PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444120

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444120

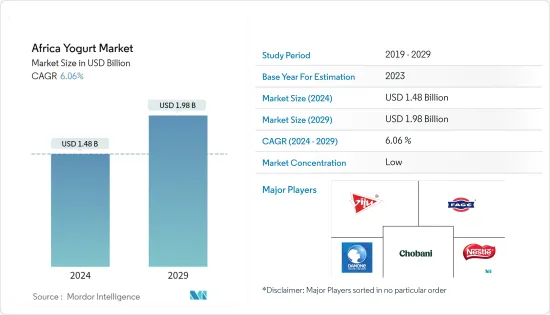

Africa Yogurt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Africa Yogurt Market size is estimated at USD 1.48 billion in 2024, and is expected to reach USD 1.98 billion by 2029, growing at a CAGR of 6.06% during the forecast period (2024-2029).

The pandemic COVID-19 affected the yogurt market but positively with the growing health-consciousness in the African region. Key players are offering products with organic and natural ingredients. African yogurt manufacturer Chirri uses fresh organic milk, couscous, and real fruits to make century-old African-style yogurt. The product does not have added artificial colors, flavors, and sweeteners, which makes it a perfect choice for active and health-conscious users.

Key Highlights

- Increasing awareness of the health benefits of yogurt acts as a catalyst for the growth of the African yogurt market. Drinkable yogurt is the fastest-growing segment in South Africa. The rise in disposable incomes, coupled with an increase in demand for convenience food and growing awareness of yogurt's health benefits, drives the growth of this market.

Africa Yogurt Market Trends

Growing Demand for Probiotic Food

The high prevalence of digestive disorders drives the demand, for probiotic foods, across various consumer groups. Globally, yogurt, in both spoonable and drinkable forms in different flavors, is the most preferred probiotic food. African yogurt market is mainly driven by the health benefits associated with consuming yogurt and increasing awareness among people about losing weight. Other factors supporting the market growth are the expansion of the retail market in various regions and the lower lactose content for lactose-intolerant consumers willing to eat dairy products. Some of the major players spreading awareness and promoting the consumption of spoonable and drinkable yogurt include Yakult, Danone, Nestle, and Chobani.

South Africa Holds a Major Market Share

The African yogurt market has been geographically segmented into South Africa, Nigeria, Egypt, and the Rest of Africa. Wherein South Africa holds a major market share in the region. Drinkable yogurt is gaining popularity and contributing to the market growth in the region due to the rising health consciousness among consumers. The consumers in this region switch brands seeking value for money. Emerging markets like South Africa are driving the growth of yogurts. Kenya is another major market in the region. Several dairy processing companies manufacture yogurt products in Kenya. Bookside Dairy Brooksidetains a huge share of around 50 % of the yogurt market due to its strong brand and the recent acquisition of smaller processing firms. They are followed by Sameerv Ltd, processing Daima and new Kenya Cooperative creameries.

Africa Yogurt Industry Overview

The vendors compete for innovation, pricing, and distribution, to stay competitive in the business. The cash-strapped consumers in this region look for promotional deals and switch brands to get value for their money. So the companies are focused on this aspect. Private labels are expected to increase their market share during the forecast period. Some of the major players in the African yogurt market are Viju Industries Nigeria Limited, Danone Southern Africa (Pty) Ltd, Fage, Yakult Honsha Co. Ltd, and Nestle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Category

- 5.1.1 Dairy-based Yogurt

- 5.1.2 Non-dairy-based Yogurt

- 5.2 By Type

- 5.2.1 Plain Yogurt

- 5.2.2 Flavored Yogurt

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Stores

- 5.3.5 Other Distribution Channels

- 5.4 Geography

- 5.4.1 South Africa

- 5.4.2 Nigeria

- 5.4.3 Egypt

- 5.4.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Viju Industries Nigeria Limited

- 6.3.2 Danone Southern Africa (Pty) Ltd

- 6.3.3 Fage

- 6.3.4 Nestle SA

- 6.3.5 Yakult Honsha Co. Ltd

- 6.3.6 General Mills

- 6.3.7 Chobani Inc

- 6.3.8 Kraft foods group Inc

- 6.3.9 Sodial SA

- 6.3.10 Parmalat Canada

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IMPACT OF COVID 19 ON THE MARKET