PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433942

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433942

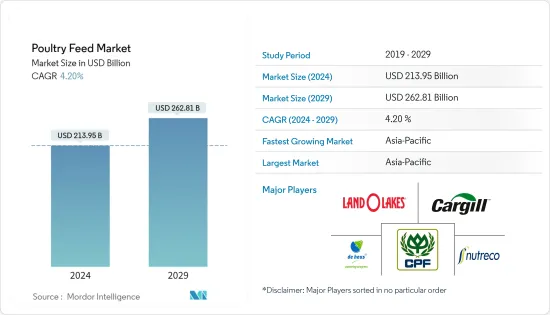

Poultry Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Poultry Feed Market size is estimated at USD 213.95 billion in 2024, and is expected to reach USD 262.81 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Key Highlights

- With the increasing global population and rising demand for poultry meat across various sectors of fast-food restaurants, poultry producers across the world are ramping up their production to meet consumer demands. According to a report by the EU Agricultural and Rural Development, the consumption of poultry meat is estimated to reach 12,443.0 metric tons by 2030 because poultry is considered a cheap, healthy, and sustainable product option by consumers. Therefore, the increased production demand for healthy and nutritious poultry meat is anticipated to propel market growth.

- The rapidly increasing demand for poultry meat products is the primary factor driving the market. Poultry is considered one of the most economical sources of protein, owing to which poultry products such as eggs and meat consistently witness growth in demand. Furthermore, the rising incomes of consumers and increasing urbanization in the Asia-Pacific region are leading to increased demand for poultry products. It, in turn, is leading to the growth of the market studied.

- According to the Alltech feed survey in 2021, among feed production by animal type, the boilers accounted for 28% of total feed production, while the layers accounted for 14% of the total feed production. The survey indicated that broilers are a predominantly growing sector in the poultry species. Thus, the growing feed production is bolstering the market's growth during the forecast period.

- The increasing poultry expansion projects are further aiding the growth of the market. For instance, in April 2021, Tyson Poultry group in Arkansas invested USD 48 million to increase the poultry production capacity and meet the rapidly soaring chicken demand. The increasing investment in poultry expansion is further serving as an opportunity for the poultry feed sector growth.

- Quality and the price of feed products are emerging as the most prominent factors in the market growth. The governments are imposing various regulations to maintain the feed quality and safeguard animal health, recognizing its importance. Thus, the increasing demand for poultry meat, growing consumer income, urbanization, and rising poultry production investments are bolstering the market's growth during the forecast period.

Poultry Feed Market Trends

Rising Demand for Poultry Products

Recently, poultry is one of the fastest-growing segments of the agricultural sector. The poultry sector underwent significant structural changes during the past two decades due to modern intensive production methods introduction, genetic improvements, improved preventive disease control and biosecurity measures, increasing income and human population, and urbanization. The increase in poultry meat consumption is most evident in East and Southeast Asia and Latin America, particularly in China and Brazil. The share of the world's poultry meat consumed in developing countries increased over the past decade. It is estimated that poultry meat production and consumption in developing countries will increase by 3.6% per annum due to rising incomes, diet diversification, and expanding markets. According to OCED Agricultural Outlook, 2020, the per capita consumption of poultry meat worldwide increased from 13.86 kg in 2017 to 13.92 kg in 2020.

Supermarkets and shopping malls' emergence support chilled and frozen poultry product retailing growth. In addition, government policies ensure competitively priced product supply, boosting the poultry sector growth. Due to the increasing working population and incomes, the demand for convenient, high-quality chicken products is continually increasing. With increased health awareness, consumers are willing to spend more on healthy meat products, further contributing to the market's growth.

Furthermore, the demand for poultry meat from rapidly growing fast-food restaurants, such as McDonald's, KFC, Nando's, Marrybrown, and various other outlets, is fueling the poultry sector growth, which is, in turn, resulting in market development. For instance, according to USDA, chicken meat production in 2018 was 92,726 thousand metric tons which increased by approximately 7.9% and reached 100,026 metric tons in 2020.

Poultry production must increase to keep up with the increasing consumer demand, which requires optimum use of high-quality feed to improve production efficiency, feed conversion ratios and enhance animal health. It is anticipated to boost the market during the forecast period.

Asia-Pacific Dominates the Market

Asia-Pacific is the largest market for poultry feed. A vast population and growing disposable incomes are likely to trigger market growth at the fastest rate in the Asia Pacific. The poultry sector in China and India experienced vigorous growth over the past two decades in terms of poultry numbers and the level of output per bird. Higher production levels are associated with the spread of intensive systems in which food conversion ratios are high.

Feed use in China is growing due to the country's strong demand for chicken meat. The production of chicken meat increased from 14,373,315 metric tons in 2017 to 15,823,712 metric tons in 2020, according to the Food and Agriculture Organization (FAO). Further, the poultry industry is also benefiting from government incentives to support recovery and restocking. Additionally, several leading broiler enterprises in China invested in new broiler construction projects, with a total investment of up to RMB 7.4 billion (USD 1 billion) in 2020.

Likewise, increasing per capita income, expansion of quick-service restaurants in India, and growing demand for quality poultry products have significantly contributed to the rising demand for poultry feed in India. It will likely accelerate poultry feed sales in the country in the future. Hence, the need for poultry feed continues to be high in emerging economies of Asia-Pacific in countries like China and India. It leads to increasing quality feed use for a higher poultry population. Also, global poultry meat production is growing, with two-thirds of the increase in Asia-Pacific.

Poultry Feed Industry Overview

The Poultry Feed Market is highly fragmented. Charoen Pokphand Foods, Cargill Inc., Nutreco NV, Land O'Lakes Inc., and De Heus BV are some major players operating in the market. The players are investing in new products and improvisation of products, partnerships, expansions, and acquisitions for business expansions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Animal Type

- 5.1.1 Layers

- 5.1.2 Broilers

- 5.1.3 Turkey

- 5.1.4 Other Animal Type

- 5.2 Ingredient Type

- 5.2.1 Cereal

- 5.2.2 Oilseed Meal

- 5.2.3 Molasses

- 5.2.4 Fish Oil and Fish Meal

- 5.2.5 Supplements

- 5.2.6 Other Ingredient Type

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle east and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle east and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Charoen Pokphand Foods

- 6.3.2 Cargill Inc.

- 6.3.3 Alltech Inc.

- 6.3.4 Archer Daniels Midland

- 6.3.5 De Heus BV

- 6.3.6 Land O Lakes Inc.

- 6.3.7 ForFarmers

- 6.3.8 Nutreco N.V.

- 6.3.9 Kent Nutrition Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS