PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441659

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441659

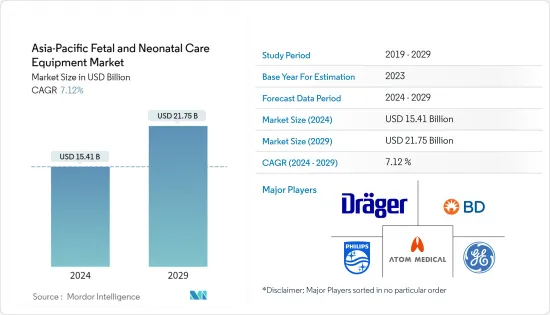

Asia-Pacific Fetal and Neonatal Care Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia-Pacific Fetal and Neonatal Care Equipment Market size is estimated at USD 15.41 billion in 2024, and is expected to reach USD 21.75 billion by 2029, growing at a CAGR of 7.12% during the forecast period (2024-2029).

The global pandemic of COVID-19 is predicted to have an impact on the market for fetal and neonatal care equipment. Pregnant women should have routine prenatal checks at 12, 20, 28, and 36 weeks of pregnancy, according to the Indian Council of Medical Research (ICMR) guidelines from 2020, unless they meet the self-isolation criteria. Appointments for women who have had COVID-19 symptoms can be postponed until seven days after the onset of symptoms unless the symptoms become severe. During the COVID-19 outbreak, according to an article published in the BMJ Journal in November 2020 by experts from the University of Tokyo, there was a dramatic decline in the number of intensive newborn care across Japanese acute care hospitals. The study also observed a drop in the number of preterm births (before 34 gestational weeks and between 34-37 gestational weeks). However, as the population has begun to cope with the pandemic, regular prenatal checkups and neonatal care is expected to boost, which is expected to significantly impact the market.

The key contributors to the market growth are the increasing number of preterm births and the technological advancements in care equipment. There was a significant regional divide between countries in eastern Asia (such as China and the Republic of Korea) and southern Asia (Bangladesh, India, Nepal, Pakistan, and Sri Lanka). China had the lowest low birth weight rate at 2.3%, while Pakistan reported a rate of 31.6%.

The technological advancements in infant and maternal care products are also a major driver for the growth of the market. Many technologies that monitor an infant's and the mother's vital signs like heartbeat are being used in rural areas where access to advanced hospital care is missing. For example, in November 2021, Abdul Latif Jameel General Trading Co. and Melody International collaborated for the distribution of Melody's innovative iCTG remote fetal monitor, a cloud-based mobile wireless fetal monitoring platform. A study published in the Journal of Pediatrics in 2020 found that nearly 6.2% of infants born with very low birth weight in Japan had birth defects such as chromosomal abnormalities, congenital heart defects, congenital malformation of the digestive system, Trisomy 18, Down syndrome, and cleft palate. Better outcomes necessitate genetic counseling and prenatal and neonatal care. As a result, the rising prevalence of preterm births and the introduction of novel technologies in the industry are likely to propel the Asia-Pacific fetal and neonatal care equipment market forward during the forecast period.

Asia-Pacific Fetal and Neonatal Care Equipment Market Trends

The Incubators Segment is Expected to Show a Significant Growth During the Forecast Period

Incubators are part of neonatal intensive care units (NICUs). They are used in conjunction with other equipment and procedures to ensure that neonates in need of additional support have the best environment and continuous monitoring. It may be helpful to think of them as a second womb designed to protect the baby and provide the right conditions for the infant's development. The incubators are mainly used in conditions like premature birth, breathing issues due to fluid or meconium in their lungs, infections or effects of gestational diabetes, jaundice, or low birth weight. The growing prevalence of these conditions in the region is the major reason for the growth of the segment. As per the National Health Portal in India, almost three and half million babies are born prematurely in India, which accounts for 13% of births in the country. With the high burden of preterm births where incubation of the neonates is compulsory, the studied segment is expected to witness steady growth.

On June 9, 2020, Singapore's National University Hospital (NUH) achieved a global record by safely discharging a 14-month-old preterm newborn weighing 212 grams. On August 7, NUH held an exclusive media conference to describe the baby's survival journey and amazing medical expertise at the NUH neonatal intensive care unit (NICU) to inspire the world. Thus, the growing need for incubators due to the prevalence of preterm births and other conditions and the increasing research and launches in the region are anticipated to boost the segment growth over the forecast period.

China Currently Dominates the Market, and It is Expected to Continue Doing so Over the Forecast Period

The Chinese fetal and neonatal care market is expected to register high growth during the forecast period, as it is being driven by several contributory factors like increasing awareness about the importance of fetal care and growing incidents of preterm birth.

For instance, according to the research article published in BioMed Central (BMC) Pregnancy and Childbirth, 2020, the risk of stillbirth and neonatal death in adolescent pregnancy aged 10 to 19 years was 2.58 times and 2.63 times that in adult pregnant women in Hebei, China. According to the research article published in BMC Pediatrics, 2020, congenital heart defect is the leading malformation in China, with an average incidence of congenital heart disease of 16.0 per 1000 births, which increased by 62.2% during 2014-2018. The three major subtypes of congenital heart disease were atrial septal defect (67.9%), patent ductus arteriosus (34.7%), and ventricular septal defect (6.4%). There were 1457 (17.1%) stillbirths, 106 (1.2%) early neonatal deaths, and 6983 (81.7%) live births associated with congenital heart disease in Zhejiang province during 2014-2018. As a result, the rapidly increasing premature childbirths are increasing the demand in the country's neonatal care market.

Ongoing development in fetal and neonatal care equipment and technological advancements are also expected to propel the growth of China's fetal and neonatal care equipment market.

Asia-Pacific Fetal and Neonatal Care Equipment Industry Overview

The Asia-Pacific fetal and neonatal care equipment market is moderately competitive. The key players in the studied market are Atom Medical Corporation, Beckton, Dickinson and Company, Dragerwerk AG & Co. KGaA, GE Company (GE Healthcare), Koninklijke Philips NV, Masimo, Natus Medical Incorporated, Phoenix Medical Systems (P) Ltd, and Vyaire Medical. The key players are evolving through various strategies such as acquisitions, collaborations, and new product launches to secure their positions in the global market.

For instance, in April 2019, InnAccel launched SAANS, which is an infrastructure-independent, portable, neonatal CPAP system built to provide breathing support to critically ill neonates with Respiratory Distress Syndrome (RDS) in resource-poor settings and during transportation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Preterm and Low-weight Births

- 4.2.2 Growing Technological Advancement in Infant and Maternal Care Products

- 4.2.3 Increase in the Prevalence of Congenital Anomalies

- 4.3 Market Restraints

- 4.3.1 High Prices of Advanced Neonatal Care Equipment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Fetal Care Equipment

- 5.1.1.1 Fetal Dopplers

- 5.1.1.2 Fetal Magnetic Resonance Imaging (MRI) Devices

- 5.1.1.3 Ultrasound Devices

- 5.1.1.4 Fetal Pulse Oximeters

- 5.1.1.5 Other Fetal Care Equipment

- 5.1.2 Neonatal Care Equipment

- 5.1.2.1 Incubators

- 5.1.2.2 Neonatal Monitoring Devices

- 5.1.2.3 Phototherapy Equipment

- 5.1.2.4 Respiratory Assistance and Monitoring Devices

- 5.1.2.5 Other Neonatal Care Equipment

- 5.1.1 Fetal Care Equipment

- 5.2 Geography

- 5.2.1 China

- 5.2.2 Japan

- 5.2.3 India

- 5.2.4 Australia

- 5.2.5 South Korea

- 5.2.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Atom Medical Corporation

- 6.1.2 Beckton, Dickinson and Company

- 6.1.3 Dragerwerk AG & Co. KGaA

- 6.1.4 GE Company (GE Healthcare)

- 6.1.5 Koninklijke Philips NV

- 6.1.6 Masimo

- 6.1.7 Natus Medical Incorporated

- 6.1.8 Phoenix Medical Systems (P) Ltd

- 6.1.9 Vyaire Medical

7 MARKET OPPORTUNITIES AND FUTURE TRENDS