PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940781

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940781

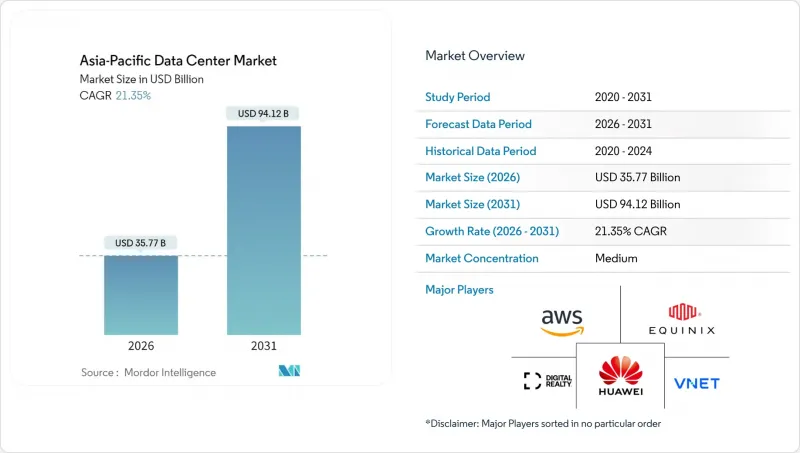

Asia-Pacific Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific Data Center Market size in 2026 is estimated at USD 35.77 billion, growing from 2025 value of USD 29.47 billion with 2031 projections showing USD 94.12 billion, growing at 21.35% CAGR over 2026-2031.

In terms of installed base, the market is expected to grow from 29.31 thousand megawatt in 2025 to 63.11 thousand megawatt by 2030, at a CAGR of 16.57% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Rapid 5G roll-outs, AI/ML workload proliferation, and data-sovereignty regulations are doubling capacity in just five years, making the Asia Pacific Data Center market the world's fastest-growing digital-infrastructure arena. Operators are racing to integrate liquid cooling, renewable-energy sourcing, and submarine-cable landing connectivity to satisfy power-dense workloads while meeting increasingly stringent efficiency mandates. China currently dominates with 34.58% share, yet India's 20.50% CAGR signals a seismic rebalancing of demand toward South Asia. Colocation remains the prevailing service model, but the hyperscale self-build wave led by Chinese cloud giants is redrawing the competitive map as enterprises weigh cost, latency, and compliance trade-offs.

Asia-Pacific Data Center Market Trends and Insights

Accelerating Roll-out of 5G Core Networks

Widespread 5G adoption is reshaping workload-placement economics across the Asia Pacific Data Center market. China surpassed 3.38 million 5G base stations in 2024, each requiring sub-20 ms latency, thereby pushing operators to position medium-sized edge facilities nearer to population centers . In Japan, carriers injected JPY 1.2 trillion into 5G infrastructure during 2024 to enable ultra-low-latency applications across manufacturing and entertainment, catalyzing regional demand for distributed compute nodes. Singapore achieved 95% 5G coverage and stipulated local processing for critical services, a policy that accelerates new edge builds . The resulting traffic dispersion explains why medium facilities are growing faster than mega sites. For developers, network-backhaul partnerships and modular designs have emerged as key differentiators when courting telecom tenants.

Rising Hyperscale Self-build Investments by Chinese Tech Majors

Alibaba, Tencent, and ByteDance are redirecting cloud-infrastructure budgets toward in-house campuses to optimize costs and comply with localization rules. Alibaba earmarked USD 28 billion for new regional builds through 2027, allocating 60% to self-operated estates . ByteDance dedicated USD 7.2 billion to AI-ready designs that support large-language-model training, while Tencent invested USD 5.8 billion in liquid-cooled sites targeting Southeast Asian gamers. The surge is boosting the Asia Pacific Data Center market's hyperscale segment yet intensifying pricing pressure on retail colocation. Incumbents are responding with deeper service portfolios-inter-cloud interconnects, managed GPU clusters, and compliance-as-a-service-to defend share.

Prolonged Grid-Connection Approval Cycles

Connection delays extend project payback periods in high-growth markets. Indian approvals average 18-24 months as state boards scrutinize environmental impact and grid stability Indonesia's PLN imposes similar timelines for >10 MW loads, and the Philippines' renewable-certificate mandate lengthens processing by up to a year. Developers shoulder idle-land costs and warehoused equipment depreciation, dampening IRRs and slowing the Asia Pacific Data Center market's capacity ramp.

Other drivers and restraints analyzed in the detailed report include:

- Government Tax-holiday Incentives for Green Data Centers

- Surging AI/ML Workload Demand for On-prem GPU Clusters

- Shortage of Certified Data center Engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-scale sites posted 12.90% CAGR through 2031 as telecom and CDN providers prioritize 5- to 20-MW nodes for metro-edge traffic aggregation. Large campuses still hold 30.62% share of the Asia Pacific Data Center market size, favored by global cloud tenants for economies of scale. Massive (>100 MW) hubs function as regional cores supporting AI training, while small facilities serve niche enterprise or remote-area requirements. As 5G densification continues, decentralized architectures will keep propelling medium-site demand, even as mega-projects dominate capital deployed.

The Asia Pacific Data Center industry increasingly embraces a hub-and-spoke topology: massive hubs supply high-density compute, and medium satellites ensure latency compliance at the network edge. Power and land constraints in primary cities are prompting land-banking strategies in secondary metros such as Osaka, Hyderabad, and Johor Bahru. For investors, portfolio diversification across size classes reduces exposure to single-site utility bottlenecks.

Tier 3 captured 62.35% share of the Asia Pacific Data Center market size in 2025, offering the 99.982% uptime most enterprises deem sufficient without tier 4's cost premium. Mandates from regulators like Singapore's Monetary Authority require tier 3 minimums for financial data residency, cementing demand. Tier 1 and tier 2 attract dev-test workloads, while tier 4 stays confined to critical clearing-house systems and select government clouds.

Standardized tier 3 blueprints shorten permitting cycles and enable prefabricated component use, trimming build schedules by up to 20%. ISO 27001 alignment further streamlines certification. Consequently, tier 3 will likely widen its leadership as AI spurs higher rack densities yet operators remain cost-sensitive.

The Asia Pacific Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Amazon Web Services, Inc

- Equinix, Inc.

- Alibaba Cloud

- Chindata Group Holdings Ltd

- AirTrunk Operating Pty Ltd

- Space DC Pte Ltd

- NTT Ltd

- Huawei Cloud Computing Technologies Co., Ltd

- Global Data Solutions Co., Ltd. (GDS)

- Google Inc

- LG Uplus Corp

- Range Technology Development Co., Ltd

- NEXTDC Limited

- Digital Realty Trust Inc.

- Beijing VNET Broadband Data Center Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition - Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating roll-out of 5G core networks

- 4.2.2 Rising hyperscale self-build investments by Chinese tech majors

- 4.2.3 Government tax-holiday incentives for green data centers

- 4.2.4 Surging AI/ML workload demand for on-prem GPU clusters

- 4.2.5 Rapid integration of submarine-cable landing stations with edge facilities

- 4.2.6 Build-to-suit models preferred by sovereign wealth funds

- 4.3 Market Restraints

- 4.3.1 Prolonged grid connection approval cycles

- 4.3.2 Pronounced water scarcity risk in Northern China

- 4.3.3 High real-estate cost inflation in tier-one Asia-Pacific cities

- 4.3.4 Shortage of certified data-center engineers

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.5.6.1 China

- 4.5.6.2 Japan

- 4.5.6.3 India

- 4.5.6.4 Indonesia

- 4.5.6.5 Australia

- 4.5.6.6 Singapore

- 4.5.6.7 New Zealand

- 4.5.6.8 Malaysia

- 4.5.6.9 Thailand

- 4.5.6.10 Rest of Asia Pacific

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MW)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale/Self-built

- 5.3.2 Enterprise/Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Country

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 Indonesia

- 5.5.5 Australia

- 5.5.6 Singapore

- 5.5.7 New Zealand

- 5.5.8 Malaysia

- 5.5.9 Thailand

- 5.5.10 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services, Inc

- 6.4.2 Equinix, Inc.

- 6.4.3 Alibaba Cloud

- 6.4.4 Chindata Group Holdings Ltd

- 6.4.5 AirTrunk Operating Pty Ltd

- 6.4.6 Space DC Pte Ltd

- 6.4.7 NTT Ltd

- 6.4.8 Huawei Cloud Computing Technologies Co., Ltd

- 6.4.9 Global Data Solutions Co., Ltd. (GDS)

- 6.4.10 Google Inc

- 6.4.11 LG Uplus Corp

- 6.4.12 Range Technology Development Co., Ltd

- 6.4.13 NEXTDC Limited

- 6.4.14 Digital Realty Trust Inc.

- 6.4.15 Beijing VNET Broadband Data Center Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment