PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639379

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639379

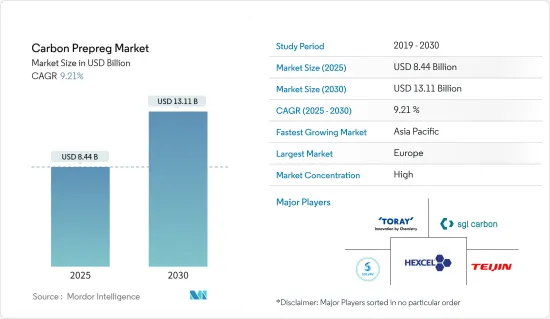

Carbon Prepreg - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Carbon Prepreg Market size is estimated at USD 8.44 billion in 2025, and is expected to reach USD 13.11 billion by 2030, at a CAGR of 9.21% during the forecast period (2025-2030).

Due to the COVID-19 outbreak tourism sector was affected negatively which affected the aerospace industry. However, the easing of lockdowns and countries lifting travel restrictions led to increased traveling in the years 2021 and 2022 which helped the carbon prepreg market reach pre-pandemic levels.

Key Highlights

- Emphasis on green energy sources, growing demand from CFRP components, and the growing demand from the aerospace and defense industry are likely to act as drivers for the market over the forecast period.

- However, the availability of eco-friendly alternatives is likely to hinder the market growth during the forecast period.

- Increasing application in the electronics industry is likely to act as an opportunity in the future.

- Europe dominated the market across the world due increased demand from the defense sector.

Carbon Prepreg Market Trends

Increasing Demand from the Aerospace and Defence Industry

- Traditionally, manufacturers in aerospace turned to carbon composites for their significant weight reductions and cost savings compared to conventional aerospace materials, such as aluminum. Most aerospace composites use carbon prepregs as raw materials, with autoclave molding as a popular fabrication process. The aerospace industry is the greatest consumer of carbon prepregs for civil aircraft, military jets, helicopters, aero-engines or space satellites, and launchers.

- Carbon fiber composites are used in aerospace and defense applications due to their properties, such as high strength, stiffness, heat and chemical resistivity, and various other thermal and chemical properties.

- According to the Boeing Commercial Outlook 2022-2041, the global forecast for commercial aviation services (which include flight operations, maintenance and engineering, ground, station, and cargo operations, and others) by 2041 is expected to be USD 3,615 billion. It will likely boost the demand for the studied market in the coming years.

- Recently, aircraft manufacturers are looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041.

- Further, according to the report, the market size of aerospace services in Southeast Asia is expected to reach USD 245 billion and in Europe USD 850 million.

- This scenario in the aerospace industry is expected to continue driving the growth of the carbon prepreg market in the long term.

Europe to Dominate the Market

- Europe dominated the global carbon prepreg market. The German economy is the largest in Europe and the fifth-largest globally.

- Germany hosts many production bases for aircraft interior components, MRO (maintenance, repair, and overhaul), and lightweight construction and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- In Europe, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes are estimated to be 8,550 units by 2041, with a market service value of USD 850 billion. Thereby, the demand for optical coatings from aircraft manufacturing will likely rise in the region in the future.

- Further, according to the Boeing Commercial Outlook 2022-2041, the airline fleet in the region is expected to grow by 4.2% by 2041.

- Over 30 to 35 thousand new aircraft are estimated to be operational by the next 20 years to meet the rising aviation demand. Thus, the increase in aircraft production is also expected to contribute to the market growth during the forecast period.

- Further, in the year 2022, two new projects, which include Advanced Radar Technology in Europe (ARTURO) and Research in eco-designed ballistic systems for durable, lightweight protection against current and new threats in the platform and personal applications (ECOBALLIFE), were handed to the European Defense Agency (EDA) which are worth EUR 30 million (~USD 31.614 million).

- Hence, such trends in the industry in the region are expected to drive the market growth for carbon prepreg during the forecast period.

Carbon Prepreg Industry Overview

The global carbon prepreg market is consolidated, with the top five players accounting for a major market share studied. Major players in the market (not in any particular order) include TEIJIN LIMITED, Hexcel Corporation, TORAY INDUSTRIES, INC., SGL Carbon, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emphasis on Green Energy Sources

- 4.1.2 Growing Demand for CFRP Components

- 4.1.3 Growing Demand from the Aerospace and Defense Sector

- 4.2 Restraints

- 4.2.1 Availability of Eco-Friendly Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Thermoset

- 5.1.2 Thermoplastic

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Energy

- 5.2.3 Automotive

- 5.2.4 Leisure

- 5.2.5 Electronics

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACP Composites, Inc.

- 6.4.2 Kordsa Teknik Tekstil A.S.

- 6.4.3 Barrday Inc.

- 6.4.4 Gurit Services AG, Zurich

- 6.4.5 Hexcel Corporation

- 6.4.6 Lingol Corporation

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 PARK AEROSPACE CORP.

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TEIJIN LIMITED

- 6.4.12 THE YOKOHAMA RUBBER CO., LTD

- 6.4.13 TORAY INDUSTRIES, INC.

- 6.4.14 ZYVEX TECHNOLOGIES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in Electronics

- 7.2 Other Opportunities