PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940794

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940794

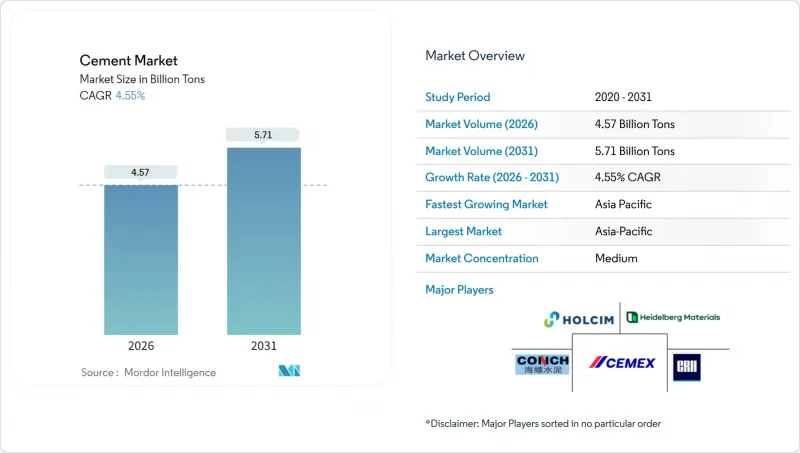

Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Cement market size in 2026 is estimated at 4.57 Billion Tons, growing from 2025 value of 4.37 Billion Tons with 2031 projections showing 5.71 Billion Tons, growing at 4.55% CAGR over 2026-2031.

Construction recovery, infrastructure upgrades, and accelerated shifts toward low-carbon binders form the core demand engine. Blended formulations gain acceptance as procurement teams embed environmental, social, and governance requirements, while data-center and logistics construction spur incremental volumes. Producers respond with kiln digitalization and fuel switching to stabilize costs in a volatile energy landscape. Regulatory tightening on CO2 emissions accelerates clinker substitution, positioning supplementary cementitious materials as strategic inputs across every major cement market.

Global Cement Market Trends and Insights

Urbanization-Linked Infrastructure Boom in Emerging Asia and Africa

Mega-city projects, regional rail corridors, and mass-housing plans push sustained volumes into every major cement market across Asia-Pacific. China's Belt and Road Initiative extends demand into partner nations, while India sustains annual infrastructure spending near 5% of GDP, underpinning domestic consumption. Housing shortfalls, such as the Philippines' projected 10 million-unit backlog by 2028, amplify residential requirements. African urban growth mirrors earlier Asian cycles, with Ghana's price-regulation framework balancing affordability and supply. Each rural-to-urban migrant drives a three-to-four-fold increase in cement-intensive assets spanning transit, housing, utilities, and commercial space.

Government Stimulus for Low-Carbon Public Infrastructure (Post-COVID)

Post-pandemic recovery packages embed emissions ceilings into project specifications, favoring lower-carbon alternatives across developed cement markets. The U.S. Bipartisan Infrastructure Law earmarks USD 550 billion for new works, a program the Portland Cement Association links to a 46 million-ton five-year volume uplift. Federal support extends to process innovation, with the Department of Energy backing carbon-capture pilots at Cemex's Knoxville plant. Multiplier effects above USD 3.5 per dollar invested trigger sustained contractor pipelines, ensuring steady pull-through of blended cement and alternative-fuel output.

Stringent CO2-Emission Caps and Clinker-to-Cement Ratios

Compliance programs such as the EU Emissions Trading System and California's net-zero mandate obligate costly kiln upgrades. Fly-ash scarcity worsens as coal utilities retire, pressing producers to seek alternative supplementary materials. National Cement's partnership with Carbon TerraVault to construct California's first net-zero facility highlights the capital burden attached to regulatory alignment. Certification standards like ISO 14001 evolve into entry requirements, raising barriers for under-capitalized firms.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Blended/Green Cement to Meet Corporate ESG Targets

- Expansion of Ready-Mix Concrete Networks in Tier-2/3 Cities

- Volatile Coal and Pet-Coke Prices Inflating Production Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blended cement captured 68.45% of 2025 shipments, underpinning the largest portion of the cement market size at the segment level. Limestone-based formulations drive the uptick, aligning commercial performance with reduced embodied carbon. Ordinary Portland Cement remains vital for early-strength highways and precast panels, yet its share declines as regulations push for lower clinker content. White cement fills decorative niches, particularly for facade panels, with Turkey acting as the primary exporter into North America. Fiber cement boards penetrate residential siding thanks to their durability and fire resistance benefits.

Investment patterns confirm the pivot. Holcim's USD 278 million package across Swiss plants seeks to boost alternative-fuel usage from 57% to above 85%, illustrating the required spend to fortify environmental credentials. Heidelberg Materials is scaling the world's largest calcined clay line in Ghana, providing a regional supply of low-carbon binder. These moves reinforce a structural realignment that supports the blended segment's 4.88% forecast CAGR and consolidates leadership within the global cement market.

The Cement Report is Segmented by Product Type (Blended Cement, Fiber Cement, Ordinary Portland Cement, White Cement, and Other Types), End-Use Sector (Residential, Commercial, Infrastructural, and Industrial and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific accounted for 74.60% of 2025 volume, confirming the region's centrality to the cement market. China's 2024 output fell 10% amid property corrections, yet state-owned majors offset domestic softness by exporting surplus to Southeast Asia and Africa. India remains the growth engine as favorable demographics and federal capital-expenditure commitments strengthen order books. Vietnam, Indonesia, and Thailand also report double-digit factory utilization rates, supported by electronics manufacturing inflows and urban transport projects.

The Middle East and Africa advance at a 4.92% CAGR through 2031, the fastest regional trajectory in the global cement market. Gulf diversification plans, typified by Saudi Arabia's Vision 2030, generate large infrastructure consortia, albeit with periodic export quotas tightening local supply. African expansion varies by market; Ghana adopts price caps to protect consumers, while Kenya experiences cyclical volatility linked to public works funding streams. Heidelberg Materials leverages an integrated network to navigate logistic hurdles and capture underserved demand pockets. North American and European consumption is mature yet steadied by asset-refurbishment agendas. In Europe, carbon pricing and kiln electrification projects dominate capex, with multinationals clustering research and development around process optimization. Holcim's 2025 spin-off of Amrize, valued above USD 30 billion, signals a sharpened focus on North American profitability and efficient capital deployment

- Adani Group

- Anhui Conch Cement Co., Ltd.

- BBMG Corporation

- Buzzi S.p.A.

- CEMEX S.A.B. de C.V.

- Cemros

- China National Building Material Group Corporation (CNBM)

- China Resources Building Materials Technology Holdings

- Concreat

- CRH

- Dangote Cement Plc

- Heidelberg Materials

- HOLCIM

- InterCement

- JSW Cement

- OYAK Cement

- SCG

- TCC GROUP HOLDINGS

- UltraTech Cement Ltd

- Vicat

- Votorantim Cimentos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanisation-linked infrastructure boom in emerging Asia and Africa

- 4.2.2 Government stimulus for low-carbon public infrastructure (post-COVID)

- 4.2.3 Rising demand for blended/green cement to meet corporate ESG targets

- 4.2.4 Expansion of ready-mix concrete networks in Tier-2/3 cities

- 4.2.5 3-D concrete-printing creating niche demand for specialised binders

- 4.3 Market Restraints

- 4.3.1 Stringent CO2-emission caps and clinker-to-cement ratios

- 4.3.2 Volatile coal and pet-coke prices inflating production costs

- 4.3.3 Shrinking fly-ash supply as coal plants retire

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Blended Cement

- 5.1.2 Fiber Cement

- 5.1.3 Ordinary Portland Cement

- 5.1.4 White Cement

- 5.1.5 Other Types

- 5.2 By End-Use Sector

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructural

- 5.2.4 Industrial and Institutional

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Indonesia

- 5.3.1.4 Japan

- 5.3.1.5 Malaysia

- 5.3.1.6 South Korea

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Australia

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adani Group

- 6.4.2 Anhui Conch Cement Co., Ltd.

- 6.4.3 BBMG Corporation

- 6.4.4 Buzzi S.p.A.

- 6.4.5 CEMEX S.A.B. de C.V.

- 6.4.6 Cemros

- 6.4.7 China National Building Material Group Corporation (CNBM)

- 6.4.8 China Resources Building Materials Technology Holdings

- 6.4.9 Concreat

- 6.4.10 CRH

- 6.4.11 Dangote Cement Plc

- 6.4.12 Heidelberg Materials

- 6.4.13 HOLCIM

- 6.4.14 InterCement

- 6.4.15 JSW Cement

- 6.4.16 OYAK Cement

- 6.4.17 SCG

- 6.4.18 TCC GROUP HOLDINGS

- 6.4.19 UltraTech Cement Ltd

- 6.4.20 Vicat

- 6.4.21 Votorantim Cimentos

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Emerging Sustainable Cement Technologies

- 7.3 Digitalisation and Automation Opportunities