PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940879

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940879

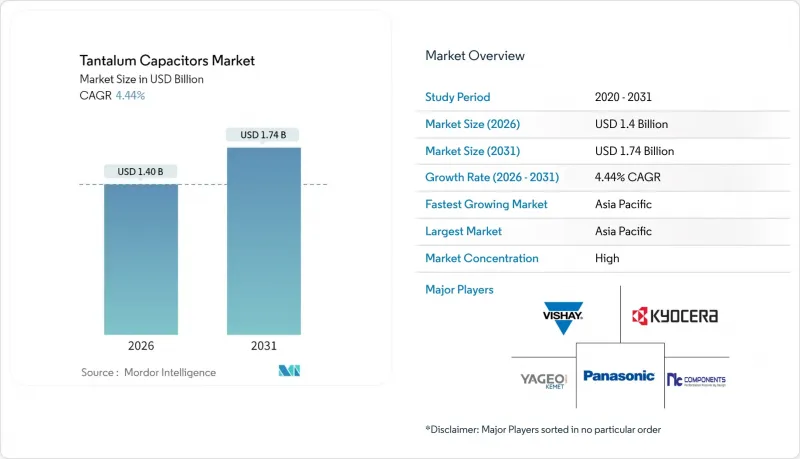

Tantalum Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The tantalum capacitors market is expected to grow from USD 1.34 billion in 2025 to USD 1.4 billion in 2026 and is forecast to reach USD 1.74 billion by 2031 at 4.44% CAGR over 2026-2031.

Strong demand for high-capacitance density, temperature stability, and long-term reliability keeps the tantalum capacitors market firmly rooted in mission-critical electronics, even as cost pressures persist. Miniaturization of consumer devices, accelerated electrification of vehicles, expanding 5G infrastructure, and supply-chain disturbances in multilayer ceramic capacitors (MLCCs) collectively underpin steady expansion. At the same time, trade restrictions on critical minerals and raw-material price spikes temper the CAGR outlook and force buyers to diversify sourcing strategies.

Global Tantalum Capacitors Market Trends and Insights

Miniaturization of Electronic Devices

As circuit boards shrink, heat dissipation per square centimeter rises steeply, making tantalum's thermal stability indispensable for power-management ICs embedded within smartphones, wearables, and implantable medical devices. A modern flagship smartphone integrates more than 1,000 capacitors, and tantalum versions secure critical power-rail conditioning roles where volumetric efficiency and elevated reflow-temperature tolerance intersect . OEM roadmaps that target foldable, ultra-slim form factors reinforce demand for smaller case sizes without sacrificing capacitance, sustaining momentum in the tantalum capacitors market.

Rising In-Vehicle Electronics Adoption

Automotive electrification multiplies capacitor demand across traction inverters, on-board chargers, advanced driver assistance systems, and infotainment modules. Polymer tantalum capacitors remain qualified at -40 °C to +150 °C and exhibit low equivalent series resistance (ESR), outperforming ceramics in 48 V and emerging 800 V architectures. TDK projected growth in passive components for fiscal 2025 by citing surging automotive orders that elevate value per vehicle . These trends keep the tantalum capacitors market well aligned with the long-term electrification curve.

Tantalum Ore Price and Supply Volatility

Conflict-related production interruptions in the Democratic Republic of Congo and forced-labor allegations among artisanal miners tighten raw-material supply lines, transmitting price spikes through to capacitor BOMs . U.S. consumption fell sharply after a 25% tariff on Chinese tantalum imports took effect in September 2024, compelling OEMs to dual-source or re-engineer designs . These disruptions limit cost-sensitive penetration of the tantalum capacitors market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in 5G Smartphone Production

- MLCC Supply Instability Favoring Tantalum

- Competition from Ceramic and Aluminum Capacitors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solid polymer tantalum capacitors captured 38.62% revenue in 2025 as OEMs prioritized ESR reduction and fail-safe performance . The tantalum capacitors market benefits from polymers' benign failure mode, eliminating the oxygen generation risk that accompanies MnO2 cathodes. Niobium oxide capacitors, though still niche, chart a 5.94% CAGR through 2031 as designers hedge raw-material risk. Solid MnO2 devices remain the volume option for cost-sensitive consumer gear, while wet-electrolytic constructions hold ground in bulk-storage niches.

Packaging innovation complements material shifts. Polymer parts support ripple-current demands in 5G power amplifiers and EV onboard chargers, reinforcing the tantalum capacitors market. As medical implants and wearable sensors push for smaller case sizes, polymer technology's stability across 1,000+ thermal cycles becomes decisive .

Surface-mount packages commanded 77.45% revenue in 2025 and are forecast to grow 5.03% CAGR, reflecting automated assembly and multilayer PCB density targets. The tantalum capacitors market size linked to surface-mount formats gains from pick-and-place accuracy improvements that shrink keep-out zones. Through-hole variants stay relevant in aerospace, defense, and heavy industrial boards where mechanical robustness and field maintainability trump form factor.

Surface-mount leadership is reinforced by PCB-embedded capacitor roadmaps that compress z-axis height and shorten power-loop inductance. Samsung Electro-Mechanics updated its part libraries to streamline simulation workflows for RF power modules, further tilting design wins toward surface-mount tantalums.

The Tantalum Capacitors Market Report is Segmented by Product Type (Solid MnO2, Solid Polymer, Wet Electrolytic, Niobium Oxide), Mounting Type (Surface-Mount, Through-Hole), Capacitance Range (Up To 100 MF, Others), Application (Consumer Electronics, Automotive Electronics, Industrial Equipment, Medical Devices, Telecommunications Infrastructure, and ), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 44.10% of global revenue in 2025 and is poised to expand at a 5.63% CAGR through 2031. China's consumer-electronics production push, backed by subsidies for advanced packaging, reinforces passive-component pull, while Korea and Taiwan anchor memory fabs that consume high-frequency decoupling parts.

North America retools supply chains after a 25% tariff on Chinese tantalum imports and impending 2027 DoD sourcing restrictions. Domestic capacitor manufacturers expedite the qualification of ethically sourced ore from Australia and Brazil to insulate military programs from conflict-area risks . These policy shifts reshape regional volumes but also create niche demand for traceable, U.S.-made tantalum components.

Europe focuses on sustainability credentials and drives procurement toward certified conflict-free tantalum. German automotive Tier 1 suppliers collaborate with Polish and Czech capacitor plants to shorten logistics loops and meet just-in-time mandates, protecting the tantalum capacitors market against lengthy maritime delays.

Rest-of-World regions rise as alternative feedstock hubs. Australia, possessing large hard-rock tantalite reserves, adds refining capacity aligned with Western ESG standards, while Rwanda develops concentrate-upgrading infrastructure to capture more value locally. Brazil's Minas Gerais projects unlock incremental ore tonnage that diversifies global supply risk.

- KEMET Corporation (Yageo)

- KYOCERA AVX Components Corporation

- Panasonic Corporation

- Vishay Intertechnology Inc.

- Hongda Capacitors Co. Ltd.

- Samsung Electro-Mechanics

- NIC Components Corp.

- Exxelia Group

- Abracon LLC

- TE Connectivity Ltd.

- Rohm Semiconductor

- Suntan Capacitors

- NEC Corporation

- UF Capacitors Factory Co., LTD

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturization of electronic devices

- 4.2.2 Rising in-vehicle electronics adoption

- 4.2.3 Surge in 5G smartphone production

- 4.2.4 MLCC supply instability favoring tantalum

- 4.2.5 Reliability demand in implantable medical devices

- 4.2.6 Expansion of mission-critical aerospace and defense electronics requiring high-reliability capacitors

- 4.3 Market Restraints

- 4.3.1 Tantalum ore price and supply volatility

- 4.3.2 Competition from ceramic and aluminum capacitors

- 4.3.3 Export controls on tantalum raw materials

- 4.3.4 Emerging niobium-oxide and graphene capacitors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investment and Funding Landscape

- 4.8 Porters Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Macroeconomic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Solid MnO2 Tantalum Capacitors

- 5.1.2 Solid Polymer Tantalum Capacitors

- 5.1.3 Wet Electrolytic Tantalum Capacitors

- 5.1.4 Niobium Oxide Capacitors

- 5.2 By Mounting Type

- 5.2.1 Surface-Mount (SMD)

- 5.2.2 Through-Hole (Leaded)

- 5.3 By Capacitance Range

- 5.3.1 Up to 100 uF

- 5.3.2 100 to 1,000 uF

- 5.3.3 Above 1,000 uF

- 5.4 By Application

- 5.4.1 Consumer Electronics

- 5.4.2 Automotive Electronics

- 5.4.3 Industrial Equipment

- 5.4.4 Medical Devices

- 5.4.5 Defense and Aerospace

- 5.4.6 Telecommunications Infrastructure

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Vendor Positioning Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.4.1 KEMET Corporation (Yageo)

- 6.4.2 KYOCERA AVX Components Corporation

- 6.4.3 Panasonic Corporation

- 6.4.4 Vishay Intertechnology Inc.

- 6.4.5 Hongda Capacitors Co. Ltd.

- 6.4.6 Samsung Electro-Mechanics

- 6.4.7 NIC Components Corp.

- 6.4.8 Exxelia Group

- 6.4.9 Abracon LLC

- 6.4.10 TE Connectivity Ltd.

- 6.4.11 Rohm Semiconductor

- 6.4.12 Suntan Capacitors

- 6.4.13 NEC Corporation

- 6.4.14 UF Capacitors Factory Co., LTD

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment