PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849975

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849975

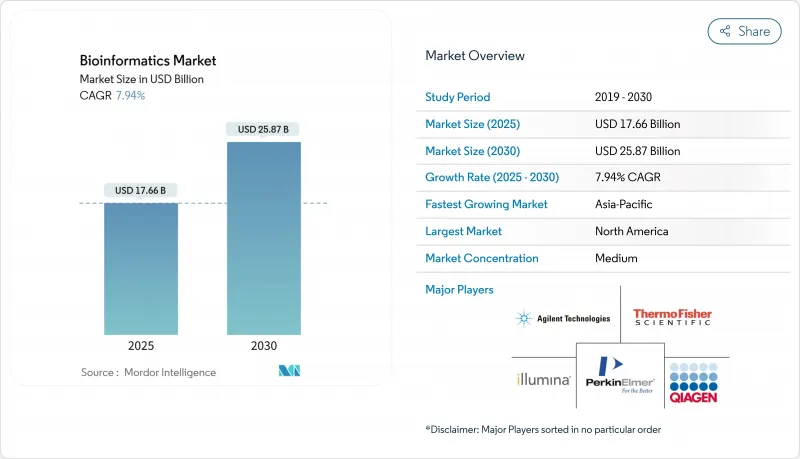

Bioinformatics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bioinformatics market size stands at USD 17.66 billion in 2025 and is projected to reach USD 25.87 billion by 2030, expanding at a CAGR of 7.94% during the 2025-2030 period.

The rise in the bioinformatics market size is being driven by rapid growth in multi-omics data generation, wider deployment of AI analytics, and steady inflows of public research funding. North America retains leadership with the largest Bioinformatics market share, supported by mature sequencing infrastructure, deep venture capital pools, and early clinical adoption of precision medicine. Asia Pacific is registering the fastest expansion as national genome programs, particularly in China and Singapore, accelerate data production and stimulate local talent pipelines.

Global Bioinformatics Market Trends and Insights

Sequencing costs keep falling while throughput rises, resulting in petabyte-scale genomic, transcriptomic, and proteomic files that outstrip legacy hardware. Laboratories are therefore modernizing pipelines that integrate batch, real-time, and streaming data layers. The data updated in August 2024 by the National Human Genome Research Institute's Multi-Omics for Health and Disease Consortium exemplifies this trend by standardizing metadata to facilitate disease subtyping. Vendors now embed foundation AI models to automate cell annotation and variant effect prediction, letting researchers focus on hypothesis generation rather than data wrangling. Consequently, the market is witnessing higher demand for secure object storage coupled with accelerated in-silico processing. The emergence of hybrid on-premise and cloud architectures signals that future Bioinformatics industry growth will depend on flexible deployment models.

Rising Adoption of Precision Medicine & Companion Diagnostics across Clinical Settings

Healthcare systems are integrating genomic interpretation pipelines into oncology and rare disease workflows, driving fresh demand for regulatory-compliant bioinformatics software. The Caryl and Israel Englander Institute for Precision Medicine shows how whole-exome sequencing can guide real-time treatment decisions. In August 2023, the National Institutes of Health announced funding for genomics-enabled learning health systems. These systems connect variant data with electronic health records and promote HL7-compliant report modules. With reimbursement models increasingly favoring data-driven care, hospitals are investing in internal sequencing labs, utilizing user-friendly interpretive dashboards. As a result, the Bioinformatics market is expanding from research institutes to mainstream clinical diagnostics. A key insight is that the integration of these systems with hospital IT infrastructures, rather than just the accuracy of algorithms, will significantly influence vendor selection.

Large-scale Government-funded Genomic Initiatives and Public-Private Consortia Worldwide

Government funding for genomics and bioinformatics is reaching new heights, creating a strong foundation for market growth through infrastructure development and data generation. In July 2024, UK Research and Innovationis investing EUR 34 million (USD 37 million) in its BioFAIR initiative. This project aims to build a unified digital research infrastructure, fostering collaboration among researchers and technical experts while promoting FAIR data principles. In the United States, the National Human Genome Research Institute is allocating about 30% of its FY2023 budget from its Computational Genomics and Data Science Program to projects focused on advancing computational methods and data analysis tools, with updates expected in March 2025. In Singapore, August 2024 marks the launch of the National Precision Medicine program's ambitious long-read sequencing project, in partnership with Oxford Nanopore and PacBio. This initiative seeks to enhance understanding of Asian genetic diversity and create a reference genome for the Asian population. Additionally, public-private collaborations, such as Illumina's Alliance for Genomic Discovery with major pharmaceutical companies, are accelerating genomic research and drug development.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Pharmaceutical & Biotech R&D Spend toward Data-centric Drug Discovery

- Persistent Shortage of Skilled Bioinformatics Talent and Training Programs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platforms account for 48.3% of the Bioinformatics market share in 2024, validating their role as the primary hub for sequence alignment, annotation, and visualization. These suites integrate graphical interfaces with algorithm libraries that streamline multi-omics workflows for both seasoned bioinformaticians and novice users. Cloud-native Bioinformatics-as-a-Service is forecast to grow at a 17.3% CAGR through 2030 as institutions favor pay-as-you-go infrastructure over capital-intensive clusters. Elastic Compute, bundled security certifications, and marketplace add-ons enable smaller labs to run complex AI models without internal DevOps expertise. Vendors are now coupling containerized workflows with billing dashboards that track per-sample costs, offering granular financial visibility to grant administrators. An important inference is that recurring consumption revenue will gradually outpace perpetual license sales, transforming vendor economics.

The Bioinformatics Market is Segmented by Products & Services (Knowledge Management Tools, Bioinformatics Platforms, and More), by Application (Genomics & Transcriptomics, Proteomics & Metabolomics, and More), by End-User (Pharmaceutical & Biotechnology Companies, Academics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a dominant 38.2% share of the market, bolstered by significant public and private investments in genomics research. A thriving ecosystem of bioinformatics firms and research institutions further cements this leadership. Notably, government funding plays a pivotal role, highlighted by the NIH's Computational Genomics and Data Science Program. This initiative dedicates around 30% of its budget from the National Human Genome Research Institute to projects centered on computational genomics and data science. The U.S. stands at the forefront of bioinformatics innovation, especially in marrying AI and machine learning with genomic analysis. A testament to this is the creation of specialized large language models tailored for biomedical research, which not only enhance context-aware responses but also boost research efficiency. Moreover, the region's sophisticated healthcare infrastructure and its early embrace of precision medicine amplify the demand for advanced bioinformatics solutions in clinical environments.

Asia Pacific is set to outpace others, eyeing a robust CAGR of 14.5% from 2025 to 2030. This growth surge is attributed to escalating government investments in genomic research, a burgeoning healthcare infrastructure, and a rising embrace of precision medicine. A case in point is Singapore's National Precision Medicine program, which in August 2024 launched an ambitious long-read sequencing project. This initiative aims to deepen the understanding of Asian genetic diversity and establish a reference genome for the continent's population. Meanwhile, in May 2024, China's BGI Genomics, on a global expansion spree, inaugurated clinical labs in Uruguay and Harbin. These labs are dedicated to colorectal cancer risk assessments and public health endeavors in Africa. Furthermore, Asia Pacific is carving a niche in the biopharmaceutical realm, with mRNA technology, personalized medicine, and AI-led drug discovery propelling its ascent, as highlighted in the December 2024 Biopharma APAC white paper. However, the region grapples with challenges in bioinformatics education and workforce development, especially in South Asian nations where programs lag behind those in Europe and North America.

Europe, bolstered by its robust research institutions and collaborative efforts, continues to hold a notable market position. A testament to this is the EUR 34 million (USD 37 million) BioFAIR investment by UK Research and Innovation in July 2024. This initiative underscores Europe's dedication to crafting a unified digital research infrastructure, championing FAIR data principles, and ensuring equitable data access. Europe's approach to bioinformatics is also heavily influenced by its strong commitment to data privacy and ethical considerations in genomic research. This focus drives the continent to develop bioinformatics solutions that harmonize innovation with responsible data management.

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Agilent Technologies

- PerkinElmer

- Roche

- BGI Genomics Co. Ltd.

- DNAnexus Inc.

- Seven Bridges Genomics Inc.

- Dassault Systemes SE (BIOVIA)

- Genedata

- Partek Inc.

- 3rd Millennium

- Data4Cure Inc.

- Ontoforce NV

- Oracle Corporation (Oracle Healthcare)

- CLC bio (QIAGEN Digital Insights)

- Geneious (Biomatters)

- SoftGenetics LLC

- Gene42 Inc.

- Eagle Genomics Ltd.

- Wuxi NextCODE Genomics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential Expansion of Multi-omics Data Volume Requiring Advanced Analytics Platforms

- 4.2.2 Rising Adoption of Precision Medicine & Companion Diagnostics across Clinical Settings

- 4.2.3 Increasing Pharmaceutical & Biotech R&D Spend Toward Data-centric Drug Discovery

- 4.2.4 Large-scale Government-funded Genomic Initiatives and Public-Private Consortia Worldwide

- 4.2.5 Integration of Bioinformatics into Agriculture, Environmental & Industrial Biotechnology Workflows

- 4.2.6 Continuous Decline in Sequencing Costs Coupled with Affordable Cloud Computing Power

- 4.3 Market Restraints

- 4.3.1 Persistent Shortage of Skilled Bioinformatics Talent and Training Programs

- 4.3.2 Fragmented Data Standards Undermining Interoperability among Platforms and Databases

- 4.3.3 Heightened Data-privacy, Security and Ethical Concerns around Genomic Information

- 4.3.4 High Up-front Investment and Ongoing Maintenance Costs for Enterprise-grade Infrastructure

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Products & Services

- 5.1.1 Knowledge Management Tools

- 5.1.2 Bioinformatics Platforms

- 5.1.2.1 Sequence Analysis Platforms

- 5.1.2.2 Sequence Alignment Platforms

- 5.1.2.3 Sequence Manipulation Platforms

- 5.1.2.4 Structural & Functional Analysis Platforms

- 5.1.2.5 Multi-omics Integration Platforms

- 5.1.3 Bioinformatics Services

- 5.1.3.1 Sequencing & Data Generation Services

- 5.1.3.2 Database Construction & Management Services

- 5.1.3.3 Data Analysis & Interpretation Services

- 5.1.3.4 Cloud-Native Bioinformatics-as-a-Service (BaaS)

- 5.2 By Application

- 5.2.1 Genomics & Transcriptomics

- 5.2.2 Proteomics & Metabolomics

- 5.2.3 Drug Discovery & Development

- 5.2.4 Microbial Genomics (Metagenomics & AMR)

- 5.2.5 Precision & Personalized Medicine

- 5.2.6 Agricultural & Animal Genomics

- 5.3 By End-user

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Academic & Research Institutes

- 5.3.3 Clinical & Diagnostic Laboratories

- 5.3.4 Contract Research Organizations (CROs)

- 5.3.5 Agri-Genomic & Environmental Testing Firms

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Illumina Inc.

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Qiagen N.V.

- 6.3.4 Agilent Technologies Inc.

- 6.3.5 PerkinElmer Inc.

- 6.3.6 F. Hoffmann-La Roche Ltd.

- 6.3.7 BGI Genomics Co. Ltd.

- 6.3.8 DNAnexus Inc.

- 6.3.9 Seven Bridges Genomics Inc.

- 6.3.10 Dassault Systemes SE (BIOVIA)

- 6.3.11 Genedata AG

- 6.3.12 Partek Inc.

- 6.3.13 3rd Millennium Inc.

- 6.3.14 Data4Cure Inc.

- 6.3.15 Ontoforce NV

- 6.3.16 Oracle Corporation (Oracle Healthcare)

- 6.3.17 CLC bio (QIAGEN Digital Insights)

- 6.3.18 Geneious (Biomatters)

- 6.3.19 SoftGenetics LLC

- 6.3.20 Gene42 Inc.

- 6.3.21 Eagle Genomics Ltd.

- 6.3.22 Wuxi NextCODE Genomics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment