PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940890

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940890

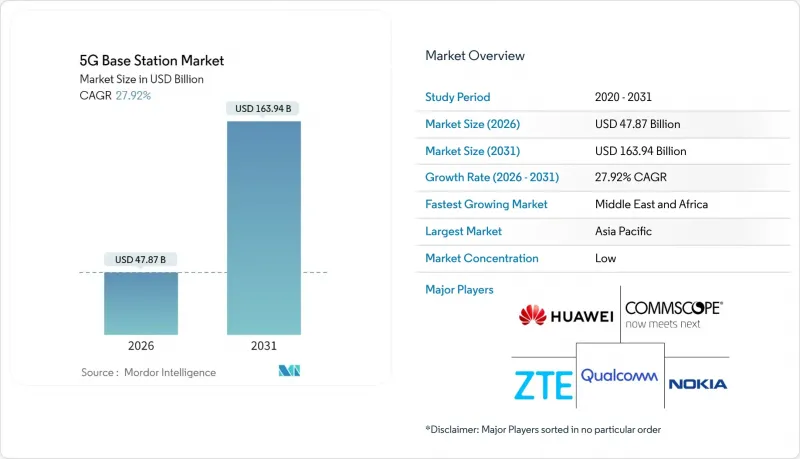

5G Base Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The 5G Base Station Market was valued at USD 37.44 billion in 2025 and estimated to grow from USD 47.87 billion in 2026 to reach USD 163.94 billion by 2031, at a CAGR of 27.92% during the forecast period (2026-2031).

Robust growth stems from governments turning spectrum auctions into infrastructure stimulus, operators upgrading to Open-RAN, and enterprises seeking ultra-reliable low-latency connections for automation and public-safety systems. China already operates more than 4.4 million live sites, while the United States and key European markets emphasize open architectures to cut vendor risk and spur innovation. Supply-chain diversification has become urgent after recent semiconductor shortages, pushing vendors to add regional manufacturing and gallium-nitride power amplifiers that lower energy bills by up to 50% at each site. Demand for private networks in smart factories, ports, and smart-city corridors further accelerates densification with small cells, massive-MIMO radios, and millimeter-wave nodes.

Global 5G Base Station Market Trends and Insights

Government Spectrum Auctions and Infrastructure Stimulus

Governments are turning spectrum sales into policy tools that expand coverage and local manufacturing. The United States allocated USD 42.45 billion under the Infrastructure Investment and Jobs Act, targeting rural broadband and 5G build-outs in underserved counties. India's USD 12 billion Production-Linked Incentive scheme rewards domestic production of radios and antennas, shortening supply chains and accelerating rural rollouts. Stable auction roadmaps and subsidy programs give operators cash-flow visibility that unlocks multi-year investment cycles and lifts the 5G base station market across both macro and small-cell layers.

Open-RAN Driven Brown-Field Upgrade Cycle

Open-RAN disaggregates radios, baseband, and software so carriers can blend best-of-breed vendors, slash procurement cost, and automate updates. Vodafone committed to swapping 2,600 United Kingdom sites to Open-RAN by 2027, targeting 30% cost savings and broader supplier diversity. Deutsche Telekom is extending multivendor trials across Germany and Poland to raise flexibility and spur domestic innovation. Although system integration remains complex, early commercial launches validate performance and are influencing procurement criteria for upcoming densification waves, boosting the 5G base station market.

High CAPEX and Long ROI Horizon

Operators face multi-billion-dollar rollouts with longer payback than prior network generations. Verizon disclosed spending above USD 10 billion per year on 5G radios and fiber backhaul and estimates a seven-to-ten-year return window versus about five years for LTE. Rural projects are even less economical, forcing carriers to focus on dense urban clusters unless subsidies cover viability gaps. The stretched cash cycle tempers the pace of nationwide coverage and limits 5G base station market expansion in lower-income countries.

Other drivers and restraints analyzed in the detailed report include:

- mmWave Small-Cell Roll-Outs for Private Industrial 5G

- Energy-Efficient GaN Power Amplifiers Cutting Total Site OPEX

- RF-Front-End Component Supply Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Macro cells represented USD 22.69 billion and 60.62% of the 2025 5G base station market share, providing umbrella coverage and mobility anchor services. Yet small cells are forecast to expand at a 28.85% CAGR, pushing their slice of the 5G base station market size toward USD 73.6 billion by 2031. Carriers deploy thousands of street-level nodes to relieve macro congestion in sports venues, transit corridors, and enterprise campuses. Verizon alone installed more than 50,000 low-power units that fill indoor dead zones and enable symmetrical gigabit rates.

Permitting challenges and aesthetic restrictions once hampered small-cell scaling, but streamlined Federal Communications Commission rulings shortened municipal review from several months to under 60 days. Private networks further lift demand because small cells create dedicated on-premises coverage without relying on public spectrum. Vertical asset owners such as Crown Castle now report triple-digit growth in signed indoor contracts, underscoring how densification underpins the global 5G base station market.

Non-standalone deployments still held 57.95% share in 2025 as operators leveraged existing LTE cores for quick service launches. However the standalone cohort is maintaining a steep 29.35% CAGR, and its share of the 5G base station market size will exceed 60% by 2031. ATandT activated standalone slices for industrial clients needing deterministic latency, while T-Mobile extended nationwide standalone coverage that enables differentiated performance tiers.

Standalone architecture unlocks network slicing, distributed edge computing, and advanced encryption that non-standalone cannot deliver. Dish Network avoided legacy anchors and built an entirely cloud-native network, demonstrating lower operating expenses and rapid feature release cycles. Although core migration raises complexity and skills requirements, operators recognize the long-term revenue upside, accelerating orders for compatible radios and core software.

The 5G Base Station Market Report is Segmented by Type (Small Cell, Macro Cell), Architecture (Stand-Alone SA, Non-Stand-Alone NSA), Frequency Band (Sub-6 GHz, Mmwave 24-40 GHz), Power Rating (<=10 W, 10-40 W, >=40 W), MIMO Technology (Conventional MIMO, Massive MIMO >=64T64R), End User (Commercial Mobile Operators, Residential/Consumer FWA, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 41.10% share in 2025 thanks to China's 4.4 million live sites and a national mandate for near-universal coverage by 2025. Japan and South Korea moved early into standalone and edge-computing deployments, commercializing network slicing for manufacturing and media services. India's 2024 spectrum auctions unlocked capital from Bharti Airtel and Reliance Jio, with first-wave deployments in twenty-three cities during 2025 and rural extensions scheduled by 2027. Local semiconductor clusters in Taiwan and South Korea anchor component supply, reinforcing the region's influence on the global 5G base station market.

North America trails only marginally in volume and leads on millimeter-wave innovation. Verizon activated gigabit fixed wireless access in twenty-six states, while ATandT concentrates on enterprise private-cellular projects for cloud and edge workloads. Canada's auctions raised funding for rural expansion and mandated open-access roaming, stimulating incremental base-station demand. Regulatory patchwork at county and city levels slows permitting in some corridors, yet stimulus funds and tower-company build-leases sustain a healthy North American contribution to the 5G base station market.

The Middle-East and Africa region is the fastest-growing at 29.55% CAGR. Saudi Arabia's Vision 2030 digital blueprint finances nationwide 5G and positions Riyadh as a tech-hub for Arabic content delivery. The United Arab Emirates rolled out 5G across 97% of populated areas and now trials 5G-Advanced services. In Africa, Kenya and Nigeria favor wireless over fiber for broadband and fintech inclusion, but currency risk and energy cost inflate project budgets. Multilateral banks and vendor-financing schemes thus play a bigger role in realizing the continent's 5G aspirations.

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co. Ltd

- CommScope Holding Company Inc.

- Qualcomm Incorporated

- Qorvo Inc.

- Alpha Networks Inc.

- NEC Corporation

- Fujitsu Ltd

- Airspan Networks Holdings Inc.

- Mavenir Systems Inc.

- Parallel Wireless Inc.

- Baicells Technologies Co. Ltd

- JMA Wireless

- Comba Telecom Systems Holdings

- Sercomm Corp.

- ACE Technologies Corp.

- NEC Platforms, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising mobile data traffic and smartphone penetration

- 4.2.2 Superior latency and bandwidth advantages of 5G

- 4.2.3 Government spectrum auctions and infrastructure stimulus

- 4.2.4 Open-RAN driven brown-field upgrade cycle

- 4.2.5 mmWave small-cell roll-outs for private industrial 5G

- 4.2.6 Energy-efficient GaN PAs cutting total site OPEX

- 4.3 Market Restraints

- 4.3.1 High CAPEX and long ROI horizon

- 4.3.2 Spectrum fragmentation and regulatory delays

- 4.3.3 RF-front-end component supply bottlenecks

- 4.3.4 Sustainability compliance inflating site costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Small Cell

- 5.1.2 Macro Cell

- 5.2 By Architecture

- 5.2.1 Stand-Alone (SA)

- 5.2.2 Non-Stand-Alone (NSA)

- 5.3 By Frequency Band

- 5.3.1 Sub-6 GHz

- 5.3.2 mmWave (24-40 GHz)

- 5.4 By Power Rating

- 5.4.1 Less than or equal to 10 W

- 5.4.2 10-40 W

- 5.4.3 More than or equal to 40 W

- 5.5 By MIMO Technology

- 5.5.1 Conventional MIMO

- 5.5.2 Massive MIMO (More than 64T64R)

- 5.6 By End User

- 5.6.1 Commercial Mobile Operators

- 5.6.2 Residential/Consumer FWA

- 5.6.3 Industrial Private Networks

- 5.6.4 Government and Defense

- 5.6.5 Smart Cities and Public Safety

- 5.6.6 Other End Users

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Chile

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Australia

- 5.7.4.6 Indonesia

- 5.7.4.7 Thailand

- 5.7.4.8 Malaysia

- 5.7.4.9 Vietnam

- 5.7.4.10 Philippines

- 5.7.4.11 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Israel

- 5.7.5.1.5 Qatar

- 5.7.5.1.6 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Kenya

- 5.7.5.2.4 Egypt

- 5.7.5.2.5 Rest of Africa

- 5.7.5.1 Middle East

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huawei Technologies Co. Ltd

- 6.4.2 ZTE Corporation

- 6.4.3 Nokia Corporation

- 6.4.4 Telefonaktiebolaget LM Ericsson

- 6.4.5 Samsung Electronics Co. Ltd

- 6.4.6 CommScope Holding Company Inc.

- 6.4.7 Qualcomm Incorporated

- 6.4.8 Qorvo Inc.

- 6.4.9 Alpha Networks Inc.

- 6.4.10 NEC Corporation

- 6.4.11 Fujitsu Ltd

- 6.4.12 Airspan Networks Holdings Inc.

- 6.4.13 Mavenir Systems Inc.

- 6.4.14 Parallel Wireless Inc.

- 6.4.15 Baicells Technologies Co. Ltd

- 6.4.16 JMA Wireless

- 6.4.17 Comba Telecom Systems Holdings

- 6.4.18 Sercomm Corp.

- 6.4.19 ACE Technologies Corp.

- 6.4.20 NEC Platforms, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment