Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685718

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685718

Yogurt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 365 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

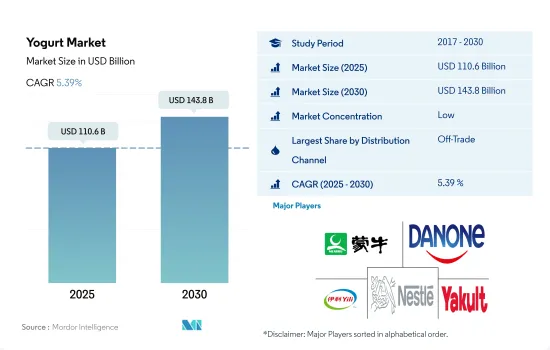

The Yogurt Market size is estimated at 110.6 billion USD in 2025, and is expected to reach 143.8 billion USD by 2030, growing at a CAGR of 5.39% during the forecast period (2025-2030).

Strong penetration of organized retail channels enhancing the market growth

- Asia-Pacific is the largest yogurt market, with a value share of 44.55% in 2022. Yogurt is consumed mainly through the off-trade channel. The market is estimated to witness a growth of 10.68% in 2023 compared to 2022. The growth is to be attributed to the easy availability of a wide range of yogurts across the retail and foodservice channels. Supermarkets account for a value share of 61.43% of the off-trade segment. The highest share is attributed to the strong penetration of popular chains such as Maruetsu, Aldi, Big Bazaar, Woolworths Group, and Aeon Retail, which provide a wide selection of yogurt varieties that are imported and made locally.

- The global yogurt distribution channel grew by 4.57% in 2022 compared to 2021 due to the availability of a wide range of yogurt flavors. Retailers also offer a wide variety of brands under the yogurt segment. In 2021, in the United States, the largest yogurt market in the North American region, strawberry flavored yogurt was preferred by 8% of the population, followed by vanilla and blueberry (both 4%), peach (3%), and mango (2%). Seeking the demand for distribution channels in the North American region, the yogurt market is expected to rise by 5.08% in 2025.

- Online retail is the fastest-growing retail sales channel in the off-trade category, and it is projected to register a CAGR of 7.75% during the forecast period. Online retailers, including Amazon, Sainsbury's, Asda, and Tesco, represent the most dominant platforms in terms of the sales of overall groceries, including dairy products, worldwide. The sub-segment held a share of 3.29% in the market in 2022. Group buying, live streaming, and discounts are the marketing campaigns that attract consumers to e-commerce.

Europe and Asia-Pacific holds significant share coupled with increasing sales through off trade channles resulting higher sales

- Global consumption of yogurt grew by 14.15% from 2017 to 2022. Yogurt is an ancient food that has been part of the daily diet for thousands of years across different countries. Europe and Asia-Pacific were the largest yogurt consumers globally, with a market volume share of 32.52% and 41.79%, respectively, in 2022.

- India and China are identified as the region's major markets. They collectively accounted for a 65.25% share of the overall yogurt volume sales across the region in 2022. The key factors driving the market's growth include the high production of raw milk, rising consumer preference for quality dairy products, and adequate industry regulation to facilitate the manufacturing and trading of dairy products. The Indian government permitted 100% FDI (Foreign Direct Investment) through an automatic route for food processing. The dairy industry records a substantial FDI constituting about 40% of FDIs in the Indian food industry. India is one of the largest yogurt-consuming countries, as it is the key component of most Indian cuisines.

- In Europe, yogurt sales are estimated to register a CAGR of 4.50% during the forecast period, reaching USD 40,103.14 million in 2029. Flavored yogurt is a largely consumed category across the region, with fruit flavors being the most popular in key countries such as Germany, the United Kingdom, and France. In 2022, 32% of UK consumers were willing to pay more for innovative yogurt flavors.

- Africa is identified as the fastest-growing yogurt market. It is anticipated to register a CAGR of 7.64% during the forecast period. The market's growth can be attributed to the frequent product launches in the flavored category. Key companies such as Libstar Holdings, LANCEWOOD, and Dannon Egypt launched new yogurt flavors during 2021-2022.

Global Yogurt Market Trends

The increasing awareness of the health benefits of yogurt, including its role in weight management, gut health, and nutrition, along with a wide range of flavors and versatile consumption options, is driving the growing demand for yogurt globally.

- A larger number of people are consuming yogurt due to its health benefits. Yogurt is considered a protein-rich food source that improves metabolism. Therefore, eating yogurt throughout the day helps to burn more calories. Apart from weight loss, yogurt also enhances gut bacteria. Thus, the demand for yogurt is continuously rising and gaining popularity worldwide. Factors like increasing government-run health and wellness campaigns designed to combat obesity and related problems (diabetes, high blood pressure, heart disease, and high cholesterol) are encouraging consumers to purchase healthier products. This is directly boosting the consumption of dairy products, including yogurt. The per capita consumption of yogurt is expected to increase by 2.67% globally during 2023-2024.

- Yogurt is available in many flavors and can be taken as a drink, a frozen good, or a dessert. Labels offer expanded nutrient information and often carry the Heart and Stroke Foundation health check symbol. Yogurt is often fortified with additional vitamins, minerals, and fiber, enhancing the consumption of yogurt among consumers. For instance, as of 2021, 80.8% of consumers in the United States consumed flavored yogurt due to its significant nutritional benefits.

- The demand for yogurt-based recipes is increasing in cafes and restaurants, which is further boosting the market's growth. This is also attributed to growth in the foodservice industry in different countries, especially in Southeast Asia, due to strategic expansion by foreign food chains and growing inbound tourists. In 2022, the number of tourist arrivals amounted to around 11.15 million, a drastic increase from the previous years.

Yogurt Industry Overview

The Yogurt Market is fragmented, with the top five companies occupying 28.87%. The major players in this market are China Mengniu Dairy Company Ltd, Danone SA, Inner Mongolia Yili Industrial Group Co. Ltd, Nestle SA and Yakult Honsha Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 46639

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Milk

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 Canada

- 4.3.3 China

- 4.3.4 India

- 4.3.5 Japan

- 4.3.6 Mexico

- 4.3.7 Netherlands

- 4.3.8 South Korea

- 4.3.9 Spain

- 4.3.10 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product Type

- 5.1.1 Flavored Yogurt

- 5.1.2 Unflavored Yogurt

- 5.2 Distribution Channel

- 5.2.1 Off-Trade

- 5.2.1.1 Convenience Stores

- 5.2.1.2 Online Retail

- 5.2.1.3 Specialist Retailers

- 5.2.1.4 Supermarkets and Hypermarkets

- 5.2.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.2.2 On-Trade

- 5.2.1 Off-Trade

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Product Type

- 5.3.1.2 By Distribution Channel

- 5.3.1.3 Egypt

- 5.3.1.4 Nigeria

- 5.3.1.5 South Africa

- 5.3.1.6 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Product Type

- 5.3.2.2 By Distribution Channel

- 5.3.2.3 Australia

- 5.3.2.4 China

- 5.3.2.5 India

- 5.3.2.6 Indonesia

- 5.3.2.7 Japan

- 5.3.2.8 Malaysia

- 5.3.2.9 New Zealand

- 5.3.2.10 Pakistan

- 5.3.2.11 South Korea

- 5.3.2.12 Rest of Asia Pacific

- 5.3.3 Europe

- 5.3.3.1 By Product Type

- 5.3.3.2 By Distribution Channel

- 5.3.3.3 Belgium

- 5.3.3.4 France

- 5.3.3.5 Germany

- 5.3.3.6 Italy

- 5.3.3.7 Netherlands

- 5.3.3.8 Russia

- 5.3.3.9 Spain

- 5.3.3.10 Turkey

- 5.3.3.11 United Kingdom

- 5.3.3.12 Rest of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Product Type

- 5.3.4.2 By Distribution Channel

- 5.3.4.3 Bahrain

- 5.3.4.4 Iran

- 5.3.4.5 Kuwait

- 5.3.4.6 Oman

- 5.3.4.7 Qatar

- 5.3.4.8 Saudi Arabia

- 5.3.4.9 United Arab Emirates

- 5.3.4.10 Rest of Middle East

- 5.3.5 North America

- 5.3.5.1 By Product Type

- 5.3.5.2 By Distribution Channel

- 5.3.5.3 Canada

- 5.3.5.4 Mexico

- 5.3.5.5 United States

- 5.3.5.6 Rest of North America

- 5.3.6 South America

- 5.3.6.1 By Product Type

- 5.3.6.2 By Distribution Channel

- 5.3.6.3 Argentina

- 5.3.6.4 Brazil

- 5.3.6.5 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 China Mengniu Dairy Company Ltd

- 6.4.2 Danone SA

- 6.4.3 Fonterra Co-operative Group Limited

- 6.4.4 Groupe Lactalis

- 6.4.5 Gujarat Cooperative Milk Marketing Federation Ltd

- 6.4.6 Inner Mongolia Yili Industrial Group Co. Ltd

- 6.4.7 Nestle SA

- 6.4.8 Saputo Inc.

- 6.4.9 The Hain Celestial Group Inc.

- 6.4.10 Yakult Honsha Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.