PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444514

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444514

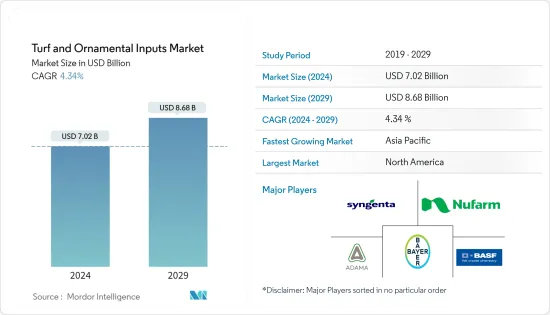

Turf & Ornamental Inputs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Turf & Ornamental Inputs Market size is estimated at USD 7.02 billion in 2024, and is expected to reach USD 8.68 billion by 2029, growing at a CAGR of 4.34% during the forecast period (2024-2029).

Key Highlights

- Turf and Ornamentals chemicals are Fertilizers, Pesticides, and other growth regulators that are required in the growth and protection of plants. The chemical input industry particularly for turf and ornamental has been transforming over the years, with robust growth coupled with changing crop mix trends and environmental regulations.

- Growing population, declining arable land, food security, and the need for augmented agricultural productivity are the significant factors driving the demand for higher agricultural output, thus augmenting the growth of the crop protection industry, globally. Turfgrass color and quality are optimized by colorants, particularly in situations where less irrigation input is needed. Regular treatments will enhance playing surfaces, lessen the need for mowing, and under extremely dry conditions, they can be used in place of overseeding.

- In situations where municipal and state governments have legislated water restrictions, colorants offer a useful tool. By favorably influencing the wetting, rewetting, and infiltration rates of the soils treated, soil surfactants are intended to lessen crop and grass physiological stresses present in naturally drought-prone soils.

Turf & Ornamental Chemical Input Market Trends

Increasing Development of the Golf Courses and Sports Field

Turf and Ornamental chemicals input play an important role in the maintenance of the turf grasses of Golf courses and sports fields. Golf course turf grass is carefully maintained by a greenskeeper to control weeds, and insects and to introduce nutrients, such as nitrogen fertilization. Fertilizing properly and on schedule is necessary to keep the course attractive and in outstanding playing condition. Turf grass will become stronger and more resilient as a result of fertilizer, which promotes growth and supplies vital nutrients. With the use of fertilizer, healthy turf can be maintained, or dying or dormant turf can be revived.

According to the Golf Around the World 2021, there were 38,081 golf courses in 206 different countries. Golf is a popular sport in the United States, in which there are currently over 15,000 golf courses in the country. Florida is a popular destination for retirees (who tend to play a lot of golf) and it has a great climate for playing year-round. After Florida, the states with the most golf courses are New York, California, Texas, Ohio, and Michigan.

Although there are many other mixtures and combinations of fertilizers on the market, phosphorus, potassium, and nitrogen are the three major fertilizers used for their maintenance, out of which nitrogen is the most essential one. These three nutrients' N (nitrogen) promotes healthy leaf and stem growth. This helps grow the best thick and strong grass throughout the spring and summer months. In low-maintenance areas a single source of nitrogen may meet the needs of the turf. But where demands are greater as for lawns, golf courses and athletic fields, combinations of different sources, polymeric colorants and surfactants are necessary.

North America Dominates the Market

North America is currently the largest market for Turf & Ornamental Chemical Input in the world, with countries, like the United States, Canada, and Mexico, demonstrating massive adoption of sports fields for controlled and sustainable turf plant growth. Moreover, due to the increasing incomes and urbanization, the people in the country are willing to spend more on the maintenance of turf grasses in the lawns.

According to a study by the Bureau of labor statistics, in 2020, the annual spending on the maintenance of lawns increased from USD 113.61 in 2018 to USD 115.07. In the United States, the new generation fertilizer is colored to enhance its appearance and value. For instance, a company, Sun Chemical, provides a wide range of colorants for fertilizers in multiple systems. The high tinting strength is expected to reduce one's costs, while light fastness properties are expected to stand up to UV rays for surface and mass fertilizer coloration.

Leisure turf and lawns are among the most grown crops in the United States. These leisure turfs and lawns are mostly preferred by house owners and commercial places for landscaping to curb the appeal. People in North America are shifting to native grasses as they help in water conservation. For instance, in Texas, native grasses, such as buffalo grass, blue grama, and thunder turf, have been replacing other grass and turf varieties. This factor is further expected to boost the demand for fertilizers and othert chemical inputs during the coming years.

Turf & Ornamental Chemical Input Industry Overview

The Turf & Ornamental Chemical Input Market is highly consolidated with the leading companies occupying the majority of the global market. The major players are BASF SE, Bayer CropScience AG, Syngenta, Nufarm Limited, and Adama Limited. New product innovation, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market across the globe. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years. These prominent companies are coming up with strategic collaborations to fetch new innovations and expansions around the globe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forcess Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type of Turf Grass

- 5.1.1 Bermuda Grass

- 5.1.2 Zoysia Grass

- 5.1.3 Blue Kentucky Grass

- 5.1.4 Rye Grass

- 5.1.5 Tall Fescue

- 5.1.6 Others

- 5.2 Type of Ornamental Grass

- 5.2.1 Feather Reed Grass

- 5.2.2 Fountain Grass

- 5.2.3 Purple Millet

- 5.2.4 Ravenna Grass

- 5.2.5 Fibre Optic Grass

- 5.2.6 Others

- 5.3 Synthetic Chemical Inputs

- 5.3.1 Pesticides

- 5.3.2 Fertilizers

- 5.3.3 Plant Growth Regulators

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Denmark

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Thailand

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions

- 6.3.2 American Vanguard Corporation

- 6.3.3 BASF SE

- 6.3.4 Bayer Crop Sciences

- 6.3.5 Chemisco Division of United Industries Corp.

- 6.3.6 Chemtura Agro Solutions

- 6.3.7 DowDuPont

- 6.3.8 FMC Corporation

- 6.3.9 Gowan International

- 6.3.10 Koch Agronomic Services LLC

- 6.3.11 Monsanto Company

- 6.3.12 Nufarm Ltd

- 6.3.13 Precision Laboratories

- 6.3.14 Syngenta AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS