PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940849

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940849

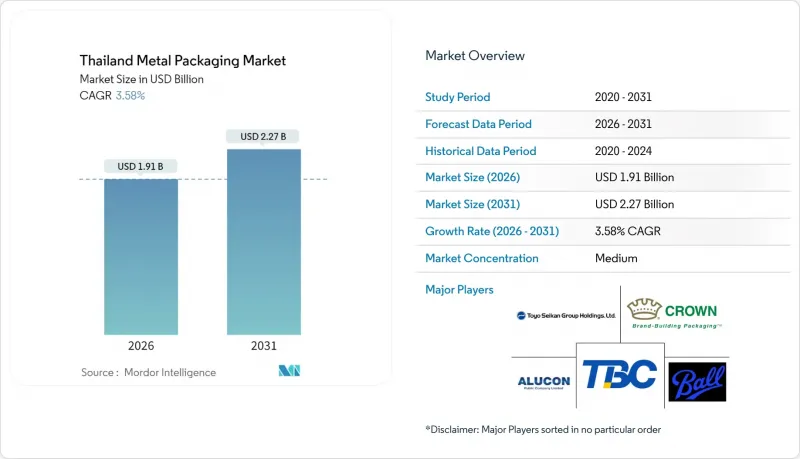

Thailand Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand metal packaging market is expected to grow from USD 1.84 billion in 2025 to USD 1.91 billion in 2026 and is forecast to reach USD 2.27 billion by 2031 at 3.58% CAGR over 2026-2031.

Robust demand from beverage fillers, food processors, and export-oriented pet-food manufacturers underpins this trajectory, while supportive trade pacts keep converter utilization rates high. Aluminum's dominance reinforces the premium positioning sought by brand owners, and continuous debottlenecking by can-stock mills has protected supply security despite raw-material inflation. Government sustainability mandates and preferential scrap-handling rules further tilt specifications toward circular-ready metal formats. Thailand's established freight corridors into ASEAN and the Middle East shorten lead times, allowing local fillers to balance domestic volumes with lucrative export runs and thereby insulate the market from periodic softness in private consumption.

Thailand Metal Packaging Market Trends and Insights

Premiumisation of Ready-to-Drink Beverages

Thailand's beverage fillers sold 13.02 billion liters worth USD 25.32 billion in 2023, locking in higher value-per-liter price points that rely on aluminum cans for barrier integrity and upscale shelf appea. Health-centric formulas and functional additives are growing 3.5-4.5% annually, and the sleek can profile has become a visual shorthand for premium performance drinks. Major brewers and energy-drink brands schedule frequent limited-edition runs, driving specification turnover that favors agile local converters. Export sales of non-alcoholic drinks delivered USD 2.78 billion in 2023, reinforcing volume certainty for can-body lines that can switch between domestic and regional SKUs overnight. Crown Holdings posted 4% global beverage-can growth in 2024 with Asia Pacific outpacing all other regions, a data point that validates persistent demand from Thai fillers.

Growth of Thailand's Pet-food Export Hub

Thailand shipped USD 26.5 billion in processed foods in 2023, with pet food singled out by regulators as a next-wave export champion requiring hermetically sealed metal formats. Leading co-packers have installed retort lines optimized for tuna-based diets, and their procurement policies specify drawn-and-redrawn cans that withstand multi-week sea freight. Eastern Economic Corridor tax incentives continue to attract new extruded-kibble producers, ensuring sticky long-term offtake for local can-stock suppliers. Regional pet ownership is climbing fastest in Vietnam, Malaysia, and the Philippines, and import agencies in those markets cite metal's oxygen resistance as critical to nutrient preservation. As unit volumes swell, Thai converters gain purchasing leverage on coil feedstock, partially offsetting global aluminum price firming.

Rising Price Volatility of Rolled Steel Coil

Benchmark HRC prices track construction demand swings and geopolitical energy shocks, pushing coil quotes beyond converters' cost-plus contracts on short notice. Steel-can makers carry thicker inventories or buy futures, tying up working capital that could otherwise fund efficiency retrofits. When spikes overlap with fixed-price tenders to tuna or paint fillers, margin compression hits fastest on domestically owned plants that lack global purchasing scale. Aluminum price curves have shown steadier climbs, nudging some food packers into metal substitution. Unless upstream mills stabilize supply with longer-term index deals, Thailand's steel-can capacity risks attrition as converters rationalize older coating lines.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Halal-certified Canned Seafood

- Government Push for Circular-economy Aluminium

- Substitution by Bio-polymer Pouches in Sauces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aluminum captured a commanding 74.22% of the Thailand metal packaging market share in 2025, and its 4.18% forecast CAGR ensures the substrate will widen its lead through 2031. UACJ's 320,000-ton mill supplies light-gauge coil that Crown, Ball, and Thai Beverage Can draw into bodies consumed by breweries and energy-drink brands. Aluminum's infinite recyclability resonates with circular-economy levies, and scrap yields north of 90% lower life-cycle emissions in life-cycle assessments.

Thailand metal packaging market buyers give aluminum premium preference on export-grade pet food and halal seafood lines where dent resistance, salty-brine compatibility, and regulatory traceability are paramount. Steel retains relevance on commodity paints, lubricants, and budget condensed-milk lines where price sensitivity overrides sustainability messaging. Still, national EPR fees are expected to rise from 2026, gradually tipping cost-of-ownership math toward aluminum even in value categories. The substrate's consolidated supply chain allows converters to hedge raw-material risk through long-term offtake deals, keeping capacity-addition economics attractive despite global price firming.

The Thailand Metal Packaging Market Report is Segmented by Material Type (Aluminium, Steel), Product Type (Cans, Bulk Containers, Shipping Barrels and Drums, and More), End-User Vertical (Beverage, Food, Paints and Chemicals, Industrial and Automotive Oils). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Toyo Seikan Group Holdings, Ltd.

- ALUCON Public Company Limited

- Crown Holdings, Inc.

- Ball Corporation

- Thai Beverage Can Co., Ltd.

- Bangkok Can Manufacturing Co., Ltd.

- Swan Industries (Thailand) Co., Ltd.

- Lohakij Rung Charoen Sub Co., Ltd.

- Next Can Innovation Co., Ltd.

- Asian-Pacific Can Co., Ltd.

- Standard Can Co., Ltd.

- Royal Can Industries Co., Ltd.

- Great Siam Metal Packaging Co., Ltd.

- Siam Toppan Packaging Co., Ltd.

- Perfect Can Manufacturing Co., Ltd.

- Can One (Thailand) Co., Ltd.

- Thai Oil Can Manufacturing Co., Ltd.

- Supreme Metal Container Co., Ltd.

- Thien Long Metal Can (Thailand) Co., Ltd.

- WR Will (Thailand) Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Premiumisation of Ready-to-Drink Beverages

- 4.3.2 Growth of Thailand's pet-food export hub

- 4.3.3 Expansion of halal-certified canned seafood

- 4.3.4 Government push for circular-economy aluminium

- 4.3.5 Rapid scale-up of E-commerce grocery formats

- 4.3.6 Brewery shift to sleek and slim can formats

- 4.4 Market Restraints

- 4.4.1 Rising price volatility of rolled steel coil

- 4.4.2 Substitution by bio-polymer pouches in sauces

- 4.4.3 Slow uptake of recycling infrastructure outside EEC

- 4.4.4 Stringent VOC emission norms for aerosol plants

- 4.5 Industry Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Aluminium

- 5.1.2 Steel

- 5.2 By Product Type

- 5.2.1 Cans

- 5.2.1.1 Food Cans

- 5.2.1.2 Beverage Cans

- 5.2.1.3 Aerosol Cans

- 5.2.2 Bulk Containers

- 5.2.3 Shipping Barrels and Drums

- 5.2.4 Caps and Closures

- 5.2.1 Cans

- 5.3 By End-user Vertical

- 5.3.1 Beverage

- 5.3.2 Food

- 5.3.3 Paints and Chemicals

- 5.3.4 Industrial and Automotive Oils

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Toyo Seikan Group Holdings, Ltd.

- 6.4.2 ALUCON Public Company Limited

- 6.4.3 Crown Holdings, Inc.

- 6.4.4 Ball Corporation

- 6.4.5 Thai Beverage Can Co., Ltd.

- 6.4.6 Bangkok Can Manufacturing Co., Ltd.

- 6.4.7 Swan Industries (Thailand) Co., Ltd.

- 6.4.8 Lohakij Rung Charoen Sub Co., Ltd.

- 6.4.9 Next Can Innovation Co., Ltd.

- 6.4.10 Asian-Pacific Can Co., Ltd.

- 6.4.11 Standard Can Co., Ltd.

- 6.4.12 Royal Can Industries Co., Ltd.

- 6.4.13 Great Siam Metal Packaging Co., Ltd.

- 6.4.14 Siam Toppan Packaging Co., Ltd.

- 6.4.15 Perfect Can Manufacturing Co., Ltd.

- 6.4.16 Can One (Thailand) Co., Ltd.

- 6.4.17 Thai Oil Can Manufacturing Co., Ltd.

- 6.4.18 Supreme Metal Container Co., Ltd.

- 6.4.19 Thien Long Metal Can (Thailand) Co., Ltd.

- 6.4.20 WR Will (Thailand) Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment