PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403935

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403935

North America Non Lethal Weapons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

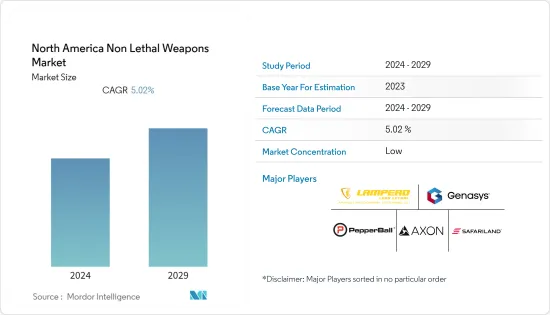

The North America Non-Lethal Weapons Market size is estimated at USD 2.48 billion in 2024. It is expected to reach USD 3.17 billion by 2029, registering a CAGR of 5.02% during the forecast period.

Law enforcement agencies and military forces in North America are updating their equipment to include non-lethal options in their arsenal. The aim is to enhance their capabilities to handle various situations, including civil unrest and crowd control. Non-lethal weapons are deployed during protests, demonstrations, and riots to disperse crowds and maintain order while minimizing casualties.

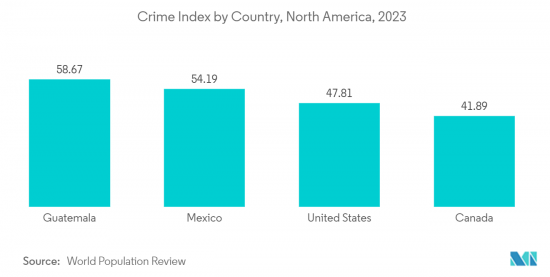

Increasing political tensions and armed violence resulted in governments worldwide taking provisions and equipping the military and police forces with non-lethal weapons. Occurrences of civilian violence and clashes with armed forces in the North American region led to the deployment of non-lethal weapons. The growth in riots in the region might drive the demand for non-lethal weapons as law enforcement agencies try to decrease fatalities and casualties in such incidents, which may help the market during the forecast period. Furthermore, technological advancements in terms of non-lethal weapons by various players across several countries in the region are expected to provide growth opportunities for the market during the forecast period.

North America Non-lethal Weapons Market Trends

Ammunition Segment to Register the Highest CAGR During the Forecast Period

Currently, the ammunition segment includes the highest share out of all the segments. Technological advancements in non-lethal weapon technologies are expected to increase demand for related ammunition, such as rubber bullets, bean bag rounds, and smoke munitions in the region. Non-lethal weapons, such as rubber bullets and tear gas, became standard tools for the police forces to control civilian protests. The law enforcement agencies use tactics and tools, such as handheld impact weapons (police batons, expandable batons, nunchakus), tasers and other electronic stun devices, and chemical agents, such as OC and CS, to subdue combative subjects and protect themselves and others from a potential threat. The effective use of such options requires officers to be near their opponents, which increases the risk to officers. It, thus, presents the possibility that an altercation may escalate to a point where deadly force becomes necessary. Hence, to reduce the likelihood of such an altercation, law enforcement agencies are rapidly adopting high-impact ammunition, such as wooden dowels, foam rubber projectiles, and small bean bags, to disperse the violent crowd from a distance. For instance, in April 2021, the city of Pittsburgh requested a Formal Invitation for Bids of various less-lethal weapons for the Pittsburgh Police Force. The request included thousands of projectile beanbags, hundreds of sponge rounds, dozens of tear gas canisters, and other less-lethal weapons. Such ongoing advancements and procurements of ammunition for less-lethal weapons are expected to boost the growth of this segment.

The United States to Dominate Market Share During the Forecast Period

The North American non-lethal weapons market is driven by an increase in violence-related incidents in the US and the subsequent demand for non-lethal weapons by law enforcement agencies to contain the situation effectively. Moreover, growing issues regarding personal safety may lead to the growth of the non-lethal weapons market in the United States. Additionally, the US Department of Defence (DoD) is now focusing on developing non-lethal weapons to minimize the probability of fatalities and permanent injuries. The use of non-lethal weapons by the US Army is increasing as they are essential in places where the army cannot engage targets located or positioned such that the application of lethal, destructive fires is prohibitive or would be counter-productive to the initial goal and objective. The Joint Intermediate Force Capabilities Office is currently working on inducting a kit for the standard remotely operated weapon station (CROWS) with laser or acoustic device, production of 81 mm flashbang munition for the US Marine Corps., and millimeter-wave active denial systems, among others.

The US Department of Defense is increasingly focused on "Gray zone" competition with other great powers, striving to deter aggression while also avoiding escalation to full-scale war. The DoD includes a variety of NLWs at its disposal, with others under development. Examples include acoustic hailers to communicate or intimidate at long ranges, eye-safe laser dazzlers that create glare, millimeter-wave emitters that cause a temporary heating sensation, and various systems that stop vehicles or vessels. Such investments of law enforcement authorities and armed forces for developing and deploying non-lethal weapons are expected to drive the growth of this market during the forecast period.

North America Non-lethal Weapons Industry Overview

The market for North American non-lethal weapons is fragmented, with several players providing various types of less-lethal weapons to military and law-enforcement agencies. Some prominent North American non-lethal weapons market players are Lamperd Less Lethal, Inc., Pepperball Technologies Inc., Genasys Inc., Axon Enterprise Inc., and Safariland LLC. To increase their market share, the companies are implementing merger and acquisition strategies by acquiring companies that complement their existing product portfolio. For instance, Byrna Technologies Inc. announced that the company completed the acquisition of Mission Less Lethal from Kore (US) Outdoor Inc. in May 2021. Mission Less Lethal is one of the US-based manufacturers of shoulder-fired .68 caliber non-lethal launchers for law enforcement and other security agencies. The companies are also introducing product innovation initiatives to strengthen their market presence. On this note, in May 2022, Verus Research received a small business innovative research (SBIR) contract from the US DoD Joint Intermediate Force Capabilities Office (JIFCO) that provided funds to develop broadband counter-electronics weapons (BCEW). The BCEW is a long-range, non-lethal weapon that is expected to be used for stopping vehicles and vessels. Such agreements for developing new, less-lethal weapons are expected to help the companies increase their regional footprint.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD, 2018 - 2027)

- 5.1 Type

- 5.1.1 Area Denial

- 5.1.1.1 Anti-vehicle

- 5.1.1.2 Anti-personnel

- 5.1.2 Ammunition

- 5.1.2.1 Rubber Bullets

- 5.1.2.2 Wax Bullets

- 5.1.2.3 Plastic Bullets

- 5.1.2.4 Bean Bag Rounds

- 5.1.2.5 Sponge Grenade

- 5.1.3 Explosives

- 5.1.3.1 Flash Bang Grenades

- 5.1.3.2 Sting Grenads

- 5.1.4 Gases and Sprays

- 5.1.4.1 Water Canons

- 5.1.4.2 Scent-based Weapons

- 5.1.4.3 Teargas

- 5.1.4.4 Pepper Sprays

- 5.1.5 Directed Energy Weapons

- 5.1.6 Electroshock Weapons

- 5.1.1 Area Denial

- 5.2 Application

- 5.2.1 Law Enforcement

- 5.2.2 Military

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lamperd Less Lethal, Inc.

- 6.2.2 Combined Systems Inc.

- 6.2.3 NonLethal Technologies Inc.

- 6.2.4 Pepperball Technologies Inc. (UTS United Tactical Systems, LLC)

- 6.2.5 Bruzer Less Lethal

- 6.2.6 PACEM Solutions International

- 6.2.7 Axon Enterprise Inc.

- 6.2.8 Condor Non-Lethal Technologies

- 6.2.9 Safariland LLC

- 6.2.10 Mace Security International Inc.

- 6.2.11 Zarc International Inc.

- 6.2.12 Rheinmetall AG

- 6.2.13 ISPRA by EL Ltd.

- 6.2.14 Herstal Group

- 6.2.15 Byrna Technologies Inc.

- 6.2.16 Armament Systems & Procedures Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS