PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940793

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940793

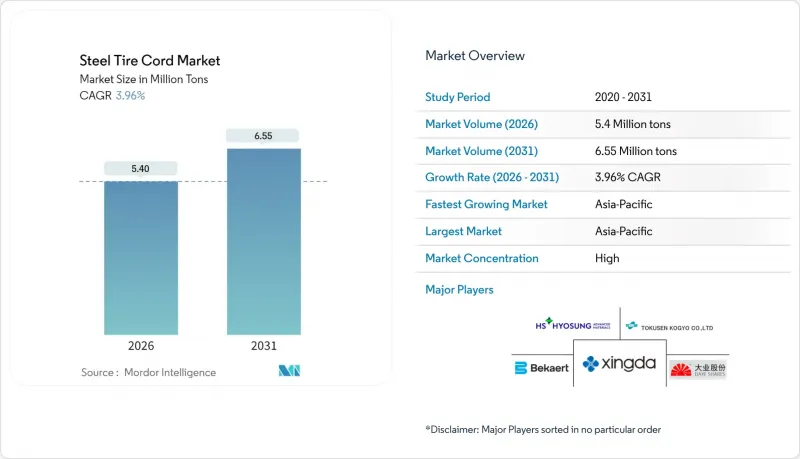

Steel Tire Cord - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Steel Tire Cord market is expected to grow from 5.19 Million tons in 2025 to 5.4 Million tons in 2026 and is forecast to reach 6.55 Million tons by 2031 at 3.96% CAGR over 2026-2031.

Strong replacement demand, resilient vehicle output in emerging hubs, and the radialization shift in commercial tires collectively underpin this expansion. China's 15.62 million-unit vehicle output in the first half of 2025 validated Asia's production momentum despite margin pressure. Automakers' pivot toward low-rolling-resistance designs, combined with 40% renewable-content targets for 2030, forces cord suppliers to refine coating chemistries and integrate recycled steel. Radial construction's higher steel content per tire enlarges volume intensity, while electric-vehicle torque profiles accelerate demand for ultra-flex, fatigue-resistant cords.

Global Steel Tire Cord Market Trends and Insights

Accelerating Automotive Production in Emerging Economies

Continuous manufacturing investments sustain the steel tire cord market as low-cost hubs strengthen vehicle output capacity. China's H1 2025 production surge echoed targeted fiscal stimuli that shielded OEM assembly lines from macro headwinds. ASEAN attracted USD 230 billion in 2023 FDI, much of it in component supply chains, anchoring new cord demand in Thailand, Vietnam, and Indonesia. Continental's USD 315 million expansion in Thailand alone adds 3 million tires annually, locking in localized cord call-offs. The geographic diversification reduces over-reliance on mature markets and offers suppliers volume hedging. Government incentives that promote EV assembly further magnify the addressable tonnage because battery weight lifts cord intensity per tire.

Rapid Radialization of Commercial Vehicle Tires

Medium-truck radial shipments in the United States are projected to climb 5.9% to 22 million units in 2024, reversing the prior dip. Radial designs embed more high-tensile steel than bias constructions, raising tonnage per unit. Fleet operators seeking 8-10% fuel savings adopt radials to cut operating costs. Regulatory pressure on greenhouse-gas emissions tightens total-cost-of-ownership calculus, making radialization pivotal. As commercial freight rebounds alongside construction activity, cord suppliers gain both OEM and replacement pull-through. Early adoption in North America and Europe sets technical benchmarks later mirrored in Latin America and Southeast Asia.

Volatile High-Carbon Steel and Brass Prices

Bekaert's 2024 sales slipped 8.6% to EUR 4.0 billion yet margin stability revealed effective hedging and cost pass-through mechanisms. The World Bank metals index rose 9% in April 2024 and is forecast to remain elevated through 2025, compressing profitability for non-integrated cord mills. Copper's rally to USD 10,000 per ton adds coating-layer inflation, forcing suppliers to rethink alloying or present eco-credit offsets. Small regional players lacking hedging tools face cash-flow strain, paving the way for consolidation or strategic exits.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Push for Low-Rolling-Resistance "Green" Tires

- Regulatory Shift to Low-Copper/Zinc Coatings Boosts Alloy Innovation

- Polymer/Aramid Fiber Substitution Threat

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Brass-coated wire retained 48.25% steel tire cord market share in 2025 and should climb at a 4.74% CAGR, cementing its dominance through 2031. The coating's Cu-Zn phase enables robust Cu2S interfacial layers during vulcanization, maximizing rubber adhesion under cyclic loading. Zinc-coated cords provide higher corrosion resistance but face environmental scrutiny, driving lab-scale trials of zinc-cobalt or zinc-manganese hybrids. Copper-coated wire occupies niche high-thermal-conductivity applications such as aircraft tires, while nano-alloy platings appear in prototype EV designs seeking thinner gauge with equal adhesion. California's impending zinc runoff limits encourage brass formulation optimization to lower residual zinc without eroding performance, nudging research and development toward gradient-layer coatings.

Technological advances in plating-bath control reduce hydrogen embrittlement risk, extending wire service life even in the harsher duty cycles of electric pickups. Suppliers invest in closed-loop effluent treatment to comply with Europe's REACH directives, aligning production with customer sustainability scorecards.

The Steel Tire Cord Report is Segmented by Type (Brass Coated, Zinc Coated, Copper Coated, and Other Types), Application (Passenger Vehicle Tires, Commercial Vehicle Tires, Two-Wheeler Tires, Aircraft Tires, and Industrial Tire), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 49.12% steel tire cord market share in 2025 and is projected to grow at 5.08% CAGR through 2031. China's H1 2025 vehicle output of 15.62 million units, coupled with government EV subsidies, guarantees base-load cord demand. ASEAN's USD 230 billion inbound FDI in 2023 underpins capacity expansions, such as Continental's Thailand plant aimed at 3 million additional tires annually.

North America is reshoring tire capacity to fortify supply resilience, with Nexen's USD 1.3 billion U.S. facility targeting 30,000 units daily by 2029. U.S. tire shipments are forecast to hit 340.4 million units in 2025, sustaining high replacement pull-through. EPA emission rules propel investment in closed-loop galvanizing lines that capture zinc run-off.

Europe prioritizes premium winter and sustainability-certified segments, with Continental reporting USD 14.6 billion tire sales in 2024 despite volume softness. EU anti-dumping duties on Chinese tires, re-imposed in 2023, protect regional producers and channel more local demand to European cord mills. Michelin's 40% renewable-content ambition intensifies the sourcing of recycled wire and eco-coatings.

- Bekaert

- Bridgestone Corporation

- Daye Co., Ltd.

- Henan Hengxing Science & Technology Co., Ltd.

- HS HYOSUNG ADVANCED MATERIALS

- Hubei Fuxing Technology Co., Ltd.

- Jiangsu Xingda Steel Tyre Cord Co., Ltd.

- Junma Group

- Kiswire Ltd.

- Qingdao HL Group Ltd.

- Saarstahl AG

- Shandong Xinhao Tire Materials Co., Ltd.

- Shougang Century Holdings Limited

- Sumitomo Electric Industries, Ltd.

- Tokusen Kogyo Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating automotive production in emerging economies

- 4.2.2 Rapid radialization of commercial vehicle tires

- 4.2.3 Sustainability push for low-rolling-resistance "green" tires

- 4.2.4 EV-specific ultra-flex fatigue-resistant cord demand

- 4.2.5 Regulatory shift to low-copper/zinc coatings boosts alloy innovation

- 4.3 Market Restraints

- 4.3.1 Volatile high-carbon steel and brass prices

- 4.3.2 Polymer/aramid fiber substitution threat

- 4.3.3 Emergence of air-less NPTs (non-pneumatic tires)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Brass Coated

- 5.1.2 Zinc Coated

- 5.1.3 Copper Coated

- 5.1.4 Other types

- 5.2 By Application

- 5.2.1 Passenger Vehicle Tires

- 5.2.2 Commercial Vehicle Tires

- 5.2.3 Two-Wheeler Tires

- 5.2.4 Aircraft Tires

- 5.2.5 Industrial Tire

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, JVs, Funding)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bekaert

- 6.4.2 Bridgestone Corporation

- 6.4.3 Daye Co., Ltd.

- 6.4.4 Henan Hengxing Science & Technology Co., Ltd.

- 6.4.5 HS HYOSUNG ADVANCED MATERIALS

- 6.4.6 Hubei Fuxing Technology Co., Ltd.

- 6.4.7 Jiangsu Xingda Steel Tyre Cord Co., Ltd.

- 6.4.8 Junma Group

- 6.4.9 Kiswire Ltd.

- 6.4.10 Qingdao HL Group Ltd.

- 6.4.11 Saarstahl AG

- 6.4.12 Shandong Xinhao Tire Materials Co., Ltd.

- 6.4.13 Shougang Century Holdings Limited

- 6.4.14 Sumitomo Electric Industries, Ltd.

- 6.4.15 Tokusen Kogyo Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 Whitespace and unmet-need assessment