PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849850

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849850

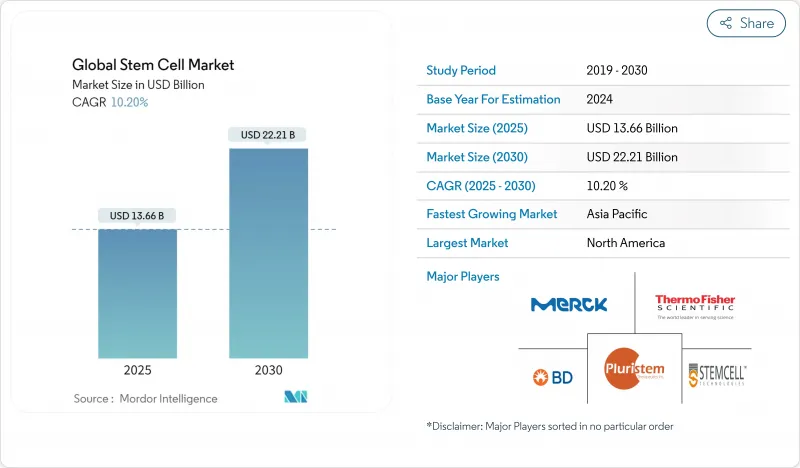

Stem Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The stem cell market stands at USD 17.13 billion in 2025 and is projected to reach USD 29.88 billion by 2030, advancing at an 11.77% CAGR.

Growth is unfolding on several fronts: newly approved mesenchymal stromal cell therapies have shortened commercial lead times, investment is pouring into induced pluripotent stem cell (iPSC) platforms, and specialized CDMOs are scaling manufacturing capacity. Accelerated regulatory pathways, especially in the United States and Japan, are bringing therapies to patients sooner, while CRISPR-enabled editing and AI-guided production workflows are lifting product quality and broadening therapeutic scope. Regional momentum is shifting toward Asia-Pacific, where national policies are positioning stem cells as strategic technologies. Competitive intensity is increasing as large biopharma acquires innovators to secure delivery tools that ease in-vivo administration.

Global Stem Cell Market Trends and Insights

High Burden of Chronic and Degenerative Diseases

Aging demographics are magnifying demand for regenerative options. Parkinson's disease is forecast to affect 25.2 million people by 2050, with population aging driving 89% of the increase.Mesenchymal stem cells (MSCs) reduce inflammation, inhibit tissue breakdown, and spur repair, positioning them as cost-effective tools for chronic disease management. Health systems are reallocating budgets toward therapies that can defer expensive long-term care, reinforcing procurement of MSC-based products and fortifying the stem cell market.

Rapidly Expanding Regenerative-Medicine Pipeline

More than 4,000 gene, cell, and RNA therapies are in development, and Phase I programs climbed 11% in early 2024. CRISPR editing is boosting CAR-T performance and opening autoimmune indications. AI-enabled analytics now automate cell phenotyping, trimming release testing from days to hours. Clinical evidence is broadening: retinal cell transplants restored meaningful visual acuity, and iPSC-derived constructs demonstrated promising glycemic control in type 1 diabetes. These advances expand addressable populations, lifting the stem cell market outlook.

Safety and Efficacy Uncertainties

Tumorigenicity and immunogenicity remain central concerns for pluripotent cell types. Batch variability complicates potency assays, prompting regulators to reinforce oversight. Research groups have engineered immune-cloaked grafts that evade NK-cell detection while integrating into host tissue. A Ninth Circuit ruling affirming FDA authority over cell therapies clarifies compliance obligations but may lengthen timelines.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Regulatory Acceleration Pathways

- Rising Penetration of Cord-Blood/Tissue Banking

- Restrictive Reimbursement Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Adult stem cells held 55.0% of stem cell market share in 2024 owing to a well-documented safety record and broad therapeutic latitude. MSC-specific quality control guidelines now standardize potency assays, supporting widespread clinical use. The stem cell market size for adult stem-cell products is projected to grow steadily as orthopedic, cardiac, and immunological programs mature. Conversely, iPSCs are advancing at a 10.43% CAGR, propelled by improved reprogramming efficiency and expanding GMP capacity. Aspen Neuroscience automated production of ANPD001 for Parkinson's disease in January 2025, demonstrating how closed-system workflows can compress autologous lead times. VSELs are gaining attention for multi-lineage potential without teratoma risk frontiersin.org. Investor focus is shifting toward off-the-shelf iPSC lines engineered for immune evasion, indicating sustained capital inflows through 2030.

Advances in cryoprotectant cocktails are reducing post-thaw apoptosis, enhancing viability across both adult and iPSC derivatives. Regulatory bodies encourage harmonized release specifications, which will gradually narrow the cost gap between the two product classes. As these innovations integrate into routine practice, the stem cell market will likely see convergence in use cases, particularly where personalized therapies must scale quickly.

Orthopedic indications represented 23.0% of the stem cell market size in 2024, anchored by evidence that MSC injections improve pain scores in osteoarthritis and promote spinal fusion. MSC therapy recorded the highest pain-reduction coefficient among regenerative orthopedic options.The segment remains resilient as an aging population drives demand for joint repair. Neurological disorders, however, are on track to grow at an 11.23% CAGR. Progress in dopaminergic neuron replacement has yielded measurable motor gains in Parkinson's cohorts. Enhanced blood-brain barrier crossing techniques and immune-cloaked cell lines are widening the clinical pipeline for Alzheimer's disease and stroke. Cardiovascular programs are similarly expanding; Cellipont's cGMP partnership targets cardiac progenitor cell supply.

Clinical trial diversity is rising. Hematologic cancers continue to anchor transplant volumes, while beta-cell replacement for diabetes is entering Phase II evaluation. Together, these trends reinforce a balanced application mix, supporting continuous revenue growth across the stem cell market.

The Stem Cells Market is Segmented by Product Type (Adult Stem Cell, Human Embryonic Cell, Induced Pluripotent Stem Cell, and More), Application (Neurological Disorders, Orthopedic Treatments, and More), Treatment Type (Allogeneic Stem Cell Therapy and More), End User (Academic and Research Institutes, Hospitals and Surgical Centers and More) and Geography. The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ATCC

- Thermo Fisher Scientific

- Merck

- Stem Cell Technologies

- Takara Bio

- Miltenyi Biotec

- Pluri Inc.

- AllCells

- International Plastics

- ReNeuron Group

- Bio-Techne Corp.

- Gamida Cell Ltd.

- Fate Therapeutics Inc.

- Cynata Therapeutics

- BioRestorative Therapies Inc.

- BrainStorm Cell

- Lineage Cell Therapeutics

- Regenexx LLC

- Orchard Therapeutics plc

- Mesoblast

- Athersys

- Medipost Co. Ltd.

- PromoCell

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of Chronic and Degenerative Diseases

- 4.2.2 Rapidly Expanding Regenerative-Medicine Pipeline

- 4.2.3 Favorable Regulatory Acceleration Pathways

- 4.2.4 Rising Penetration of Public and Private Cord-blood/Tissue Banking and Personalized-Medicine Programs

- 4.2.5 Technology Breakthroughs Enabling Off-the-Shelf Therapies

- 4.2.6 Intesifying Colloboration Among Market Players for Innovation and Development in The Field

- 4.3 Market Restraints

- 4.3.1 Safety and Efficacy Uncertainties Associated with Therapies

- 4.3.2 Restrictive Reimbursement Policies

- 4.3.3 Manufacturing Scale Challenges and High Cost of Products and Procedures

- 4.3.4 Ethical and Policy Divergence Due to Persistent Moral Concerns

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Adult Stem Cells

- 5.1.1.1 Mesenchymal Stem Cells

- 5.1.1.2 Hematopoietic Stem Cells

- 5.1.1.3 Neural Stem Cells

- 5.1.2 Human Embryonic Stem Cells

- 5.1.3 Induced Pluripotent Stem Cells (iPSCs)

- 5.1.4 Very Small Embryonic-like Stem Cells

- 5.1.5 Other Product Types (e.g., Cancer Stem Cells)

- 5.1.1 Adult Stem Cells

- 5.2 By Application

- 5.2.1 Neurological Disorders

- 5.2.2 Orthopedic Treatments

- 5.2.3 Oncology Disorders

- 5.2.4 Cardiovascular and Myocardial Infarction

- 5.2.5 Diabetes and Metabolic Disorders

- 5.2.6 Wounds and Burns

- 5.2.7 Other Applications

- 5.3 By Treatment Type

- 5.3.1 Allogeneic Stem Cell Therapy

- 5.3.2 Autologous Stem Cell Therapy

- 5.3.3 Syngeneic Stem Cell Therapy

- 5.4 By End User

- 5.4.1 Academic & Research Institutes

- 5.4.2 Hospitals and Surgical Centers

- 5.4.3 Pharmaceutical and Biotechnology Companies

- 5.4.4 Stem Cell Banks and Cryopreservation Facilities

- 5.4.5 Contract Development and Manufacturing Organizations (CDMOs)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATCC

- 6.4.2 Thermo Fisher Scientific Inc.

- 6.4.3 Merck KGaA

- 6.4.4 STEMCELL Technologies

- 6.4.5 Takara Bio Inc.

- 6.4.6 Miltenyi Biotec

- 6.4.7 Pluri Inc.

- 6.4.8 AllCells LLC

- 6.4.9 International Stem Cell Corp.

- 6.4.10 ReNeuron Group plc

- 6.4.11 Bio-Techne Corp.

- 6.4.12 Gamida Cell Ltd.

- 6.4.13 Fate Therapeutics Inc.

- 6.4.14 Cynata Therapeutics Ltd

- 6.4.15 BioRestorative Therapies Inc.

- 6.4.16 BrainStorm Cell Therapeutics

- 6.4.17 Lineage Cell Therapeutics

- 6.4.18 Regenexx LLC

- 6.4.19 Orchard Therapeutics plc

- 6.4.20 Mesoblast Ltd

- 6.4.21 Athersys Inc.

- 6.4.22 Medipost Co. Ltd.

- 6.4.23 PromoCell GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment