PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852029

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852029

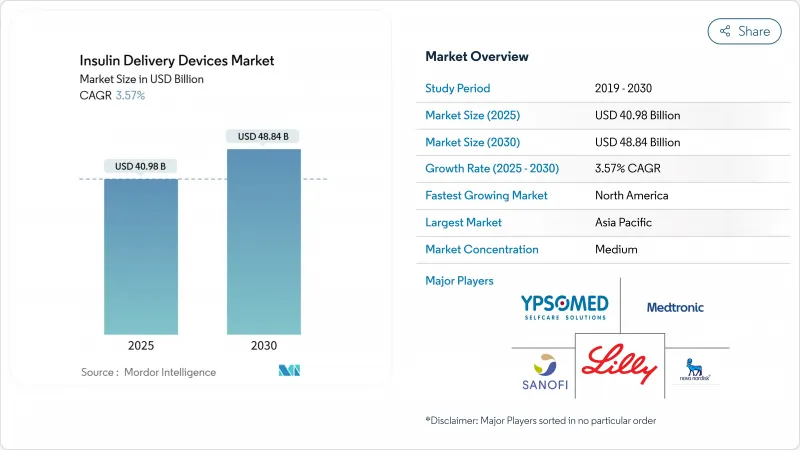

Insulin Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The insulin delivery devices market size generated USD 40.98 billion in revenue in 2025 and is projected to reach USD 48.84 billion by 2030, advancing at a 3.57% CAGR.

This moderate headline growth conceals rapid technological change fueled by automated insulin delivery ecosystems, smart patch pumps, and app-enabled dose-guidance platforms that together reframe diabetes therapy. A sharp rise in global diabetes prevalence-from 7% in 1990 to 14% in 2022-continues to widen the addressable patient pool, while CMS's proposed USD 35 insulin cap for Medicare Part D from 2026 further expands U.S. demand. Home-based care now anchors device adoption as remote monitoring proves clinically effective and cost-efficient, prompting manufacturers to tailor products for easy self-management. North American reimbursement leadership sustains early uptake of novel systems, but Asia-Pacific contributes the fastest incremental volumes as regulatory agencies streamline approvals for locally made pumps and pens.

Global Insulin Delivery Devices Market Trends and Insights

Rising Global Diabetes Prevalence

Adult diabetes cases quadrupled since 1990 to exceed 800 million in 2022, and epidemiologists expect the figure to climb to 1.31 billion by 2025, creating sustained demand for the insulin delivery devices market. Type 2 diabetes now represents 96% of cases, prompting manufacturers to build higher-capacity reservoirs and simplified interfaces that suit late-stage oral-to-insulin transitions. Asia-Pacific bears the heaviest burden, yet low- and middle-income countries still account for 90% of untreated cases, revealing significant white-space for automated and low-cost delivery formats. Device makers therefore prioritize reliable wearables that tolerate variable climates, intermittent electricity, and limited clinical support.

Preference Shift Toward User-Friendly Insulin Pens

Smart pens equipped with Bluetooth modules, mobile apps, and missed-dose alerts have moved mainstream as patients seek discreet tools that fit daily routines. Medtronic's 2024 FDA-cleared InPen upgrade now recommends corrective doses and records boluses automatically. Such innovations counter adherence declines observed when GLP-1 receptor agonists overtook insulin as the third most-dispensed diabetes medication in pharmacies. Healthcare providers view app-linked pens as a pragmatic bridge for type 2 patients hesitant to adopt pump therapy, accelerating unit volumes in both mature and emerging markets.

High Cost of Advanced Insulin Delivery Devices

Fully featured pump systems can exceed USD 10,000 per year when disposables are included, dwarfing syringe-based regimens and limiting uptake in price-sensitive economies. Insurance coverage remains patchy; Medicare treats disposable patch systems under Part D but classifies durable pumps under Part B, causing access disparities. China's volume-based insulin procurement lowered drug prices yet has not extended to hardware, leaving advanced devices priced well above average household health budgets. Payers are testing value-based contracts but adoption is gradual, keeping price a medium-term drag on the insulin delivery devices market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Insulin Pumps

- Increasing Home Healthcare Adoption

- Stringent Regulatory Approval Processes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Insulin pumps held 44.56% revenue share in 2024, anchoring the largest slice of the insulin delivery devices market. However, smart patch pumps are on track for a 5.67% CAGR to 2030 as they eliminate tubing and boost cosmetic appeal. The insulin delivery devices market size attributable to pumps is poised to widen further as hybrid closed-loop algorithms become standard. In parallel, reusable pens integrate dose-capture chips, and jet injectors court needle-averse users, preserving device plurality.

Advanced wearables strengthen user confidence by automating basal adjustments and simplifying mealtime bolusing. Embecta's FDA-cleared 300-unit disposable patch illustrates purpose-built engineering for high-dose type 2 regimens, while Tandem's t:slim X2 reports 86% satisfaction across adult cohorts. Clinical trials published by MDPI confirm greater time-in-range with automated pump platforms versus sensor-augmented pens, prompting physicians to recommend pumps earlier in therapy journeys.

Delivery hardware accounted for 62.45% of insulin delivery devices market share in 2024, yet consumables will accelerate at a 5.45% CAGR through 2030. Infusion sets, reservoirs, and needle cartridges form an annuity-like revenue stream attractive to investors. Extended-wear cannulas reduce insertion frequency, lifting adherence and lowering total cost of care, while antimicrobial coatings cut infection risk.

Manufacturers leverage consumables portfolios for sticky customer relationships; Insulet now derives a majority of sales from recurring pod shipments that pair exclusively with Omnipod controllers. Patch pumps integrate reservoir and cannula in one unit, expanding per-patient consumable spend even as upfront controller prices moderate. Material-science advances profiled in ScienceDirect show silicone-hydrogel blends that maintain elasticity over longer wear periods, underscoring innovation in disposables.

The Insulin Delivery Devices Market Report is Segmented by Device Type (Insulin Pumps, Insulin Pens, and More), Component (Delivery Devices and Consumables), End-User (Hospitals & Clinics, and More), Distribution Channel (Hospital Pharmacies, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the highest regional revenue with 35.78% share in 2024 as broad insurance coverage, early technology adoption, and sophisticated clinical pathways underpin rapid pump and CGM uptake. The CMS insulin cap arriving in 2026 is expected to widen access, while Insulet, Tandem, and Medtronic each delivered double-digit unit growth in 2025. Canada's single-payer structure funds national CGM rollouts, and Mexico's Seguro Popular reforms now reimburse select insulin pens, incrementally enlarging the continent's user base.

Europe shows solid mid-single-digit expansion as reimbursement agencies in Germany, France, and the Nordics approve hybrid closed-loop systems. Insulet's Omnipod 5 entered Italy, Denmark, Finland, Norway, and Sweden in 2025, illustrating how multi-sensor compatibility accelerates adoption. Pan-European harmonization through EMA simplifies clinical evidence filings, letting manufacturers stagger market launches with predictable timelines. Preventive-care mandates push clinicians to adopt outcome-oriented technologies that reduce hypoglycemia emergencies, reinforcing demand for interoperable ecosystems in the insulin delivery devices market.

Asia-Pacific is advancing at a 4.67% CAGR, the fastest worldwide, as China, India, and Japan ramp screening and treatment programs. China's NMPA approved 61 innovative medical devices in 2024, up 11% year-on-year, signaling policy momentum, though pump penetration among Chinese type 1 patients remains 11.4% due to cost concerns. India benefits from expanding employer insurance and local assembly of insulin pens, trimming prices. Japanese guidelines now recommend hybrid closed-loop adoption for pediatric patients, unlocking payer reimbursement, and supporting robust volume growth. Nevertheless, marked income dispersion and fragmented delivery infrastructure still hinder uniform adoption across rural zones, imposing a ceiling on near-term unit sales.

- Medtronic

- Insulet

- Tandem Diabetes Care

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Ypsomed Holding Ag

- Beckton Dickinson

- Roche

- Sooil Development Co.

- Terumo

- Vicentra B.V.

- Cellnovo Group

- Valeritas Holdings

- Debiotech Sa

- Jiangsu Delfu Medical Device

- Nipro

- Owen Mumford

- Companion Medical (Medtronic)

- Bigfoot Biomedical

- Cequr Sa

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Diabetes Prevalence

- 4.2.2 Preference Shift Toward User-Friendly Insulin Pens

- 4.2.3 Technological Advancements In Insulin Pumps

- 4.2.4 Increasing Home Healthcare Adoption

- 4.2.5 Favorable Reimbursement Policies For Advanced Delivery Devices

- 4.2.6 Growing Pediatric Type 1 Diabetes Population

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Insulin Delivery Devices

- 4.3.2 Stringent Regulatory Approval Processes

- 4.3.3 Device Malfunction and Recall Incidents

- 4.3.4 Limited Healthcare Access In Low-Income Regions

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power Of Suppliers

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Threat Of New Entrants

- 4.5.4 Threat Of Substitutes

- 4.5.5 Intensity Of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Insulin Pumps

- 5.1.1.1 Patch Pumps

- 5.1.1.2 Traditional Pumps

- 5.1.2 Insulin Pens

- 5.1.2.1 Reusable Pens

- 5.1.2.2 Disposable Pens

- 5.1.3 Insulin Syringes

- 5.1.4 Insulin Jet Injectors

- 5.1.5 Smart Insulin Delivery Wearables

- 5.1.1 Insulin Pumps

- 5.2 By Component

- 5.2.1 Delivery Devices

- 5.2.2 Consumables (Reservoirs, Cartridges, Infusion Sets, Needles)

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Home-care Settings

- 5.3.3 Ambulatory Surgical Centres

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Medtronic Plc

- 6.3.2 Insulet Corporation

- 6.3.3 Tandem Diabetes Care

- 6.3.4 Novo Nordisk A/S

- 6.3.5 Eli Lilly And Company

- 6.3.6 Sanofi S.A.

- 6.3.7 Ypsomed Holding Ag

- 6.3.8 Becton, Dickinson & Co.

- 6.3.9 Roche Diabetes Care

- 6.3.10 Sooil Development Co.

- 6.3.11 Terumo Corporation

- 6.3.12 Vicentra B.V.

- 6.3.13 Cellnovo Group

- 6.3.14 Valeritas Holdings

- 6.3.15 Debiotech Sa

- 6.3.16 Jiangsu Delfu Medical Device

- 6.3.17 Nipro Corporation

- 6.3.18 Owen Mumford Ltd.

- 6.3.19 Companion Medical (Medtronic)

- 6.3.20 Bigfoot Biomedical

- 6.3.21 Cequr Sa

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment