PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940862

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940862

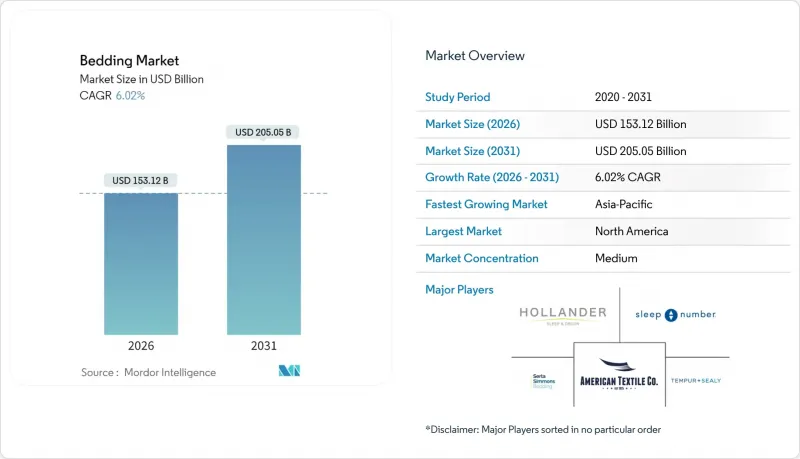

Bedding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Bedding market is expected to grow from USD 144.43 billion in 2025 to USD 153.12 billion in 2026 and is forecast to reach USD 205.05 billion by 2031 at 6.02% CAGR over 2026-2031.

Momentum stems from consumers linking sleep quality with well-being, corporate and hotel refurbishment programs, and steady innovation in smart-sleep technology. Although raw-material cost spikes and logistics bottlenecks intermittently squeeze margins, suppliers are offsetting these headwinds through premiumization, rigorous sustainability programs, and direct-to-consumer (DTC) channel expansion. North America retains leadership on the back of high purchasing power and ongoing consolidation among multibrand retailers, while Asia-Pacific builds scale fastest as rising disposable incomes elevate comfort expectations. Across all regions, omnichannel strategies, scientific product testing, and regenerative-fiber sourcing are becoming table-stakes differentiators for manufacturers and retailers.

Global Bedding Market Trends and Insights

Expansion of E-commerce and DTC Channels

Online shopping has changed the way people buy bedding.. Online B2C bedding sales are outpacing the overall bedding market, rising at 7.7% per year as digital storefronts replace the traditional mattress-showroom model. Retail giants like Amazon and Wayfair, along with direct-to-consumer brands such as Casper and Parachute that offer personalized picks and even subscription refills, give shoppers a wide choice, easy ordering, and competitive prices, pushing the industry's growth forward. Rising customer-acquisition costs are prompting scale leaders to rely on proprietary stores to amortize marketing outlays across channels, with Tempur Sealy operating more than 750 stores . The most resilient players view e-commerce less as a channel shift and more as a holistic go-to-market architecture that unites logistics, customer support, and post-purchase engagement.

Rise of Wellness-Centric Sleep Technology

Smart beds, temperature-regulating fabrics, and antimicrobial finishes have repositioned mattresses from functional furniture to health-improvement devices. Shoppers increasingly tie good sleep to better health, turning bedding from a routine buy into a wellness investment. That shift is fueling demand for tech-enabled products. For instance, Sleep Number's sensor-based models continually adapt firmness and have now logged millions of nightly data points, giving the brand defensible IP despite a 16% revenue dip in Q1 2025. Concurrently, Dow and GoodBed formed a research consortium introducing objective comfort metrics that are narrowing the gap between marketing claims and scientific validation. Wearable-integrated diagnostics, breathable memory foams, and pressure-mapping coils are migrating from premium into mid-price tiers, widening addressable demand and energizing a host of component suppliers.

Raw-Material Price Volatility

Sharp fluctuations in input costs are squeezing bedding manufacturers, and polyurethane foam is the biggest pain point. American Foam Products notes that foam prices have jumped 40% since late 2020 as winter storms closed key refineries and oil markets remained volatile. Larger suppliers are hedging futures or deepening vertical integration, but smaller converters struggle to absorb spikes, leading to trimmed SKU counts or contract renegotiations with retailers. Adoption of recycled or blended fibers can buffer volatility, yet the material premium may clash with consumer price ceilings in developing countries. Additionally, the shift toward sustainable and organic materials often commands premium pricing, creating tension between environmental goals and cost competitiveness in price-sensitive market segments.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and Traceable Organic Fibers

- Growing Hospitality Refurb Cycles Post-COVID

- Fragmented Supplier Base Limits Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bed linen retained 29.35% bedding market share in 2025, underpinned by high replacement frequency and universal household penetration. The segment's predictable turnover anchors retailer inventory planning and sustains cash flow even during macro-slowdowns. In contrast, mattress toppers and pads are scaling at a 7.14% CAGR as wellness-oriented consumers fine-tune comfort without replacing core mattresses. Their ascendancy highlights a migration toward modular bedding ecosystems where specialty accessories elongate the lifecycle and unlock cross-selling.

Technologies such as cooling gels, phase-change materials, and antimicrobial yarns are present across all product tiers, narrowing performance gaps between premium and mass segments. Sustainable-fiber initiatives pivot designers toward organic cotton and lyocell blends, reinforcing brands' ESG narratives. The cumulative effect positions accessories as both margin enhancers and loyalty accelerators within the broader bedding market.

The Bedding Market is Segmented by Product (Bed Linen, Pillows and Pillowcases, and More), by End User (Residential, Commercial), Distribution Channel (B2C/Retail Channels, B2B/Directly From Manufacturers by Large Commercial Users), and by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 32.60% of the global bedding market revenue in 2025, owing to strong purchasing power and entrenched replacement habits. Tempur Sealy's USD 5 billion Mattress Firm acquisition yielded a vertically integrated conglomerate spanning 100 countries, tightening control over retail shelf space and supply-chain throughput. Regional headwinds include tariff-shielded competition from Asia and a deflationary push in mattress average selling prices amid heavy promotions. Yet, wellness-centric products continue to command price premiums, and smart-bed penetration remains highest worldwide.

Europe follows with pronounced sustainability momentum; 86% of consumers consider eco-credentials influential, pulling demand toward traceable fibers and low-carbon manufacturing. Regulatory guardrails such as the EU Corporate Sustainability Reporting Directive are intensifying supply-chain scrutiny, favoring proactive brands like Welspun Living, which targets carbon neutrality by 2030 and zero freshwater consumption. Macroeconomic sensitivity persists, yet premiumization in northern Europe partially offsets softness in discretionary spend.

Asia-Pacific is the fastest-growing bloc with a 7.05% CAGR through 2031. As global commodity prices slide, inflation should ease to 2.3% next year and 2.2% the year after, giving central banks room to loosen monetary policy. Indian incumbents like Duroflex eye IPO proceeds to fund capacity and distribution upgrades in anticipation of surging domestic demand; meanwhile, regional e-commerce penetration enables cross-border boutique labels to court niche segments, enhancing category depth. Japan and Australia focus on innovation, whereas Southeast Asia drives volume growth through first-time buyers entering the organized bedding market.

- American Textile Company

- Somnigroup International Inc.

- Sleep Number Corporation

- The Bombay Dyeing And Manufacturing Company Limited

- Casper Sleep Inc.

- Hollander Sleep Products LLC

- Beaumont & Brown

- Alok Industries Limited

- Crane & Canopy Inc.

- Serta Simmons Bedding LLC

- The White Company

- Ralph Lauren Corporation

- Boll & Branch LLC

- Serena & Lily Inc.

- Brooklinen Inc.

- Parachute Home Inc.

- Williams-Sonoma Inc.

- WestPoint Home, LLC

- Leggett & Platt, Incorporated

- Purple Innovation, Inc.

- Welspun Living Limited

- Luolai Lifestyle Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of E-commerce and DTC Channels

- 4.2.2 Rise of Wellness-Centric Sleep Technology

- 4.2.3 Sustainability & Traceable Organic Fibers

- 4.2.4 Growing Hospitality Refurb Cycles Post-COVID

- 4.2.5 Premiumization in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (cotton, foam)

- 4.3.2 Fragmented supplier base limits standardisation

- 4.3.3 Logistics and Supply Chain Challenges

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Bed Linen

- 5.1.2 Pillows and Pillowcases

- 5.1.3 Blankets & Quilts

- 5.1.4 Mattresses

- 5.1.5 Mattress Toppers & Pads

- 5.1.6 Other Products

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.2.1 Hospitality (Hotels & Resorts)

- 5.2.2.2 Healthcare & Elderly-care Facilities

- 5.2.2.3 Institutional (Dorms, Military, etc.)

- 5.2.2.4 Other Commercial End Users

- 5.3 By Distribution Channel

- 5.3.1 B2C/Retail Channels

- 5.3.1.1 Multi-Brand Stores

- 5.3.1.2 Specialty Bedding Stores (including exclusive brand outlets)

- 5.3.1.3 Online

- 5.3.1.4 Other Distribution Channels

- 5.3.2 B2B/Directly from Manufacturers by Large Commercial Users

- 5.3.1 B2C/Retail Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East And Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves & Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 American Textile Company

- 6.4.2 Somnigroup International Inc.

- 6.4.3 Sleep Number Corporation

- 6.4.4 The Bombay Dyeing And Manufacturing Company Limited

- 6.4.5 Casper Sleep Inc.

- 6.4.6 Hollander Sleep Products LLC

- 6.4.7 Beaumont & Brown

- 6.4.8 Alok Industries Limited

- 6.4.9 Crane & Canopy Inc.

- 6.4.10 Serta Simmons Bedding LLC

- 6.4.11 The White Company

- 6.4.12 Ralph Lauren Corporation

- 6.4.13 Boll & Branch LLC

- 6.4.14 Serena & Lily Inc.

- 6.4.15 Brooklinen Inc.

- 6.4.16 Parachute Home Inc.

- 6.4.17 Williams-Sonoma Inc.

- 6.4.18 WestPoint Home, LLC

- 6.4.19 Leggett & Platt, Incorporated

- 6.4.20 Purple Innovation, Inc.

- 6.4.21 Welspun Living Limited

- 6.4.22 Luolai Lifestyle Technology Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Sustainability-Driven Bedding Products