PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940909

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940909

United States Roofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

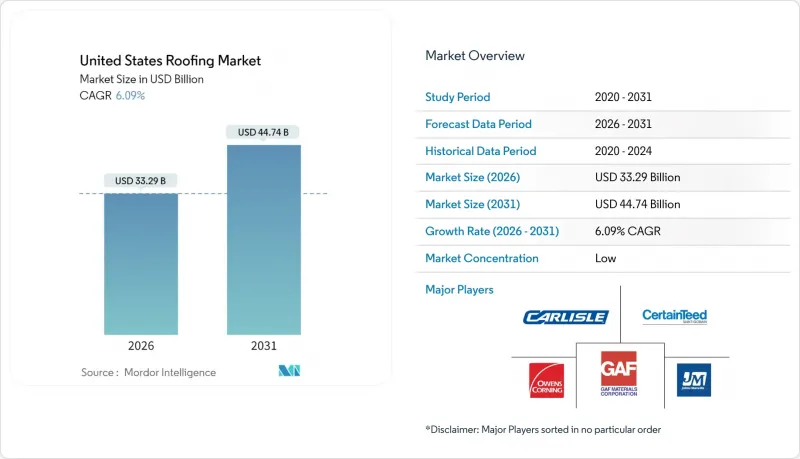

United States Roofing Market market size in 2026 is estimated at USD 33.29 billion, growing from 2025 value of USD 31.38 billion with 2031 projections showing USD 44.74 billion, growing at 6.09% CAGR over 2026-2031.

Renewals triggered by the nation's aging housing stock, the growing frequency of severe weather events, and federal energy-efficiency incentives underpin this steady expansion. Re-roofing activities account for more than four-fifths of annual installation volume, giving the industry a predictable demand foundation even when new construction moderates. Flat and low-slope systems dominate commercial projects because their membrane technologies satisfy modern building-code requirements for energy performance, while metal and TPO products outpace other materials as owners seek durability and solar-ready surfaces. Distribution consolidation, led by Home Depot's and QXO's multibillion-dollar deals, ushers artificial-intelligence tools into supply chains and positions large platforms to offer contractors faster deliveries and tailored assortments.

United States Roofing Market Trends and Insights

Housing-Stock Re-Roofing Cycle Drives Sustained Demand

More than four-fifths of annual roofing demand comes from re-roofing, and the median U.S. home age is nearing 40 years. Elevated wind exposure accelerates asphalt-shingle degradation, with field studies showing failures as early as 10 years into service life. Concentrated cohorts of post-war homes in the Northeast and Midwest are now simultaneously entering their renewal windows, giving contractors consistent volume regardless of macroeconomic swings. The cycle intensifies when mortgage rates dip, allowing owners to convert equity into upgrade budgets. Drone-based condition assessments shorten inspection times and create objective datasets that speed insurance claims, further smoothing project pipelines.

Climate-Driven Storm Repairs Reshape Market Dynamics

U.S. roof-related claims exceeded USD 30 billion in 2024 as convective storms produced USD 57 billion in property damage, almost double the prior year. Texas, Colorado, and adjacent Tornado Alley states account for a rising share of events, with non-catastrophic wind and hail claims climbing from 17% in 2022 to 25% in 2024. This recurring hazard compresses replacement cycles and pushes demand spikes into already tight labor markets. Insurers now depreciate coverage for roofs older than 15-20 years and offer premium credits for Class 4 impact-rated systems, nudging customers toward higher-cost metal and synthetic products.

Skilled-Labor Shortages Constrain Growth Potential

The construction sector needs 501,000 more workers in 2025, yet 1 in 5 roofers is already over 55 years old. Harsh job-site conditions drive higher turnover than in other trades, and apprenticeship completions lag demand despite NRCA's expanded TRAC curriculum and Clemson's USD 1 million Roofing Industry Center commitment. Labor shortfalls inflate installation costs, extend project backlogs, and limit the pace at which contractors can scale into storm-damaged regions. Private equity-backed platforms recruit aggressively, but smaller shops struggle to match wage offers and benefit packages, widening capacity gaps.

Other drivers and restraints analyzed in the detailed report include:

- Federal Energy Efficiency Incentives Accelerate Premium Adoption

- Retail Distribution Consolidation Transforms Market Access

- Material Price Volatility Pressures Margin Stability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential applications generated 59.12% of 2025 revenue for the United States roofing market and are on track for a 7.18% CAGR through 2031 as aging homes collide with storm-driven replacements. Predictable renewal cycles give installers steady baselines, while Section 25C credits persuade owners to upgrade to energy-efficient shingles or metal panels that boost property values. Insurers incentivize impact-rated systems, compressing replacement timelines even further.

Commercial demand gains momentum from corporate net-zero commitments and an e-commerce-fueled warehouse boom. Low-slope membranes with solar-ready surfaces attract facility managers seeking lower operating costs, and federal infrastructure funding channels work to schools, transit centers, and public offices. Although residential still anchors the United States roofing market, large national contractors increasingly balance their portfolios with diversified commercial projects to hedge regional single-family swings.

Replacement undertakings represented 81.65% of the United States roofing market size in 2025, reflecting a mature building inventory and frequent storm damage settlements. Drone imagery, AI-assisted condition scoring, and streamlined insurance portals shorten claim cycles, driving faster roof tear-offs once weather events hit. Contractors, therefore, allocate personnel and inventory toward ready-response teams that specialize in reroof projects.

New installations account for a smaller share yet are forecast to grow 7.52% CAGR as migration pushes housing starts in the Sun Belt and data-center builds sweep secondary metros. Modern codes mandate reflective or fire-rated coverings, often elevating unit costs. Partnerships between builders and distributors enable job-site staging that minimizes theft and weather delays, reinforcing adoption even when labor remains tight.

The United States Roofing Market Report is Segmented by Sector (Residential, Commercial, Infrastructure), by Installation Type (New Installation, Replacement/Renovation), by Roofing Type (Slope Roof, Flat/Low-Slope Roof), by Material Type (Modified Bitumen, EPDM Rubber, TPO, PVC Membrane, and More), and by Geography (Northeast, Midwest, Southeast, West, Southwest). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- GAF Materials Corporation

- Owens Corning

- CertainTeed (Saint-Gobain)

- Carlisle Companies Inc.

- Johns Manville (Berkshire Hathaway)

- IKO Industries

- TAMKO Building Products

- Atlas Roofing Corporation

- Beacon Building Products

- ABC Supply Co.

- Holcim Elevate (Firestone Building Products)

- Duro-Last Inc.

- Malarkey Roofing Products

- CentiMark Corporation

- Tecta America

- Flynn Group

- Baker Roofing Company

- IronHead Roofing

- Sika Sarnafil

- MFM Building Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Housing-stock re-roofing cycle (>=80 % of demand)

- 4.2.2 Climate-driven storm repairs & insurance spend

- 4.2.3 Federal/State energy-efficiency incentives (IRA tax credits, Title 24)

- 4.2.4 Retail giant entry into specialty distribution (Home Depot-SRS deal)

- 4.2.5 AI-enabled aerial data pricing/claims (Verisk, EagleView)

- 4.3 Market Restraints

- 4.3.1 Skilled-labor shortages elevating installation costs

- 4.3.2 Volatility in asphalt & polymer feedstock prices

- 4.3.3 Proliferation of counterfeit/sub-spec materials

- 4.3.4 Insurance tightening: higher deductibles & roof-age exclusions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.2.1 Offices and Retail

- 5.1.2.2 Industrial and Logistics

- 5.1.2.3 Others

- 5.1.3 Infrastructure

- 5.2 By Installation Type

- 5.2.1 New Installation

- 5.2.2 Replacement / Renovation (Re-Roofing)

- 5.3 By Roofing Type

- 5.3.1 Slope Roof

- 5.3.2 Flat / Low-Slope Roof

- 5.4 By Material Type

- 5.4.1 Modified Bitumen

- 5.4.2 EPDM Rubber

- 5.4.3 Thermoplastic Polyolefin

- 5.4.4 PVC Membrane

- 5.4.5 Metals

- 5.4.6 Tiles

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 Southeast

- 5.5.4 West

- 5.5.5 Southwest

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 GAF Materials Corporation

- 6.4.2 Owens Corning

- 6.4.3 CertainTeed (Saint-Gobain)

- 6.4.4 Carlisle Companies Inc.

- 6.4.5 Johns Manville (Berkshire Hathaway)

- 6.4.6 IKO Industries

- 6.4.7 TAMKO Building Products

- 6.4.8 Atlas Roofing Corporation

- 6.4.9 Beacon Building Products

- 6.4.10 ABC Supply Co.

- 6.4.11 Holcim Elevate (Firestone Building Products)

- 6.4.12 Duro-Last Inc.

- 6.4.13 Malarkey Roofing Products

- 6.4.14 CentiMark Corporation

- 6.4.15 Tecta America

- 6.4.16 Flynn Group

- 6.4.17 Baker Roofing Company

- 6.4.18 IronHead Roofing

- 6.4.19 Sika Sarnafil

- 6.4.20 MFM Building Products

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment