PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1522877

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1522877

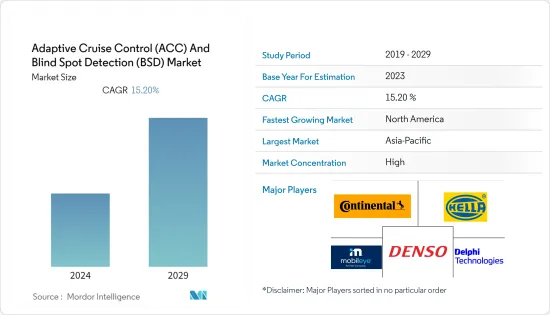

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Adaptive Cruise Control And Blind Spot Detection Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 7.27 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

The market for adaptive cruise control and blind spot detection has witnessed a significant surge in recent years. The growing awareness about vehicle safety has been one of the vital factors in the development of advanced safety systems, such as adaptive cruise control and blind-spot detection.

Additionally, the increase in the sales of luxury vehicles worldwide is also driving the market for ACC and BSD. In 2023, over 183 thousand units of luxury cars were sold worldwide, compared to 157 thousand units in 2022. This indicated a significant surge of over 16%.

Further, the enactment of stringent safety regulations and increasing vehicle safety concerns among consumers have also propelled the market for ACC and BSD. According to the World Health Organization, nearly 1.35 million people die annually due to road accidents. The cause of these accidents is mostly attributed to the driver's inability to judge certain conditions and make the right decisions. The efforts of governments to reduce fatalities due to road accidents have led to increased installation of safety systems in new vehicles.

More than 90% of the market studied is captured by OEMs, with a limited and unorganized aftermarket for the blind spot detection system. Eyeing the growth opportunities present in the market, the leading players are increasingly incorporating these features in their vehicles to cater to consumer demand.

All these factors combined indicate potential growth for the ACC and BSD market during the forecast period.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Market Trends

Passenger Car Segment is The Largest Vehicle Type Segment

The passenger car segment is the largest market segment for adaptive cruise control (ACC) and blind spot detection (BSD) among vehicle types. There has been a widespread integration of advanced driver assistance systems (ADAS) in modern passenger cars, driven by a growing emphasis on safety and the increasing consumer demand for enhanced driving experiences.

Passenger car manufacturers are largely offering cutting-edge features that enhance both safety and convenience. ACC systems are well-suited for highway driving, making them particularly attractive for daily commuters and long-distance travelers using passenger cars. The mainstream adoption of ACC in passenger cars is fuelled by advancements in sensor technologies, affordability, and a shift toward semi-autonomous driving features.

Similarly, blind spot detection has also become a crucial safety feature, especially in urban environments with dense traffic. The passenger car segment, being the largest volume contributor in the automotive market, experiences a higher incidence of lane changes and merging movements. BSD addresses the limitations of driver visibility by using sensors to detect vehicles in blind spots, reducing the risk of accidents during lane changes-a common scenario in passenger car usage.

Furthermore, regulatory initiatives and safety ratings that prioritize vehicles equipped with advanced safety features contribute to the prevalence of ACC and BSD in passenger cars. In North America, the United States New Car Assessment Program (US NCAP), a flagship program of the country's National High Traffic Safety Administration (NHTSA), focused on the incorporation of these safety systems, was introduced to reduce the safety-related concerns of buyers.

Automakers are integrating these technologies into their passenger car models, making them more appealing to a broader customer base. Market players have multiple active patents registered to their name related to autonomous features in their vehicles. In 2022, Toyota had the most number of active patents, amounting to 1,823, followed by Baidu and Honda Motors.

Apart from passenger cars, commercial vehicles, particularly large trucks, are also seeing an increase in demand for sophisticated driver assistance systems and collision avoidance systems. Commercial vehicles are longer and broader than passenger vehicles, resulting in substantially greater blind areas. Thus, to enhance safety and eliminate blind spots, companies, in consultation with commercial vehicle manufacturers, are developing blind spot detection systems that are suitable for these vehicles.

The rising vehicle safety concerns and a growing number of blind spot-related accidents are some of the factors that will drive the market for ACC and BSD systems during the forecast period.

Asia-Pacific and North America Driving the Market

Asia-Pacific is projected to be the fastest-growing regional market, contributing significantly to the growth of both the BSD and ACC industries, followed by North America. The growth in these regions is driven by factors such as increasing vehicle sales, particularly of luxury cars, and an increase in safety installations per vehicle.

The presence of fast-developing countries, like India and South Korea, and the safety regulations imposed on vehicles in the region have influenced the Asia-Pacific market for driving assistance systems significantly. These regulations are as stringent as those of Europe and North America.

- The Bharat New Car Assessment Program, commonly known as Bharat NCAP, is the 10th NCAP in the world and has been set up by the Government of India. The program commenced in October 2023. The program aims to evaluate the safety performance of cars sold in India and assign star ratings based on their safety features and performance. Bharat NCAP will assign star ratings ranging from 1 to 5 for cars tested, with 1 being the lowest rating. These ratings cover Adult Occupant Protection (AOP), Child Occupant Protection (COP), and Fitment of Safety Assist Technologies.

Additionally, the improvement in socioeconomic conditions in India, Thailand, and Indonesia has also created a demand for the premium passenger cars segment, thereby increasing the demand for ACC and BSD in these countries.

Further, the rising awareness of driver safety systems is enhancing the market for ADAS-equipped vehicles in Asia-Pacific countries. Government regulations are compelling car manufacturers to design their vehicles with advanced ADAS modules. Moreover, the evolution of autonomous cars in this region is creating the opportunity for tier-1 manufacturers to design and deliver ADAS with the latest technologies and user-friendly systems.

All these developments combined are expected to drive the market for adaptive cruise control (ACC) and blind spot detection (BSD) in Asia-Pacific.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Industry Overview

The adaptive cruise control (ACC) and blind spot detection (BSD) market is fairly consolidated. Companies such as Continental AG, Hella KGaA Hueck & Co., Mobileye, Denso Corporation, and Delphi Automotive PLC are some of the major players in the market.

To meet the increasing standards for safety features in the vehicles, major ACC and BSD manufacturers in the market have started investing in R&D activities. For instance,

* In July 2023, Mitsubishi Motors Corporation premiered the completely redesigned Triton 1-ton pickup truck in Bangkok, Thailand. The truck company scheduled a launch in Japan in early 2024 for the first time in 12 years. Safety and comfort have been greatly improved in the vehicle with the adoption of Adaptive Cruise Control (ACC), among other new safety features and emergency support using connected car technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Increasing Concern of Consumers Toward Vehicle Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Costs of ACC and BSD Act as a Major Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD Billion)

- 5.1 Type

- 5.1.1 Adaptive Cruise Control (ACC)

- 5.1.2 Blind Spot Detection (BSD)

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Technology

- 5.4.1 Infrared

- 5.4.2 Radar

- 5.4.3 Image

- 5.4.4 Other Technologies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corp

- 6.2.4 Autoliv Inc.

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Robert Bosch GmbH

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Bendix Commercial Vehicle Systems LLC (Knorr-Bremse AG)

- 6.2.10 Mobileye

- 6.2.11 Mando-Hella Electronics Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of ADAS Features in Vehicles Presents Ample Growth Opportunities

8 MARKET SIZE AND FORECAST IN TERMS OF VOLUME

9 ANALYSIS OF THE TECHNOLOGICAL ADVANCEMENTS IN ACC AND BSD TECHNOLOGIES

10 INSIGHT INTO THE REGULATORY MANDATES FOR VEHICLE SAFETY AND ADAS FEATURE INCORPORATION ON REGIONAL/COUNTRY LEVEL