PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687221

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687221

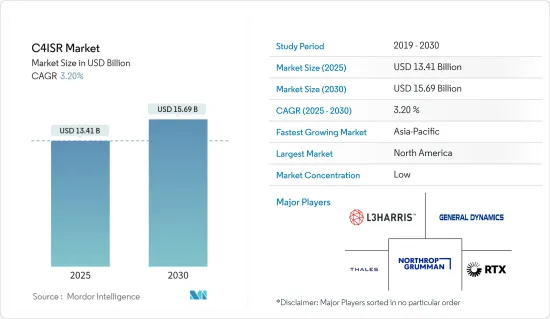

C4ISR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The C4ISR Market size is estimated at USD 13.41 billion in 2025, and is expected to reach USD 15.69 billion by 2030, at a CAGR of 3.2% during the forecast period (2025-2030).

The growing demand for asymmetric warfare, along with increasing demand for advanced technologies like network-centric battle management and unmanned vehicles, is expected to accelerate the market growth during the forecast period. The integration of intelligence-gathering sensors into the ISR systems with enhanced surveillance range and capabilities for better situational awareness of military personnel is expected to propel the growth of the ISR market in the region.

The increasing focus on miniaturization and improving the accuracy of the ISR systems and payloads are propelling their utilization across all platforms. Their high reliability and availability at low costs have propelled militaries to procure these systems in abundance. As a new line of threats emerges, these systems have become integral to military preparedness due to their utility.

Rapid technological developments are breeding disruptive technologies in the defense industry. The current focus is on incorporating AI and machine learning technologies into ISR platforms. Militaries are also focusing on shifting toward open-architecture ISR systems. The growing demand for unmanned systems and systems with autonomous capabilities is expected to propel the market studied in the coming years.

While the adoption of a variety of C4ISR systems is increasing, it is presenting a host of challenges for end users, thereby putting pressure on manufacturers to help them overcome the challenges. Although technological advancements in the C4ISR industry are growing at unprecedented rates, the increasing amount of generated data is presenting a host of challenges for militaries and industry players.

C4ISR Market Trends

Space Segment Will Witness Highest Growth During the Forecast Period

C4ISR technologies in space encompass advanced satellite systems, remote sensing, and data analytics. These enable precise and timely intelligence gathering, strategic surveillance, and reconnaissance, which is crucial for informed decision-making in national security. The changing face of warfare, moving toward hybrid scenarios, will be underpinned by joint operations and will require interoperability to allow effective operation.

Though military satellites and surveillance drones have been used for decades now, the advent of pseudo-high-altitude satellites (HAPS) has bridged the gap between drones and satellites in terms of coverage and cost. HAPS incorporates the best aspects of terrestrial and satellite-based communication systems. They eliminate the capacity and performance limitations of satellites by efficiently delivering voice, video, and broadband services at much more economical pricing vs. performance margins than conventional geostationary satellites.

For instance, in November 2023, Northrop Grumman Corporation completed Thermal Vacuum tests on the Arctic Satellite Broadband Mission (ASBM), a two-satellite constellation designed to deliver broadband communications to the Northern polar region for the US Space Force and Space Norway. Similarly, in February 2023, The National Geospatial-Intelligence Agency awarded Maxar Technologies a five-year contract worth USD 192 million to provide commercial satellite imagery to US allies. Maxar will also provide three-dimensional data services to the allies. Such developments are expected to augment the prospects of the Space-based C4ISR segment during the forecast period.

North America is expected to witness highest growth during the forecast period

The North American region currently dominates the market and is expected to continue its domination during the forecast period. This is mainly due to the procurement of various land, air, sea, and space ISR systems by the US and Canadian governments. For FY 2023, the US Pentagon allocated USD 12.7 billion for command, control, communications, computers, and intelligence systems. The US armed forces are modernizing their special mission aircraft fleet, Electronic Warfare aircraft (EC-37B), Battlefield Airborne Communications Node aircraft (E-11A), and Maritime Patrol Aircraft (P-8A) on order. Between 2022 and 2029, a total of 12 P-8A and 5 E-11A are expected to be delivered. Such investments in the development of advanced communication and situational awareness systems are expected to accelerate the growth of the market studied.

Furthermore, in March 2022, the Canadian Department of National Defense selected Elbit Systems UK to provide a TORCH-X-based solution as part of the Airspace Coordination Centre Modernization (ASCCM) Project. Under the project, Elbit Systems UK will likely supply a joint-air version of its TORCH-X-based Battle Management Application (BMA) that will provide situational awareness by constantly displaying a local or recognized air picture, thus enabling effective coordination of air assets into complex land and joint battlespace. The system will be operated utilizing Elbit Systems' E-CIXTM open architecture framework that will enable connectivity to the Canadian Armed Forces' legacy applications and tactical datalinks while allowing future integration of new applications in support of the Canadian Armed Forces digital transformation plan. Thus, the growing focus on enhancing defense capabilities and the rising adoption of advanced C4ISR systems drive the growth of the market across the region.

C4ISR Industry Overview

The C4ISR market is fragmented, with many international and regional players supporting the armed forces worldwide. Some of the prominent players in the C4ISR market are Northrop Grumman Corporation, RTX Corporation, L3Harris Technologies, Inc., THALES, and General Dynamics Corporation. The companies are formulating new strategies to expand their presence in various regions and capture new contracts from the armed forces. The market players are actively forming JVs and partnerships with local manufacturers to expand their presence in other regions. In addition to such plans, investments into R&D for developing C4ISR systems that are integrated with technologies like AI and quantum networking are also anticipated to help the companies attract new customers and increase their share in the market in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Air

- 5.1.2 Land

- 5.1.3 Sea

- 5.1.4 Space

- 5.2 Purpose

- 5.2.1 Command, Control, Communications, and Computer (C4)

- 5.2.2 Intelligence, Surveillance, and Reconnaissance (ISR)

- 5.2.3 Electronic Warfare (EW)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lockheed Martin Corporation

- 6.2.2 Northrop Grumman Corporation

- 6.2.3 Elbit Systems Ltd

- 6.2.4 BAE Systems PLC

- 6.2.5 Saab AB

- 6.2.6 THALES

- 6.2.7 RTX Corporation

- 6.2.8 L3Harris Technologies, Inc.

- 6.2.9 CACI INTERNATIONAL INC.

- 6.2.10 General Dynamics Corporation

- 6.2.11 Honeywell International Inc.

- 6.2.12 The Boeing Company

- 6.2.13 Leidos

- 6.2.14 Israel Aerospace Industries Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS