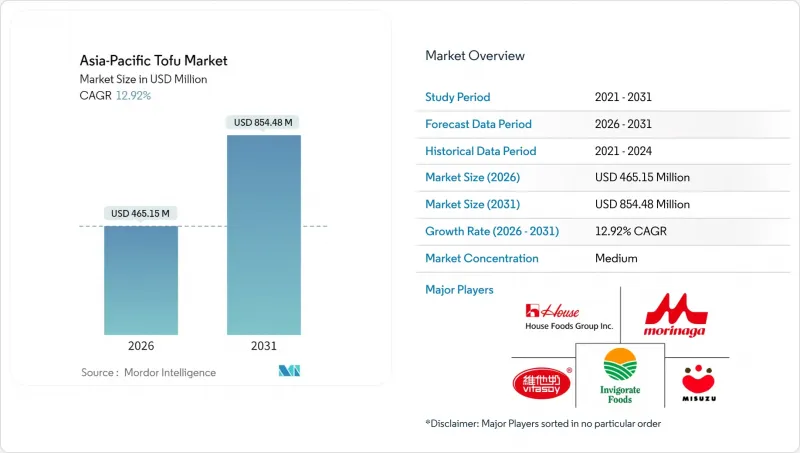

Asia-Pacific Tofu - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia Pacific tofu market was valued at USD 411.92 million in 2025 and estimated to grow from USD 465.15 million in 2026 to reach USD 854.48 million by 2031, at a CAGR of 12.92% during the forecast period (2026-2031).

This trajectory is underpinned by rising urban incomes, strong cultural familiarity with soy foods, widening regulatory support for plant-based proteins, and upgrades in cold-chain logistics across the region. Intensifying health awareness around cholesterol-free, low-fat nutrition is accelerating product premiumization, while technology investments in extended shelf-life and aseptic packaging are unlocking new export opportunities. Supply-side modernization, including contract farming and smart processing lines, is simultaneously improving cost structures and traceability, thereby supporting long-run volume growth. Competitive dynamics remain moderate; however, scale advantages and innovation depth are beginning to reward early adopters with faster revenue expansion and higher margins.

Asia-Pacific Tofu Market Trends and Insights

Growing Plant-Based and Vegan Population

Urban populations across Asia Pacific are increasingly shifting towards plant-based diets, driving steady growth in demand for traditional soy-based proteins. Younger generations are at the forefront, adopting flexitarian eating habits while preserving cultural connections to tofu. In Thailand, the plant-based food market is expected to grow by 10-35% annually, with its value projected to reach USD 1.5 billion in 2024, as reported by the United States Department of Agriculture's Foreign Agricultural Service. Urban centers are influenced by Western dietary trends, while traditional consumption patterns continue to provide a stable foundation for demand. Additionally, government nutrition programs are incorporating plant-based protein recommendations, signaling institutional support for market growth. This shift, fueled by rising health awareness and environmental concerns, reflects a lasting change rather than a temporary dietary experiment.

Deep-rooted consumption of tofu in the region

East Asian markets, deeply rooted in culinary traditions, exhibit a distinct resilience in tofu consumption, distinguishing them from the global growth of plant-based markets. These longstanding consumption habits not only establish a stable demand but also provide market stability during economic uncertainties. China's significant 45.82% market share reflects both its large population and the cultural integration of tofu consumption across generations, as noted by the USDA Economic Research Service. In Japan, major tofu brands have achieved widespread availability, with over 30,000 convenience store locations highlighting the country's advanced infrastructure and steady consumption trends. Additionally, regional trade flows benefit from well-established supply chains and processing expertise, offering a competitive advantage over markets still cultivating their plant-based consumer bases. As global plant-based trends align with traditional consumption practices, East Asia's cultural authenticity becomes a key strategic advantage.

Competition from Other Plant-Based Proteins

Alternative protein proliferation intensifies competitive pressure as pea, oat, and novel protein sources capture market share through targeted positioning and innovation investments. Plant-based protein market diversification creates consumer choice expansion that fragments traditional tofu demand, particularly among younger demographics exploring variety. Venture capital funding flows toward alternative protein startups developing next-generation products with superior functional properties or sustainability profiles. Multinational food companies leverage distribution advantages and marketing resources to promote proprietary plant-based alternatives that compete directly with traditional soy-based products. Regulatory approval processes for novel proteins may create temporary competitive advantages for established tofu producers, yet long-term market dynamics favor diversified protein portfolios. Strategic responses require innovation acceleration and premium positioning to maintain relevance against emerging alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Consumers increasingly seek low-fat, cholesterol-free, and high-protein foods

- Increasing demand for sustainable, eco-friendly protein sources

- Quality and Freshness Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, regular tofu leads the market with a 31.12% share, highlighting strong consumer preferences and price sensitivity across the Asia Pacific. In contrast, flavored and smoked variants are experiencing the fastest growth, with a 15.07% CAGR projected through 2031. This growth reflects effective premiumization strategies that go beyond traditional consumption patterns. Japanese manufacturers have spearheaded texture innovations, creating tofu products that replicate the luxury of foie gras. Similarly, Taiwanese producers have introduced thousand-layer tofu, a premium product known for its enhanced mouthfeel. Fortified and functional tofu segments are leveraging nutritional advancements, incorporating calcium, vitamins, and protein levels exceeding 12 grams per 100 grams, positioning themselves as strong competitors to dairy alternatives.

Aseptic packaging technology is transforming the tofu market by enabling products with a 180-day shelf life. This advancement supports export growth and minimizes food waste in distribution channels. Organic certification offers a clear quality differentiation, with certified products commanding a 15-30% price premium over conventional options. Smoked tofu appeals to Western-influenced consumers seeking familiar flavors, while traditional tofu preparations preserve cultural authenticity for established demographics. Manufacturing innovations are focused on improving coagulation methods and automating filling processes, enhancing consistency while reducing production costs. Producers who successfully integrate traditional preparation techniques with modern food technology are gaining a competitive edge, particularly in scaling premium product lines.

The Asia Pacific Tofu Market Report is Segmented by Product Type (Regular, Smoked/Flavored, Fortified/Functional), Distribution Channels (On-Trade (Hotels, Restaurants, Catering), Off-Trade (Supermarkets and Hypermarkets, Convenience Stores, Online Channel, Others)), and Geography (India, China, Japan, Australia, Indonesia, Thailand, Rest of Asia Pacific). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Hangzhou Bean Food Co. Ltd.

- Invigorate Foods Pvt. Ltd.

- Leong Guan Food Manufacturer Pte Ltd.

- Miracle Soybean Food Int'l Corp.

- Misuzu Corporation Co. Ltd.

- Morinaga Milk Industry Co. Ltd.

- PSC Corporation Ltd.

- Pulmuone Corp.

- Vitasoy International Holdings Ltd.

- Unicurd Food (Singapore)

- House Foods Group Inc.

- CJ CheilJedang (Chilmyeon)

- Sanquan Food Co. Ltd.

- Nanri Tofu Co. (Taiwan)

- Fuji-Soy Food Co.

- Hong Kong Tofu Factory Ltd.

- Bean Supreme (NZ/APAC)

- Marusan-Ai Co. Ltd.

- Soy Company (Australia)

- Beijing Hechuang Food

- PT Indofood CBP - Tofu Unit

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Plant-Based and Vegan Population

- 4.2.2 Deep-rooted consumption of tofu in the region

- 4.2.3 Consumers increasingly seek low-fat, cholesterol-free, and high-protein foods

- 4.2.4 Government and Institutional Initiatives

- 4.2.5 Increasing demand for sustainable, eco-friendly protein sources

- 4.2.6 Introduction of organic, flavored, ready-to-eat, and premium tofu varieties

- 4.3 Market Restraints

- 4.3.1 Competition from Other Plant-Based Proteins

- 4.3.2 Fluctuating Soybean Prices

- 4.3.3 Quality and Freshness Concerns

- 4.3.4 Varying Food Safety Regulations

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST (Value and Volume )

- 5.1 Product Type

- 5.1.1 Regular

- 5.1.2 Smoked/Flavored

- 5.1.3 Fortified/Functional

- 5.2 Distribution Channels

- 5.2.1 On-Trade

- 5.2.1.1 Hotels

- 5.2.1.2 Restaurants

- 5.2.1.3 Catering

- 5.2.2 Off-Trade

- 5.2.2.1 Supermarkets and Hypermarkets

- 5.2.2.2 Convenience Stores

- 5.2.2.3 Online Channel

- 5.2.2.4 Others

- 5.2.1 On-Trade

- 5.3 Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 Indonesia

- 5.3.6 Thailand

- 5.3.7 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Hangzhou Bean Food Co. Ltd.

- 6.4.2 Invigorate Foods Pvt. Ltd.

- 6.4.3 Leong Guan Food Manufacturer Pte Ltd.

- 6.4.4 Miracle Soybean Food Int'l Corp.

- 6.4.5 Misuzu Corporation Co. Ltd.

- 6.4.6 Morinaga Milk Industry Co. Ltd.

- 6.4.7 PSC Corporation Ltd.

- 6.4.8 Pulmuone Corp.

- 6.4.9 Vitasoy International Holdings Ltd.

- 6.4.10 Unicurd Food (Singapore)

- 6.4.11 House Foods Group Inc.

- 6.4.12 CJ CheilJedang (Chilmyeon)

- 6.4.13 Sanquan Food Co. Ltd.

- 6.4.14 Nanri Tofu Co. (Taiwan)

- 6.4.15 Fuji-Soy Food Co.

- 6.4.16 Hong Kong Tofu Factory Ltd.

- 6.4.17 Bean Supreme (NZ/APAC)

- 6.4.18 Marusan-Ai Co. Ltd.

- 6.4.19 Soy Company (Australia)

- 6.4.20 Beijing Hechuang Food

- 6.4.21 PT Indofood CBP - Tofu Unit

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK