PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907232

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907232

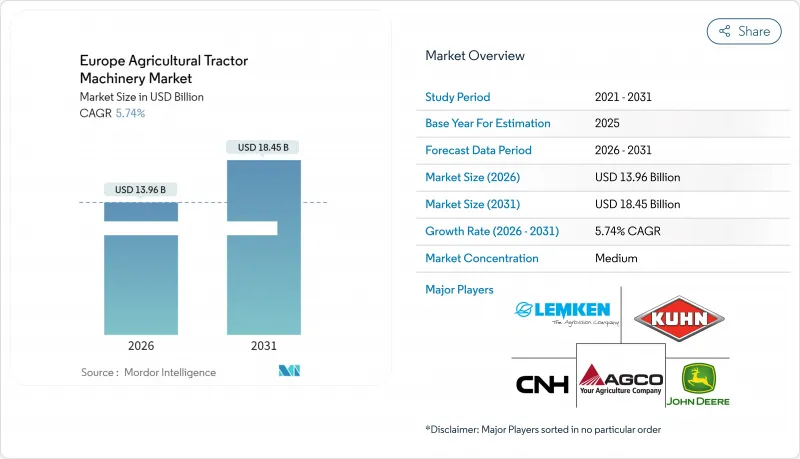

Europe Agricultural Tractor Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe agricultural tractor machinery market was valued at USD 13.2 billion in 2025 and estimated to grow from USD 13.96 billion in 2026 to reach USD 18.45 billion by 2031, at a CAGR of 5.74% during the forecast period (2026-2031).

Demand gains stem from the European Union Common Agricultural Policy eco-schemes that underwrite precision-farming hardware, Stage V emissions compliance that accelerates fleet renewal, and persistent labor shortages that nudge farms toward automation. Suppliers answer with powered, sensor-rich implements that integrate through the ISO 11783 (ISOBUS) protocol, while electrification pilots create a parallel pull for low-draw attachments compatible with battery tractors. At the same time, dealer inventory overhang from 2023, volatile commodity prices, and mixed-fleet interoperability frictions temper adoption in price-sensitive pockets of Central and Eastern Europe. Competitive intensity remains moderate because the top five vendors leave room for niche specialists that address strip-till, orchard under-vine mowing, or greenhouse applications.

Europe Agricultural Tractor Machinery Market Trends and Insights

Precision-Farming Subsidies Under the EU Common Agricultural Policy (2025-2027 Tranche)

Mandatory eco-schemes now channel 25% of direct payments into proven input-efficiency projects, pushing farms to buy variable-rate planters, ISOBUS sprayers, and yield-mapping sensors. France, Germany, and Poland are moving toward such upgrades. Adoption lifts data-sharing, cooperative Terrena saw 38% of members stream implement telemetry in 2024, extending equipment life by 15%. Certification requirements favor ISO 11783-compliant brands and squeeze fringe suppliers out of subsidy eligibility, consolidating demand around a few large telematics ecosystems.

Labor Shortages Accelerating Automation Demand in Western and Northern Europe

Full-time farm employment in Germany fell 12% year on year in 2024. Horticulture in the Netherlands faces similar gaps, spurring take-up of robotic planters and vision-guided sprayers. Deere and Company reported a 47% jump in European shipments of its See and Spray system during 2024. Danish Agro deployed 15 autonomous mower-conditioner units that cut hay harvest labor costs by 30% while running day and night. The Europe agricultural tractor machinery market, therefore, tilts toward powered implements with embedded autonomy, widening the gap with legacy passive tools.

Dealer Over-Inventory Amassed Since 2023 Suppressing Fresh Orders through 2026

European dealers carried 9.2 months of implement supply at the start of 2024 versus a normal 5.5 months. BayWa posted EUR 340 million (USD 360 million) in unsold tillage and seeding stock, then cut 2025 purchase plans by 22%. French distributor InVivo similarly trimmed new orders 18% and pivoted to refurbishing used assets. Manufacturers extended payment terms to 180 days and offered consignment, but the margin squeeze still discourages dealers from stocking incremental models, slowing near-term growth in the Europe agricultural tractor machinery market.

Other drivers and restraints analyzed in the detailed report include:

- Stage V Emissions Rules Propelling Retrofit and Replacement of PTO-Efficient Implements

- Growth of Controlled-Traffic Farming Boosting Demand for Lightweight, Wide-Working-Width Tillage Tools

- High Capital Cost for Smart Implements on Fragmented Small Holdings in Eastern Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plowing and cultivating machinery tools secured 45.30% of 2025 revenue in the Europe agricultural tractor machinery market. Planting machinery, aided by controlled-traffic mandates and real-time variable-rate algorithms, will grow at a 7.66% CAGR through 2031. French cooperative Axereal documented a 12% reduction in seed cost per hectare after rolling out GPS section control across 85,000 hectares.

Planting machinery capture the fastest expansion because eco-scheme payments specifically reward reductions in seed waste. Lemken's electric-meter Azurit planter sells at a 28% premium yet pays back within three seasons on farms above 500 hectares. Haying and forage machinery continue to serve the continent's grassland but hinge on stable dairy and beef herds. Other specialty implements remain fragmented. The segment illustrates how subsidy rules and data capability shift profits toward powered, software-defined machines within the wider Europe agricultural tractor machinery market size.

The Europe Agricultural Tractor Machinery Market Report is Segmented by Machinery Type (Plowing and Cultivating Machinery, Planting Machinery, and More) and by Geography (Germany, France, Italy, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation (Kubota Corporation)

- CLAAS KGaA mbH

- Kuhn Group (Bucher Industries AG)

- Lemken GmbH & Co. KG

- SDF Group

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Ltd

- Amazonen-Werke H. Dreyer SE

- Pottinger Landtechnik GmbH

- Vaderstad AB

- Maschio Gaspardo S.p.A.

- Salford Group (Linamar Corporation)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Precision-farming subsidies under the EU Common Agricultural Policy (CAP) (2025-2027 tranche)

- 4.2.2 Labor shortages accelerating automation demand in Western and Northern Europe

- 4.2.3 Stage V emissions rules driving retrofit and replacement of PTO-efficient implements

- 4.2.4 Growth of controlled-traffic farming boosting demand for lightweight, wide-working-width tillage tools

- 4.2.5 Surge in vineyard/orchard mechanization in Mediterranean countries

- 4.2.6 Emerging electric-tractor ecosystem requiring low-draw, ISOBUS-ready implements

- 4.3 Market Restraints

- 4.3.1 Dealer over-inventory since 2023 suppressing fresh orders through 2026

- 4.3.2 High capital cost for smart implements on fragmented small holdings in Eastern Europe

- 4.3.3 Complex interoperability standards (ISOBUS, TIM) delaying adoption among mid-size farms

- 4.3.4 Volatile commodity prices lowering farmers cash flow for discretionary equipment

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Threat of Substitutes

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Bargaining Power of Suppliers

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Plowing and Cultivating Machinery

- 5.1.1.1 Plows

- 5.1.1.2 Harrows

- 5.1.1.3 Rotovators and Cultivators

- 5.1.1.4 Other Plowing and Cultivating Machinery

- 5.1.2 Planting Machinery

- 5.1.2.1 Seed Drills

- 5.1.2.2 Planters

- 5.1.2.3 Spreaders

- 5.1.2.4 Other Planting Machinery

- 5.1.3 Haying and Forage Machinery

- 5.1.3.1 Mowers and Conditioners

- 5.1.3.2 Balers

- 5.1.3.3 Other Haying and Forage Machinery

- 5.1.4 Sprayers

- 5.1.5 Other Types

- 5.1.1 Plowing and Cultivating Machinery

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 Italy

- 5.2.4 United Kingdom

- 5.2.5 Spain

- 5.2.6 Netherlands

- 5.2.7 Poland

- 5.2.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation (Kubota Corporation)

- 6.4.5 CLAAS KGaA mbH

- 6.4.6 Kuhn Group (Bucher Industries AG)

- 6.4.7 Lemken GmbH & Co. KG

- 6.4.8 SDF Group

- 6.4.9 Mahindra & Mahindra Ltd

- 6.4.10 Tractors and Farm Equipment Ltd

- 6.4.11 Amazonen-Werke H. Dreyer SE

- 6.4.12 Pottinger Landtechnik GmbH

- 6.4.13 Vaderstad AB

- 6.4.14 Maschio Gaspardo S.p.A.

- 6.4.15 Salford Group (Linamar Corporation)

7 Market Opportunities and Future Outlook