PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850073

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850073

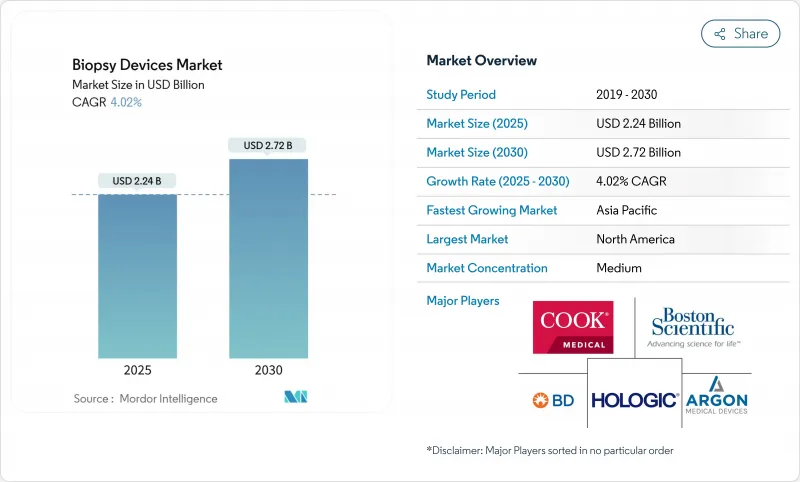

Biopsy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biopsy devices market generated USD 2.24 billion in 2025 and is forecast to reach USD 2.72 billion by 2030, posting a 4.02% CAGR during the period.

Demand is advancing steadily as hospitals, ambulatory centers, and diagnostic clinics expand early-cancer programs that hinge on tissue confirmation. Needle-based innovation, especially systems that mate vacuum technology with AI image guidance, is driving procedural efficiency and supporting a shift toward minimally invasive work-flows. Government-funded screening initiatives, such as Australia's new lung program using bulk-billed low-dose CT, are pushing higher volumes of follow-up biopsies and reducing barriers to access. Meanwhile, the biopsy devices market faces headwinds from sterility-related recalls and the accelerating uptake of liquid-biopsy assays, factors that temper-but do not derail-its growth trajectory.

Global Biopsy Devices Market Trends and Insights

Rising Demand For Minimally Invasive Cancer Diagnostics

Nanoneedle patches developed at King's College London allow painless tissue sampling by inserting millions of micro-needles that are 1,000 times thinner than human hair, enabling real-time monitoring without tissue damage. Parallel advances in pneumatically driven robotic catheters achieve six-direction sampling inside tortuous luminal organs, cutting procedure time and improving patient comfort. Clinics therefore increasingly favor less invasive hardware that minimizes complications and yields high-quality specimens, a key catalyst for the biopsy devices market worldwide. Health-system purchasers also note lower downstream costs from shorter recovery times and fewer repeat procedures, reinforcing adoption. As these technologies mature, suppliers that integrate robotic actuation and micro-sampling into cohesive platforms are gaining a competitive edge.

Growing Incidence Of Hard-To-Reach Organ Cancers

Lung cancer remains the world's top cause of cancer mortality, representing 18.7% of global cancer deaths in 2024. The anatomical obstacles of accessing lungs, pancreas, and brain heighten demand for precision needles, steerable catheter systems, and advanced imaging accessories. High-income nations report the greatest disease burden, yet emerging markets are witnessing rapid incidence growth without equivalent diagnostic capacity. Hospitals are therefore upgrading to image-guided core and vacuum-assisted devices that improve sampling accuracy and shorten anesthesia time-an investment pattern that sustains the biopsy devices market even as reimbursement regimes tighten.

Device Recalls & Sterility-Failure Events

Olympus withdrew single-use lung-biopsy sheaths after detachable tips caused 26 serious injuries, compelling hospitals to quarantine stock and reschedule procedures. Hologic's Class I recall of 53,492 BioZorb markers followed reports of pain, infection, and migration. Cardinal Health likewise pulled biopsy-related procedure kits over sterility concerns. Such events intensify regulatory scrutiny, force costly remediation programs, and can dampen clinician confidence, thereby restraining near-term growth for the biopsy devices market.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Image Guidance Improves First-Pass Yield

- Expansion Of Government-Funded Screening Programs

- Competition From Liquid-Biopsy Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Needle-based instruments generated USD 0.79 billion of revenue in 2025, equal to 35.25% of the biopsy devices market size, and they are forecast to clock an 8.25% CAGR through 2030. Core and vacuum-assisted models integrate electromagnetic tracking and AI analytics that highlight suspicious tissue in real time, cutting the learning curve for less-experienced operators. Elucent Medical's EnVisio X1 earned FDA breakthrough status for combining optical navigation with radiofrequency-guided depth control, underscoring the investment arms race around precision targeting. In parallel, disposable needle cartridges align with infection-control mandates and accelerate turnover in ambulatory theatres, helping the biopsy devices market penetrate lower-acuity settings.

Procedure trays register steady gains because standardized kits streamline set-up and lower costs per case, an advantage prized by outpatient facilities under bundled-payment models. Localization wires remain a breast-care staple, yet newer clip-based markers that dissolve or emit low-energy radar signals are gradually cannibalizing demand by improving patient comfort and eliminating retrieval steps. Supporting accessories such as cannulas, obturators, and vacuum tubing now feature RFID tags that automate lot tracking and simplify recall management, a response to recent sterility failures.

The Biopsy Devices Market Report is Segmented by Product (Needle-Based Biopsy Instruments [Core Biopsy Devices, and More], Procedure Trays, and More), Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, and More), End-User (Hospitals, Diagnostic & Imaging Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 41.82% of 2024 revenue owing to robust insurance coverage, technology-minded clinicians, and well-defined reimbursement pathways, cementing the region's anchor position in the global biopsy devices market. Continuous innovation-illustrated by AI-assisted OCT, robotic bronchoscopy, and ultrathin flexible needles-ensures a steady refresh cycle for capital equipment. Nevertheless, hospitals face payer scrutiny over procedure bundles, nudging facilities toward cost-effective disposables and predictive analytics that prune unnecessary sampling.

Europe records modest but stable gains as national health systems emphasize value-based purchasing and personalized medicine. Uptake of markers that aid in margin assessment and molecular assays that guide targeted therapy is noticeable, spurring EU demand for high-quality tissue retrieval. Regulatory alignment under the Medical Device Regulation has lengthened approval timelines, but clear clinical-benefit documentation offsets the bureaucratic burden.

Asia-Pacific is projected to log an 8.62% CAGR through 2030, by far the fastest cadence for the biopsy devices market. India's USD 612 billion health-sector build-out, China's expansion of tier-2 oncology centers, and Southeast Asia's private hospital boom enlarge the addressable install base. Governments simultaneously roll out lung, bowel, and cervical screening policies that feed procedure pipelines. Domestic manufacturers are emerging, yet premium U.S., Japanese, and European brands maintain technical leadership in vacuum and image-guided systems.

The Middle East, Africa, and South America account for smaller shares but show selective spikes where public-private partnerships fund cancer hubs. In the Gulf, large specialty hospitals procure top-tier biopsy suites tied to comprehensive oncology campuses. In Brazil and Mexico, reimbursement reforms encourage private insurers to cover advanced biopsy techniques, incrementally widening the patient pool. Supply-chain challenges and variable regulatory oversight temper immediate gains, but multinationals are positioning via local assembly and distribution alliances to unlock future growth.

- Beckton Dickinson

- Hologic

- Danaher

- Cook Group

- Boston Scientific

- Gallini Medical

- TSK Laboratory Europe

- Argon Medical Devices

- B. Braun

- Cardinal Health

- Medtronic

- FUJIFILM

- INRAD

- Olympus

- Merit Medical Systems

- IZI Medical Products

- Danaher

- Devicor Medical Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Minimally-Invasive Cancer Diagnostics

- 4.2.2 Growing Incidence Of Hard-To-Reach Organ Cancers

- 4.2.3 AI-Enabled Image Guidance Improves First-Pass Yield

- 4.2.4 Expansion Of Government-Funded Screening Programs

- 4.2.5 Growth Of Ambulatory Surgical Centers In Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Device Recalls & Sterility-Failure Events

- 4.3.2 Competition From Liquid-Biopsy Technologies

- 4.3.3 Reimbursement Pressure In High-Volume Markets

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Needle-based Biopsy Instruments

- 5.1.1.1 Core Biopsy Devices

- 5.1.1.2 Aspiration Biopsy Needles

- 5.1.1.3 Vacuum-Assisted Biopsy Devices

- 5.1.2 Procedure Trays

- 5.1.3 Localization Wires

- 5.1.4 Other Products

- 5.1.1 Needle-based Biopsy Instruments

- 5.2 By Application

- 5.2.1 Breast Biopsy

- 5.2.2 Lung Biopsy

- 5.2.3 Colorectal Biopsy

- 5.2.4 Prostate Biopsy

- 5.2.5 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic & Imaging Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Becton, Dickinson & Company

- 6.3.2 Hologic Inc.

- 6.3.3 Danaher Corporation

- 6.3.4 Cook Medical

- 6.3.5 Boston Scientific Corporation

- 6.3.6 Gallini Medical

- 6.3.7 TSK Laboratory Europe BV

- 6.3.8 Argon Medical Devices

- 6.3.9 B. Braun Melsungen AG

- 6.3.10 Cardinal Health Inc.

- 6.3.11 Medtronic PLC

- 6.3.12 Fujifilm Holdings Corporation

- 6.3.13 INRAD Inc.

- 6.3.14 Olympus Corporation

- 6.3.15 Merit Medical Systems Inc.

- 6.3.16 IZI Medical Products

- 6.3.17 Leica Biosystems

- 6.3.18 Devicor Medical Products

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment