PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403804

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403804

Asia Pacific Wheat Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

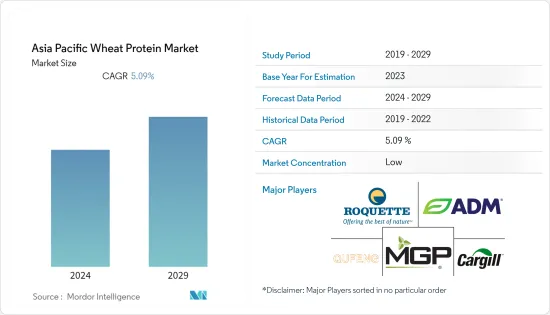

The Asia-Pacific wheat protein market size is expected to grow from USD 616.01 million in 2024 to USD 789.73 million by 2029, at a CAGR of 5.09% during the forecast period (2024-2029).

Key Highlights

- The market has witnessed significant growth due to the increasing intolerance towards animal protein, thereby leading to the shift in preference of the meat-consuming population toward meat substitutes made of vegan protein, therefore driving the market studied. In addition, major benefits such as high nutritional value and a good source of several proteins, with the growing demand for natural and organic substitutes, thus driving the market growth in the coming years.

- Additionally, there has been a significant increase in the demand for wheat protein application in animal feed due to growing awareness regarding animal health, which is anticipated to drive the demand for wheat protein. According to the National Bureau of Statistics of China, the production volume of beef and veal across China amounted to approximately 7,180 thousand metric tons in the year 2022. Hence, the increasing trend of cattle rearing for the production of beef, veal, and other such products also offers lucrative opportunities for the growth of the wheat protein market across the Asia-Pacific region.

- Moreover, companies in the region have initiated awareness programs and campaigns, which are directed to make consumers understand the benefits of alternative proteins and establish popularity among consumers, which is expected to further drive the market growth during the study period. Additionally, there has been a rise in the popularity of meat substitutes across the region. Hence, players have been innovating solutions to produce meat alternative products.

- For instance, in December 2022, Harvest B opened its first plant-based meat ingredient facility in Australia. The company offers a range of plant-based meat ingredients, including an array of wheat-textured plant proteins. Such developments, coupled with the rise in demand for wheat proteins for various applications in end-user industries, are expected to propel the market studied over the forecast period.

Asia Pacific Wheat Protein Market Trends

Rising Demand for Plant-Based Food & Beverages

- There is a growing demand for plant-based food and beverages across the region. Especially, easy-to-cook or ready-to-eat meals have been gaining traction due to the busy lifestyle, rising healthy packaged food consumption, rising consumption of breakfast cereal, changing dietary patterns, and an increasing number of convenience stores that are driving the demand for wheat protein ingredients among packaged food manufacturers across the region.

- The shift in consumer demand from animal protein to plant protein can be witnessed with the expansion of the wheat protein market. This gradual inclination toward a plant-based diet is largely associated with different factors, such as sustainability issues, health awareness, ethical or religious views, and environmental and animal rights.

- Hence, the countries in the region have been importing substantial amounts of wheat proteins to meet the demand for the same. For example, according to the Japan Plant Protein Food Association, the shipment volume of wheat proteins in the nation was approximately 18.35 thousand metric tons in the year 2022.

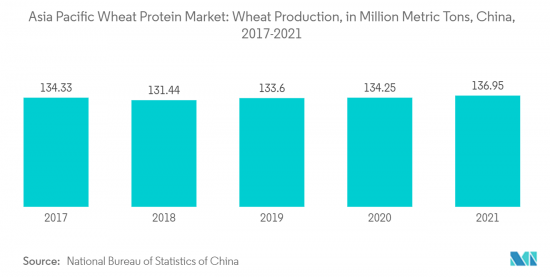

- Additionally, the increased production of wheat leading to the easy availability of raw materials for players offering wheat protein isolates and other wheat protein products are expected to drive the demand for the products.

- As per the National Bureau of Statistics of China, in the year 2021, the production of wheat across the nation was 136.95 million metric tons. The economical cost of the raw materials helps the manufacturers offer their wheat protein products at competitive prices. The increasing application of wheat proteins for food and beverages and other such industries is expected to boost the market studied during the forecast period.

China and Japan are Expected to Have the Fastest Growing Market

- Countries such as China and Japan are expected to have the fastest-growing market in the Asia Pacific region, owing to the inclination of these consumers toward protein alternatives, such as plant protein, due to the reduction in animal protein intake, weight management, and general health maintenance. This has led to a rise in the daily intake of wheat protein, as it is one of the prominent plant-based proteins gaining traction in the Chinese market.

- In these countries, wheat protein is majorly used in bakery and meat substitute products. The great demand is due to the wide range of functionalities of wheat gluten, such as viscoelasticity, texturing, foaming, emulsification, and binding, leading to its wide-scale usage in bakery products and its role as an excellent meat alternative for consumers preferring vegetarian food products are expected to drive its market in the countries. The growth of such end-user industries can also play a significant role in the expansion of the wheat protein market across the region.

- According to the All Nippon Kashi Association, the production volume of cookies in Japan was valued at 249.9 thousand metric tons in the year 2022. According to the Japan Ministry of Tourism, there has been a steady increase in the number of the vegetarian population coming into the country. Most of the inbound vegetarian tourist consumers consume plant proteins regularly, which gives opportunities to the companies to process better quality plant-based proteins. Additionally, there has been a rise in awareness among the population residing in these nations regarding plant-based foods.

- For instance, according to a survey conducted in Japan by NH Foods Ltd., a food processing company, in 2022, 25.2% of respondents said that they knew about plant-based meat alternatives, and 33% responded that they had heard about them. As wheat protein is used in plant-based meat products, these factors can also play a crucial role in driving the market studied across the region.

Asia Pacific Wheat Protein Industry Overview

The Asia-Pacific wheat protein market is competitive and fragmented owing to the presence of many regional and domestic players. Emphasis is given to the merger, expansion, acquisition, and partnership of the companies, along with new product development, as strategic approaches adopted by the leading companies to boost their brand presence among consumers. The companies operating in the market studied have been investing in the expansion of the production of their wheat protein products across the region.

Additionally, the companies have been focussing on research and development activities to innovate wheat protein and other such plant protein products, which could further drive the market studied. Key players dominating the market include MGP Ingredients Inc., Cargill Incorporated, Roquette Freres, The Archer-Daniels-Midland Company, and Shandong Qufeng Food Technology Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Demand for Plant-based Protein Products

- 4.1.2 Surging Consumer Inclination Towards Meat Analog

- 4.2 Market Restraints

- 4.2.1 Inclination Towards Gluten-free Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wheat Concentrate

- 5.1.2 Wheat Protein Isolate

- 5.1.3 Texturized Wheat Protein

- 5.2 Application

- 5.2.1 Dairy

- 5.2.2 Bakery

- 5.2.3 Sports Food

- 5.2.4 Confectionery

- 5.2.5 Pet Food

- 5.2.6 Nutritional Supplements

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 Australia

- 5.3.4 India

- 5.3.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 he Archer-Daniels-Midland Company

- 6.3.2 Cargill, Incorporated

- 6.3.3 Roquette Freres

- 6.3.4 Tereos

- 6.3.5 Manildra Group

- 6.3.6 Glico Nutrition Co.,Ltd.

- 6.3.7 MGP Ingredients Inc.

- 6.3.8 Shandong Qufeng Food Technology Co. Ltd

- 6.3.9 Harvest B

- 6.3.10 Kroner-Starke

7 MARKET OPPORTUNITIES AND FUTURE TRENDS