PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911715

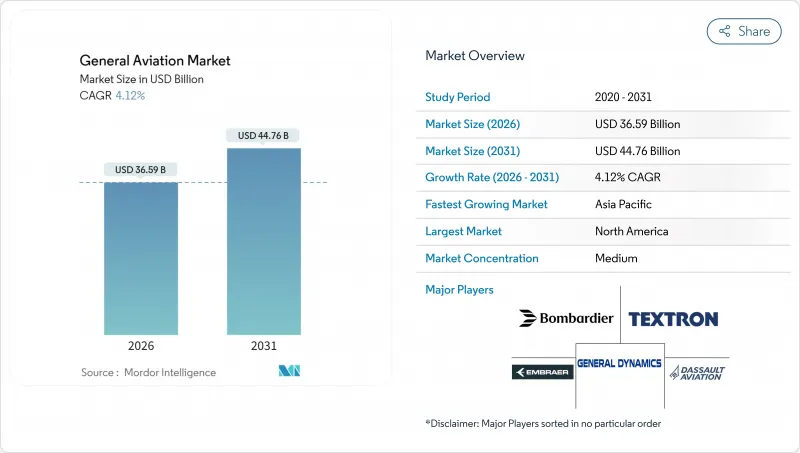

General Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The general aviation market was valued at USD 35.15 billion in 2025 and estimated to grow from USD 36.59 billion in 2026 to reach USD 44.76 billion by 2031, at a CAGR of 4.12% during the forecast period (2026-2031).

Steady wealth creation, corporate profitability, and the rising appeal of point-to-point travel underpin this momentum. Business travel continues to dominate high-yield demand, yet the landscape is widening as electric vertical take-off and landing (eVTOL) programs advance certification processes. Fractional ownership platforms widen access, while infrastructure upgrades in developing economies open new routes. Established turbine propulsion retains a firm footing, but battery advances and sustainable aviation fuel incentives set the stage for cleaner operations.

Global General Aviation Market Trends and Insights

Growing HNWI Population and Corporate Profits

Robust wealth expansion feeds premium aircraft demand as high-net-worth individuals (HNWIs) place a premium on time and privacy. After a strong 2024 earnings rebound, large corporations added aircraft to secure executive productivity and bypass congested hubs. Asia-Pacific generated 40% of new wealth pools, yet still lags in airport density, intensifying demand for mid-size and large-cabin jets capable of nonstop intercontinental legs. Fleet planners cite trackable productivity gains over scheduled airlines, reinforcing purchase justification. The result is a stable delivery pipeline that shields the general aviation market from broader airline cyclicality.

Fleet Modernization and Replacement Cycle

North America's median business jet age crossed 20 years in 2024, spurring operators to replace legacy cabins with fuel-efficient models. Modern flight decks deliver safety and connectivity upgrades that outweigh retrofit costs. Europe's tightening noise rules are grounding non-compliant units sooner, lifting new-build demand. For multi-aircraft departments, digital fleet-wide health monitoring is now a baseline requirement. Modernization spending is thus framed as a strategic investment that lowers lifecycle costs and enhances dispatch reliability.

High Acquisition and Operating Costs

Aircraft sticker prices climbed 8-12% in 2024 as supply-chain strain pushed component costs upward. Fuel volatility and spares inflation added pressure to hourly operating budgets. Insurance underwriters raised premiums amid pilot-shortage risk assessments, while rising interest rates increased debt-service burdens. For currency-weak emerging markets, dollar-denominated transactions became even less affordable. These immediate cost hurdles may defer some purchase decisions despite healthy long-term fundamentals.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Fractional Ownership and Charter Platforms

- Emerging Aviation Infrastructure in Developing Nations

- Stringent Noise and Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Business jets accounted for 46.36% of the general aviation market share in 2025, reflecting their dominance in time-critical corporate travel. Large-cabin platforms lead in revenue thanks to nonstop intercontinental range and high-comfort layouts. Mid-size variants offer balanced economics for regional missions, whereas light jets attract owner-pilots and charter brokers targeting short hops. The advanced air mobility eVTOLs segment is comparatively small today. Yet, this segment is set for a 3.62% CAGR as certification hurdles fall and urban congestion drives adoption. Rotorcraft remain indispensable for point-to-point emergency and utility roles but face growing urban competition from eVTOL platforms.

A diverse pipeline of clean-sheet designs underscores OEM confidence. Joby Aviation reached key FAA milestones in 2024, signaling imminent service entry. Turboprop and piston fixed-wing categories continue to serve training, cargo, and regional connectivity niches where runway constraints favor short-field performance. Overall, variety across mission sets insulates the general aviation market from a single-segment downturn.

Conventional piston and turbine engines comprised 90.98% of the general aviation market in 2025. Turbine powerplants prevail in business jets for their high-altitude performance and global maintenance network support. Piston engines remain the mainstay of training fleets, benefiting from lower entry costs. Although only a small base today, all-electric propulsion is advancing at a 4.49% CAGR as battery-energy density improves. Hybrid-electric concepts are bridging range gaps while meeting early sustainability goals. Certification authorities are working alongside manufacturers to finalize electric-propulsion safety codes, setting the stage for broader adoption by decade's end.

Operating-cost advantages, especially in short-hop training or urban shuttle applications, are emerging as pivotal adoption drivers. Charging-infrastructure projects at regional airports pair with renewable-energy mandates, accelerating ecosystem readiness. Still, until batteries meet longer-range mission needs, conventional turbines will retain primacy in the general aviation market.

The General Aviation Market Report is Segmented by Aircraft Type (Business Jets, and More), Propulsion Type (Conventional Piston/Turbine, Hybrid-Electric, and More), Ownership Model (Full Private Ownership, and More), End-User Application (Business/Corporate Transport, Personal and Leisure Flying, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 51.12% of the general aviation market share in 2025, anchored by the United States' 200,000-plus active fleet and dense airport grid. Mature financing channels, comprehensive maintenance coverage, and a deep pilot pool reinforce regional leadership. Canada leverages aviation for resource exploration and remote-community access, whereas Mexico's tourism corridors rely on private charters for point-to-point luxury traffic. Corporate balance-sheet strength and consistent residual-value performance build regional fleet modernization cycles.

Asia-Pacific is the fastest-growing arena with a 6.33% CAGR forecast through 2031. China's plan to establish 500 general aviation airports by the decade's end reshapes local air connectivity. India's economic upswing is lifting charter activity despite infrastructure bottlenecks that are gradually easing via public-private partnerships. Japan and South Korea maintain high technology adoption rates, catalyzing avionics and sustainability innovations that ripple across global fleets. Australian operators continue to exploit general aviation for mining and medical outreach in sparsely populated interiors.

Europe commands a solid share, supported by dense corporate corridors and a sophisticated charter network. Stringent environmental rules are accelerating fleet renewals and pushing OEMs toward sustainable aviation fuel compatibility. Though ongoing EU harmonization efforts seek to mitigate friction, Brexit-related customs and regulatory divergence complicate cross-border operations. Natural-resource projects and VIP transport underpin demand in the Middle East and Africa, but varying regulatory maturity and infrastructure gaps temper near-term fleet expansion.

- Bombardier Inc.

- Textron Inc.

- Embraer S.A.

- Cirrus Design Corporation (Aviation Industry Corporation of China)

- Piper Aircraft, Inc.

- COMPAGNIE DAHER SA

- Leonardo S.p.A.

- Airbus SE

- Honda Aircraft Company (Honda Motor Co., Ltd.)

- Robinson Helicopter Company

- Costruzioni Aeronautiche TECNAM S.p.A.

- MD Helicopters, LLC

- Joby Aero, Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Dassault Aviation SA

- Pilatus Aircraft Ltd.

- Diamond Aircraft Industries GmbH

- Epic Aircraft, LLC

- Archer Aviation Inc.

- Gulfstream Aerospace Corporation (General Dynamics Corporation)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 High-Net-Worth-Individual (HNWI) Trend Analysis

- 4.1.1 North America

- 4.1.2 Europe

- 4.1.3 Asia-Pacific

- 4.1.4 South America

- 4.1.5 Middle East and Africa

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Growing HNWI population and corporate profits

- 5.2.2 Fleet modernization and replacement cycle

- 5.2.3 Expansion of fractional ownership and charter platforms

- 5.2.4 Emerging general aviation infrastructure in developing nations

- 5.2.5 Urban-air-mobility (UAM) corridor integration

- 5.2.6 Sustainable-aviation-fuel (SAF) incentive uptake

- 5.3 Market Restraints

- 5.3.1 High acquisition and operating costs

- 5.3.2 Stringent noise and emission regulations

- 5.3.3 Pilot workforce shortage

- 5.3.4 Avionics supply-chain disruptions

- 5.4 Value Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porteers Five Forces Analysis

- 5.7.1 Bargaining Power of Suppliers

- 5.7.2 Bargaining Power of Buyers

- 5.7.3 Threat of New Entrants

- 5.7.4 Threat of Substitutes

- 5.7.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Aircraft Type

- 6.1.1 Business Jets

- 6.1.1.1 Large Jet

- 6.1.1.2 Mid-Size Jet

- 6.1.1.3 Light/Very-Light Jet

- 6.1.2 Turboprop Fixed-Wing

- 6.1.3 Piston Fixed-Wing

- 6.1.4 Rotorcraft

- 6.1.5 Advanced Air Mobility eVTOLs

- 6.1.1 Business Jets

- 6.2 By Propulsion Type

- 6.2.1 Conventional Piston/Turbine

- 6.2.2 Hybrid-Electric

- 6.2.3 All-Electric

- 6.3 By Ownership Model

- 6.3.1 Full Private Ownership

- 6.3.2 Fractional Ownership

- 6.3.3 Charter/Air-Taxi Operators

- 6.3.4 Training and Academic Institutions

- 6.3.5 Government and Special-Mission Operators

- 6.4 By End-User Application

- 6.4.1 Business/Corporate Transport

- 6.4.2 Personal and Leisure Flying

- 6.4.3 Special Mission (ISR, Surveillance, Law Enforcement)

- 6.4.4 Emergency Medical/Air-Ambulance

- 6.4.5 Pilot Training

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Spain

- 6.5.2.5 Italy

- 6.5.2.6 Russia

- 6.5.2.7 Netherlands

- 6.5.2.8 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.3.5 Indonesia

- 6.5.3.6 Australia

- 6.5.3.7 Thailand

- 6.5.3.8 Malaysia

- 6.5.3.9 Philippines

- 6.5.3.10 Singapore

- 6.5.3.11 Rest of Asia-Pacific

- 6.5.4 South America

- 6.5.4.1 Brazil

- 6.5.4.2 Colombia

- 6.5.4.3 Rest of South America

- 6.5.5 Middle East and Africa

- 6.5.5.1 Middle East

- 6.5.5.1.1 Saudi Arabia

- 6.5.5.1.2 United Arab Emirates

- 6.5.5.1.3 Qatar

- 6.5.5.1.4 Turkey

- 6.5.5.1.5 Rest of Middle East

- 6.5.5.2 Africa

- 6.5.5.2.1 South Africa

- 6.5.5.2.2 Egypt

- 6.5.5.2.3 Algeria

- 6.5.5.2.4 Nigeria

- 6.5.5.2.5 Rest of Africa

- 6.5.5.1 Middle East

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 Bombardier Inc.

- 7.4.2 Textron Inc.

- 7.4.3 Embraer S.A.

- 7.4.4 Cirrus Design Corporation (Aviation Industry Corporation of China)

- 7.4.5 Piper Aircraft, Inc.

- 7.4.6 COMPAGNIE DAHER SA

- 7.4.7 Leonardo S.p.A.

- 7.4.8 Airbus SE

- 7.4.9 Honda Aircraft Company (Honda Motor Co., Ltd.)

- 7.4.10 Robinson Helicopter Company

- 7.4.11 Costruzioni Aeronautiche TECNAM S.p.A.

- 7.4.12 MD Helicopters, LLC

- 7.4.13 Joby Aero, Inc.

- 7.4.14 Guangzhou EHang Intelligent Technology Co. Ltd.

- 7.4.15 Dassault Aviation SA

- 7.4.16 Pilatus Aircraft Ltd.

- 7.4.17 Diamond Aircraft Industries GmbH

- 7.4.18 Epic Aircraft, LLC

- 7.4.19 Archer Aviation Inc.

- 7.4.20 Gulfstream Aerospace Corporation (General Dynamics Corporation)

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-need Assessment

9 KEY STRATEGIC QUESTIONS FOR GENERAL AVIATION CEOS